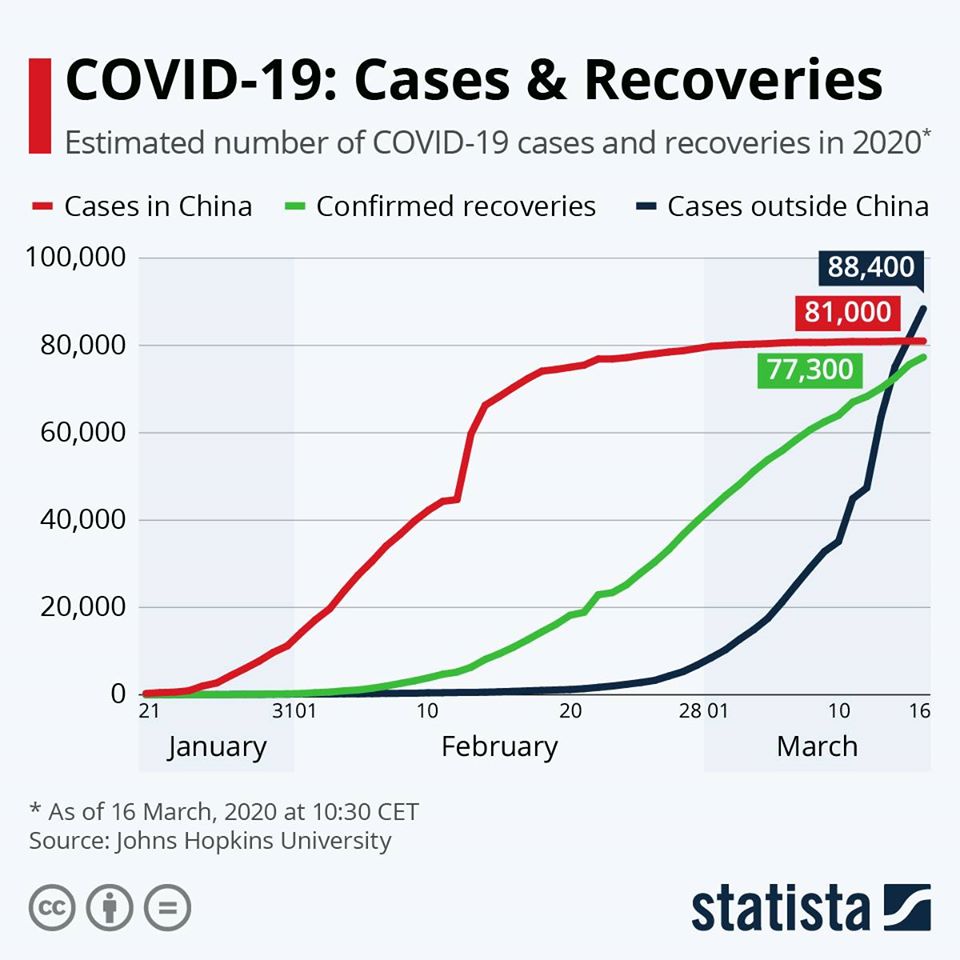

The past few weeks have undoubtedly been a real test for both Bitcoin investors andsupporters of traditional finance. Markets continue to be hectic, and the pace of the spread of coronavirus shows no sign of abating, creating significant uncertainty.

The spread of the virus remains the same (green line), and the number of infected in the world exceeded the number of patients in China. Source: Statista, data for March 16

Closed shopping malls and internationalbusiness units, logistics and public transport are hindered, production chains are disrupted. The borders of countries are also being closed and many large-scale events, including the European Football Championship, are being transferred. All this worsens investor sentiment, reduces business activity and aggregate demand, which inevitably affects global indices.

Will a new world crisis come, or maybehas it already begun? How will bitcoin, other cryptocurrencies and miners behave if the coronavirus continues to spread, and world indices fall? ForkLog will try to answer these questions.

Desperate measures by the Fed, as in 2008

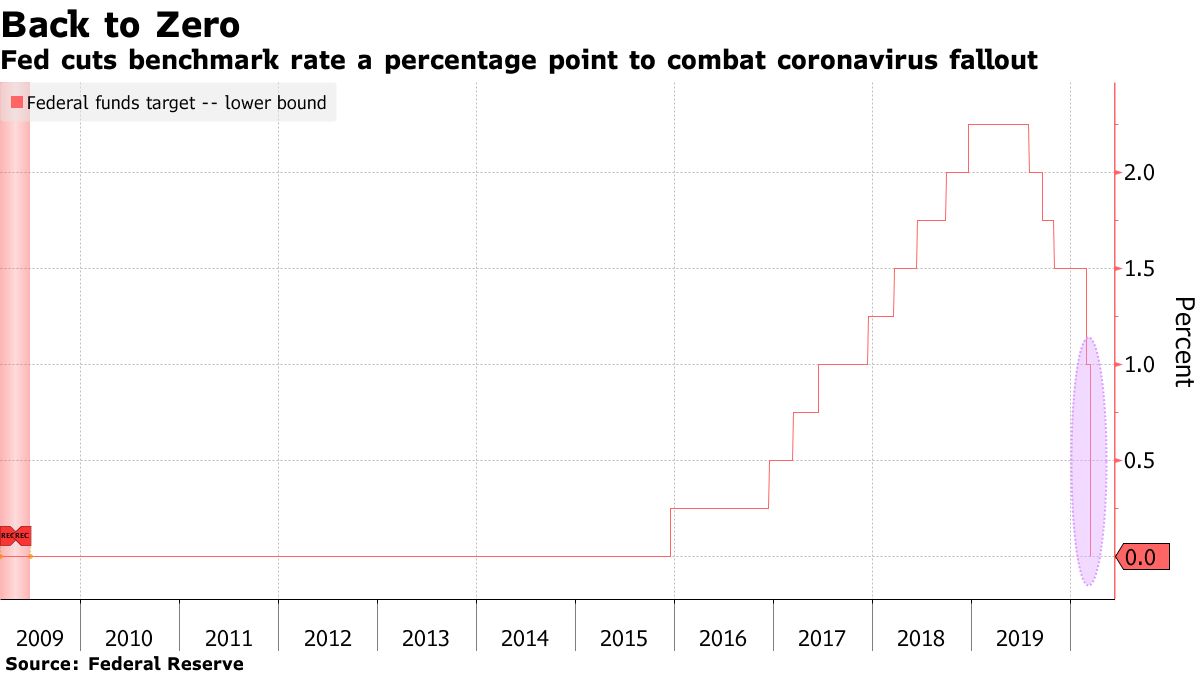

Amid increasing global uncertaintyand the fear of the further spread of coronavirus, the Federal Reserve System (FRS) suddenly lowered its key rate by 1%, to a range of 0-0.25%. To prevent a recession and revitalize business activity, the central bank decided to buy back $ 700 billion worth of treasury and mortgage-backed bonds.

Monetary expansion and quantitative easing(QE) for the injection of liquidity into the economy look like emergency measures, very reminiscent of the events of 2008. The financial crisis that began in the United States then developed into a global one, comparable in scale and impact only to the Great Depression of the 1930s.

For the first time, the Fed applied quantitative easing in November 2008 by $ 600 billion. Although the indices continued to decline until March 2009, QE helped slow down the pace of decline.

In addition to the above measures, March 15, the Federal Reserveannounced the introduction of the so-called discount window - allowing financial institutions to borrow money for up to 90 days to cover liquidity shortages. At the same time, reserve requirements were reduced to zero. Apparently, such measures are aimed at supporting low-cost loans to troubled enterprises to prevent massive layoffs of workers or, worse, bankruptcy.

These are perhaps the most radical measures thatthe central bank has ever taken in just one day. Fed officials said they were ready to use the entire arsenal of monetary instruments in the event of increased risks of a global recession.

During a hastily organized press briefingFed Chairman Jerome Powell expressed concern that business activity in the second quarter will be weak. According to him, it is difficult to predict how long the pandemic will last. He also hinted that he did not exclude the use of stimulating fiscal measures by the government.

“What fiscal policy can do and in reality only fiscal policy is to directly affect the affected industries and workers”- emphasized Powell.

Note that emergency measures of fiscal policyusually involve an even greater degree of government intervention in the economy and, consequently, a significant distortion of market signals. Moreover, they are aimed, as a rule, at a long-term effect.

Powell emphasized that excludes the introductionnegative rates that were used in European countries and Japan. Given this statement and the current rate, it can be assumed that the last stronghold of the US authorities will be the expansion of quantitative easing (possibly up to $ 1 trillion), as well as the provision of powerful fiscal incentives to businesses and the public.

A rate close to zero was first set in 2008, holding out at that level until December 2015.

Grant Thornton Chicago economist Diana Swank is confident that the Fed is confident that more radical measures are needed to prevent a recession.

“Monetary incentives are not enough. The Fed is more willing to go much further than the federal government. ”“Said Swank.

Now the Fed is preparing to give money to primarydealers - leading American banks - to buy cheaper corporate bonds, that is, company debts. Thus, the American authorities are seriously afraid of a powerful wave of bankruptcies. However, the rating agency S&P Global expects the level of corporate defaults in the US to rise above 10% in the next 12 months.

Like a dead poultice

Even extraordinary monetary incentives were not enough - they only reinforced the investors' bad premonitions.

The day after the rate is resetAmerican markets showed one of the deepest declines in history. In particular, March 16 turned out to be the third worst day for the S&P 500 index, which fell by 324.89 points (-11.98%) to 2386.13.

S&P 500 Index chart from TradingView

Historically the worst day for the “barometer”American Economy” was October 19, 1987, when the S&P 500 index fell by 20.5%. The second largest daily drop occurred on October 28, 1929 - 13%.

The oldest American industrial index, Dow Jones, March 16, fell 12.93%. The US dollar index fell 0.4% to 98.482, while the price of gold rebounded slightly.

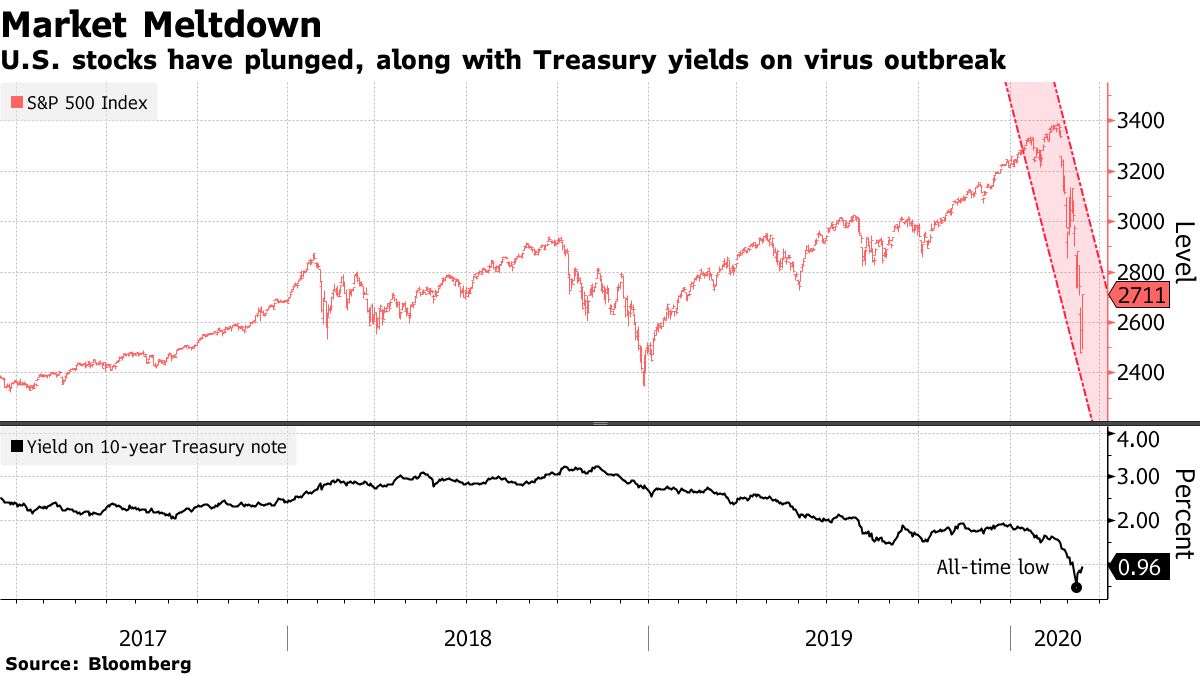

Against the backdrop of a rapid decline in the S&P 500, the yield on US government bonds has dropped to a historical low, which indicates high demand for them as a “safe haven” for capital.

European indices, including the FTSE 100 and DAX, fell more than 7%, CAC 40 and Euro Stoxx 50 fell 8.8% and 9%, respectively.

Fiat Chrysler said Monday that it would suspend production at most of its plants in Europe until March 27 because of the coronavirus. Shares of the company fell 10%.

British Airways (BA) and EasyJet said sharplywill reduce power to try to survive the outbreak of coronavirus, which has suspended travel around the world. International Airlines Group, the owner of British Airways, said it will reduce its flight capacity by at least 75% in April and May. Shares fell 26%.

EU finance ministers are considering using the Financial Stability Facility (ESM), which played an important role in overcoming the sovereign debt crisis in 2010-2012.

ESM currently has a reserve in€ 410 billion and it is very likely that the ministers will use these funds. Amid the ongoing panic in the financial markets, the G7 countries have already promised "to do everything necessary to ensure a decisive global response."

On Friday, March 13, the European Commission lowered its GDP forecast for 2020 from 1.4% to -1%, estimating the damage from coronavirus at 2.5%.

Brent crude for the first time since January 2016 fell below $ 30.

TradingView Brent Oil Chart

Now the price of oil is the lowest in the last 20 years.

</p>It is obvious that such a rapid drop in "black gold" is due not only to an excess of its supply on the market, but also to a decrease in demand due to a drop in business activity on a global scale.

After the shock of the OPEC + deal, the Russian market, which did not move away after the shock on March 16, predictably fell 3.79% to 2228.5 points after the opening of trading, the RTS index fell 3.78% to 954.18 points.

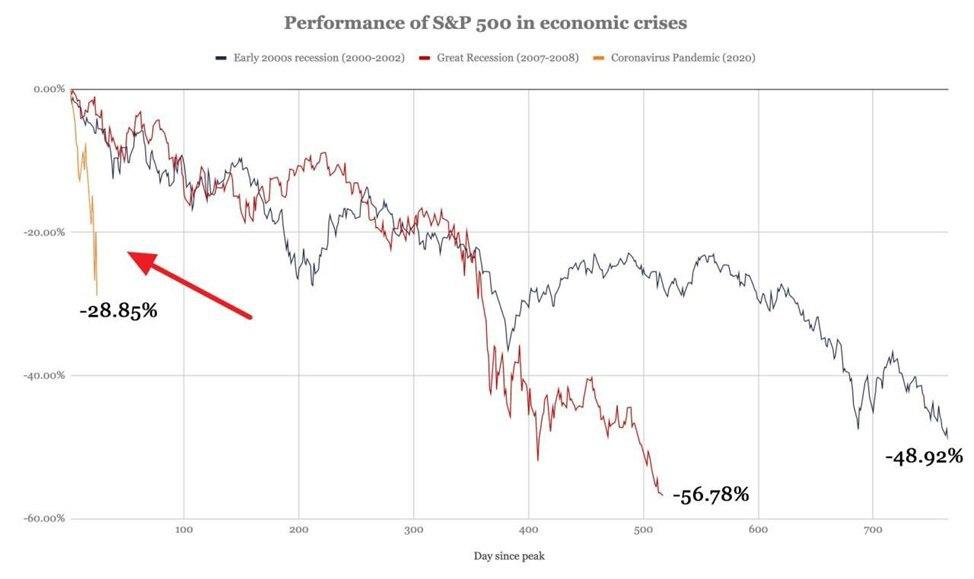

Lack of any positive reactionmarkets on the emergency anti-crisis measures taken by states indicates a high probability of a continuation of the steep peak in world indices, commodities and stocks. By the way, the rate of decline of the S&P 500 is significantly faster than the dynamics of this index in the previous crises of 2000 and 2008:

Source: ZeroHedge

The global recession is on the verge

RecessionIt is usually considered to be a fall in GDP, an increase in unemployment and a reduction in investment for two quarters in a row.In particular, this is how a recession is recorded by the UK Office for National Statistics.

However, the US National Bureau of Economic Research may call the recession, accompanied by a "significant decrease in business activity," a recession that lasts only a few months.

There is also the term"depression", meaning the “lowest point” of production andemployment, bottom of the business cycle. This is usually a strong reduction in real GDP for several years in a row. In essence, depression is an extremely powerful and protracted recession.

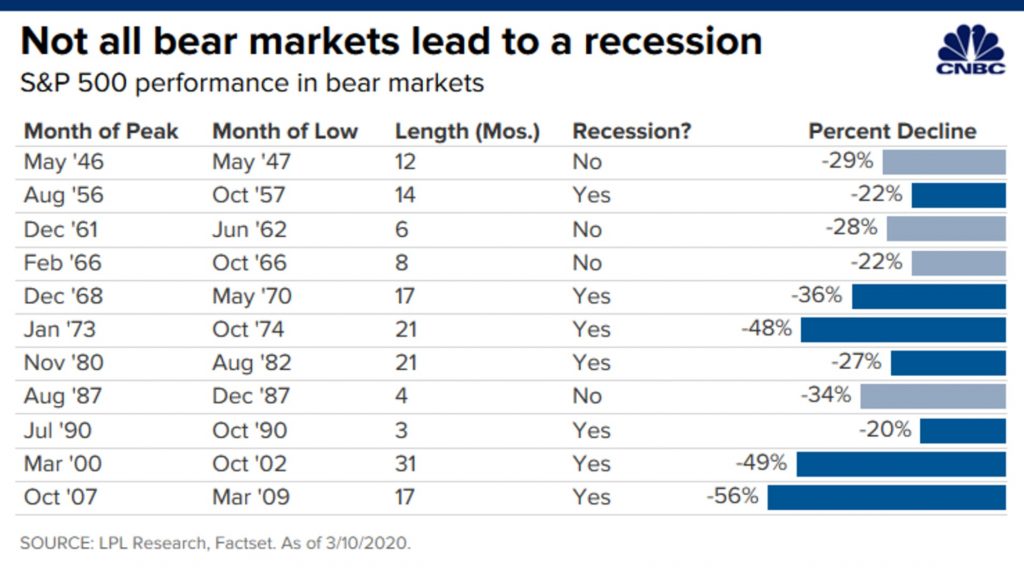

Experts from LPL Financial, the largest independent broker-dealer in the United States, without a shadow of a doubt said that the longest bull market in the history of traditional finance has been completed.

However, according to analysts, the beginning of a bear market does not mean the onset of a recession. Nevertheless, the latter happens in most cases after a reversal of a long-term trend.

The last three bear markets went into recession.

Historically, most bear markets - over 70% - have been accompanied by a recession, according to the LPL. So it was in recent decades - in 1990, 2000 and 2008.

Some economists are convinced that economicthe recession will last only a few months and the US will be able to avoid a technical recession. For example, JPMorgan expects business activity to recover in mid-2020, after a slowdown in the spread of coronavirus.

Remain moderate optimism and experts of Bank of America.

“We believe that in the coming months, the economy will“ flirt ”with the recession. A negative indicator of GDP will be in the II quarter, and weak growth will begin in III, after which recovery will begin ”- said the chief economist of the bank Michelle Mayer.

Goldman Sachs is not so optimistic, whose experts predict that the S&P 500 index will reach the bottom at around 2000 if the coronavirus continuesproliferation with all the ensuing consequences for the economy.

According to Goldman Sachs strategist David Costin,the aggravation of the epidemiological situation will deprive many companies of their profits, which will affect the markets and the economy as a whole. So, on Sunday, March 15, Nike Inc. announced the closure of all stores in North America and Western Europe. A similar decision was made by Apple, which will close all stores outside of China until March 27.

Nevertheless, there is a ray of hope in Kostin's statements - the analyst expectsalmost in a V-shaped reversal of the market at the end of the year and the return of the S&P 500 to 3200 as a result of a 60% rally from theBottom.

As for the short term, in March-April Goldman Sachs expect a sharp reduction in the US economy and do not exclude the official announcement of the recession.

According to experts of the investment bank,the world's largest economy will shrink by 5% in the second quarter, and zero growth will be recorded in the first quarter. However, in the third and fourth quarters Goldman Sachs still expects growth of 3% and 4%, respectively.

They added that people will limit themselves totrips, entertainment, going to restaurants. Disturbances in the supply chains and deterioration of the general financial condition of companies will continue to escalate an already difficult situation.

A few days after these statements, it became known that Goldman Sachs, as well as Morgan Stanley, already considered the global recession to be the underlying scenario.

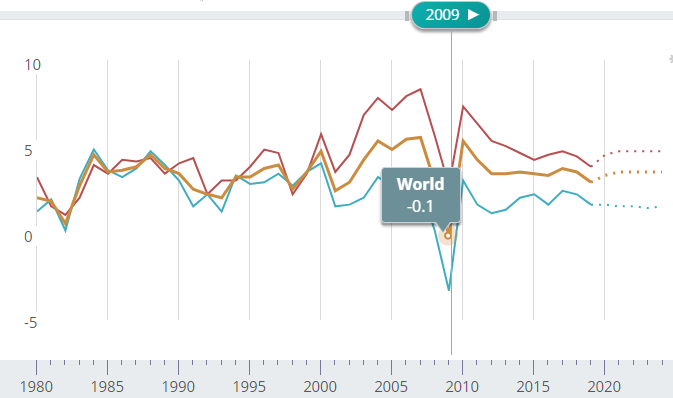

In particular, Morgan Stanley expects the global economy to slow down to 0.9% this year, Goldman Sachs to 1.25%, and S&P Global Ratings to 1-1.5%.According to Morgan Stanley, the downturn will not be as painful as in 2009, but much worse than in 2001 or the early 1990s.

The decline in world GDP in 2009. Data: IMF

Both Morgan Stanley and Goldman Sachs expect recovery in the second half of the year. However, according to experts, there is a risk of a worsening economic situation.

Bloomberg analysts significantly lowered their forecasts for the Chinese economy for 2020.

“Our previous forecast for this year was about 5.2% growth. In our new forecast, the mark is 1.4%, which provides for an 11% decrease in the first quarter ”- noted experts of the publication Chang Shu, David Ku and Tom Orlik.

JPMorgan and Deutsche Bank AG already insist on the feasibility of introducing fiscal stimulus by governments of developing countries and more active government intervention in the economy.

The international consulting company McKinsey & Company presented three scenarios for the consequences of the spread of coronavirus.According to the most pessimistic of them, the COVID-19 pandemic will lead to a global recession.At the same time, the level of consumption and savings of the population will recover to previous values no earlier than the third quarter of 2020.

Thus, most famous andreputable analysts are inclined to believe that a sharp decline will nevertheless turn into a global recession. Taking into account the absolute inefficiency of monetary leverage and the still exponential rate of spread of the virus, very recent forecasts are constantly being reviewed for the worse.

But what about bitcoin?

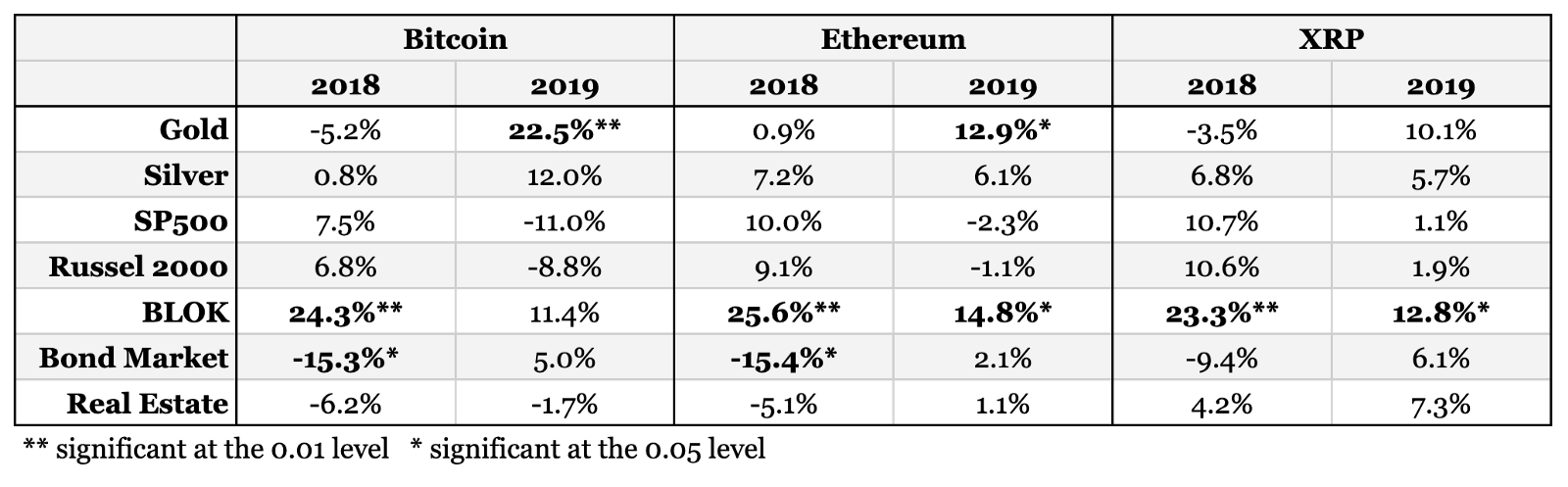

It is widely believed that bitcoinexists on its own, without correlating with any traditional assets. Proponents of this hypothesis argue that such uncorrelatedness makes the first cryptocurrency an excellent means of diversifying investment portfolios. For example, billionaire Chamat Palihapitiya is firmly convinced that every investor should store at least 1% of his assets in bitcoin.

Crypto Michaël technical analyst noted that amid global instability, many are now selling “stocks, bitcoin and even silver,” increasing their fiat positions.

</p>If you compare the recent dynamics of the S&P 500 and the first cryptocurrency, it turns out that both charts are goingAlmost leg-to-foot:

In other words, investors in a panic are dumping bitcoin like any other risky asset.

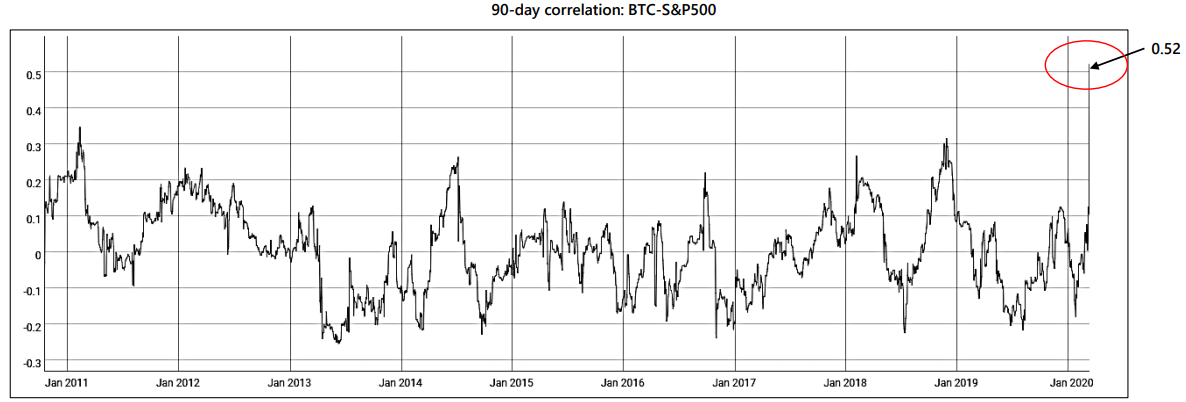

According to Arcane Research, against the backdrop of the recent collapse, the correlation between the price of bitcoin and the S&P 500 has reached the highest values in history.

It is worth considering that last year the correlation of BTC with the S&P 500 was predominantly negative, and with the traditionally protective asset gold - positive.

Data: The Block

Now everything is the other way around, and in terms of the rate of decline, bitcoin does not lag behind equity markets, and the correlation with gold has significantly weakened.

</p>Not all experts had a positive reactionrecent Fed rate cut. While Morgan Creek Digital co-founder Anthony Pompliano considered the sharp easing of monetary policy a bullish signal for Bitcoin, The Block analyst Larry Chermak drew attention to the close correlation of the first cryptocurrency with the S&P 500, which continued its rapid decline. Well-known trader Josh Rager also said that at the current stage Bitcoin is not able to act as a hedge against turbulence in financial markets.

“This time, the investment world already knew for sure that the cryptocurrency sector would not stand up to the risk, and traders began selling bitcoin in exactly the same way as any other asset”- said RoboForex analyst Dmitry Gurkovsky.

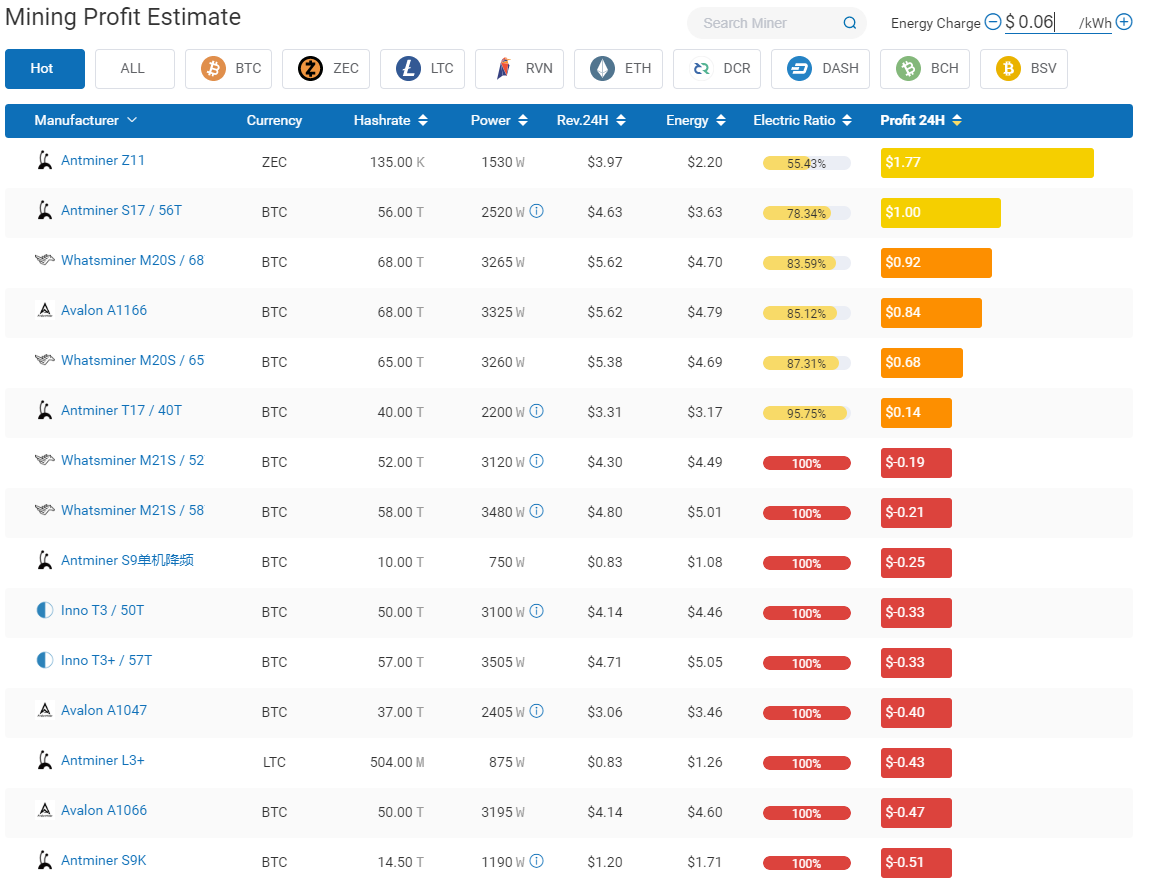

We also note that such a significant decreaseBitcoin prices create significant uncertainty, especially given the approaching halving of block rewards. The latter will make the activities of miners much less profitable.

The table below shows that at an electricity price of $ 0.06 per kWh, only the latest miner models work for profit. The once overly popular Antminer S9 generate a loss.

Data: Poolin as of March 18

It can be assumed that if, until May 12, the price is notwill show any significant growth, but the complexity of production will remain approximately at the current level, many industry players will simply leave the game. Prior to this date, one can expect pressure on the market from some miners who will sell their stocks of financial strength to cover various costs.

***

The thesis of the inevitable, popular in recent yearscrisis has become relevant as never before and is now taken more than seriously. It is already obvious that a global recession is almost inevitable, given the inefficiency of monetary incentives and the sustained pace of the epidemic.

It’s possible that COVID-19 served as a trigger,which caused an avalanche of long-overdue crisis processes. The latter is clearly not limited to financial markets, covering many industries and entire countries.

Given the strong correlation in recent monthsBitcoin with world indices and the non-adoption of cryptocurrency as a protective asset in times of shock, it can be assumed that the cryptocurrency market will continue to stagnate until global uncertainty dissipates and the virus spreads.

The low price of bitcoin does the job of manyminers unprofitable. In all likelihood, some players with less advanced equipment and relatively expensive electricity will quit the game, especially after halving. As a result, the bitcoin hash will decline, pulling complexity along with it. Mining breakeven point, as well as BTC price, will continue to seek equilibrium.

Alexander Kondratyuk