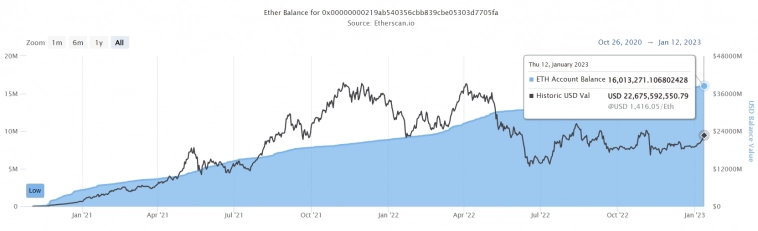

After Ethereum switches to PoS, the validator funds deposited into the deposit contract remain blocked.At the moment, their total volume exceeds 16 million ETH or $22.5 billion. This is 13% of the total supply of coins.

Image source: etherscan.io

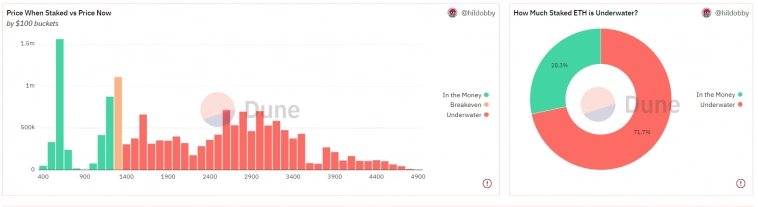

March hardfork "Shanghai" will remove restrictions,which may cause some validators to want to get rid of ETH. At the moment, 72% of their coins are “under water”, that is, they bear unrealized losses. Most of the validators linked their hopes for the growth of the coin with the transition to PoS, but they did not come true.

Image Source: dune.com

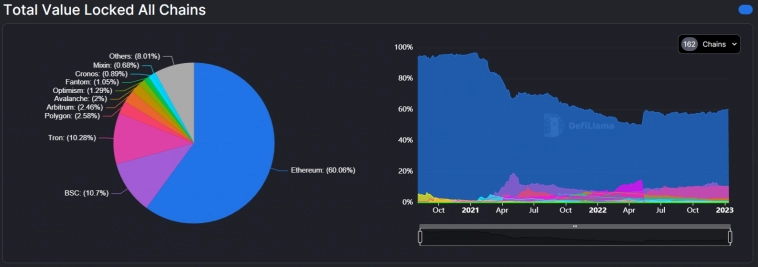

The graph below clearly shows that from June 2021the exchange rate difference between Ethereum and Bitcoin remains at the same level, while in the previous year and a half, Ethereum was significantly ahead of Bitcoin due to the development of the DeFi and NFT sectors.

Image Source: Cryptocurrency ExchangeStormGain

Loss of momentum due to increased competitionin the announced sectors, however, the trend changed after the collapse of Terra (LUNA) in May last year. Since then, the share of Ethereum has grown from 50% to 60%, as it remains the most reliable among the blockchains supporting smart contracts in community assessments.

Image source: defillama.com

The return of interest in Ethereum could causea corresponding strengthening of the altcoin against Bitcoin. However, it did not happen for a number of reasons: this is a significant reduction in the NFT and DeFi sectors in 2022, and the close attention of regulators to Ethereum due to the transition to PoS, and the growth of network centralization.

Now to these negative aspectsadds the risk of a significant increase in supply after the lock is lifted. During the “merger” days, whales from the top ten (miners and crypto exchanges are excluded from the calculations) transferred 3 million ETH to exchanges to sell reserves, preventing the bullish momentum from being realized. In March, 16 million ETH will be unlocked. If a fifth of the validators decide to get rid of the coins, the hard fork will again fail to meet the expectations of investors.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)