The US Securities and Exchange Commission (SEC) prevents regulation of the cryptocurrency industry andacts unethically towards its members. This was stated by member of the House of Representatives Tom Emmer.

During the meeting of the Financial Services CommitteeUS lower house Emmer accused the Commission of politicizing the rules. In his opinion, the chairman of the department, Gary Gensler, chose the tactics of harassment and threats.

“Under Gensler, the SEC became power hungryregulatory body that politicizes law enforcement by forcing companies to ‘come and talk’ with the Commission, and then taking coercive measures against them, hindering good faith cooperation, ”the politician emphasized.

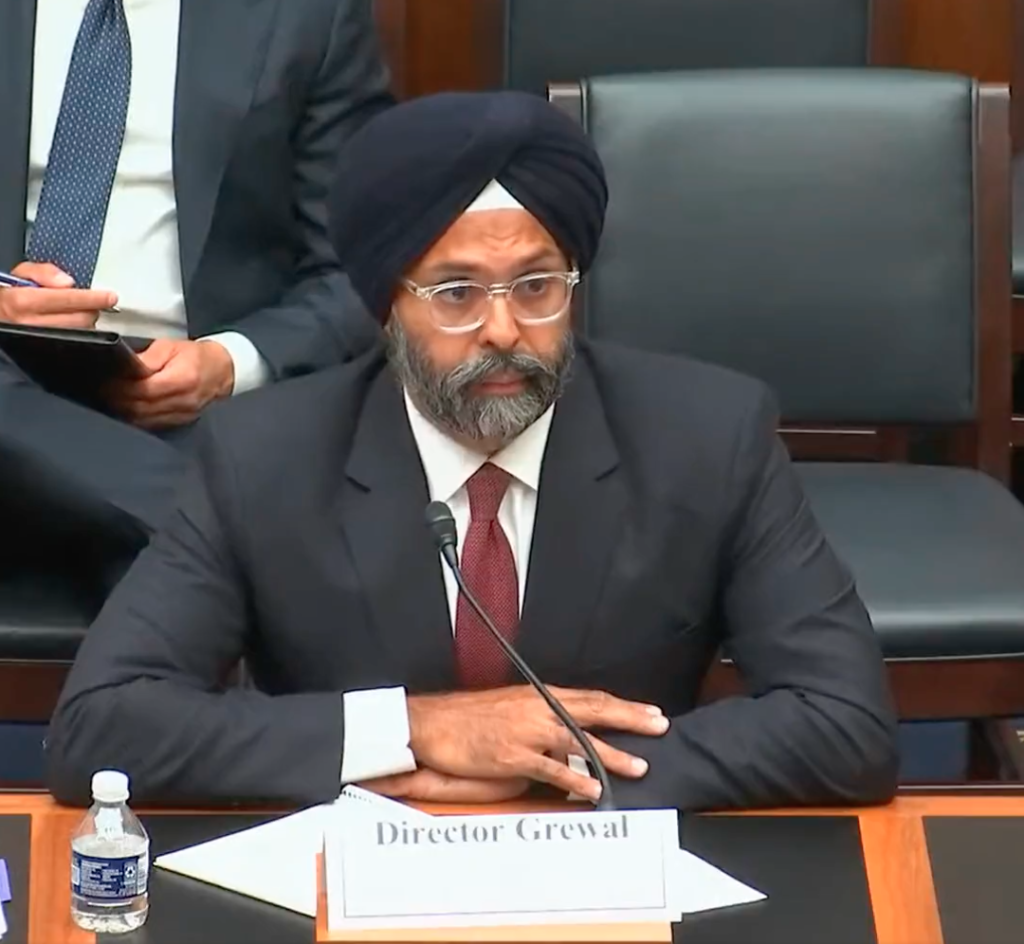

Emmer asked Gurbir Grewal, director of enforcement at the SEC, whether such checks are within the authority of the agency and what threatens companies that refuse to dialogue.

Data: Thom Emmer's Twitter.

The spokesman admitted tocoercive measures against organizations not under the jurisdiction of the Commission. Emmer called the actions of the regulator "absolutely unacceptable." In his opinion, the department uses unfair methods when it comes to digital assets.

Congressman Brad Sherman, who previously calledban the purchase of cryptocurrencies and mining, also criticized the SEC for its approach to industry participants. He recalled that the regulator charged Ripple with selling unregistered securities in the form of XRP, and not with trading platforms.

Gensler took over the department in April 2021.Over the next few months, he called on Congress to bring clarity to the regulation of the crypto industry and warned of increased oversight of stablecoins and DeFi.

Later, the head of the Commission called on bitcoin exchanges to dialogue.

In September, the SEC warned Coinbase of possible legal action if it launched USDC-based crypto savings accounts. The company subsequently abandoned its plans.

In the summer of 2021, BlockFi faced claims from financial regulators at the state level. Bloomberg later reported that the SEC initiated an investigation into the company.

In February 2022, it became known that the crypto lending platform would pay $100 million in fines as part of the settlement.

In the same month, the Commission ruled out the absence of sanctions for companies that voluntarily come under the supervision of the agency.

Recall that in June, the head of Ripple, Brad Garlinghouse, accused the SEC of using a coercive approach instead of working on clear regulation for the industry.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.