Bitcoin is getting big. Currently, its capitalization is about $700 billion, and within a yearit reached $ 1 trillion. This makes people worry about the law of diminishing returns. After all, the larger the market, the harder it is to grow, right? Or is it not?

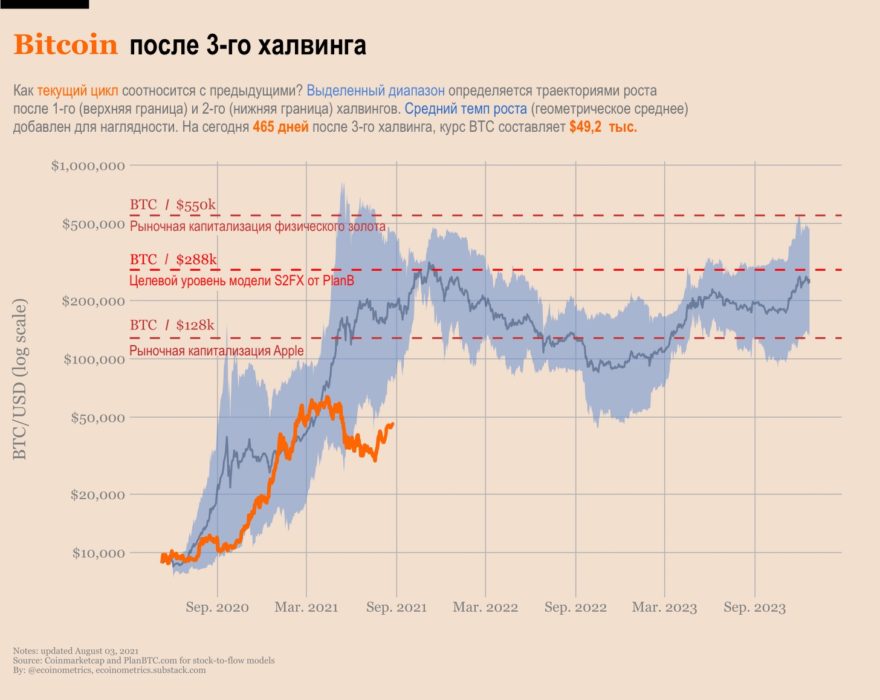

If you look at the growth of quotations from the momentthe previous halving and project it in advance, then you can estimate where the bitcoin rate will be if the growth rate continues. This perspective is reflected in the graph below.

Many, meanwhile, do not believe when they see these numbers, because they seem too large.

However, when placed in the context of the size of markets for other financial instruments, they fall into a reasonable, albeit wide, range:

- at the bottom dashed line, Bitcoin's capitalization will equal that of Apple,

- at the top it will equal the size of the physical gold market.

Thus, all these values are large, but quite real.

Still talk about growth when it comes tomarket capitalization of hundreds of billions or even more than one trillion US dollars, many are worried. And one of the most common things one can hear in response is that the law of diminishing returns is already taking effect.

One way to formulate the law of diminishing returns is as follows:

The larger the market capitalization of an asset, the slower it grows.

Or put it differently:

The larger the market capitalization of an asset, the longer it will take to double it.

I have chosen this rather specific formulation, because it clearly visualizes the operation of the law. Now you will understand why.

So the question is: can we see any effect of the law of diminishing returns on bitcoin?

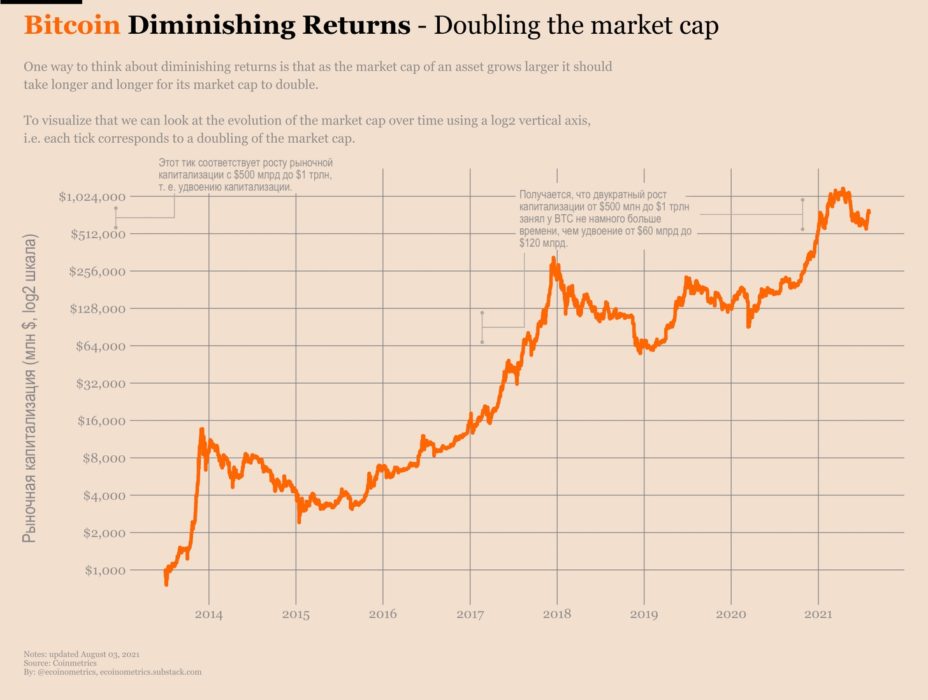

To answer it, let's build an evolution graphmarket capitalization of Bitcoin using a binary logarithmic scale on the vertical axis. This means that in the chart below, each tick on the vertical axis corresponds to a doubling of the market cap. The axis covers the entire range of capitalization from $ 1 billion to a maximum of $ 1 trillion.

Doubling market capitalization

The first thing to look out for isthat the growth in market capitalization is quite volatile. During a bull market, Bitcoin can double its capitalization several times over a period ranging from a few months to 2 years. But during a bear market, things are relatively slow.

The second point to note is that as market capitalization grows, the period in which it doubles does not necessarily increase.

Let's look at an example.The growth of capitalization from $ 64 billion to $ 128 billion took the same time as the growth from $ 512 billion to $ 1 trillion. This means that despite the increase in market capitalization, in terms of doubling periods, its growth rate does not decrease. In other words, the size of Bitcoin's market capitalization does not significantly affect the growth rate of BTC quotes, that is, we do not see an obvious diminishing return.

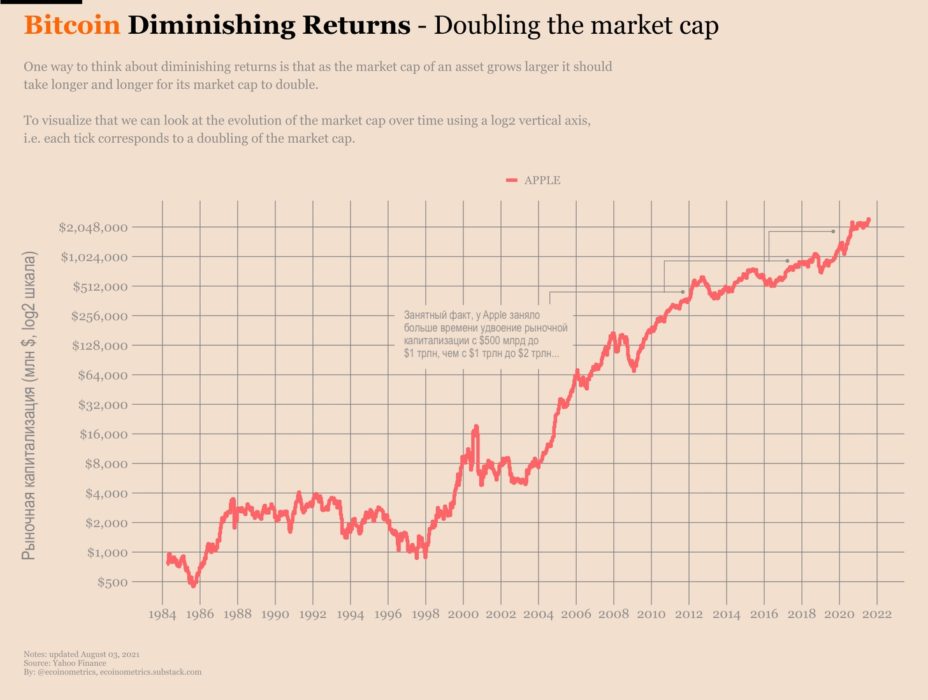

Is there the same dynamic in relation toother assets? Let's analyze Apple stock using the same method. After all, Apple is the largest share in terms of capitalization, and therefore it would be logical to use it as an example of diminishing returns. Take a look:

Doubling market capitalization

Note that it took Apple longerto increase the market capitalization from $ 500 billion to $ 1 trillion, than from $ 1 trillion to $ 2 trillion. And it also took Apple just as long to grow its market cap from $ 32 billion to $ 64 billion as it did to climb from $ 1 trillion to $ 2 trillion.

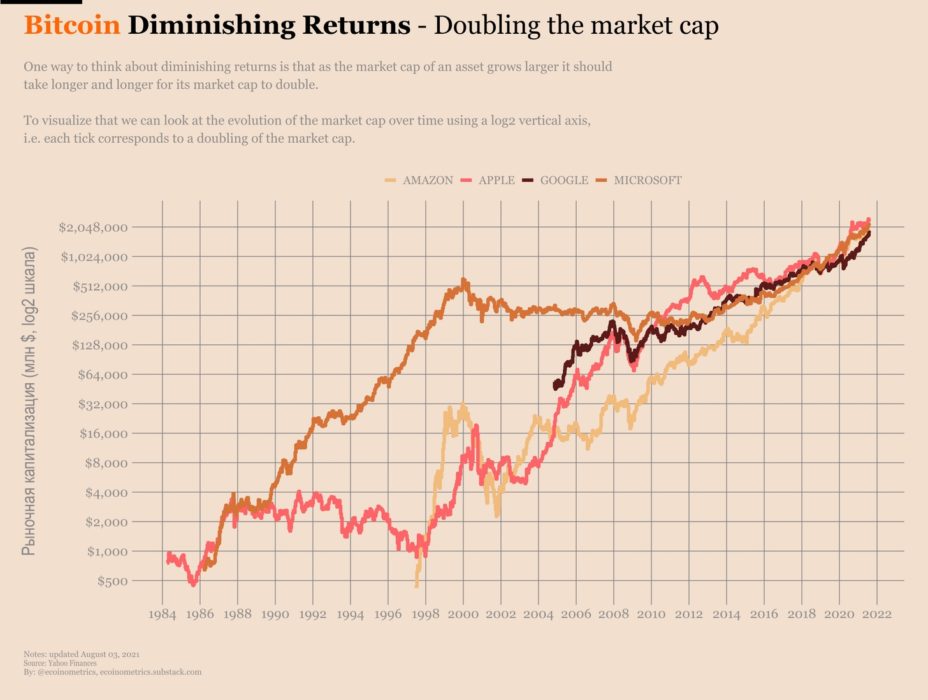

You can continue to add more high-cap stocks to this chart and observe a similar trend:

Doubling market capitalization

At least for the largest companies, the fact is that it doesn't take longer to double their market capitalization, even as it grows.

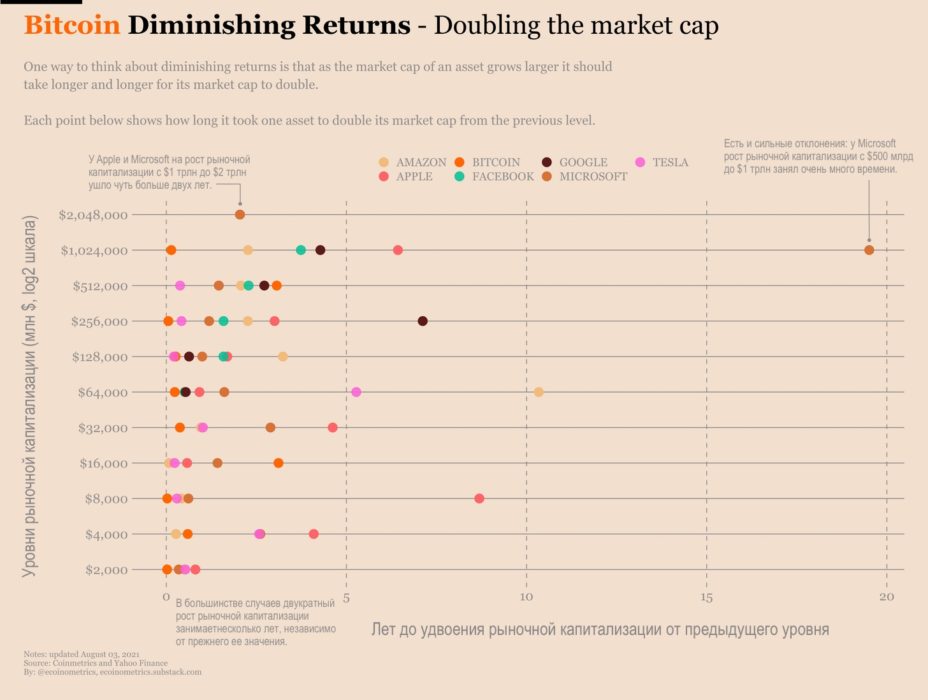

To see this again, let's seeto this from a different angle. Take stocks of tech companies that are currently leading by market capitalization (Amazon, Apple, Facebook, Google, Microsoft, Tesla) and Bitcoin.

How long did it take for each of these assets to grow from $ 1 billion to $ 2 billion, then from $ 2 billion to $ 4 billion, and so on from $ 1 trillion to $ 2 trillion (which only Apple and Microsoft have achieved)?

Let's build a graph:

- The vertical axis is the market capitalization levels. Each level is twice the size of the previous one.

- The horizontal axis is the number of years in which the market capitalization doubled.

- Different assets are marked with different colors.

- Each dot represents the first time an asset has reached a given level of market capitalization compared to the previous level.

For example, if you look at the points in the linemarket cap of $ 2.048 trillion, the x coordinates will show how long it took to get there for the first time after they hit $ 1.024 trillion.

If the effect of diminishing returns acts in thisspecific case, then we should see that as the market capitalization increases, the points shift to the right (doubling takes longer). See for yourself:

Doubling market capitalization

With regard to Facebook, the effect of a decrease in profitability does take place.

But for the rest of the assets, the data is actually very noisy. It is fairly common to see longer doubling periods with lower market caps than with higher ones.

There is no clear effect of diminishing returns, and perhaps we have nothing to worry about with Bitcoin.

If you look at the dynamics of the growth of stocks with a highcapitalization since 2008, you can see that they adhere to approximately the same growth rate. This suggests that some external factor is probably pushing everything higher: the Fed, money printing.

Doubling market capitalization

Will Bitcoin continue to grow the samepace to add the next $ 1 trillion to your market cap? Or will we see some convergence with high-cap stocks when enough institutional investors come into play?

More on that another time, but at least I don't think we should worry too much about a significant slowdown in growth until Bitcoin surpasses Apple in capitalization.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>