An article appeared on the official website of the State Central Television of China in whichtalked about the upcoming halving of Bitcoin and the recent increase in cryptocurrency prices on May 8.

It also cites Paul Tudor Jones, who stated that one of his foundations had decided to acquire bitcoins.

Crypto enthusiasts drew attention to an interesting passage in the article:

«In 2012, rewards for minersdecreased from 50 to 25 BTC, and the price increased by almost 8200% per year. In the 18 months following the second halving in 2016, the price of Bitcoin increased by more than 2,200%.

This statement sounds very unexpected, because in China they officially oppose speculation on the price of bitcoin, although it is not prohibited to invest fiat currency in BTC.

Considering thatChina's state television is directly controlled by the government, this article is quite shocking.

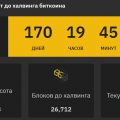

«Halving, scheduled for May 11,takes place every four years. It reduces the number of bitcoins given out as a reward to miners for their work. As miners bring new bitcoins to market, the rate at which they enter the market will also decrease. Given the deflationary nature of Bitcoin, this event will have a significant impact on the price of the asset», - is added to the article.

This passage also contrasts sharply with the position of the Chinese government, which, despite these arguments, did not recommend investing in a volatile asset.

Nevertheless, to believe that China’s attitude towards Bitcoin could change would be too bold.

«For the first time, Chinese national media started talking about the Bitcoin pump», ”Tweeted HashKey Hub's marketing manager.

Meanwhile, China is about to release itsdigital currency, and it obviously will not be as absurd as the Venezuelan Petro. There is every reason to believe that this will be the first powerful digital state currency that can squeeze the world dominance of the American dollar.

</p>Rate this publication