Our beloved Central Bank opened a discussion on the topic of the digital ruble several months ago.

All details:

cbr.ru/StaticHtml/File/112957/Consultation_Paper_201013.pdf

cbr.ru/analytics/d_ok/dig_ruble/

We can immediately say that there is no smell of crypto, but probably some semblance of blockchain will be implemented.

the simultaneous circulation of cash, non-cash, and digital rubles is assumed.

But we all, of course, understand that in 5-10 years, it’s likely that only the digital form of the ruble will remain.

The digital ruble will be issued by the central bank (Bank of Russia) in digital form.

The digital ruble will take the form of a unique digital code, which will be stored on a special electronic wallet.

The transfer of a digital ruble from one user to another will take place in the form of moving a digital code from one electronic wallet to another.

On the one hand, the digital ruble is similarwith banknotes because it has a unique digital code (just as a banknote has a series and number) and is issued by the central bank, which is why central bank digital money is sometimes called “digital cash.” Continuing the analogy with cash, it should be possible to use the digital ruble in offline mode, that is, in the absence of access to the Internet and mobile communications.

The main thing is that each money is unique (code number), which means you can always track the entire path of its movement through wallets, from the moment of issue.

Those, all transactions are as transparent as possible,who, to whom, when, for what (easy to do). And this, in turn, allows you to organize automatic write-off of taxes from any payment. Moreover, the taxes themselves can be changed at least every hour.

If society follows this path, in the future we will have a phenomenal tax reform, and 10-15 million free accountants, accountants, tax specialists and other accountants.

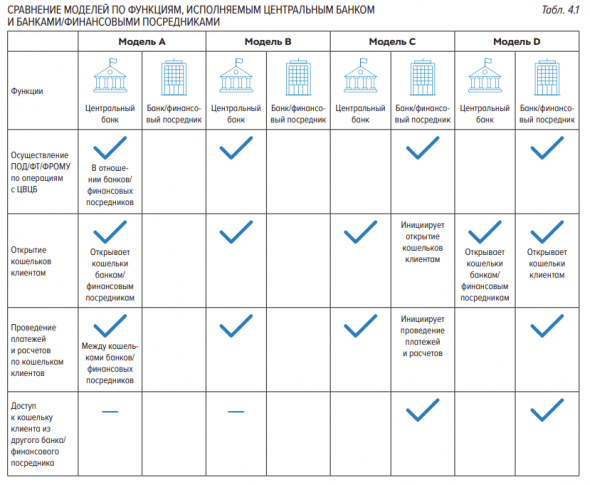

There are currently 4 options for the digital ruble being considered:

In all options, one single wallet is assumed for each owner.

The most progressive option is, of course, model B (second).

All accounts of physicists, lawyers, government officials, and otherssystem participants are entirely in the Central Bank. Banks in such a system actually lose their settlement function. The client will never be able to use the services of banks even once in his life. The Central Bank gets the opportunity to accumulate gigantic monetary resources and direct them to targeted government lending. projects, with full control of every money. This has never happened before in the history of mankind.

Banks in this model, from the almighty financialorganizations are turning into highly competitive institutions in the struggle to provide credit-deposit, transaction-interest, complexly structured financial services to wallet owners. In fact, this completely changes the banking system in its current understanding.

Of course we will see the banking lobby for options C and D.

In addition, total automatic controlbehind each wallet will allow you to compare income and expenses, virtually eliminating the possibility of monetary corruption at the lowest and middle levels. Of course, non-monetary forms of corruption will remain, and the outside world has not been canceled either.

The Bank of Russia has not yet made a decision on issuing a digital ruble.

Public discussion[email protected]