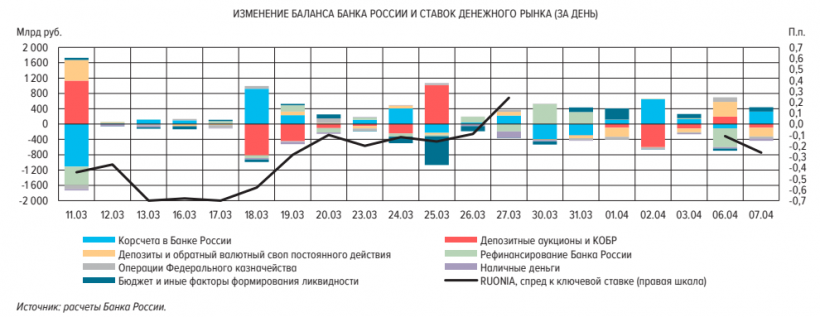

In March, the liquidity surplus in the Russian banking sector decreased by 1.5 trillion rubles and reachedcomparable to 2017 - 2.3 trillion rubles. It is reported by the Central Bank of the Russian Federation.

Liquidity of the banking sector… by ForkLog on Scribd

The regulator connects the outflow of liquidity with the growth in demand for cash - their volume in circulation in March grew by 0.7 trillion rubles.

«In conditions of increased uncertaintythe population tends to have a high demand for cash. Quarantine measures could also have played a significant role, requiring the accumulation of cash reserves for payments during the isolation period. Moreover, after the situation has stabilized, these funds will gradually return to bank accounts in the form of collected revenue from retail trade enterprises, deposits and other receipts»- noted the central bank.

Also lower surplus at the beginning of Aprilcontributed to the increase in banks' balances on correspondent accounts with the Central Bank of the Russian Federation compared with the same period of the previous month. This was due to the formation of a stock of funds in case of unforeseen large outflows due to exchange rate volatility.

In addition, the Central Bank of the Russian Federation recorded a decrease in the number of foreign currency deposits by 4% compared with January 2020, which is caused by a drop in oil prices and the high demand of world markets for the dollar.

Cash withdrawals from bank accounts are characteristicfor investors' behavior during the crisis, although a massive withdrawal of funds may negatively affect the solvency of banks, independent expert Mansur Huseynov said in a comment to ForkLog.

«Nevertheless, I think that this timethe situation will not worsen, since the banks are in good shape, there have been no rumors of possible bankruptcies and there is no panic. People will gradually return funds to banks, since storing cash at home is simply unsafe»,- noted the expert.

Recall that earlier Russian banks facedthe growth of customer applications for closing deposits and cash withdrawals from accounts against the background of information on the introduction of an additional tax on interest on deposits of more than 1 million rubles.

At the same time, quarantine increased the popularity of bitcoin exchanges in the Russian Federation by 5.5%.