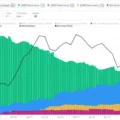

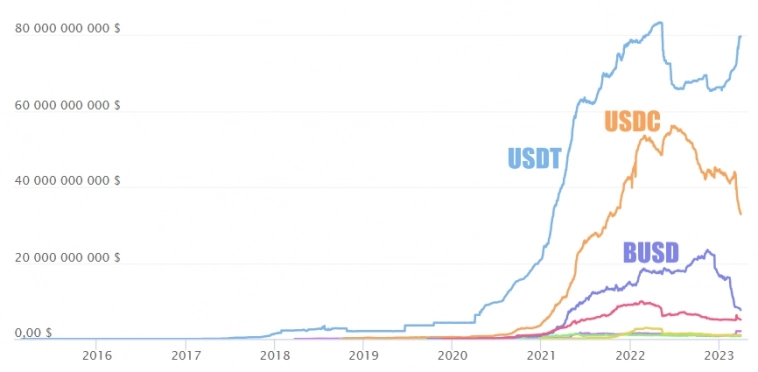

The issue of stablecoin viability escalated in May last year with the crash of the third-largestUST stablecoin. If at that time the capitalization of the segment was estimated at $162 billion, now it is $133 billion. The annual decline was 18%.

The recent revival of the cryptocurrency market has not led to an increase in demand for stablecoins.

Image Source:glassnode.com

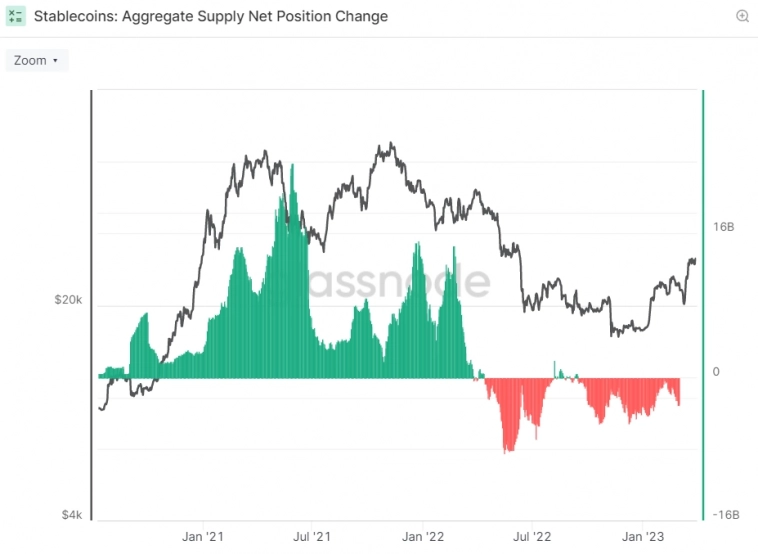

First, stock trading does not demonstratean increase in activity, which reduces the demand for stablecoins. In November, the market faced the collapse of FTX, and now the US regulators have taken Binance seriously. According to The Block, on March 27-28 alone, cryptocurrencies worth $2.2 billion were withdrawn from the crypto exchange. After fixing part of the profit in March, users returned to withdrawing Bitcoin from crypto exchanges to cold wallets.

Image Source:glassnode.com

Second, NYDFS pressured Paxos to stopcooperation with Binance. The issuance of new BUSD stopped on February 21, and in a year, support for the stablecoin will probably be completely discontinued. In a month and a half after the claim was made, the capitalization of BUSD halved to $7.6 billion.

Thirdly, confidence in the USDC, the mostreliable in terms of regulation and reserves stablecoin. The bankruptcy of SVB, in which Circle (USDC issuer) held part of the reserves, led to the decoupling of the stablecoin from the US dollar. On March 11, the discount exceeded 10%.

By agreeing to emergency measures, the governmentsaved all SVB contributors. However, the risk of new bankruptcies remains, and Treasury Secretary Janet Yellen announced that there are no plans to provide insurance to all banks without exception. This allows the emergence of new excesses with the USDC rate. Partner banks include: Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, a division of Flagstar Bank, N.A., Signature Bank, Silicon Valley Bank and Silvergate Bank. The last three have already gone to the bottom.

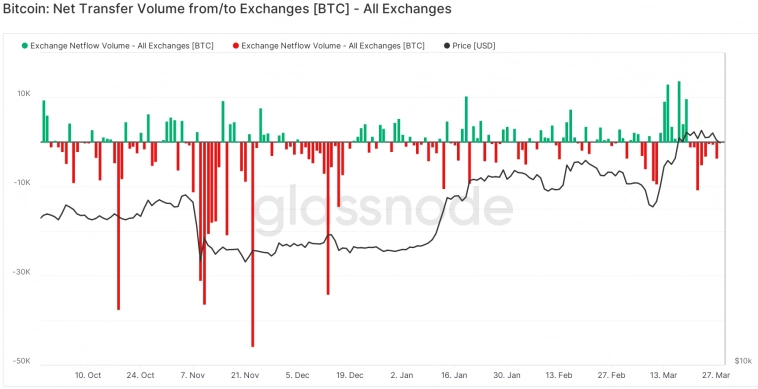

Image Source: Cryptocurrency ExchangeStormGain

Some users decided to sit out difficulttimes in BTC or ETH, and some preferred to use USDT for savings. As a result, its share in the stablecoin market exceeded 60%, and capitalization jumped to $80 billion.

Image Source:coingecko.com

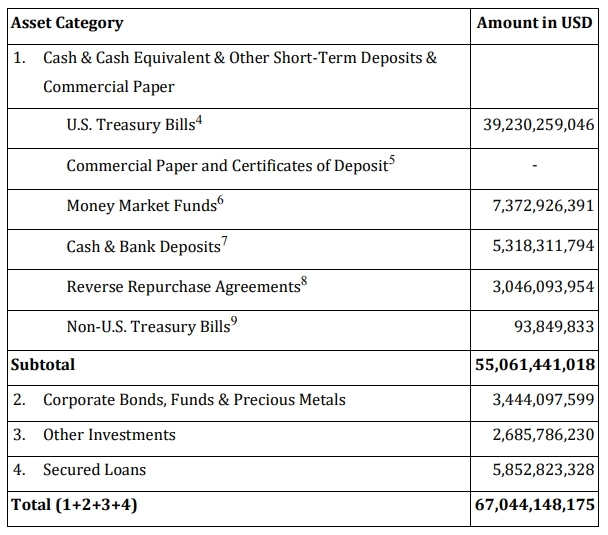

Tether also relies on the services of bankswhile holding reserves, but does not disclose information about partner banks in the audit, unlike Circle. This makes even a rough estimate of their bankruptcy risk difficult. At the same time, the user agreement states that the company disclaims responsibility in the event of such an outcome.

In addition, soon the leadership of Tethermay face new accusations from supervisory authorities. So, last year, an American judge requested accounting and financial reports on all ongoing operations over the past five years in connection with an investigation into the excess issue of USDT for the Bitcoin pump in 2017.

Image Source: BDO audit dated 02/08/23

Quality has always been a big issuereserves, in which part of them are commercial loans (and other forms of obligations) issued in USDT to third parties. In the event of a sharp outflow of funds, the company risks facing a liquidity crisis, due to which USDT will lose its peg to the US dollar.

With tighter crypto regulation, possible prosecution, a banking crisis, and questions about the quality of reserves, keeping funds in USDT should be treated with caution.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)