This week, Cred and DonAlt, regular Technical Roundup contributors, talk about the narrowing window of opportunity for recoveryBTC and ETH are above the defining levels, and at the end of the review, they present the author's commentary on the structure of the altcoin market cycle.

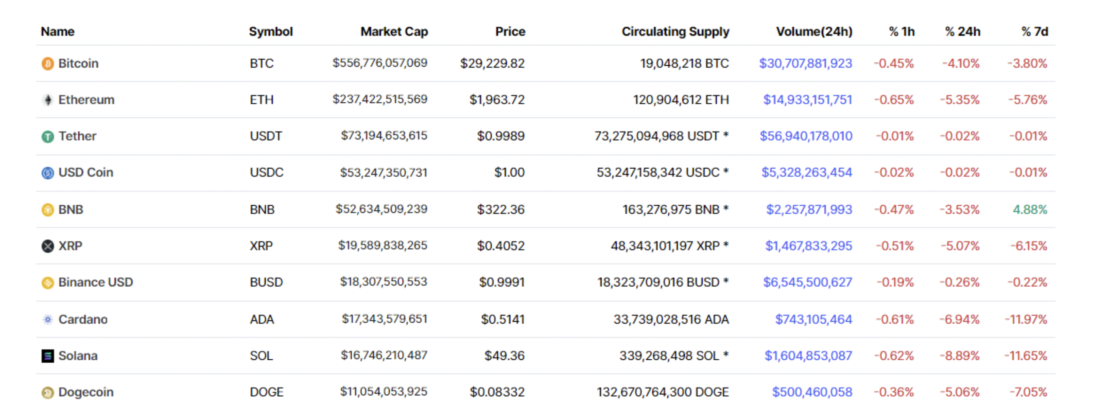

https://coinmarketcap.com/coins/views/all/

Bitcoin Still Below Key Levels

BTC/USD on higher timeframes is still trading below support.

On the monthly chart the price is below the lowrange ($35–37 thousand). And since there is only a week left until the close of the month, in the absence of a strong rally in the coming days, it will be possible to state a breakdown of the macro range downwards.

Even if the market rises after the close of the month, this rally would correctly be viewed as a bearish retest of resistance (former support) in the $35-37k area.

On the weekly chart, another candle closed below the support of $32-34 thousand.

As we wrote last week, from the point of viewThe TA price chart of BTC on higher timeframes does not show any signs of strength. It will be possible to talk about them only if they recover above $32-34 thousand.

So far, there is neither a downward wick on the monthly timeframe (and there is only a week left), nor a close in the previous range on the weekly chart.

In case of further market decline, our targetthe mid-term level is in the $20K area (previous cycle high, coinciding with the 200-week moving average) on the weekly timeframe and, apparently, up to $14K on the monthly.

In general, only some wonderful rally not laterthan this week, the market will be able to refute what threatens to become a breakdown of support on the weekly and monthly timeframes. If such a miraculous recovery does not occur, then any subsequent rallies into the $32-34k area should be considered bearish retests, making further declines much more likely.

Ethereum also needs a bailout

The ETH/USD chart needs a saving rally in the last week of the month just as much as Bitcoin.

We wrote about these levels in our last issue, and it's becoming more and more obvious that May is about to close with a breakdown of the $2,300 support.

The weekly chart looks a bit better, holding the range low at $1940 for now, but that's not very convincing on its own since it doesn't align with the monthly timeframe.

The BTC and ETH vs USD charts are very similar tomonthly timeframe. There is a macro range that is more and more likely to be broken down by next week's closing results. A break of support is a bearish signal unless it is refuted by a strong price retracement above the break.

In the case of ETH/USD, this requires closing the month above $2300.

As for target levels in case of further declines, strong support in the $1000 area (round number, 200-week moving average, monthly support) can be assumed.

In general, although the next week closed above support, it is difficult to remain optimistic if, by the end of May, the price confirms a breakdown of support on the monthly timeframe.

On the other hand, a clear show of force withrestoring back to the range in our understanding would look convincing. A clear discount to the target levels on the monthly timeframe could also be an attractive buying opportunity. At the time of writing, the market offers neither.

Altcoin Market Cycle Structure

Cred here tweeted that the accumulationAlts in a bear market is basically a stupid idea. Let's use this information occasion to talk about how altcoin market cycles work in general terms.

- BTC and ETH are rising. Interest in cryptocurrencies too.

- Market participants want to get more profit.BTC and ETH are "boring". Generally speaking, smaller-cap coins need fewer dollars to gain a larger percentage gain. The big players have a lot of capital to place, especially in venture capital deals on favorable terms.

- The market finds (or creates) a narrative around altcoins: DeFi, GameFi, Layer1, whatever.

- A reflexive cycle is created: prices rise → fundamentals (based on price) look good → buyers increase → prices rise → and so on.

- The pump gets stronger:market momentum, expectations of improvements in fundamentals/positive feedback cycle, runaway optimism, holders and traders in constant profit and so on.

- Traders and investors (with a colossal "paper"profit) close their positions. The price is falling. Or maybe BTC and ETH are forming a top. Or maybe it's just a later phase of the cycle and the whole market has already switched to something even more brilliant. It doesn't matter. Prices stop going up.

- A reflexive cycle is created: prices fall → fundamentals (based on price) look bad → sellers increase → prices fall → and so on.

- Dump amplifies:market momentum, deteriorating fundamentals/negative feedback cycle, pessimism, traders and holders at a loss, narrative fatigue, and the burden of opportunity cost (holding assets that don't make big losses at best while other instruments rise).

- Convinced supporters buy and hold (usually the entire decline) and become more committed to the project; it becomes their identity.

- The project is dying. Or maybe not dying.In any case, it is likely to enter a long-term downtrend against BTC and ETH. And almost certainly inferior in profitability to any new hot crypto projects of the next cycle, whatever they may be.

TA-dah!

Cynically, but in general terms, this is something like thisworks. EOS, Zcoin, Dragonchain, Stellar Lumens, IOTA, OmiseGo - remember these? We don't either. That is, we remember, of course, but not at all because they have real growth prospects or they are especially relevant.

With rare exceptions, in the next cycle overyou will be laughed at for falling behind the market and continuing to hold the “old” altcoins of 2020-2021. If you want a recent example, take a look at the profitability of first-generation DeFi projects (Aave, Synthetix, Compound, Uniswap, yearn.finance, etc.) over the past year - in dollars and in ETH.

In bear markets, it makes sense to buy only proven assets with a high probability of survival. For us, these are BTC and ETH.

Then, when new trendy projects appear (usually after the biggest cryptocurrencies find the bottom), trade them at your pleasure. Just do not forget to reset and forget in time.

And so cycle after cycle.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>