This time, the Chinese government is putting pressure on miners and investors through commercial banks and financialinstitutions:clearing, settlements and insurance of cryptocurrencies were banned. Despite the overseas registration, the largest crypto exchanges in China reduced the list of services, and the crypto market lost $ 1 trillion in capitalization in two weeks.

Image Source: StormGain Cryptocurrency Exchange

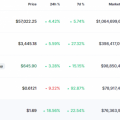

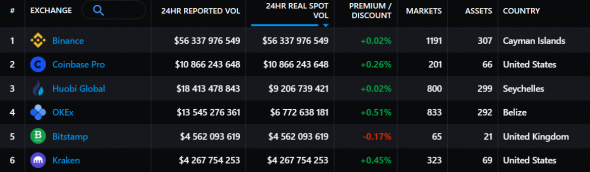

The leading position in the Chinese market isHuobi with $ 18 billion in daily turnover, followed by OKEx. Due to the problems that have arisen, Huobi has stopped providing leverage to new users "from several countries and regions" (read - China), and OKEx is closing trading pairs with the yuan from today. Huobi, which has the eighth largest mining pool in the world, is closing access to mainland Chinese residents.

Image source: messari.io

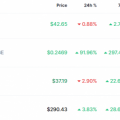

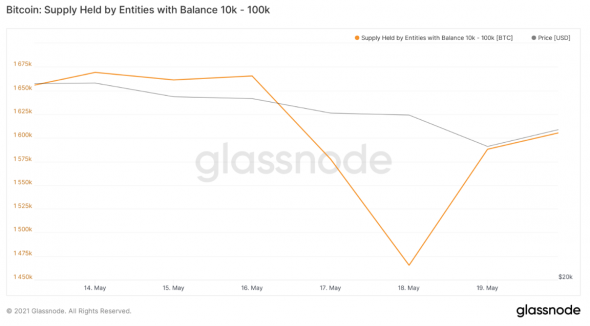

Negativity from China led to a sell-off in cryptocurrenciesand the subsequent exchange of stablecoins for the yuan, which caused volatility of 12% in the USDT/CNY pair. While Chinese traders were trying to get out of cryptocurrencies and get yuan while it was still possible, Western investors were buying up cheaper coins. According to Glassnode, whales (from 10 thousand to 100 thousand BTC) bought 123,588 BTC during the fall. Purchases came mainly from the United States, since on Coinbase during the fall, Bitcoin was trading at a $3,000 premium compared to other crypto exchanges.

Image Source:glassnode.com

China accounts for about 50% of the world'shash rate and 60% of the volume with perpetual futures contracts. The next persecution of miners and investors can lead to global changes in the structure of world crypto-finance. In early November 2020, US Director of National Intelligence John Lee Ratcliffe wrote to SEC Chairman Jay Clayton recommending that US companies be allowed to compete with China on digital currencies. Perhaps, in the near future, the United States will become the leaders in terms of hashrate and volume of crypto trading.

Analytical group StormGain