In this article, Forex broker Weltrade provides up-to-date analytics of the latest events on financialmarkets, and also consider options for the development of basic trading instruments.

Dynamics of recent days in financial marketsdictated solely by factors of interest in risky assets. That is, in this case, a very tight correlation is obtained: if there is interest in risk, then risky assets go up, and accordingly, in the reverse process, safe-haven assets go up. In fact, so far nothing threatens this dynamic.

We see that the market is experiencing moderateoptimism regarding developments. The two main irritating factors of recent weeks, the Brexit negotiation process and trade relations between the United States and China, do not currently cause acute pessimism; on the contrary, there are quite positive expectations. It can be noted that this is reflected in the general state of the market.

In short, a situation can be described.as follows: risky assets, that is, in this case, the euro, pound, Australian, New Zealand and Canadian dollars, all these currencies are growing; as for the safe haven assets, the Japanese yen and gold are under pressure, and apparently this situation will continue in the near future.

For a better understanding, we will turn to each specific financial instrument separately.

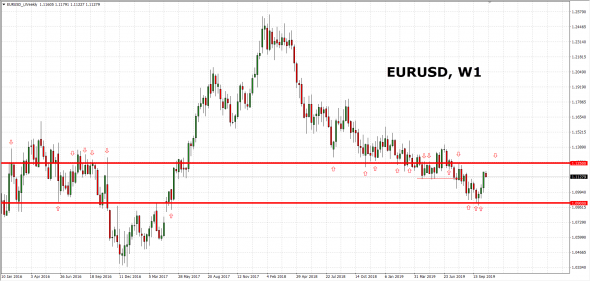

EUR / USD

Here, after a breakthrough above the 1.10 mark,stable technical picture. Progress is not the highest, there is no rapid growth. This pair encounters a lot of liquidity on its way, so linear growth does not occur here.

The fact that it’s time has successfully risen abovemarks 1,11 and was fixed there, this indicates a very likely continuation of further growth to 1,120 and 1,125. So far, the global range that can be designated is approximately 1.09-1.13. At the moment, we are slowly moving towards the upper border. Even despite the fact that the ECB is ready to further delve into the zone of negative interest rates. By and large, now this factor is not critical and the dynamics are affected only by a steady increase in investor interest in risk. In this case, the euro looks quite attractive, which is noted here in the dynamics.

Thus, it can be assumed that the nearestthe attempt to grow towards 1.12 will continue, and below there is a critical support level of 1.10. On the contrary, we are even above the 1.11 mark and for now consolidation between 1.11-1.12 is a matter of the next few days, and maybe weeks.

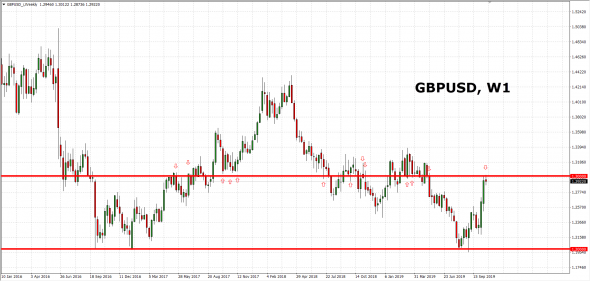

GBP / USD

This pair has a very remarkable growth, whichis explained by the fact that there is a large-scale crowding out of short positions from the market. We see that the 1.30 mark has already been tested for strength, there have even been attempts to jump higher, but so far sales of 1.30-1.31 are holding back growth. Since the market assesses the prospects for Brexit only in a positive way, there is no serious decline observed here.

It can be assumed that until October 31st it remainsthere is some intrigue in the Brexit process: on what conditions will the UK leave the European Union, if it happens at all; will there be a delay? There is ambiguity with this issue, but we see that the market regards this as follows: since the negotiation process continues, the parties are making every effort, this means this can be characterized as a positive trend for the pound.

It is precisely under these factors that thenow the dynamics of the pound/dollar pair, but it should be noted that over time, the chances for negative aspects increase, which could potentially affect the pair and push it lower; it is over time that this situation can worsen. That is, surprises in our case can only be in the downward direction, and the greater the growth, the greater the risk of a rapid and deep downward correction.

While we note that it is time to confidently entrenched above1.29, and will continue its growth attempts towards 1.30. Since the market has now absorbed most of the market optimism, sharp growth has not yet been noted. If the growth happens above the 1.30 mark, then the crowding out of short positions can continue and at some stage it cannot be ruled out that a period of total surrender of shorts will happen. Against this background, the time can jump out above 1.31 and even towards 1.32-1.33. While the consolidation period is being proposed, it is marked approximately at 1.29-1.30 with possible spikes in one direction or another of 50 points, but this does not change the picture globally.

XAU / USD

Gold, surprisingly, retains enoughnarrow trading range: below is the $1480 mark, there were multiple attempts to break below, but regularly below $1480 there was immediate demand and the metal was returned; from above, we can only indicate the level of $1,500 - a round figure and a psychological barrier that is currently holding back growth.

Gold is under a certain pressure,interest in risk is not conducive to growth, moreover, quite substantial long positions have been accumulated, therefore long crowding out here is more than likely. With such a moderate decline below $ 1480, when demand is just below this mark will be absorbed, the surrender of the longs may increase and then we will see a failure in the direction of $ 1470 and $ 1460.

If in the world the risk situation worsens, thengold will react first. The first sign of this will be a sharp increase above 1500. Here you need to be very careful, because from a technical point of view, a break above 1500 will formally return gold to an uptrend.

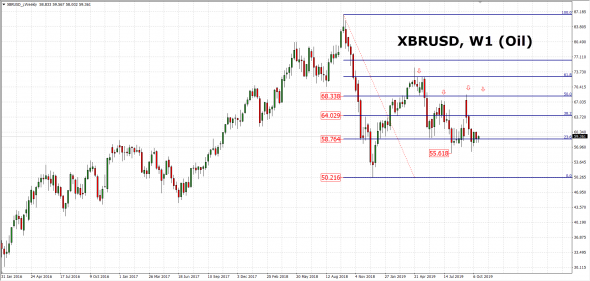

Brent

We turn our attention to oil, heresignificant changes have not yet been noted. Such a global trading range of $ 58-61 has been going on for a long time and apparently this situation will continue. The very fact that amid growing interest in risk, oil cannot restore its growing trend, indicates that there will be a failure below $ 58 and oil will move towards $ 57 or even $ 56.

Of course, oil will be pressured by suchfundamental factors, such as the global slowdown in global demand and attempts to surge higher, will be at some aggravation of geopolitical conflicts. Now, any attempt to break above should be used to form shorts. Because the global situation is unlikely to change in the near future, fundamental factors will put pressure, and short-term surges will be used for sales.

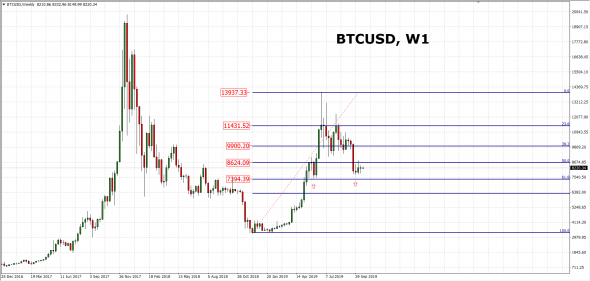

Bitcoin

To conclude our review, let's look atsituation on the cryptocurrency market. There has been some stabilization here, Bitcoin has moved away from the $8,000 level, most recently it was around $7,900 and even a little lower, there was still demand and it evened out the situation. Of course, most of this is speculative demand associated with fixing short positions, but some speculative longs are also present here.

This great confidence is facilitated by the situation in the altcoin market, where the situation has improved.

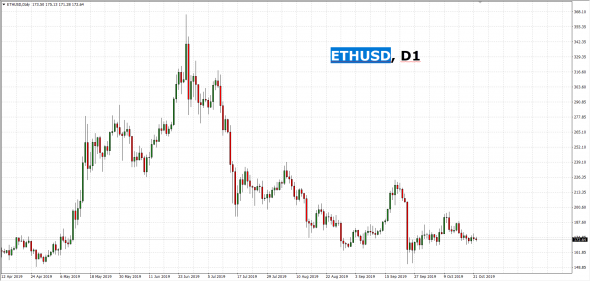

Altcoins look a little more cheerful. This also applies to Ethereum, Litecoin and Ripple.

Thus, it can be stated that the phaseSuch a powerful decline is postponed, if it happens at all, consolidation is now observed. This is due to the fact that the market has already absorbed the negative news, the delayed launch date of the telegram cryptocurrency and the situation around the libra cryptocurrency, all this is negative, but the market managed to cope, managed to digest it, a global fall did not happen.

The dynamics of the crypto market will be left to the mercy ofshort-term speculators, and lately they have not welcomed long-term trends. Most likely, consolidation here will continue, we can mark it at $8000-8500, and if sustainable growth occurs above $8500, then there is every chance of returning to the $9000-9200 zone - this level will be fundamental for possible large-scale growth and long-term trend. Otherwise, if Bitcoin falls below $7,700, the decline will continue here and the closure of long-term long positions is more than likely.

Vasily Barsukov (Chief Dealer WELTRADE)