Speaking about the growing popularity of cryptocurrencies, we note a regular increase not only in the overall marketcapitalization, but also the volume of daily transactions. According to CoinMarketCap, every 24 hours, more than 500 sites trade digital assets worth more than $200 billion.

At the same time, portal analysts calculated thatthe list of active cryptocurrencies is updated weekly with 24 new coins, which are vital to provide liquidity for fast and uninterrupted trading on exchanges. This is where market makers come into play. In this review, we will take a closer look at their role and significance for the market, as well as give examples of the leading market makers in 2022.

Who are market makers

Market makers are direct participants in the financial market who support active trading by constantly making deals with other trading participants.

In other words, market makers create a “live market” - they support supply and demand for a certain asset, trading it in a price range predetermined by the strategy and in a volume sufficient toensure liquidity and maintain a narrow spread. The smaller the spread is the difference between the best pricessales (Ask) and purchases (Bid) - the higher the liquidity. And this means that the market becomes more attractive due to the fact that absolutely at any time an asset can be bought easily and quickly.

For an ordinary user who trades on exchanges,it may seem that all instant transactions are carried out between ordinary traders. However, in most cases it is market makers who buy orders to eliminate any possible delays or difficulties. Otherwise, users can wait for the execution of their orders for several days or even weeks.

Simply put, the role of market makers is tois to create an efficient and reliable market mechanism that will ensure stable trade even during times of turmoil. In addition to creating liquidity and keeping the spread low, market makers increase the depth of the market, thereby preventing price spikes to fill large orders.

How market makers work

Professional companies with their traders, technical analysts and developers act as market makers on the crypto market.

To automate trading strategies andexecute a huge number of orders every minute, market makers use API - a special protocol for integrating their own set of trading algorithms (bot) into the platform with which the user interacts. However, if the exchanges suddenly experience failures in working with the API, fully robotic trading becomes impossible and the market maker starts trading manually with the help of regular traders. That is why high-class teams of traders are always valuable.

How do market makers actually make money?

1. Receiving payment for services from project-issuers with whom a contract has been concluded;

2. Receiving monetary compensation from exchanges or a reduced commission for concluding transactions;

3. On the spread, placing orders on both sides of the order book;

4. On interest from over-the-counter transactions.

In the current realities, the success of crypto startups isexchanges is impossible without the involvement of a reputable market maker who ensures trading after the listing of new coins, understands the exchange structure, builds a long-term strategy for the development of the token price, and most importantly,helps to increase the profit of the project.

The largest market makers in the cryptocurrency market

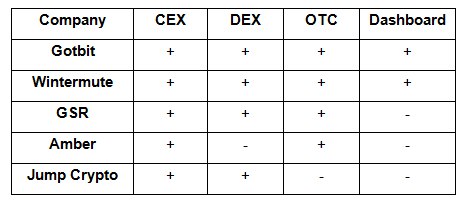

Today, there are many companies in the industry that provide market making services. Below we have put together a short list of market makers that are in the spotlight in 2022.

gotbit

Opens our selection of hedge fund and market makerGotbit founded in 2017. Over 5 years of work on the crypto market, the start-up of MSU graduates has grown into a large trading company with over 100 specialists, including ex-employees of Goldman Sachs, PWC and McKinzey. With rich experience in the banking, consulting and investment sectors, Gotbit successfully cooperates with more than 300 projects, as well as with leading exchanges - Binance, Coinbase, KuСoin, Huobi and Bybit.

Gotbit's basic approach that makes it stand out forcompared to other market makers, this is a complete immersion of the team in each project and product, thanks to which the client gets the opportunity to generate monthly net profit to cover fixed costs - for example, salaries and office rent - and further development of the company. Gotbit also has its own OTC service for OTC trading and an online platform with 24/7 access to balances, PNL and performance tracking tools. Here, the client exercises full control over the financial operations of the market maker.

Another key advantage of Gotbit isa variety of unique solutions for both centralized and decentralized exchanges. Gotbit algorithms were developed by prize-winners and winners of the All-Russian Olympiads in Mathematics and Informatics, and the trading strategies used by the market maker are individual - they are constantly optimized and checked by in-house developers. Gotbit also hosts weekly strategy sessions with its clients to update each trading strategy in terms of marketing, product updates and partnerships.

A separate area of work for Gotbit issearch and support of new crypto-startups at all stages: from investment rounds to listing on exchanges. Projects enter the incubator after Due Diligence by Gotbit. The company helps projects improve financial models and trading strategies, uses direct access to the largest exchanges (both CEX and DEX) and launchpads, and also helps to improve the tokenomics of assets to attract the largest venture capitalists and invests in projects together with them.

GSR

Market maker GSR was founded in 2013 inHong Kong. Today, the company employs more than 300 employees worldwide, including former employees of traditional financial institutions, namely Goldman Sachs, Citadel, J.P. Morgan and Two Sigma.

To execute orders, the market maker usesyour internal software. GSR has implemented many trading models, integrating them into over 30 liquidity pools, making it one of the lowest fees on the market. The company's proprietary trading technology is easily customized to meet the needs of the client, and sales and aggregation strategies are adjusted based on current liquidity and volatility.

GSR uses tokens as capital that provides liquidity, which it borrows from a client at a certain percentage per annum.

The advantage of GSR is that it constantlystabilizes the pre-determined bid-ask spread and the efficiency of the order book, thereby guaranteeing the execution of orders on the terms specified in the contract. Thus, projects can consider cooperation with the company as an opportunity for profitable investment.

Another killer feature of GSR is the completely understandablerisk management strategies and providing clients with additional hedging opportunities. The market maker also offers insurance for large miners, taking over financial management and developing strategies to increase profitability. In addition, it is a provider of OTC and options trading and also invests in crypto startups.

Wintermute

Wintermute focuses on high frequencytrading (HFT) and has been creating liquid markets on centralized and decentralized exchanges since 2017. In total, he cooperates with more than 50 trading platforms, supporting both high-profile blockchain projects and traditional financial institutions that plan to work with cryptocurrencies.

The Wintermute team are experts in DeFiand skilled traders with rich experience in the world's largest companies, such as the leading traditional market maker Optiver, which specializes in high-frequency trading. Wintemute independently develops algorithms for HFT using in-house developers, thereby providing its partners with a competitive advantage.

Access to the market maker is carried out through a web interface or API. Similarly, GSR Wintermute uses a client token loan model.

The company often participates in earlyinvestment rounds, helping attracted crypto startups to enter the market. Wintemute also has an OTC service and NODE OTC platform for OTC spot and derivatives trading. NODE serves as a professional tool for highly qualified investors and has no performance fee.

In 2022, the Wintermute DeFi system will behacked. The latest attack happened in September, and while the incident didn't disrupt the company's day-to-day operations, it did shake the company's financial position - the hacker stole $162 million worth of assets. The head of Wintermute Evgeny Gaevoy assured that the market maker has not lost its solvency. However, the frequency of hacks raises serious concerns about the security of working with the platform.

Amber Group

The specialization of the Hong Kong company Amber iselectronic market making and systematic trading that brings a stable income. Amber partners with token issuers by programming its own trading rules, algorithms and technologies and providing clients with customized solutions based on specific liquidity requirements.

Amber can act as the mainas a market maker on crypto exchanges and as a designated partner, creating predictable markets for cash and derivatives. The market maker analyzes real-time trading data and also offers some of the best hedging and risk management systems for tokens of various shapes and models. The Amber team has extensive experience with algorithmic stablecoins and elastic supply tokens, Dutch auctions and lockdrops, futures primaries and dual token structures, as well as trade mining and DeFi derivatives.

In early November, the market maker entered into a partnershipwith BitGo Trust, BitGo's custodial arm, hoping to attract major investors from Taiwan, Seoul and Hong Kong. Amber actively uses the tokenized version of Wrapped Bitcoin (WBTC) in trading, the only custodian and counterparty of which is BitGo. Already, the market maker is supported by such well-known investors as Paradigm, Dragonfly, Pantera, Polychain, Sequoia and Tiger Global.

As the main advantages of Amber partnersfocus on regulatory compliance and safety. By the way, shortly after the Wintermute hack, the market maker team determined that the vulnerability of the system was in the way the Profanity address generator generated random numbers to generate keys. Amber fully reproduced the attack in just 48 hours using a regular Macbook M1 with 16 GB of RAM, and described the scheme on his blog.

Jump Crypto

Closes our shortlist Jump Crypto -the cryptocurrency division of the Wall Street trading giant Jump Trading and a market maker that is one of the largest in the DeFi segment. Together, Jump Crypto and Jump Trading unite more than 1200 employees.

Jump Trading is a private trading company witha closed operating activity whose history began at CME in 1999. Over the years, the team has refined its trading strategies, as a result of which it now focuses on high-frequency trading. This is what led to the emergence of a cryptocurrency branch in 2021. The firm also has a venture capital arm, Jump Capital, which invests in crypto companies, including BitGo, Bitnomial, Bitso, and Curv.

Jump Crypto provides services formarket making platforms such as Robinhood, Bitfinex and BitMEX. In addition, the company became the crypto hedge fund of the Solana network, as well as decentralized exchanges like Serum and DeFi projects running on this blockchain, such as the Metaplex NFT marketplace. In light of the collapse of FXT, many companies and market makers have faced the risk of losing their solvency. However, Jump Crypto, which has invested in the Solana ecosystem along with FTX, stated that the firm is still well capitalized and liquid and assured clients that there were no issues.

Jump Crypto continues to trade and invest in crypto projects along with other investors who use the Solana collapse to buy coins, despite the ongoing debate about the future of the network.

Output

Market makers in the cryptocurrency markets generateprofit to projects by helping to attract traders to the markets and actively combating problems such as wide spreads, insufficient liquidity and changing market depth. And stable volumes, low volatility and the minimum difference between the purchase and sale prices primarily contribute to the further placement of assets on exchanges and opens up opportunities for the strategic development of crypto projects.

That is why a competent choice of a market maker is soessential to the success of the company. Before deciding in favor of any of the market makers on our list, we also recommend doing your own research. We summarize the aspects that must be considered in the process of finding a reliable partner:

● Spread width;

● KPI and SLA;

● List of partner exchanges;

● Ease of access to reporting;

● Security methods;

● Availability of OTC service;

● Experience and proven reputation of the team;

● Easy communication.

Author: Ikrom Ergashev