Cryptocompare: cryptocurrency derivatives traded at a record $ 600 billion in May

<div class="article_image" data-custom_post_type="1">

#cryptocompare # derivatives # trading volume

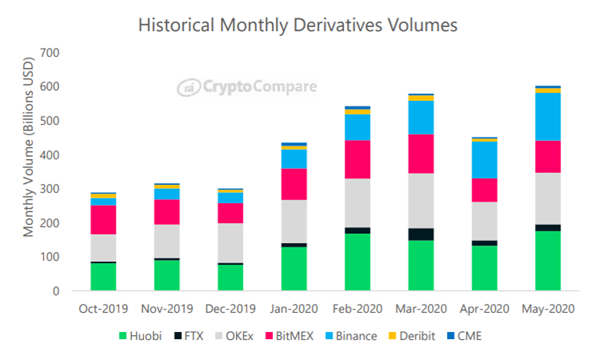

According to the Cryptocompare analytical service,In May, the cryptocurrency derivatives market experienced a noticeable influx of funds from institutional investors. Whale activity led to an increase in trading volume by 32% to a new high of $ 602 billion.

CryptoCompare@CryptoCompare

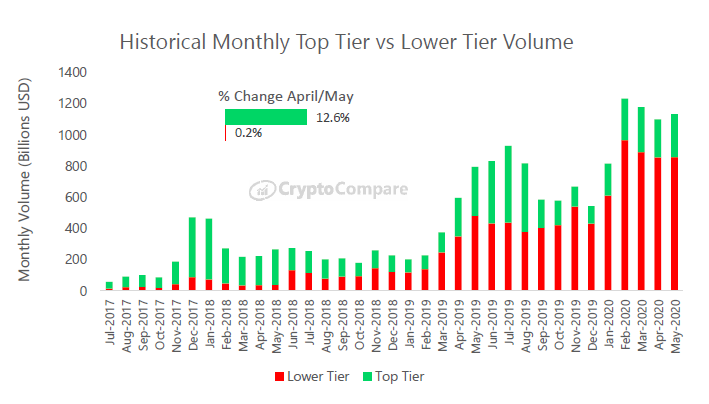

#Crypto spot volumes picked up notably in May…Interestingly, Top Tier Exchanges saw an increase in volume of 12.6% while Lower Tier Exchanges saw an increase of only 0.2%.

Is the market maturing?

Read more in our May Exchange Review here: https://bit.ly/308hjpa

59:30 PM — Jun 4, 2020Twitter Ads info and privacy

See CryptoCompare’s other Tweets

Against the backdrop of the past halving, there was a boom inBitcoin options segment. Trading volumes for this instrument on the Chicago Mercantile Exchange (CME) increased 16-fold over the month, to 5,986 contracts. Including BTC futures, trading activity as a whole jumped 59% to $7.2 billion.

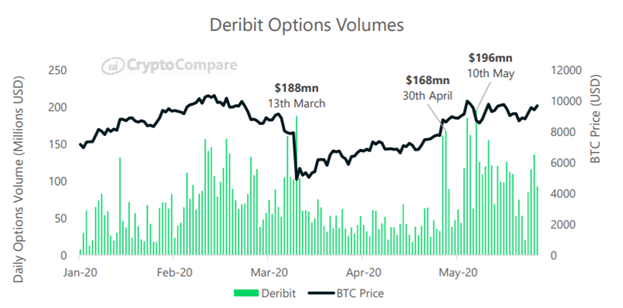

Even more impressive were the success of Deribit. On May 10, a record of $ 196 million was set in this site in the trading of bitcoin options. According to the results of the month, the trading volume amounted to $ 3.06 billion, having more than doubled compared to April ($ 1.47 billion).

According to CryptoCompare CEO Charles Hayter,Such data eloquently illustrates the influx of “more sophisticated investors” not only in anticipation of the May halving, but also due to the “unprecedented financial measures” taken around the world amid the COVID-19 pandemic.

In general, the cryptocurrency derivatives marketHuobi, OKEx and Binance stood out - they together accounted for about 80% of the activity. The largest trading volume of $ 176 billion was recorded on Huobi; at OKEx and Binance it amounted to $ 156 billion and $ 139 billion, respectively. The former leader, BitMEX, with an indicator of $ 94.8 billion, did not enter the top three again.

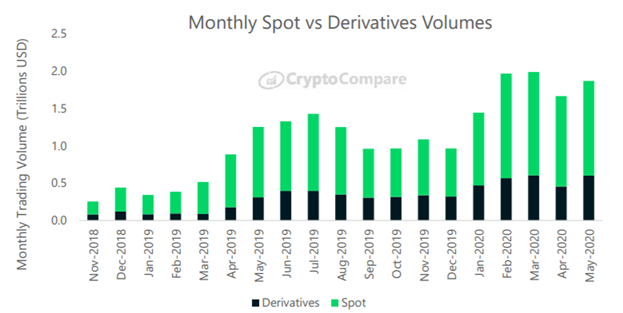

The halving of the miners' reward has led toa surge in activity in transactions with the first cryptocurrency. On May 11, trading volumes jumped to $64.7 billion. Over the month they amounted to $1.27 trillion (an increase of 5%) versus $602 billion in the crypto derivatives market (an increase of 32%). As a result, the latter's share increased from 27% to 32%.

On spot markets, Binance leader (growth on18.2% to $ 57.2 billion) reduced its advantage over OKEx and Coinbase, whose performance increased by 25.7% (to $ 52.1 billion) and 25.7% (to $ 11.2 billion), respectively.

Let us remind you that the total volume of assets under management of institutional-oriented Grayscale Investments reached $4 billion.

source: https: //forklog.com/cryptocompare-obem-torgov-kriptoderivativami-v-mae-dostig-rekordnyh-600-mlrd/

As you can see, the capacity of the cryptocurrency market is constantly growing! From this we can continue to draw conclusions that the era of cryptocurrencies is not the future, it is our present!