Futures reports are a useful tool for traders to help them capture sentiment among majorplayers and complement the vision of the market situation. Analyst Dmitry Perepelkin specifically told ForkLog about the mood that prevails in the camp of bitcoin whales.

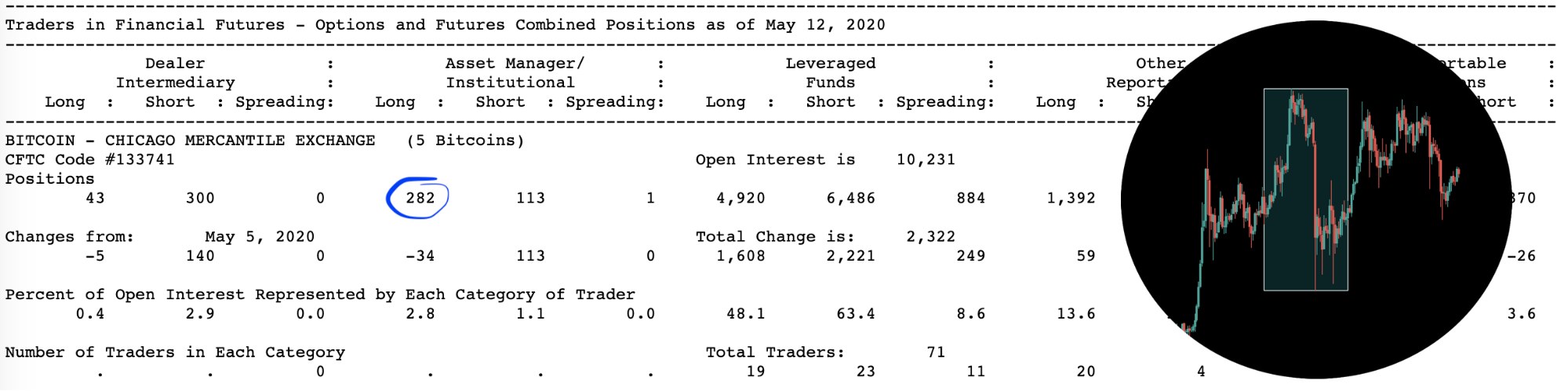

During the period from May 5 to May 19, a number of important changes took place in the camp of large players on the Chicago Mercantile Exchange (CME). The market managed to grow by 13%.

The graph below shows the growth of bitcoin over the period of the last two COT reports.

In a report for May 5-12, Asset Managers retained 282long positions. They have been picking them up since the end of April, when Bitcoin was trading at $ 7,800. Over the course of a month, Asset Managers were up for gains, although 113 shorts appeared.

Short positions were opened during the lateral movement, which is a natural reaction to stagnation when the asset is near an important resistance zone.

All attention is now concentrated on the line of $ 10,000. The longer the price is below this level, the greater the pressure on long holders becomes.

Some are already starting to close long positions, as can be seen in the chart below (Bitfinex Long VS Short), where in two weeks the longs decreased by 26.6%.

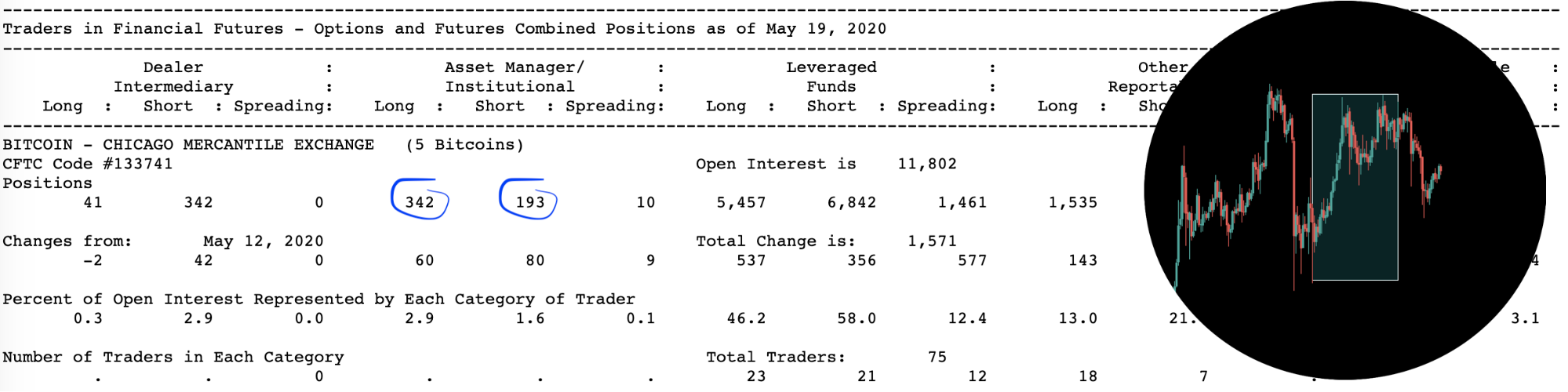

Between May 12 and 19 Asset Managers increased the number of long positions by 60. At the same time, 80 new short positions were added.

The number of longs exceeds the number of shorts by 77%, but the increase in the latter is an alarm.

A signal in favor of a decrease to $ 8000 will be the closure of more than 30% of long positions in the Asset Managers section and an increase in short ones.

Open interest in the growth of bitcoin has already reached the mark of March 23, when the figure was 9757 contracts.

In practice, growing open interest amidprice growth signals a strengthening of the uptrend. The $ 10,000 level is now the defining milestone. For further growth, it is necessary to consolidate prices above the $ 10,500 mark (this is the threshold on February 13, 2020).

Futures analysis is only partintegrated analysis. In no case can you make trading decisions based on futures analysis only. This review is analytical and not a forecast or trading recommendation. The bitcoin market is very volatile, so do not forget about risk management, hedging and diversification.