Decentralized finance (DeFi) has become one of the hottest topics in the crypto industry, with monthly launchesdozens of new projects.DeFi apps essentially allow you to create financial contracts that run automatically. Broadly speaking, these contracts facilitate the issuance, lending, trading and management of cryptoassets.

The range of DeFi applications is so wide thatit is difficult to measure the level of acceptance of this topic in general. After all, trading and lending involve different transactions that are not entirely comparable. To solve this problem, the crypto industry invented a metric calledTotal Value Locked(total value of blocked assets), orTVL,to measure the adoption of DeFi projects.

Most DeFi applications, regardless of their purpose - lending or trading - require collateral in the form of a crypto asset, such as stablecoins.Total Value Lockedprotocol is calculated as total dollarthe value of all collateral contributed to that particular application, regardless of its functionality. Thus, TVL makes it possible to compare money markets such as Aave with decentralized exchanges such as Uniswap.

Since 2019, the DeFi industry has experiencedexponential growth. TVL has become the de facto way to measure DeFi adoption and one of the most requested metrics across many analytics platforms. In this post, I would like to share some of the problems that prevent accurate TVL calculation, as well as critical disadvantages when using this metric to evaluate DeFi protocols.

We have identified three main issues that make calculating a reliable TVL value challenging.

Variety of protocols: the myth of "Total"

Decentralized finance is still very youngan area where protocols and applications start and disappear every day. Some of these projects are simply copies of existing protocols or new versions on an existing system, while others are completely new creations. Each of them complicates holistic assessments for a given smart contract blockchain.

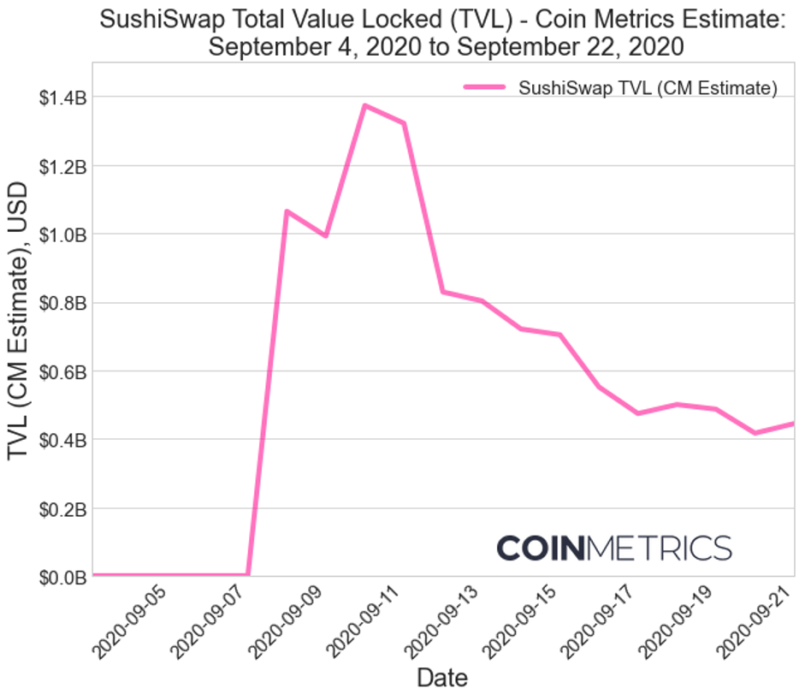

Protocols can be successful overnight,collecting billions of dollars in collateral within days. For example, Sushiswap, a clone of Uniswap, gained almost instant fame in September 2020 when its TVL surged from a few thousand to over a billion dollars overnight:

What explains this growth rate?In fact, the incentive structures in DeFi protocols are perfectly flexible. SushiSwap came out of nowhere and has raised over a billion dollars in deposits through an aggressive token release schedule that favors early adopters.

This approach has created a precedent that is rathereverything will be repeated ad infinitum. Given the frequency with which clone protocols are launched, it has become almost impossible to perfectly track all the collateral allocated to the blockchain in real time. Analytics services have to choose which protocols to monitor TVL for, since each such case requires some manual work.

The frequency of launching new protocols leads toa natural underestimation by data providers of the aggregate locked-in value used as collateral across all DeFi applications. To accurately calculate TVL for a platform like Ethereum, data providers have to constantly revise past measurements to reflect the addition of new protocols and collateral types. With DeFi currently rolling out heavily on new smart contract platforms, this rapid pace of new launches undermines the accuracy of any approach to getting correct TVL estimates across the protocol as a whole.

In addition to the problem of launching new protocols, moreone complicating factor is that existing protocols can mutate and change as well. To account for such mutations, it is also necessary to constantly monitor new versions and deployments of contracts. Uniswap, for example, is already in its third iteration, with the amount of security tracked slightly differently for each version. Accordingly, the TVL for Uniswap is equal to the amount of collateral allocated for each of its versions, which must be individually priced.

Perhaps in the future, the DeFi sphere will stabilizearound a set of norms or standards. If such standardization happened, it could make it easier for analytic services to integrate these new protocols. However, standardization is not a panacea, as there is no guarantee that all protocols will conform exactly to standards. As we saw with the proliferation of the ERC20 standard, there are many variations that still require manual intervention. Thus, in the short to medium term, DeFi normalization is unlikely to provide data providers with a performance leap in adding new protocol data.

Variety of types of collateral: the myth of “Value”

Decentralized finance protocolssupport an almost infinite variety of assets that can be used as collateral. Some protocols restrict the types of collateral available, but many do not.

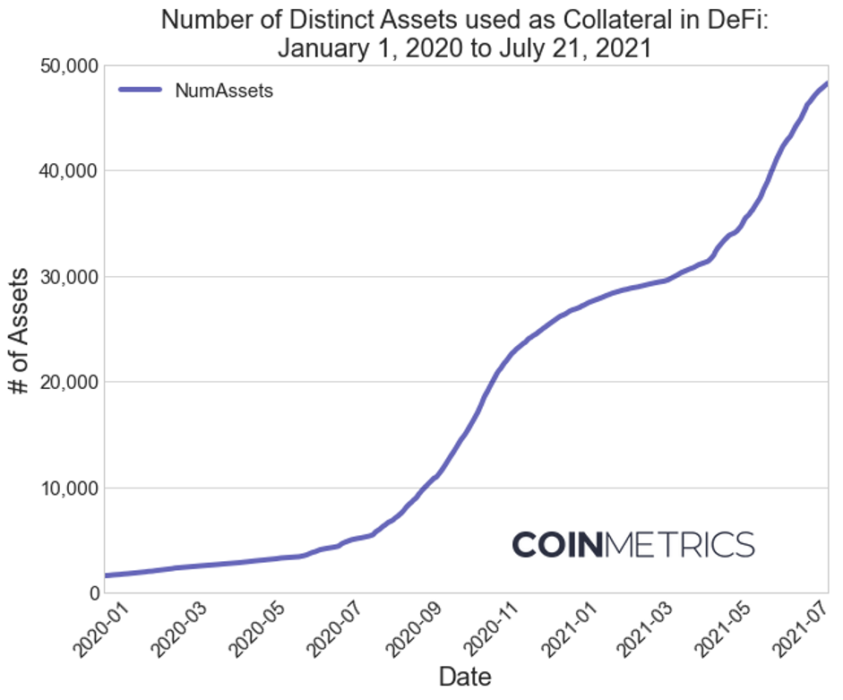

(includes data from Uniswap v1 / v2 / v3, Sushiswap, Curve, Aave v2, Compound, Maker)

This graph displays the lower bound of the realthe number of different assets used as collateral in DeFi applications. This is not a holistic assessment as it does not include data from all DeFi protocols and is limited to ERC-20 tokens only. However, this lower bound gives insight into the impact of tokenization and the rapid growth of the types of collateral that can now be used in DeFi.

A huge variety of types of collateralcollateral complicates the valuation. All of these assets can be traded on various platforms ranging from centralized exchanges with off-chain transactions to decentralized protocols with on-chain transactions. Collecting price data from all of these sites is a titanic task that, like protocol integration, scales poorly. At the same time, this is necessary so that the asset used as collateral can be correctly valued using an index value that takes into account each location.

Even if the data provider has sufficientbandwidth to retrieve index values from all possible marketplaces, it is difficult to take all the collected data at face value. Similar to the problem of correctly calculating the market capitalization of a cryptoasset, price data in DeFi liquidity pools can be manipulated and ultimately distort the estimated value.

Reliable price sources cover no more thanseveral hundred assets. On-chain exchanges can be used to get the current price of the rest, but there is no guarantee that they are traded with sufficient frequency to provide accurate prices, or that the liquidity in these protocols is organic.

Remortgage: The Locked Myth

Finally, the most subtle but important problem withusing TVL is related to understanding the structure of assets used as collateral. When evaluating the TVL protocol, it can be assumed that each unit of value deposited as collateral is used exclusively within the protocol. In other words, assets are “locked” in the sense that they are strictly used in the context of the given application and nowhere else.

However, due to the way money markets workDeFi, this assumption is wrong. DeFi allows the creation of derivative financial instruments to re-mortgage assets already used as collateral. Simply put, the collateral used in one application can be used - in whole or in part - in another, which can then be used in another, and so on. There are DeFi applications specifically designed to re-mortgage assets so that their users can take advantage of additional leverage. While this knowledge is nothing new, it challenges the understanding of what constitutes “blocked” collateral.

In short, some of the assets used inDeFi applications as collateral are derivatives that constitute a right to claim on other collateral. This creates a multiplication factor that can significantly overestimate the TVL score, since the data takes into account both real and re-pledged fully or partially collateral. The existing approaches to calculating TVL do not allow distinguishing between them. Thus, the amount of blocked collateral can be significantly overestimated, depending on the protocol.

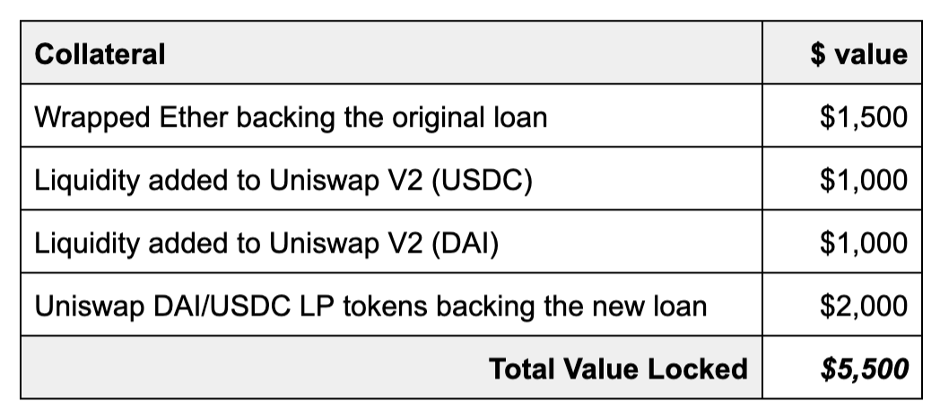

For an illustration, take a look at the following example:

- A user deposits $ 1,500 in Maker Wrapped Ether (WETH) to receive a $ 1,000 DAI loan (150% collateral ratio).

- The user then contributes these newly released DAIs,as well as USDC worth $ 1000 to the USDC-DAI pool on Uniswap V2. In return, he receives liquidity provider tokens representing a share of the pool's liquidity of $ 2,000.

- After this the user canre-mortgagethese liquidity provider tokens into Maker to receive another loan of $1,960 DAI (102% collateralization rate).

At first glance, TVL can be calculated as:

However, a more sophisticated approach is toto count as “real” collateral only $ 1500 in Wrapped Ether and $ 1000 in USDC, which gives TVL $ 2500. This approach will ignore assets that represent the right to claim other collateral, such as DAI (issued as collateralized loan) and the DAI / USDC liquidity provider tokens in Uniswap (representing the right to claim liquidity held in the DAI / USDC pair for Uniswap).

This introduces additional complexity as it makes it difficult to determine whether the collateral asset adds “hidden” leverage to the TVL values.

Finding the best metrics for DeFi

To better understand DeFi systems and properhow to value them, it can be useful to view DeFi assets as a new type of asset backed securities (ABS). It is a type of derivative financial instrument that is a claim on a pool of secured assets. In the DeFi context, these derivatives provide the foundation for trading, lending, and managing cryptoassets. Compared to the traditional systems used to issue ABS, DeFi is trying to provide greater transparency and automated risk management.

In this sense, what Total Value measuresLocked is the overall size of the margin lending market. As described in this article, this figure can be misleading because it is inflated by the leverage multiple, is highly price sensitive, and is far from holistic. Without knowing what exactly this multiplier is, it becomes impossible to correctly determine the level of «health» systems. Most importantly, the absence of these data prevents systematic analysis of the system's sensitivity to price shocks, which is critical for these types of systems.

For these reasons, it is imperative to distinguishbetween “real” and re-mortgaged collateral before doing your own TVL evaluation. Likewise, it is important to keep track of these numbers in the “native units” of the protocol, which removes price sensitivity and provides a better picture of application growth. In addition to improved approaches to TVL pricing, another potentially interesting metric is the simplified DeFi equivalent of “open interest” (the amount of open positions), which takes into account the total number of contracts that support the application instead of value.

Developing all these metrics at the same time -not an easy task. To better automate the data collection process, analytics services are creating a new set of tools for more scalable analysis of smart contract data. Given the challenges of holistic measurement, the expansion of DeFi metrics will focus primarily on application-level risk management as well as trade data from reputable automated market makers.

Conclusion

In conclusion, it should be noted thatTotal Value Lockedis a complex metric hiding under a deceptively simple name. Each word that makes up its name carries its own set of problems:

«Total”involves tracking all versions of a protocol, or even some of its versions, across multiple blockchains (Ethereum, Binance Chain), as well as second-layer protocols such as Matic or Fantom.

"Value"involves finding a reliable price for each of the thousands of assets that can be used as collateral.

"Locked"- in most protocols, liquidity can beadded or removed pretty quickly. There is also the problem of untangling complex and ramified relationships between assets in order to avoid double or triple counting of the same collateral.

</p>