AnalystWill Clementeanalyzes the current situation in the Bitcoin market, using on-chain metrics to separatesignal from noise.

</p>Dear readers, I hope the week has gone well for you.successful. Let's start our weekly column with a macro-review, covering the picture of what is happening in the market today, from a specially invited author. I present to you my good friend, Nick Bhatia. Nick is widely known for his book Layered Money and he recently launched his own newsletter called The Bitcoin Layer.

Macro overview

Bitcoin has struggled with the topic over the yearscorrelations with the stock market. This is true as the March 2020 pandemic showed that Bitcoin can definitely be both a risk-free and a risky asset. In terms of currency, the bitcoin price has also periodically correlated with the RMB due to capital flight from the country. However, it is most fair to say that Bitcoin is not correlated with other asset classes. As a commodity, it has its own characteristics, characteristics and internal mechanisms that determine the base value. However, Bitcoin is responsive to what is happening in the world, and it is therefore necessary to keep a close eye on the themes contributing to the underlying Bitcoin long position thesis, namely, the topics of stock market fragility. First, let's discuss the dollar and the situation in China.

The global dollar system is on thinice and constantly needs additional liquidity provided by the Federal Reserve, but the dollar still holds the lead over all other world currencies. When the dollar strengthens, it is a sign that investors around the world fear the weakness of the economic and financial markets. Here is the Bloomberg Dollar Spot Index (BBDXY) over the past couple of years.

In March 2020, in the midst of a pandemicthe liquidity crisis, notice how the US dollar soared as fear gripped the markets. Following this rise, the sustained depreciation of the dollar was the result of the Fed's guarantee of infinite quantitative easing. When the Fed eases monetary policy, markets breathe a sigh of relief, selling US dollars and buying riskier assets denominated in other currencies.

However, over the past few monthsthe US dollar remains roughly flat and appears to be forming a moderate uptrend. The dollar is partially responding to the Fed's threats to cut QE, which is another way of saying "less heroin in the banking system than in previous months." This is worth keeping an eye on because a rise in the dollar will be a symptom (not a cause) of global economic weakness, however relative it may be. How bitcoin will react to small fluctuations in the dollar is anyone's guess, but another round of asset price declines will always support bitcoin's opportunity to exhibit its risk-free asset. The second-tier dollar strength effect is that global economic weakness often triggers bailouts, which undermines the credibility of the traditional financial system, further strengthening the bullish hold on Bitcoin. Bottom line: The dollar's net strength is pure financial tightening and should be watched closely.

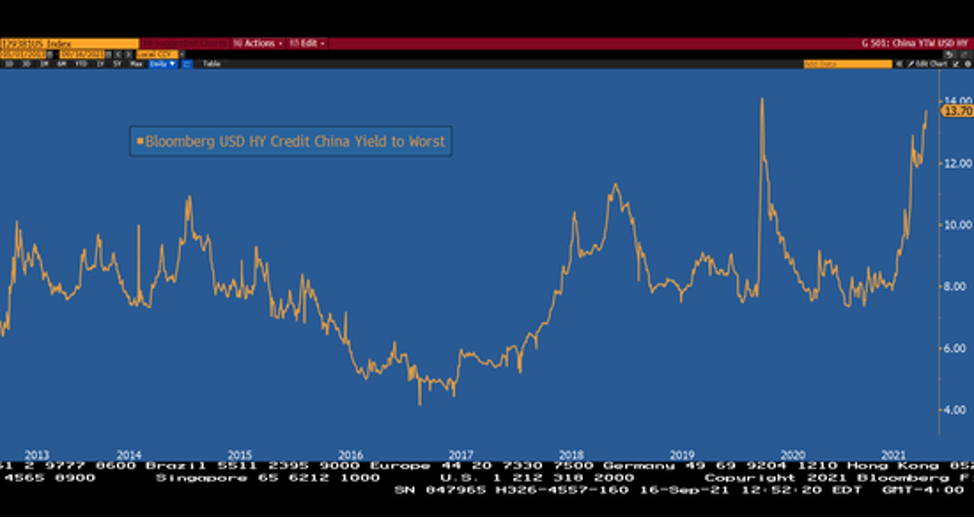

The next point worth discussing isthat the Chinese real estate giant Evergrande is on the brink of default. Those directly affected include vendors demanding payment, employees potentially receiving future real estate in lieu of money market deposits, home buyers faced with unfinished real estate, bondholders, and the list goes on. While it is too early to tell how widespread this contagion will be, calls for emergency measures from the Chinese leadership are becoming louder every day. Here is an index of China's high yield bonds over the past few years.

Yield Returns To Highs Of March Crisis2020 as bondholders sell positions in risky Chinese corporations. This shows us the spread of the infection outside of Evergrande, but so far there is no evidence that the sale will spread to the fixed income markets in the US. Things can get more interesting in China, however. Some banks in China appear to be amassing the yuan at their highest price in nearly four years, according to Bloomberg, a sign that they may be gearing up for a strategist at Mizuho Financial Group Inc. he called it "the contraction of liquidity in a crisis mode." Evergrande is expected to miss its first interest payment on September 20th. How quickly will the Chinese authorities intervene?

Will Clemente speaks

From the point of view of on-chain metrics, little has changed this week, except for some continuation of the trends that the quotes have already followed over the past month.

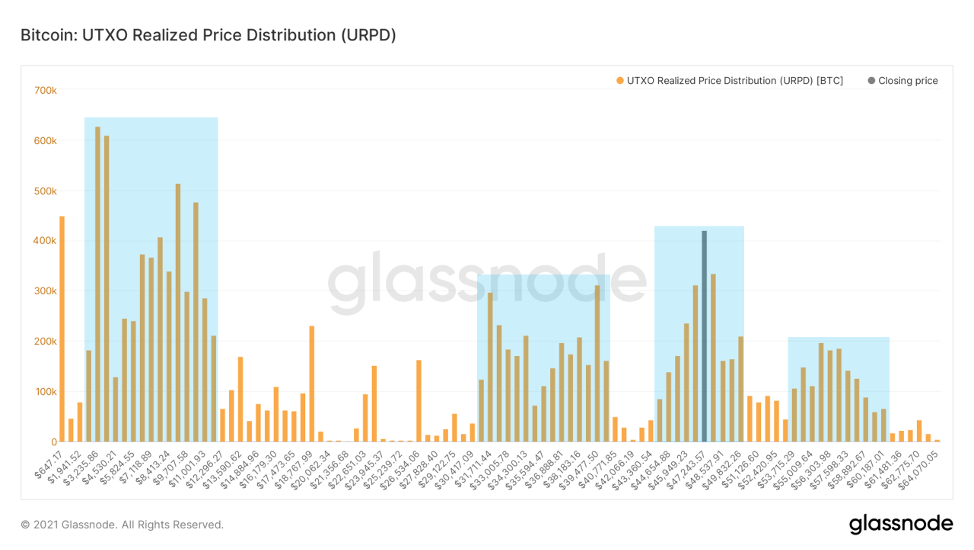

We continue to highlight the fourth clusteron-chain volume, emphasizing the high cost of market participants in the range from 44 thousand to 50 thousand dollars. Before the cascade liquidation of positions last week, we started working in the final cluster, starting at $ 53k

Distribution of UTXOs by Selling Price (URPD)

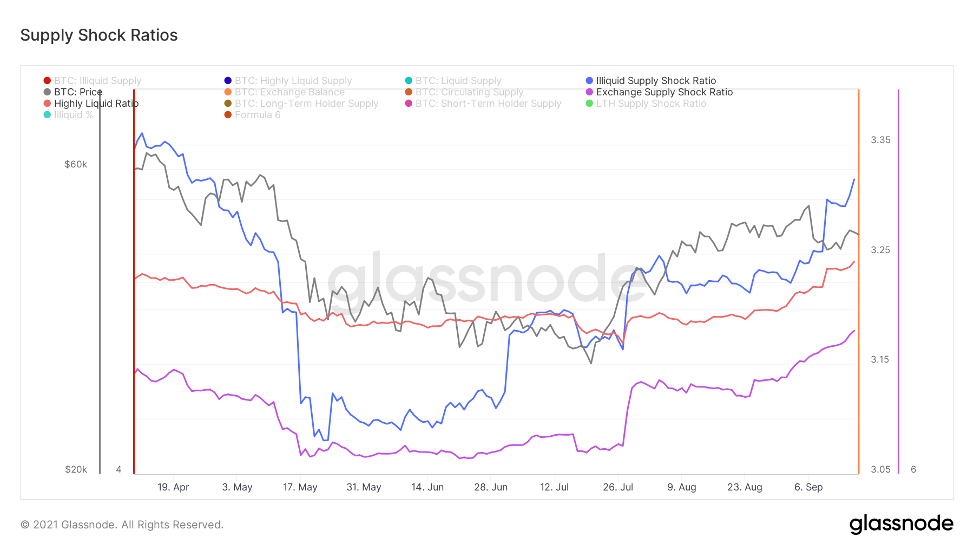

We observe the continuation of the trend usingSupply shock metrics. The Illiquid Supply Shock Ratio shows another upside momentum, indicating that coins are going to network entities with a statistically low probability of selling. We also see an increase in the high liquidity ratio, showing the movement of coins from highly liquid entities to liquid or short-term owners. I wish this would continue to lead to more growth for ISSR. We also have a Supply shock ratio for the exchange offering, which shows that coins continue to be withdrawn from exchanges. This week, 26,148 BTC left the exchanges for a total of about $ 1.25 billion at a BTC price of $ 48,000.

Supply Shock Ratio for highly liquid (red line), illiquid (blue) and stock (purple) supply

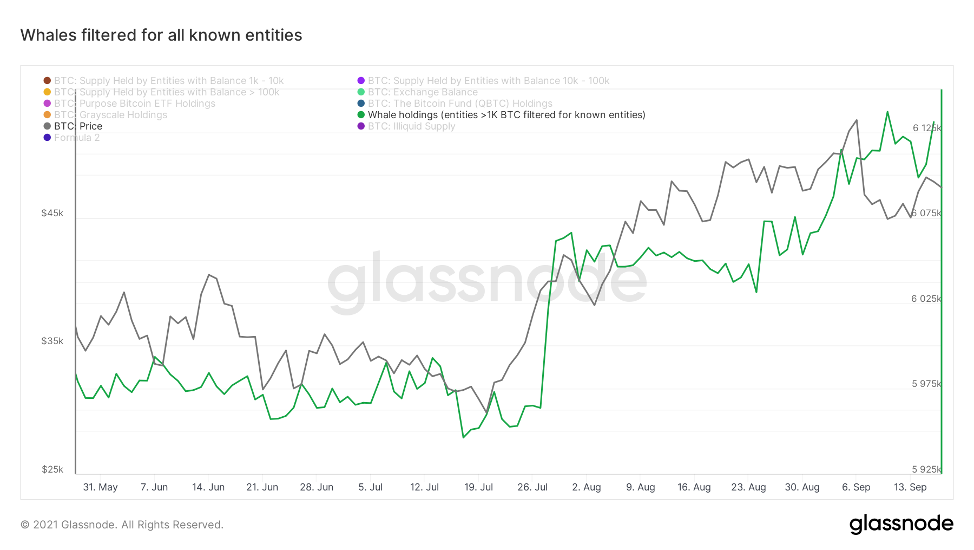

Looking at the subjects of the network with more than 1 thousand.BTC filtered for well-known entities like exchanges, we also see significant interest from large players. The whales have now added 184,699 BTC to their assets over the past 2 months, for a total of roughly $ 8.8 billion at a bitcoin price of 48k (since July 17).

The volume of bitcoins held by whales (balance >1 thousand BTC). All clusters of addresses of known Glassnode exchanges, funds, over-the-counter brokers, etc. are filtered.

We still see that long-term holdersincreasing their positions and estimated savings, and coins older than 5 months cross the 155-day threshold. This is significant, as it means that the subjects of the network who are currently crossing the threshold bought them right before the sale on May 19. A continued rise in the supply of long-term holders over the next few weeks would be a very positive sign, as it would mean that market participants are not worried about the mini bear market that Bitcoin is trying to get out of.

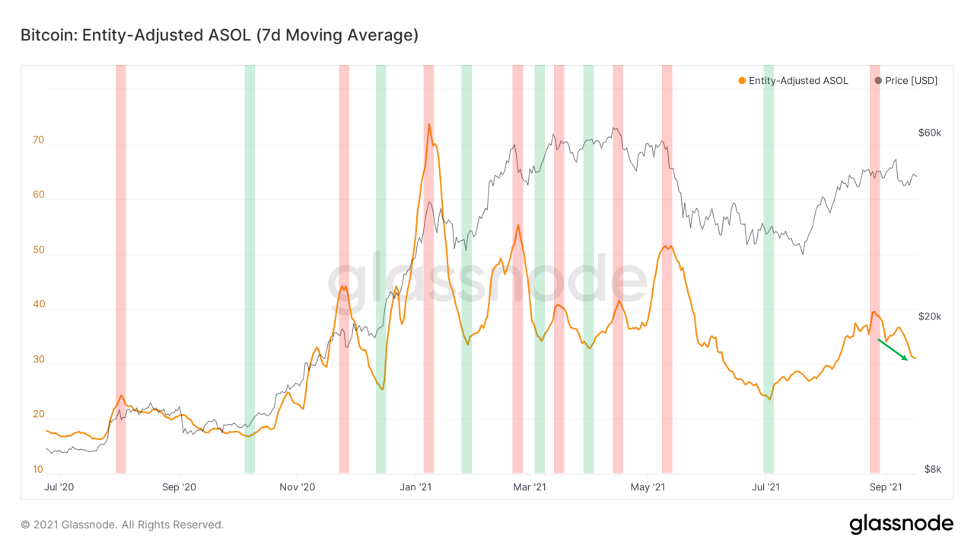

Another way to track behaviorlong-term investors - use our coin age-related cost-oriented metrics such as SOAB, SVAB, CDD, dormancy, liveliness and ASOL. I decided to add ASOL to today's release, but similar trends can be found in the metrics listed. However, they are best used in tandem because, for example, the Spent Volume Age Bands (SVAB) ratio shows the actual spending per cohort, while ASOL is simply the average age of each issue. Nuance, nuance, nuance ...

We see here as older market participantshold on tightly to their assets, as evidenced by the declining life expectancy of outputs spent. Generally, high costs on the part of longer-term holders are bearish, low costs are bullish.

Entity-Adjusted ASOL Indicator (User-Adjusted Average Life Spent Exit) by Glassnode

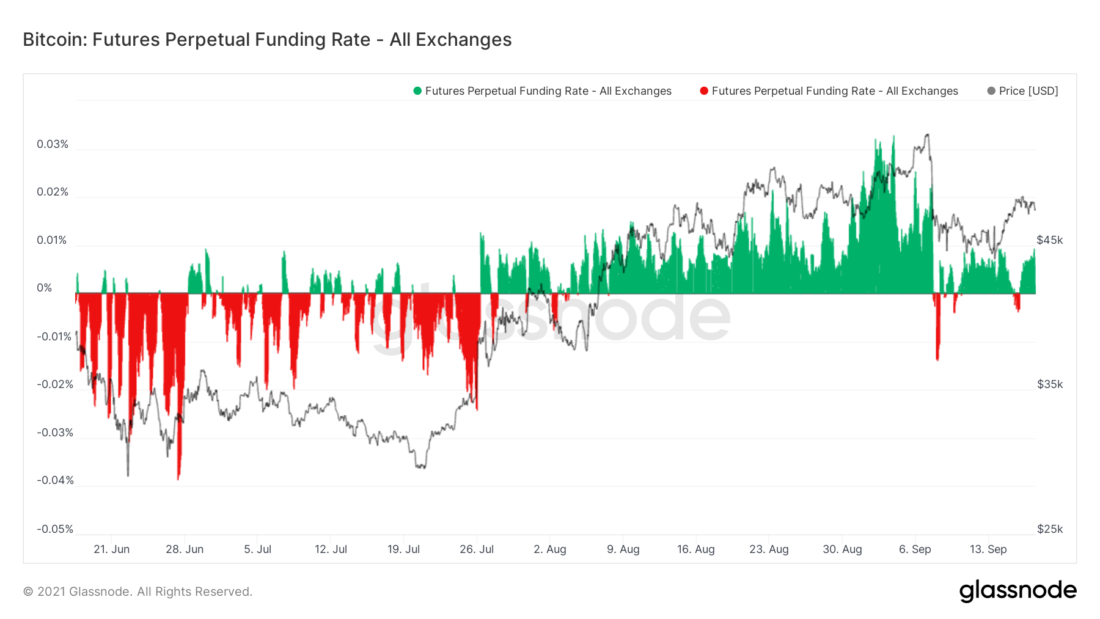

As I promised we will touch every weeksome data related to derivatives to be prepared for any potential short-term price fluctuations. Funding has returned to positive after last week's negative, although it has not come close to the levels that preceded the cascading liquidations of positions last week. Open interest in futures has rebounded by about $ 1 billion, but it is still $ 3 billion lower than it was before last week's sell-off. This indicator will certainly need to be monitored in the future. The futures market looks bullish but prudent.

Bitcoin Perpetual Futures Funding Rate

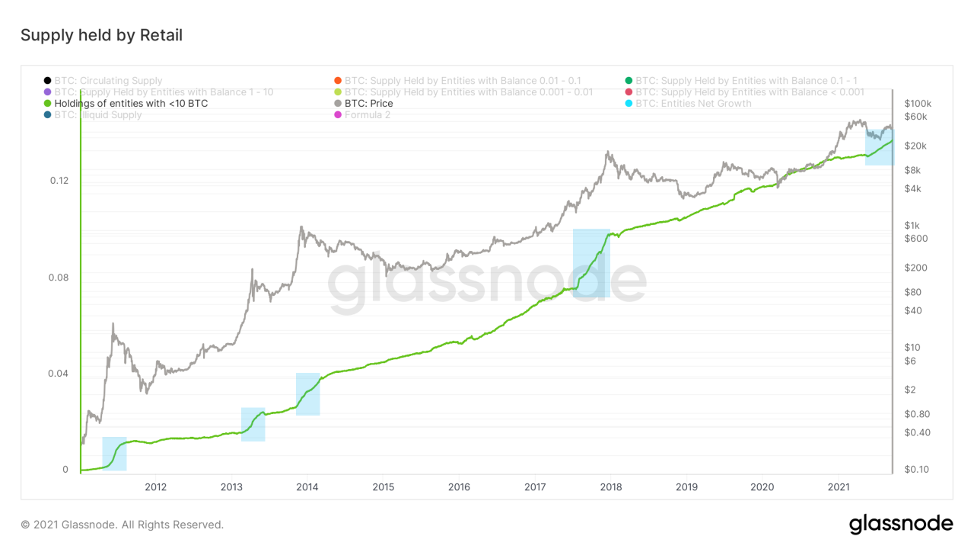

And finally, let's add a macro diagram to getmore general picture. Consider the supply held by retail as a percentage of the total circulating supply. For reference, I define retail as any network entity with a balance of less than 10 BTC. Pay attention to the macro-pattern that took place during every bullish rally in Bitcoin. Beginning in May, small market players started piling up BTC like crazy and now retail is running the middle of the bull markets. When in doubt, take a look at the big picture.

Retail held offer

That's all for today. Great weekend to everyone.

BitNews disclaim responsibility forany investment advice that this article may contain. All the opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>