On Tuesday, EU finance ministers will continue to discuss a coordinated response to the consequencesepidemics of coronavirus. They are considering using the Financial Stability Fund (ESM), which played a decisive role in overcoming the sovereign debt crisis in 2010-2012, Reuters reports.

ESM currently has a reserve in€ 410 billion. Ministers are more likely to use these funds. Amid the ongoing panic in the financial markets, the G7 countries have already promised "to do everything necessary to ensure a decisive global response."

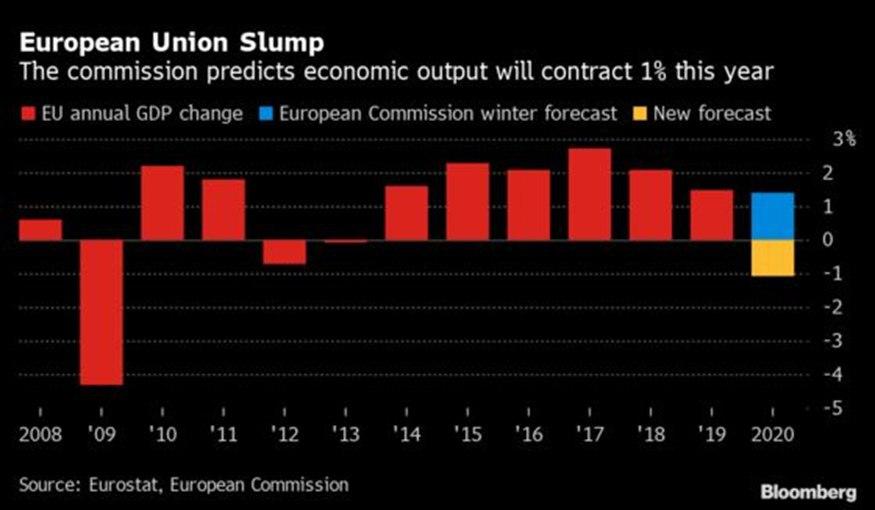

On Friday, March 13, the European Commission lowered its GDP forecast for 2020 from 1.4% to -1%, assessing the damage fromcoronavirus in 2.5%

From that moment, the borders were blocked by Spain and Germany (partially), and European Commission President Ursula von der Leyen proposed completely closing the external borders of the Schengen zone for 30 days.

Monday urgent funding neededAir France KLM and Lufthansa; planned nationalization of the Italian Alitalia. Retailers and tourism have been threatened. The services sector over the past years has supported the growth of the eurozone economy amid uncertain industrial dynamics.

It’s already clear that soon the forecast of potentialeconomic damage will have to be reviewed. The authorities are prepared to worsen the situation, say the words of German Minister of Economy Peter Altmeyer, who did not rule out the localization of part of the production chains and the nationalization of individual companies.

This is also evidenced by the intention of Berlin to extend the protection of bankrupts from creditors for an additional 30 days.

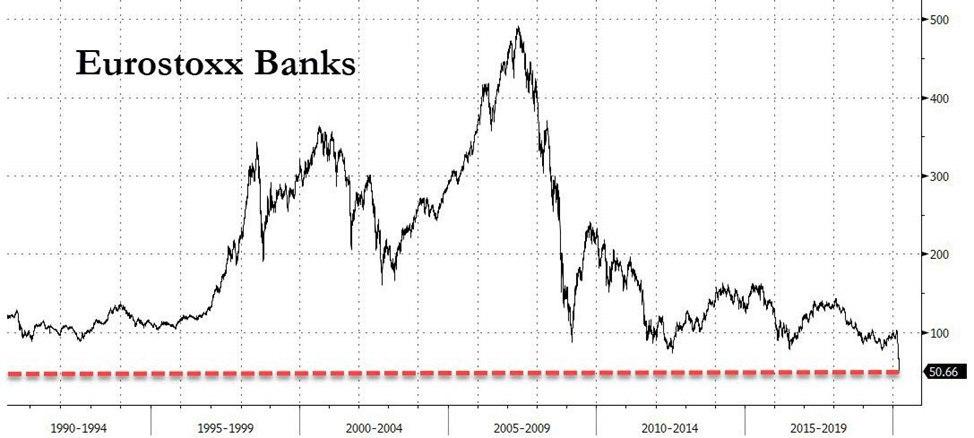

Investors are also concerned about the state of the eurozone banking sector.On Monday, the sectoral index went to even lower levels, even compared to the crises of 2008-2009 and 2010-2012.

Source: Zerohedge

At the beginning of the week, the ECB, as a preventive measure, took regulatory exemptions in calculating the capital adequacy ratio. This allowed banks to free up about € 100 billion.

But investors cannot help but be alarmed by the ECB's comments that there is a lot of cash in the ATMs of Eurozone credit institutions, as well as the words of German Chancellor Angela Merkel about the government's readiness to help banks.

On Monday, trading on the European stock market ended with a drop of 4.8% on the Stoxx Europe 600 index.At the same time, at the moment, the index was declining by more than 8%, and this is after an 18% drop in the previous week.

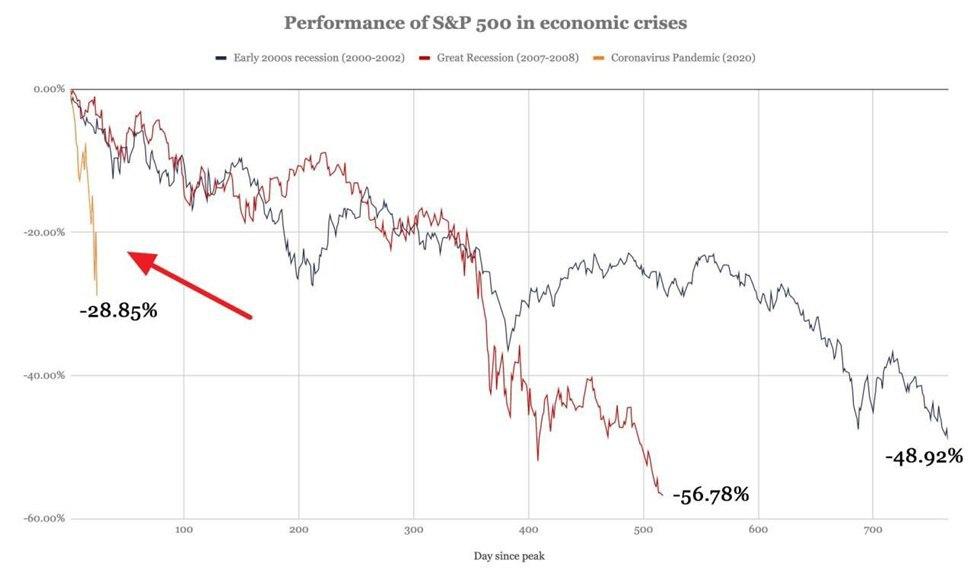

Lack of positive reaction to the secondThe Federal Reserve's emergency package indicates a high probability of a continuation of the downward spiral, which is already faster than the previous crises of 2000 and 2008.

Source: Zerohedge

About how the crypto community regards the recent actions of the Fed and the situation in the global economy, read the link.