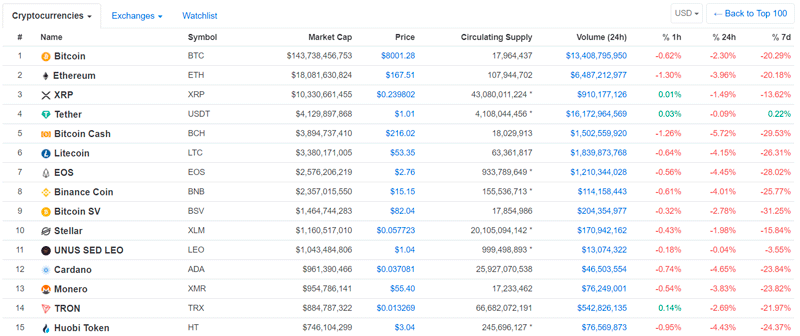

The past week turned out to be one of the most memorable in 2019 for the cryptocurrency industry - for a long timethe expected launch of the Bakkt platform finally took place, but market growth, as many suspected, did not happen. Moreover, over the week, the price of "digital gold" fell by an impressive 20%.

Bitcoin exchange rate volatility

Back on Monday, Bitcoin was trading around $ 10.000, but even a slight decrease during the day did not portend a collapse that could be observed the next day when the asset fell by more than $ 1000 in a short period of time.

The decline continued the next day - inat a certain point, bitcoin fell below $ 7,800. Further recovery attempts were far from good luck, and by the end of Sunday, the first cryptocurrency was trading around $ 8,000 with a downward trend.

</p>Note that this was the deepest weekly drop in bitcoin for the whole of 2019, which pulled into the deep red zone and the rest of the cryptocurrency market.

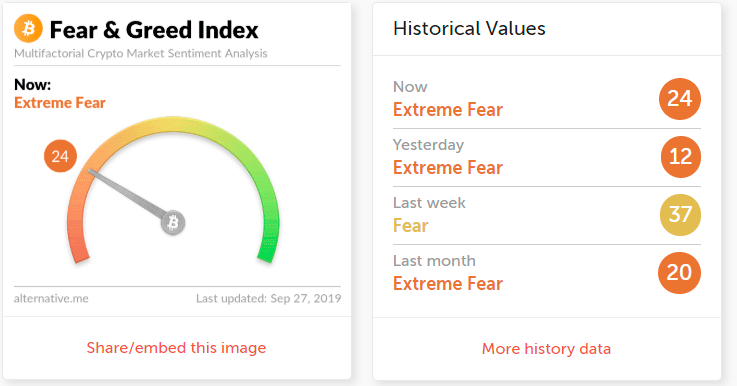

Against the backdrop of a sharp decline in the price of Bitcoin, the market sentiment indicator Fear & The Greed Index fell to 24 earlier in the week, indicating extreme anxiety among investors.

The tool takes into account factors such as volatility, market dynamics, trading volumes, social media trends, data from various studies, the BTC dominance index, as well as Google Trends data.

Interestingly, a sharp drop in the market occurred in anticipation of the expiration of bitcoin options on Deribit and LedgerX exchanges, as well as CME futures.

According to data from analytics company ArcaneResearch, which analyzed data from January 2018 to August 2019, on the eve of the expiration of CME futures contracts, the price of Bitcoin fell by an average of 2.27%.

Meanwhile, CoinDesk Markets analysts pointed tothe fact that on Friday the price of bitcoin closed below the 200-day moving average (MA 200), regarded by many investors as a kind of boundary between the bull and bear markets.

#BTC EU Daily Chart Snapshot

Closed below 200-day MA yesterday

5, 10-day MAs trending south and could cap corrective rallies, if any.

RSI oversold

MACD continues to produce deeper bars in favor of bears pic.twitter.com/QVSv86DLZa

- CoinDesk Markets (@CoinDeskMarkets) September 27, 2019

The predominance of sellers is indicated by the slope of MA withperiods 5 and 10, as well as the histogram of the MACD indicator. Moreover, the fall in prices is accompanied by a significant increase in trading volumes, confirming the strength of the downward correction.

#Bitcoin daily volume has been at its highest levels in total in over a month.

Sept. 24 — Sept. 25.$BTC pic.twitter.com/5AcyKV9zz9

- CoinDesk Markets (@CoinDeskMarkets) September 27, 2019

Renowned trader Ton Weiss, meanwhile, suggested that Bitcoin could move toward $4,000.

Launch of Bakkt Platform with Delivered Bitcoin Futures

On the night of Monday, September 23, athe previously highly publicized launch of cryptocurrency platform Bakkt. Its first products were futures contracts for Bitcoin with physical settlement - upon expiration of the contract, payment in case of a successful bet is made in cryptocurrency, and not in fiat, as happens, for example, on the Chicago Mercantile Exchange.

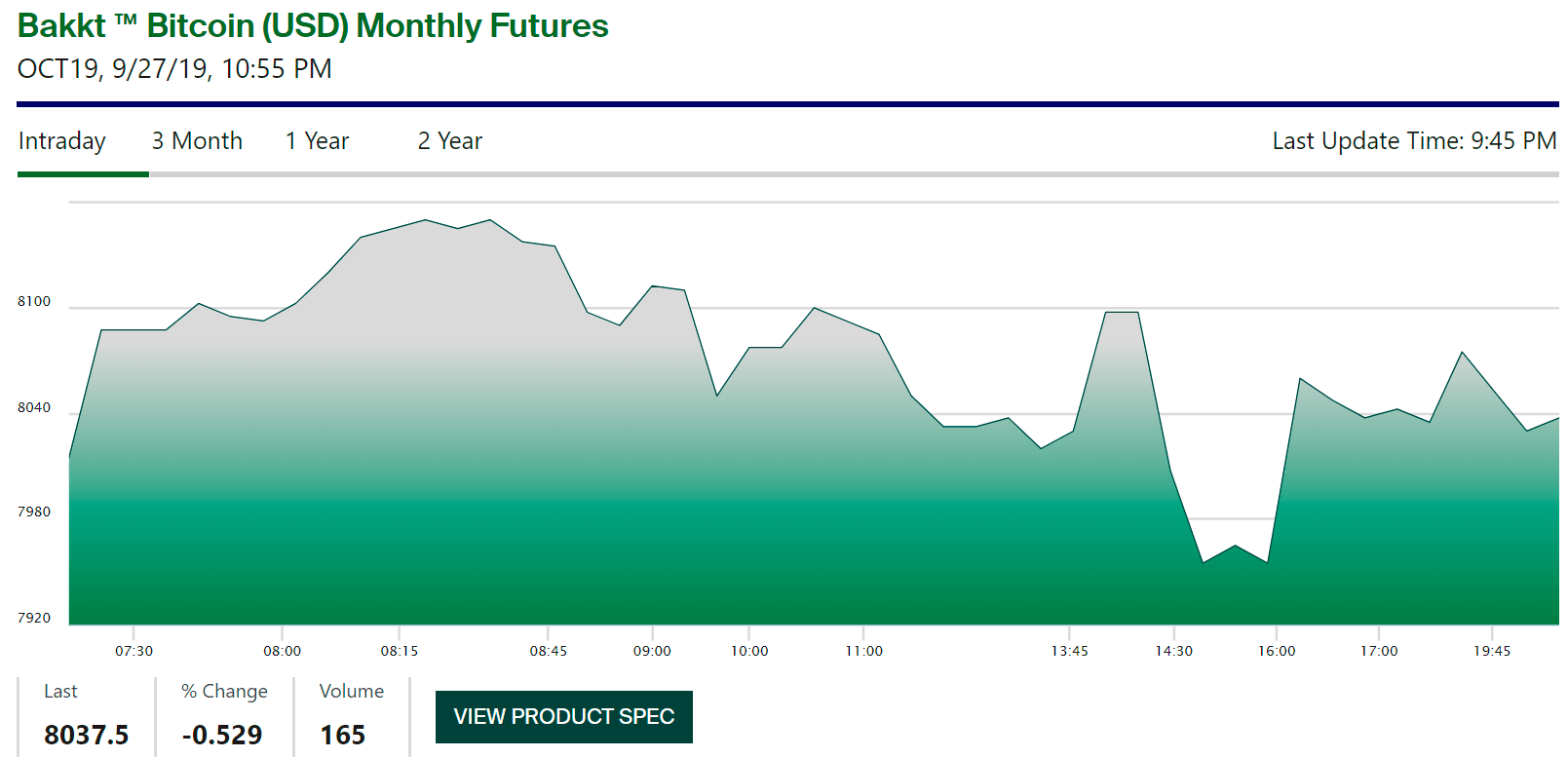

However, as mentioned above, the expectedThere was not only no market growth in connection with the launch of the platform, but moreover, during the week the price of Bitcoin dropped noticeably. Trading volumes are still quite modest, which experts have also noticed.

So, by Sunday evening, the total volume of monthly transactions on the platform amounted to 165 BTC with the last contract price of $ 8037.5.

Bakkt CEO Kelly Loeffler, however, is convinced that the launch of the platform is an extremely important event for the industry.

Three reasons why Bakkt's deliverable bitcoin futures are important for the entire industry, according to the head of the company, are as follows:

- proven and regulated infrastructure;

- adoption of new technology based on digital currencies;

- the rapid spread of innovative management practices and the transfer of digital value.

German Stock Exchange launches spot trading in bitcoin

Also on Monday another important thing took place,however, the event was overshadowed by Bakkt. Germany's second largest stock exchange, Börse Stuttgart, in partnership with fintech company solarisBank, has announced the launch of regulated cryptocurrency spot trading. At this stage, only one pair is presented on the site - Bitcoin to Euro.

Börse Stuttgart Digital Asset TradingDigital Exchange (BSDEX) is conducted in accordance with the German Banking Act. At the same time, both retail and institutional traders have access to the trading platform, and it itself is not much different from the existing platform for trading in securities.

Viber can launch its cryptocurrency in Russia

About Viber's plans for the release of its cryptocurrency wasIt has been known for a long time, but this week there were interesting details. The head of the company said he was considering Russia as the first country to launch. Given the huge audience of the messenger in our country, the news can be called really important.

The messenger cryptocurrency should get a nameRakuten Coin, taken from the company that owns Viber. Despite the fact that this organization is located in Japan, there are no plans to launch a digital currency in its homeland. If everything goes smoothly, Russia could become the first country where Rakuten Coin will appear. According to various sources, Viber's user base in Russia is about 50 million people.

However, at least a couple of questions remain:

- Firstly, the Russian authorities have already said thatthat they will not allow the use of Libra in the country, and this cryptocurrency should initially be integrated into the WhatsApp messenger. Will a similar tool from Viber be allowed — The question is complex.

- Secondly, the messenger has a fairly old audience, and will they be interested in cryptocurrency — unknown.

The number of Lightning nodes in the Bitcoin network has exceeded 10,000

On Thursday, September 26, the number of activeLightning nodes in the Bitcoin network exceeded 10,000 for the first time. It was noted that 40% of the network’s capacity is controlled by just one player, LNBIG.

An anonymous programmer providing theseNode, said that micropayments are the future, and the Lightning Network is the same breakthrough as Bitcoin itself. He also said that he reduced the fees for using his channels to almost zero, because he previously earned only $ 20 per month.

LNBIG uses the LND client, as c-lightning and Eclair are less convenient.

“If even a small part of Bitcoin users starts using LN, then my project will become profitable instantly,”- said the LNBIG operator.

EOS network successfully hosted the first hard fork

EOS block producers have activated version 1.8 of the EOSIO protocol. The large-scale update required the first hard fork on the network, which took place on Monday, September 23.

Release includes protocol updatesconsensus # 6831 and # 7167, as well as a set of protocol functions that are activated independently of each other. These included fixing problems related to a deferred transaction, prohibiting references to non-existent resolutions, resolving conflicts of deferred transaction identifiers, and other important functions aimed at making interaction with the EOSIO blockchain cheaper and more complete.

Brendan Bloomer, CEO Block.one, the company that is responsible for developing the EOSIO protocol, noted that the new release will allow application developers to offer their users a free and seamless interface, while the latter will no longer have to worry about overuse of resources.

Congratulations #EOS, today’s 1.8 upgrade now allows application developers to offer a free and frictionless UX to their customers. Users no longer need to worry about resources!

- Brendan Blumer (@BrendanBlumer) September 23, 2019

Telegram will pay up to $ 400 thousand to the creators of smart contracts for TON

This week, representatives of the Telegram messenger announced a competition to create smart contracts for the Telegram Open Network (TON) blockchain platform.

According to the terms of the competition, participants must:

- create one or more smart contracts as described in the attached file;

- Suggest improvements for FunC or the TON virtual machine;

- identify bugs and suggest fixes for the Telegram Open Network test network.

The prize fund ranges from $ 200,000 to $ 400,000, and the competition will end on October 16 at 01:00 Moscow time.

Recall that the launch of the main Telegram Open Network should take place no later than October 31, otherwise, in accordance with the agreement, the project is obligated to return funds to investors.

Mining in Russia was proposed to be equated to a treasure discovery

This week the Association of Russian Banks(ADB) has prepared a concept for the circulation of cryptocurrencies, which, according to its idea, will deprive owners of digital assets of anonymity. This suggests the possibility of recovering cryptocurrency as part of enforcement proceedings, taxation or bankruptcy.

Tax collection system is proposed to be madesimilar to that applicable to investors in the securities market. To implement his ideas, ADB Vice President Anatoly Kozlachkov, in particular, proposed equating cryptocurrency mining to occupying property or finding treasure.

“Using legal fiction, it could be argued that the first owner of the crypto assets“ found ”them, since receiving from an anonymous system can be conditionally considered a find,”- noted in the ADB document.

The organization proposes to consider cryptocurrencies as “newly created” property produced by the citizen himself.

Ukraine plans to legalize cryptocurrency and mining for taxation

The Ukrainian government, which in the past has notshowed special sympathy for cryptocurrencies, looked at them from a different angle and understood — Good taxes can come from this industry, but for this, crypto must be legalized.

The Ministry of Digital Transformation of Ukraine plans to legalize Bitcoin and other cryptocurrencies. The corresponding initiative came from the current head of the Ministry of Finance, Mikhail Fedorov.

He stressed that although cryptocurrencies are not prohibited in Ukraine, they also do not have an official status. Legalization is necessary, among other things, in order, for example, to protect business from searches.

“People who do this [cryptocurrency] should get out of the gray zone and start paying taxes.”- said Alexander Bornyakov during the presentation of the state brand in a smartphone.

As noted, the Ukrainian authorities want"Earned mining" and in the future, the state could "earn from cryptocurrency traders." It is also planned to transfer state registries to the blockchain.

Ethereum mining ASIC miners released that are 5 times more efficient than GPUs

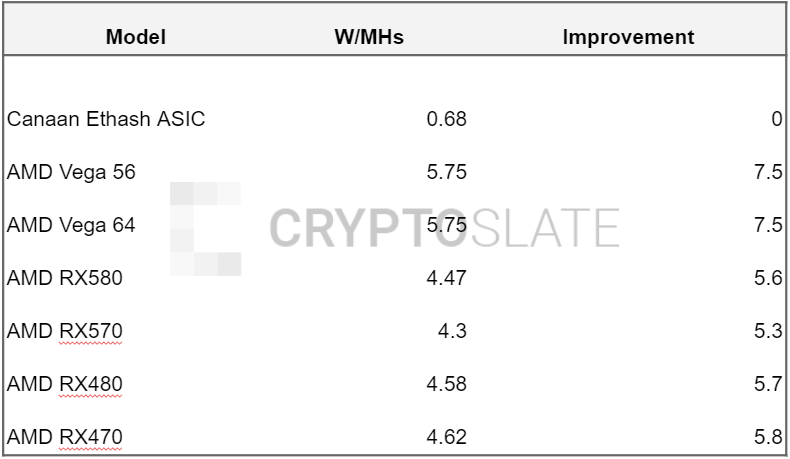

Chinese mining equipment manufacturer Canaan Creative has unveiled the new Ethereum ASIC miner, which is 5 times more efficient than public GPUs.

As presented this Thursdaydocumentation at the “New Era of Mining” summit in China, the Canaan device is 5.3-7.5 times higher than consumer equipment in terms of watts per megahash per second, traditionally used to measure the effectiveness of miners.

Ethereum developers are also currentlyThey are considering introducing the ProgPOW algorithm, which will allow equalizing ASIC and GPU miners before switching the network to the Proof-of-Stake consensus mechanism. Subject to the resolution of the differences and final approval, ProgPOW can be integrated into the Ethereum code along with a hard fork next year.

</p>