Weltrade provides up-to-date analytics on major trading assets.

As can be noted,the last few days the market has prevailedsustained interest in risk and risky assets. This is taking place against the backdrop of easing tensions in two key topics that have been troubling markets for a fairly long period of time.

The first is the brexit negotiation process,which is approaching its logical conclusion, since October 31 is scheduled for the last date by which the UK should withdraw from the European Union. As the news headlines of the country show, they are working to ensure that a mutually acceptable agreement is reached before this date and that a deal will be concluded later on by which Great Britain will exit the European Union, or, as a second option, the release date may be delayed. In any case, this is a positive factor for the pound, which we note on the chart.

Secondly, we have the prospects for trade relations between China and the United States. Here, too, everything looks optimistic, the parties are trying to find a consensus, there are no aggravations.

All this is reflected in investors’ interest in risk; risky assets are currently experiencing a boom and safe-haven assets working in opposition to risky assets are under pressure.

To illustrate how this is displayed on the main trading instruments, we will consider each of them.

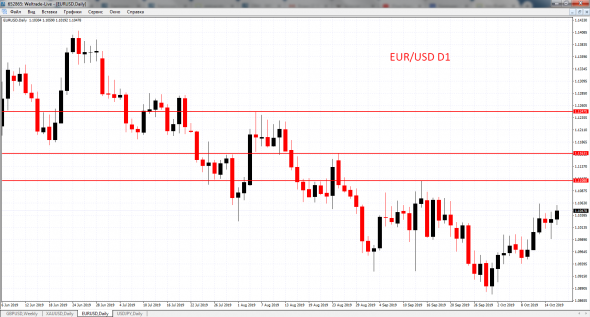

EUR / USD

Here we have formed stable support onaround 1.10. Yesterday, the couple tried to break a little lower, but we see that these attempts were unsuccessful. The pair was slightly below the 1.10 mark, but apparently the demand was sufficient, today we are already around 1.109 - so far this is the maximum.

From a technical point of view, everything looks very good for the euro-dollar; now there is a possibility that the 1.11 mark may be tested in the coming days.

We also note that, according to the tradition of recent years, the euro-dollar is a very slow pair and remains one in the near future, due to the highest liquidity among all other currency pairs.

Thus, while the time is above 1.10, the risk shifts up. That is, growth towards the 1.1100-1.1150 mark is the business of the next few days.

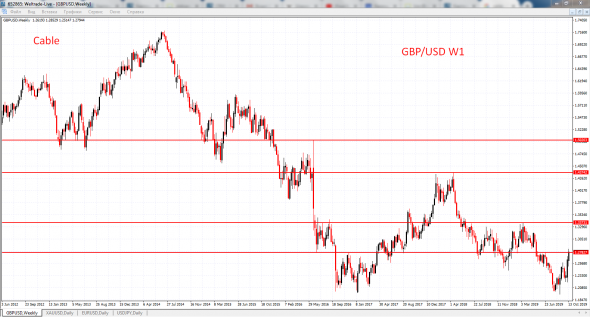

GBP / USD

Euphoria prevails in this pair.In fact, the current growth target is now 1.30 - a round number and a psychological barrier. It’s difficult to say how justified these expectations are; as I already said, the news headlines are now more than positive and, accordingly, the market is beginning to lean toward a positive end to this whole saga of Britain’s exit from the European Union.

If everything continues in approximately the same style, then sooner or later the pair will reach 1.30, everything will depend on the conditions under which the UK leaves the European Union.

If at some stage the negotiation processstall? This development of events could be very painful for the pound. So far we see a steady, progressive movement higher. If the situation returns to a negative outlook, the pound has a fairly long way down, towards 1.25 - at the moment disappointment, if negotiations fail and there is no compromise, there may be a deeper decline towards 1.22. So far, these figures look unlikely and they are very far from current price levels.

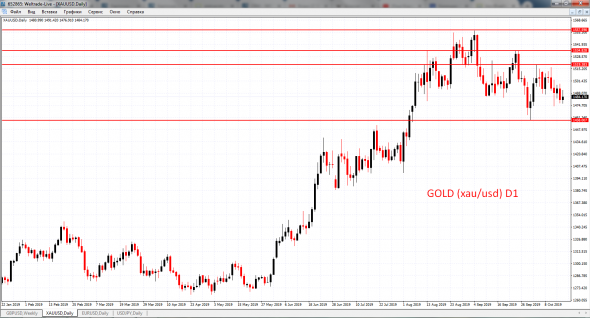

XAU / USD

Gold as a safe haven in the current situationIt is under pressure and, apparently, the $ 1,480 mark, which has already been tested several times, formally holds. But if, nevertheless, a failure below $ 1480 happens, we are waiting for a further drawdown in the direction of $ 1460 and then $ 1450.

As we can see, $1500 is now the levelresistance and in general we can assume that the $20 range of $1480-$1500 are the boundaries that will set the tone for further movement, once broken. If gold falls below $1,480, we will see a further decline; if the risk situation worsens again and safe-haven assets become in demand, we will see a breakout above $1,500 and the first wave of movement towards $1,520.

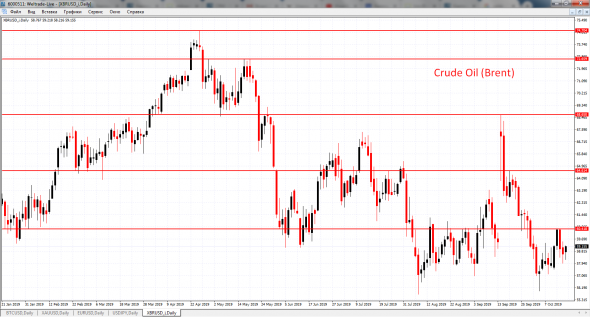

Brent

Here we have formed a stable range of about 3 dollars, it is $ 58 - the lower limit and $ 61 - the upper limit. While we are in this range and it suits everyone.

Globally, oil remains under pressure after an impressive decline from $67-68, which we noted just recently.At the moment, $57-58 is a strong support, below this demand band, oil is not falling yet.

All that remains is to observe the dynamics,If this breakthrough confidently happens, then the nearest target will be the level of $56.00-$55.70 - these are the lows that were noted on the daily chart this year.

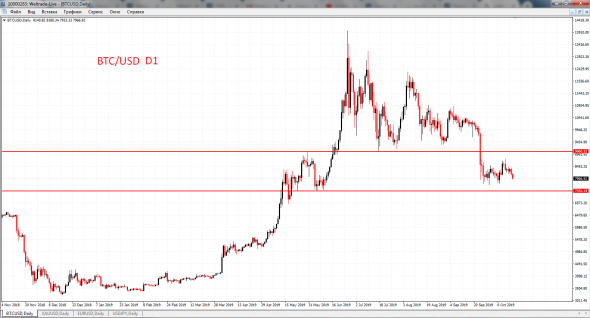

Bitcoin

At the end of our review, we will consider the crypto market, in particular Bitcoin, since its capitalization of the entire crypto market is about 70%.

Bitcoin has currently dropped to$8000, after a long period of consolidation between $8000 and $8500. Today there are attempts to reduce below $8,000, but so far they are sluggish and blocked by demand. Note that the general news background remains negative for cryptocurrencies.

Firstly, the decision of the Securities CommissionUS securities, postpone the decision on the cryptocurrency of the Telegram company. As we know, the TON cryptocurrency was supposed to be launched by the end of October, but for now Pavel Durov and the team informed investors that the launch was being postponed in order to resolve disagreements with the Securities Commission. This event is negative for the crypto market.

Secondly, the situation withcrypto project of another global giant Facebook, libra is also in limbo. Many participants in the launch and creation of the consortium left the project, among them Visa and MasterCard. This, of course, is a significant blow.

Since the appeal of Libra in the future is disturbingmany financial regulators, of course, they are ready to somehow postpone the launch of this crypto project (to perform any new formalities, achieve new agreements, etc.).

In general, all these bureaucratic procedures certainly do not contribute to the growth of interest in the crypto market and, accordingly, have an impact on cryptocurrency rates.

If Bitcoin breaks below sustainably enoughmark of $8000, we will again face a decline towards the support of $7700-7800. But this time, if this support band is already broken, Bitcoin will fall somewhere around the $6000 mark.

We note that some demand is present, butperhaps this is due to the fixation of short positions. Since, we see high speculative activity in this market segment, and speculative activity is always short-term. Thus, if a rebound occurs above the $ 8000 figure, absolutely no one will be surprised, as this will simply confirm our confidence that speculators still dictate the short-term dynamics of the market.

Vasily Barsukov (Chief Dealer WELTRADE)