The situation in macro markets will begin to improve only when the Fed makes it clear that it is done withquantitative hardening.And there are only two reasons why they can do this: either inflation will start to decline, or something will break. But what does it mean "something will break"? I will try to answer this question in the next few posts, starting with this one.

The US is about to publish inflation data forApril. At the time of writing, they are not yet available. It's a big question whether inflation has already peaked or not. But even if it has, it is unlikely that the Fed will immediately abandon the tightening. It will take at least three months of a steady decline in inflation for them to think about it. These are simply the terms and time categories in which economists work.

The default situation, meanwhile, is raising rates and shrinking liquidity. Until something breaks.

But this “until something breaks” sounds very vague if you don’t know roughly what it might be about.

So what are these things that the Fed certainly doesn't want to break? And what data do you need to pay attention to in order to understand whether this is something that is about to break or not?

From past events, we can conclude that the Fed cares about three things:

- US economy. They don't want to allow a recession.

- REPO market. They don't want liquidity problems for US bonds.

- credit market. They don't want to get a bunch of corporate defaults.

Today I want to focus on creditmarkets. More specifically, in the corporate lending market. I plan to write about REPO liquidity and the US economy as a whole in the next posts in the near future.

Okay, so why does the Fed care about the credit market? It's simple: it's a good indicator of the strength of corporate America.

How it works?

Let's say you have free cash.You can either lend them to the US government at a certain rate of return and with a very high certainty that you will get your money back. Or you can borrow your money to some business. Of course, the probability of getting money back in this case is less than from the US government. Therefore, you will want to get a higher return to offset the additional risk of losing your investment.

The difference between the yield on Treasury (US Treasury bonds) and corporate bonds is called the credit spread.

If the economy is booming and business is strong, the credit spread is relatively small because the risk of companies defaulting on their debt is low.

But when economic conditions becomeunfavorable, the risk of default increases, and lending to companies becomes much more risky than holding money in treasuries. In this case, the credit spread will naturally increase.

When credit spreads become very wide, it means that lenders have low confidence that they will get their money back and that something is about to break.

At this point, the Fed sees that there is a problem and that something needs to be done about it, otherwise the market for business debt will quickly become unsustainable.

I'm oversimplifying a bit, but in general terms, this is why people watch credit spreads.

Credit spreads are also of different types, independing on the timing, credit ratings of companies and benchmarks. We can't cover them all here, so I've made some selections based on readily available data.

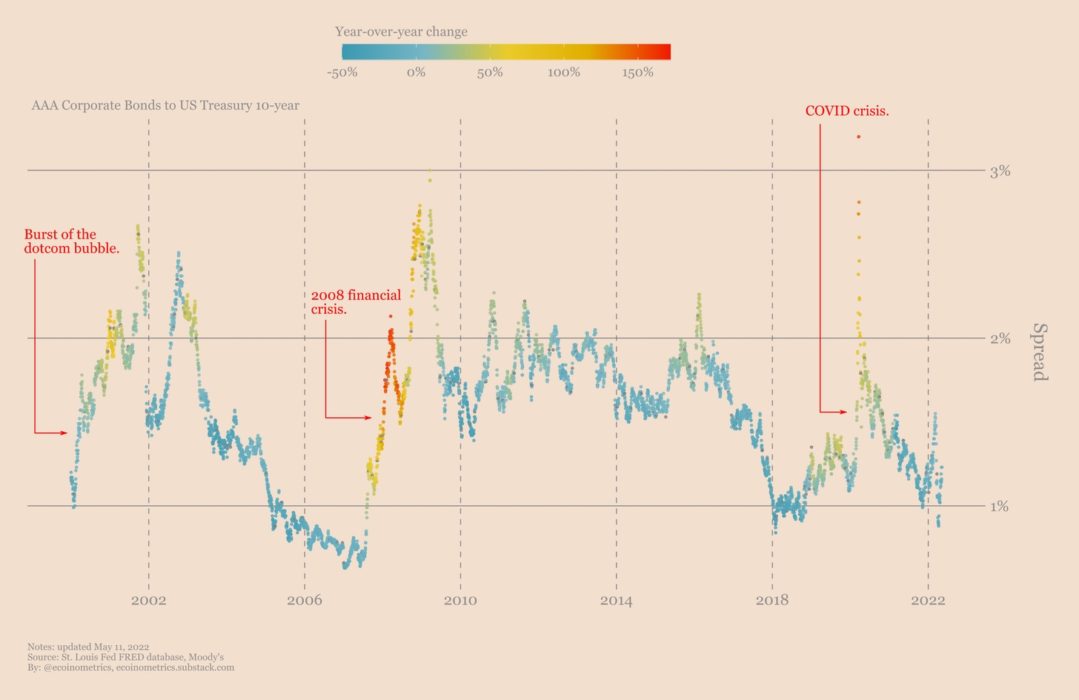

As an example, you can take Moody’s AAA corporate bonds (the highest rating, the most reliable loan) and look at the spread between them and 10-year treasuries.

While the absolute level of these credit spreads says something about overall credit market conditions, we are more interested in spikes.

That is what the Fed will be looking at: a sudden rise in credit spreads beyond the range of standard values.

Credit spreads between corporate bondsand 10-year Treasuries. At the moment, corporate bonds with the highest AAA rating have historically low credit spreads. But this can change very quickly.

As you can see, during previous crises/recessions things got out of control quite quickly. However, at the moment there is nothing that could worry the Fed.

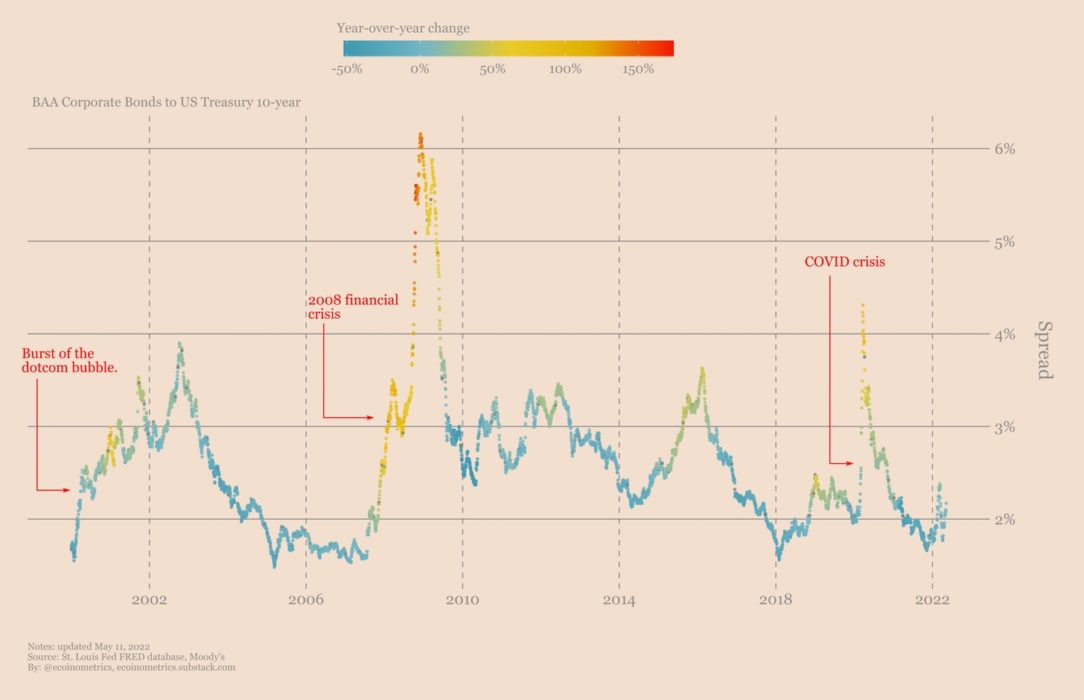

Going down a step from the point of viewcreditworthiness, you can look at the credit spreads of Moody's BAA corporate bonds. Here, too, there is nothing special compared to the previous crisis.

Credit spreads between corporate bondsand 10-year Treasuries. Credit spreads for corporate bonds with an average rating of BAA are at historically low levels. Although this can change very quickly.

In fact, if all that we caninteresting is the rapid deterioration of the situation in the corporate loan market, we probably do not need to consider all possible combinations of ratings and maturities.

I mean, if you zoom out and relate these two graphs as a whole…

Find the differences between these pictures.

- It's the same picture.

I'm sure that by turning to highly profitablecredit spreads or something like that, we find some differences. But unless you are trading something that is directly related to the credit markets, this is likely to be overkill.

What is the conclusion? Credit spreads are a measure of corporate default risk as perceived by lenders.

When credit spreads skyrocketincrease, which means that lenders find it much riskier to lend to businesses than to invest in government bonds. This is usually a sign of a bad economic situation.

At the moment, credit spreads are not particularly wide and there is no surge.

So the Fed is unlikely to be worried about the possibilitythe collapse of the credit market in the near future. So, on this parameter, they have a green light for further tightening of monetary conditions in order to regain control over inflation.

Until something breaks…

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.