Thanks to the creation of virtual money, a new cryptocurrency market and an entire industry withcapitalization of more than $ 2 trillion.Thousands of decentralized applications are being built on the basis of existing blockchains. Thus, now we can observe a large-scale implementation of what 30 years ago was just an idea.

Prerequisites for the emergence of cryptocurrencies

Back in the 60s of the last centuryprofessional cryptographers discussed the possibility of creating a global information network. The first practical steps in this direction were taken in the 80s. With the help of the info network, they began to exchange broker data, which were needed for trading on stock exchanges.

At the same time, the idea of digital money appeared. The main value of the concept came down to the ability to quickly buy stocks, various financial assets and their derivatives.

At that time, the idea of electronic money was being implementedAmerican cryptographers David Chaum and Stefan Brands worked. They described the principles of operation of an anonymous digital payment system, and also proposed the first “electronic cash” protocols.

In 1990 David and Stefan set up a companyDigiCash, which specialized in the design and implementation of the eCash monetary system. It had a function of maintaining the confidentiality of electronic payments and there was a cryptographic data protection.

The main difference between eCash and moderncryptocurrencies were centrally controlled. In 1998, this platform went bankrupt. But the very idea of using fast anonymous payments was noticed by many cypherpunks.

Made a significant contribution to the development of cryptocurrencyAdam Bakov. It was he who in 1997 used HashCash, a technology resistant to spam and DoS attacks. Later, Hal Finney began improving it. He managed to create a more advanced algorithm for controlling electronic payments. The essence of the improvement was the implementation of a chain of hash blocks in working with transactions.

HashCash technology became one of the key concepts in the creation of the first blockchain. On its basis, in 1998, two developers independently launched their digital projects:

- Wei Dai is a B-money project.

- Nick Szabo is a Bit-Gold project.

Each of them as a base for the system to workused a decentralized ledger. In fact, these projects of Wei and Nick became the prototypes of the cryptocurrency. Later, Satoshi Nakamoto will refer to B-money as the foundational technology for Bitcoin development. The first blockchain was created by Hal Finney in 1998, and after a while he will also join the Bitcoin project.

Thus, blockchain technology andcryptocurrency is the result of the efforts of a group of people. But the final step in the implementation of the idea of digital money was made by an anonymous developer under the pseudonym Satoshi Nakamoto.

The birth and formation of the Bitcoin cryptocurrency

Who exactly is hiding under the name Satoshi Nakamoto- is still not known for certain. It is believed that this pseudonym was used by a whole group of specialists. It all started in 2007 with the formation of the idea of a decentralized blockchain and cryptocurrency Bitcoin version 1.0.

The entire development path of bitcoin can be divided into separate stages.

2007 year

At this time, Satoshi began to work on the principles of building a distributed network - that is, a system without central control.

2008 year

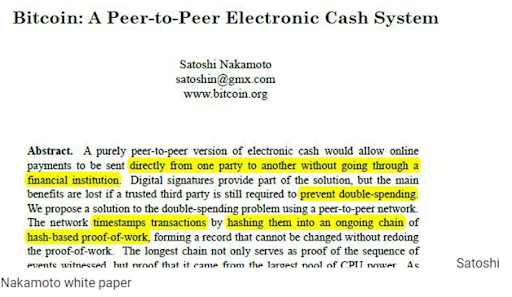

An unknown person or group of persons underunder the pseudonym Satoshi Nakamoto, they published a text file White Paper, in which they talked about what bitcoin is. The document contained a description of the operation of the digital payment system, as well as information about the key features of the blockchain and bitcoin.

year 2009

In January of this year, the first clients of Bitcoin 0.1 / 0.1.0 / 0.1.5 were developed.

After generating the initial block "Genesis 0", there werereceived the first 50 BTC. Soon, the developers of the cryptocurrency made a test transaction: Satoshi sent 10 BTC to another network participant and he successfully received them.

Version presented in January 2009blockchain could only work on Windows 2000, Windows NT and Windows XP. Therefore, immediately after the release of the first client, the creators of this technology began to refine the blockchain.

In September 2009, for the first time,buying bitcoin for fiat currency. The transaction amount was USD 5.02. For this money, Marty Malmi sold 5050 BTC to the user of NewLibertyStandard. The dollars were deposited into a PayPal account.

In November 2009, Bitcoin developers decidedcreate a portal bitcoin.org. The site quickly attracted the attention of those interested in cryptocurrency. Many people came to the site, that is, the first crypto community was formed. A little later, the Bitcointalk.org forum was launched on the basis of this portal. He played a key role in the popularization of Bitcoin and the further development of the community.

In December 2009, the Bitcoin 0 client was released.2, which could already function on Linux. The new version of the decentralized network made it possible to launch the block generation process in several parallel threads. This update significantly increased mining efficiency.

As it became easier to mine coins, minecrypto money was launched en masse by ordinary users. This led to the rapid growth of the Bitcoin community. During the same period, developers started implementing the JSON RPC API. And the community, united by the idea of cryptocurrency, began to actively participate in the development of bitcoin.

2010 year

Bitcoin 0.3 was released this summer. The difficulty of mining has increased. But the popularization of bitcoin did its job - the number of users mining crypto coins was growing rapidly.

Due to the complication of mining, the developers advised miners to use video cards to speed up computations. A user under the nickname ArtForz appreciated this idea and decided to create the first crypto farm.

In August 2010, a serious bug was discoveredsystems. The essence of the problem was that before adding transactions to the blockchain, they were not analyzed. Having identified this weak point, unknown attackers launched an attack on the system on August 15th. They managed to generate 184 billion coins in one transaction and send them to 2 addresses.

The developers quickly fixed the system bug andcanceled the hacker transaction. But users were unpleasantly surprised by this vulnerability. To prevent such stories from repeating themselves, the network was transferred to a new version of the protocol. There were no more problems with hackers.

In November 2010, the firstmining pool called Slush's Pool. Its appearance was logical, since the competition in the field of bitcoin mining was constantly growing. It has become easier for ordinary users to combine efforts to generate network blocks. So mining coins became a more realistic task, compared to mining with a single PC. Subsequently, pools became popular due to the provision of a stable income from cryptocurrency mining.

The final version was released at the end of 2010Bitcoin client (0.3.9). At the same time, the person (or team of people) hiding behind the pseudonym Satoshi Nakamoto left the project without explanation. Until today, many assumptions have been made about who is the creator of the first cryptocurrency. But there is still no clear version.

In the future, developers who were part of the crypto community began to work on the creation of other digital currencies.

Pizza worth 10,000 BTC

Back in 2010, the bitcoin rate was low, becausethat the coins were mined without much difficulty. Users were mining for the sake of interest, but did not have a clear picture of where they would spend the mined cryptocurrencies.

Once on a forum dedicated to the topic of bitcoin,a man named Laszlo Heinitz wrote that he wanted pizza and was willing to pay 10,000 BTC for it. For this money, a hungry user wanted 2 boxes. At that time, 10 thousand bitcoins were worth about $ 50.

Another forum member with the nickname jercos decidedrespond to this offer and sent Laszlo 2 pizzas with onions, mushrooms, tomatoes and sausages. Jercos spent $ 40 on the purchase of this portion. As a result, he received the promised 10,000 BTC into his account.

If Laszlo had waited, he could have received significantly more money:

- after 1 year, 10,000 bitcoins were worth $ 100,000;

- in 3 years this figure would have changed by $ 9 million;

- At the current rate, 10 thousand BTC can be exchanged for approximately 500 million USD.

As a result, 2 pizzas that Laszlo ordered becamethe most expensive food delivery in history. All over the world this deal became known as Bitcoin-Pizza. There are even special sites that track the "pizza rate" by showing the current cost of Laszlo's order.

A simple conclusion follows from this story: you should not quickly leave promising projects. If an asset has growth potential and investments in it are not associated with high risks, then it is better to wait.

The beginning of the altcoin era

Over time, more and more professional programmers came to the bitcoin community who tried to improve this technology to one degree or another. As a result, the developers were divided into two groups:

- traditionalists who want to work stably on the basis of an already existing algorithm;

- specialists who saw opportunities in new and more flexible approaches to using blockchain technology.

Thanks to the second group, crypto technologies have been strongly developed and introduced into many areas of modern society.

2011

This year, Amir Taaki developedBIP technology. Its key value came down to the possibility of improving the structure of the Bitcoin client. This development helped to neutralize bugs that still remained in the code.

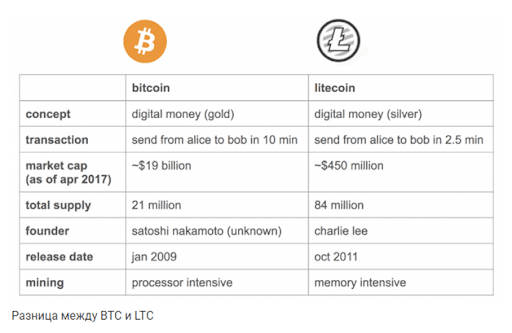

But the most important innovation that came withBIP technology, lies in the possibility of creating new cryptocurrencies - altcoins. The first to launch the Namecoin project, the second to Litecoin. These are forks (offshoots) of bitcoin.

The Litecoin (LTC) cryptocurrency is similar to Bitcoin, but has a higher transaction speed, is easier to mine and costs significantly less.

Also in 2011, the first mobile applications for working with cryptocurrency were created.

year 2012

The main event of this year was the launch of the multi-signature function, which allows working with smart contracts.

For the first time, difficulties appeared related to the size of the BTC blockchain. Experts from related fields began to get involved in solving this problem - they were looking for a way to remove restrictions.

As a result, the CryptoNote technology was developed -application layer protocol. On its basis, the developers were able to create a whole family of anonymous cryptocurrencies. Examples include Monero and Bytecoin. Such cryptocurrencies provide a high degree of protection and fast transactions.

In addition, fall 2012 was the launch season for various cryptocurrency wallets. Users were able to move coins to offline storage and connect browser wallets.

What cryptocurrencies exist today?

Depending on the features and characteristics of altcoins, they can be divided into many different groups. But there are three directions that have strong differences in the most basic concept:

- innovative technologies;

- stable assets;

- anonymous coins.

Unique technologies

Such coins have technologies that Bitcoin does not have.

A striking example is the Ethereum (ETH) project, which hashas its own blockchain, which has broader functions. It provides the ability to create tokens (new crypto assets based on the Ethereum blockchain), and also allows the use of smart contracts.

One of the most innovative projects, Polkadot,has even wider functionality compared to Ethereum. Based on its protocol, you can create an entire ecosystem with your own blockchain, tokens and applications.

Another example is IOTA. What makes it special is directed acyclic graph (DAG) technology, which provides high speed and level of protection during the transfer of payments and data.

Stablecoins

These are stable crypto coins whose price ispegged to $1. They are actively used by traders to hedge risks. Such assets are called “digital safe havens” because they protect capital from large price changes. For example, Bitcoin's problem of high volatility remains unresolved.

Examples of stableblocks: Tether (USDT), Binance USD (BUSD), Dai (DAI), Gemini Dollar (GUSD), TrueUSD (TUSD).

Anonymous

These are confidential altcoins, well suitedusers who want to hide information about their assets and transactions. When operating with anonymous cryptocurrencies, it will be difficult to obtain data on the movement of funds between different wallets. Examples are Monero, ZCash, Dash, Grin.

Developers from different countries are constantly coming up with new projects, so the number of altcoins is growing every year. There are more than 11,000 cryptocurrencies in the world now.

New technologies

If we talk about the most important breakthroughs in the history of digital money, it is worth starting with the specifics of working with the blockchain.

Open source

The Bitcoin client, once invented, is not hidden from other users. Anyone can use the BTC code as a basis for creating new projects.

It was this fact that caused the appearance of thousandsaltcoins. Users took the code, changed and supplemented it. As a result, digital assets with unique properties were obtained. Over time, startups began to appear that offer effective solutions to various problems that are relevant to business and not only.

If the Bitcoin code remained proprietary, progress in crypto technology could have a completely different dynamic.

Ethereum creation

In addition to the fact that the Ethereum blockchain made possible the use of smart contracts, it stands out due to other advantages:

- increased speed of operations;

- more stable work (than in the military-technical cooperation);

- software solutions that allow you to create various decentralized applications.

Due to new and stable functions, the crypto segment is becoming more and more useful for business and ordinary users.

Cryptocurrency popularization results

The more attention is drawn to technologyblockchain, the more perfect it becomes. Developers set themselves new challenges and find ways to solve them. The result is the enrichment of the crypto segment with new projects with more stable, convenient and flexible functions.

The popularization of digital money leads to theiractive use all over the world as a means of payment, a way of earning or a tool for preserving capital. Smart contracts enable a wide variety of agreements to be digitized. Now with the help of cryptocurrency, you can pay for advertising, food or a hotel room.

The popularity of crypto money motivates states to create their own digital national currencies. With their help, everything related to payments and transfers will be simplified and accelerated as much as possible.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication