The price of gold is stagnating, but that's not necessarily a bad thing for digital gold, Bitcoin.

BTC price correction bythis week I once again reminded that the marketdoes not go up in a straight line. Meanwhile, another topic is attracting much attention, namely the strong rise in the yield on 10-year United States government bonds.

In recent weeks, the yield on 10-year US Treasuries has surged 35% to a new high of 1.44%, the highest since the global collapse in March 2020.

Treasury yields bounced off 60-year low

US 10-year Treasury yield, 1-week chart. :TradingView

10-year Treasury bond yield perhas risen sharply in recent weeks, as happened in the run-up to the 2000 and 2008 recessions. Based on past experience, rising Treasury yields are generally considered a sign of weakness in the economy and could have a significant impact on many markets.

Increased profitability means that governmentshave to pay more on their underlying government bonds. Unsurprisingly, this factor, coupled with the current post-skew economic environment and record government debt, is worrying economists.

However, if we look at the chart above from a technical analysis point of view, this rally can still be considered a normal bearish retest of the previous support level.

Marked on the chart and the previous similaran attempt to test the immediate apparent resistance. History may repeat itself this time too - in this case, rates will again fall from ~ 1.53%. However, it is important to monitor the behavior of rates at this level, as a breakout upward can have a serious impact on the markets.

Government bond yields provideimpact on mortgage markets. Given that the real estate market is overheated and people continue to take out huge loans to buy houses, a rise in interest rates could burst this bubble, much like it did in 2008.

However, bond yields also affectother markets - this is how gold often reacts to these changes too. But maybe this time everything is different? And how will Bitcoin respond to these potential macroeconomic shocks?

Weakening dollar versus bitcoin

US dollar currency index, 3-day chart. :TradingView

The dollar currency index (DXY) continuesshow weakness amid rising Treasury yields, which is generally good news for bitcoin bulls. This indicates that investors are running away from the dollar towards riskier and more profitable investments like Bitcoin.

In terms of technical analysis, DXY sawbearish retest at 91.50 points, followed by further declines as seen in the chart above. Now there is a retest of 90 points and the main question is whether this level will hold as a support.

BTC/USD compared to DXY. :TradingView

However, the question of whether growth hasbond yields have any direct impact on the price of bitcoin remains controversial, especially in recent days. Meanwhile, the DXY has often shown an inverse correlation with the BTC price, although this trend has weakened in recent months (see chart below).

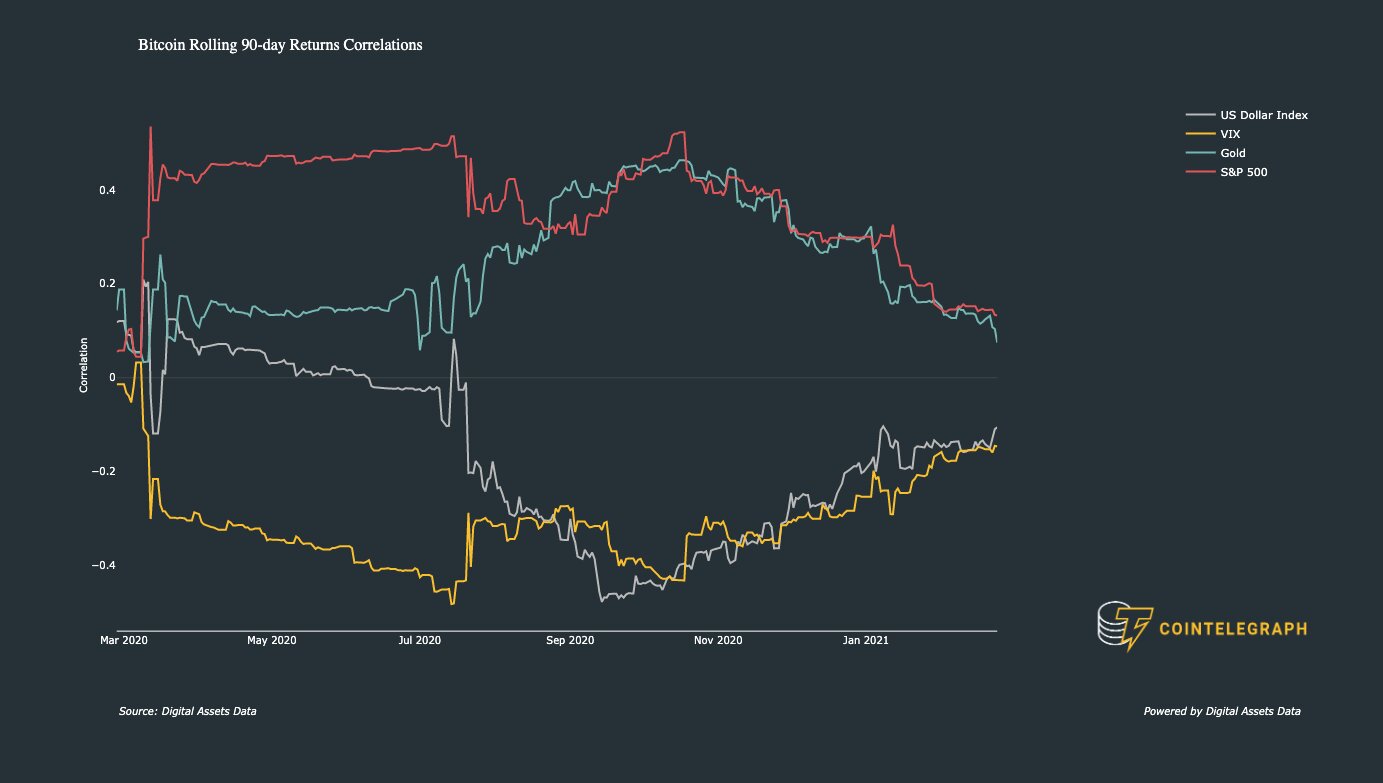

Correlation of BTC returns with USD (gray chart), CBOE Volatility Index (yellow), gold (green) and S&P 500 (red) over 90 days. : Digital Assets Data

After the market crash in March 2020, this inverse relationship intensified until September 2020 - the weakening of the dollar was accompanied by a significant increase in the BTC price each time.

Of course, there is a correlation between assetsonly until it is disrupted, and many other factors - such as bitcoin sales by miners or whales, government regulation, etc. - can have a much greater impact on the price of BTC in the short term.

Why is gold showing weakness?

Gold, 3-day chart. :TradingView

The three-day gold price chart shows clearlypronounced correction from August 2020. More importantly, rising Treasury yields and a weakening dollar have not affected the gold market as much as it did the Bitcoin market.

Even with the recent surge in profitability, peopledon't buy gold. In fact, historically, gold has not benefited in any way from increased yields on government bonds - at least in the short term - because the higher yields make bonds more attractive to funds - both for settlement and as a risk-free investment.

However, when Treasury yieldsbonds continue to climb to higher levels, economic uncertainty also increases, and investors tend to start shifting from the dollar to gold as a safe haven. This also happened in the 1980s, when Treasury yields reached 14% and the price of gold also reached new record levels.

BTC plays an increasingly important role in macroeconomics

Perhaps, in the current situation, the fall in prices forgold may simply be a direct reaction to higher yields on financial instruments in general. However, there is another possibility that more and more investors are opting for digital gold over precious metal - not only because of the higher upside potential and therefore better risk / reward ratios, but also because these positions are much easier to liquidate at digital trading platforms.

11 August 2020, dotted blue line, US corporations led by $ MSTR begin buying #bitcoin as a treasury asset. pic.twitter.com/LEMNzwqQru

— Willy Woo (@woonomic) February 25, 2021

@woonomic:On August 11, 2020 (vertical line), US corporations led by $MSTR began buying Bitcoin as a treasury asset.

Today, Bitcoin's market capitalization is still only 7-10% of gold's capitalization, further highlighting BTC's huge growth potential.

So the possible macro conclusion isthe fact that the markets' uncertainty about the future of the economy and the dollar is growing, as evidenced by the rising yields on 10-year Treasuries. Nevertheless, it is too early to attribute the current BTC price correction to this macroeconomic trend, since there are many other variables in the cryptocurrency game.

Ultimately, the growth of treasury yieldsbonds and a weaker dollar are interesting trends to watch out for. With Bitcoin becoming an increasingly important player in the macroeconomic environment, strategists at JPMorgan Chase, for example, believe that BTC may continue to eat up gold's market share further. This is likely to lead to an even higher valuation of bitcoin at the expense of gold, especially in the event of another economic crisis.

In December 2020, JPMorgan strategists noted:

"The adoption of Bitcoin by institutional investorshas just begun, unlike gold, which is at much later stages in this process. If this medium and long term thesis turns out to be true, it should become a significant deterrent to the price of gold in the coming years. "

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>