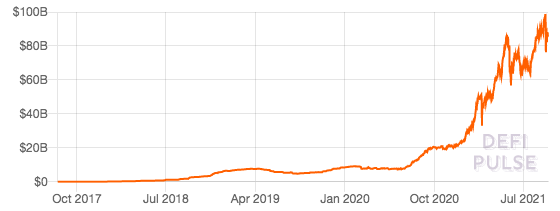

Decentralized finance (DeFi) is one of the fastest growing and innovative sectors of the crypto market. WITHAt the beginning of the year, the volume of user funds blocked in DeFi protocols increased from $ 21.34 billion to almost $ 180 billion.

Moreover, in 2021, the tokens of successfulDeFi projects have become one of the most profitable assets on the crypto market - their holders have increased their capital tens and even hundreds of times. But all this does not yet lead to a significant increase in the participants in this market, and even more so does not apply to mass users.

We figured out whether DeFi will be able to revolutionize and squeeze out the traditional financial market or whether it remains a closed niche for professionals and speculators.

DeFi Sector Potential

The DeFi market goes far beyond cryptocurrencies andsimple translations. It provides access to decentralized exchanges (DEX) and liquidity pools, lending, borrowing and escrow protocols, insurance, derivatives trading and a variety of other financial services. In theory, this sector offers a complete alternative to the traditional financial market, but operates without intermediaries, on the blockchain and using smart contracts.

Crypto enthusiasts believe that DeFi is not onlyhigh profitability and speculation. This sector has the power to displace the traditional financial market, replacing banks and fintech companies for hundreds of millions and even several billion people. First of all, we are talking about that part of the population that does not have access to the services of the traditional financial market.

This opinion is based on the fact thatDecentralization and smart contracts allow DeFi protocols to conduct transactions faster and cheaper than traditional financial service providers. Moreover, such transactions are carried out without minimum transfer amounts, paperwork and in conditions of complete transparency. To gain access to DeFi services, you don’t need to provide documents to anyone, go through KYC/AML checks, or enter into contracts—all you need is a smartphone and a blockchain wallet.

It is expected that this could encourage a huge number of people to abandon the services of traditional banks and brokers in favor of DeFi protocols.

The DeFi sector is far from mass adoption

However, the real picture of the adoption of the DeFi sectoris still far from its theoretical perspectives. Although the sector is growing at a fantastic rate, the number of users and transactions, as well as the volume of liquidity, are not impressive.

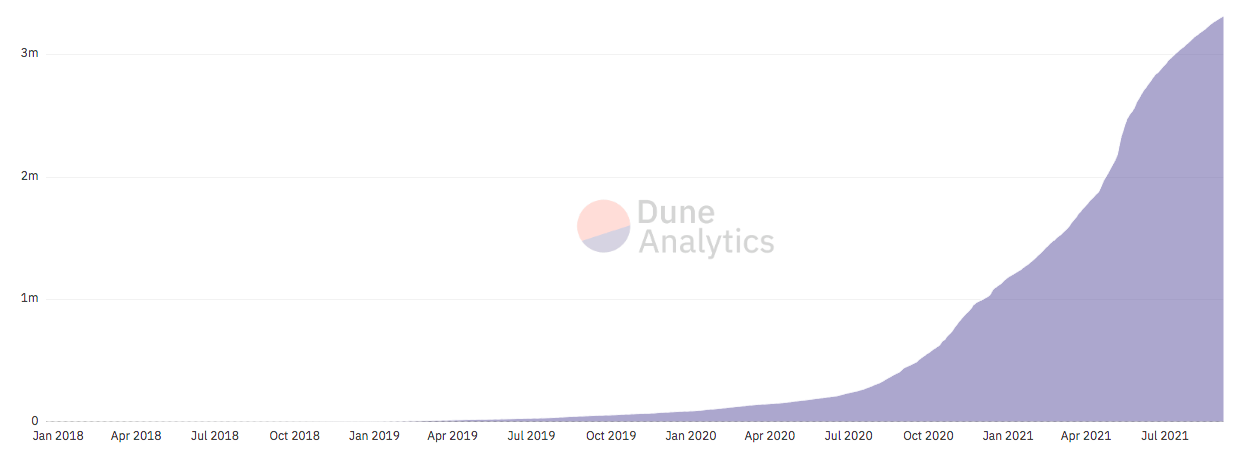

According to the analytical agency DuneAnalytics, the total number of unique DeFi addresses is 3.31 million. This is small compared to the total number of cryptocurrency owners, estimated at over 220 million people.

Growth graph of the number of unique DeFi wallets

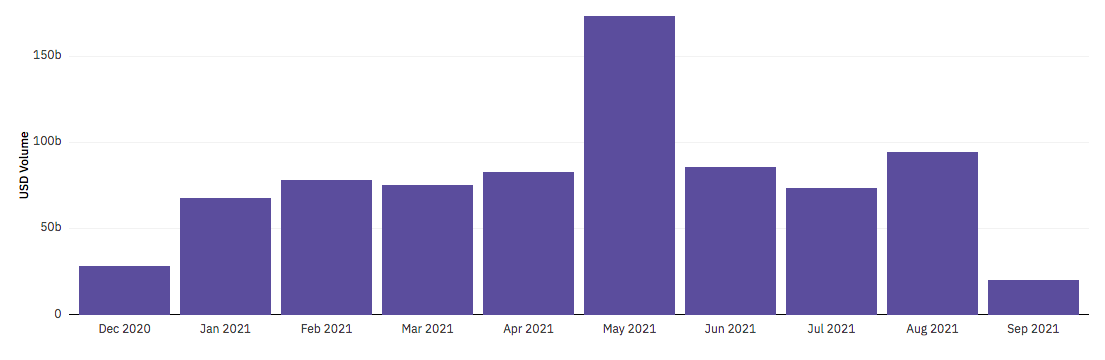

Average monthly DEX trading volume in 2021amounted to about $ 75 - $ 80 billion per month, although in May this figure exceeded $ 173 billion (in August - $ 94.5 billion). For comparison, the daily trading volume on only one centralized crypto exchange Binance exceeded $ 28 billion.

DEX Monthly Trading Volume

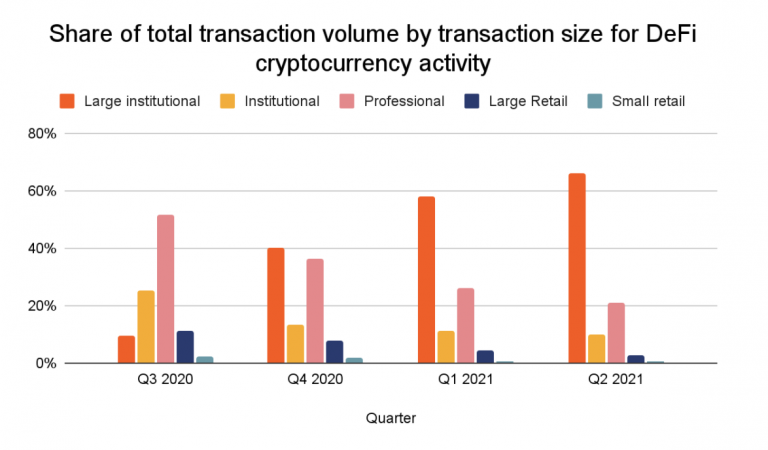

According to the company's August reportChainalysis, which publishes the Global Cryptocurrency Adoption Index, finds that the highest activity in DeFi comes from those players conducting large transactions.

So, in the second quarter of 2021 on operationsmore than $ 10 million accounted for more than 60% of transactions in the sector. On the crypto market as a whole, the share of such transactions amounted to 50% over the same period. Chainalysis experts note that the main players in the DeFi sector are professional traders and speculators, as well as large and institutional investors.

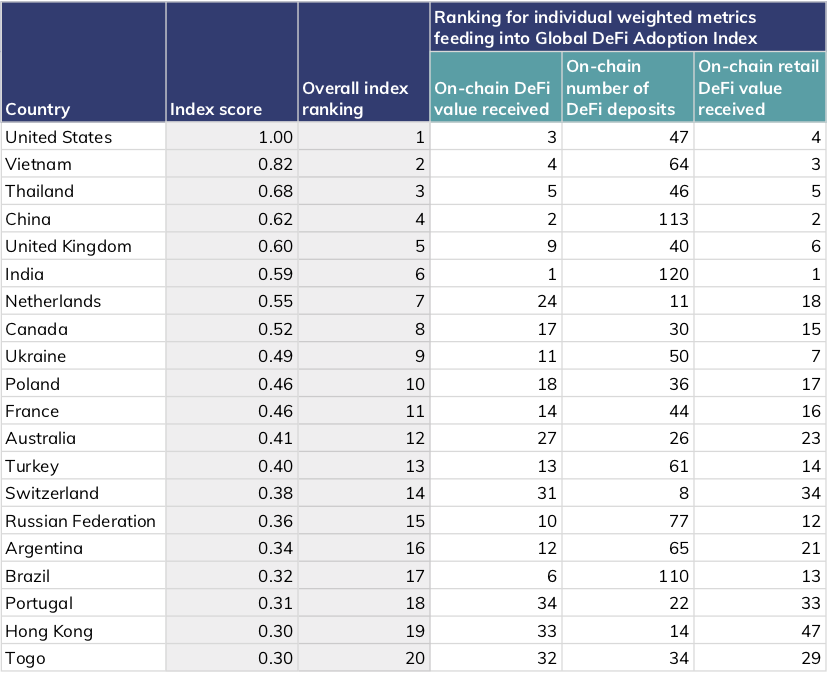

Chainalysis also compiled a ranking of countries whosecitizens use decentralized finance most often. So, the five leaders in the implementation of DeFi included the United States, Vietnam, Thailand, China and the UK. Ukraine was in 9th place, and Russia - in 15th. The countries in this ranking are ranked according to three categories: the volume of funds blocked in DeFi per capita, the total volume of assets in DeFi, and the number of transactions.

Ranking of Countries for DeFi Adoption Based on Multiple Metrics by Chainalysis

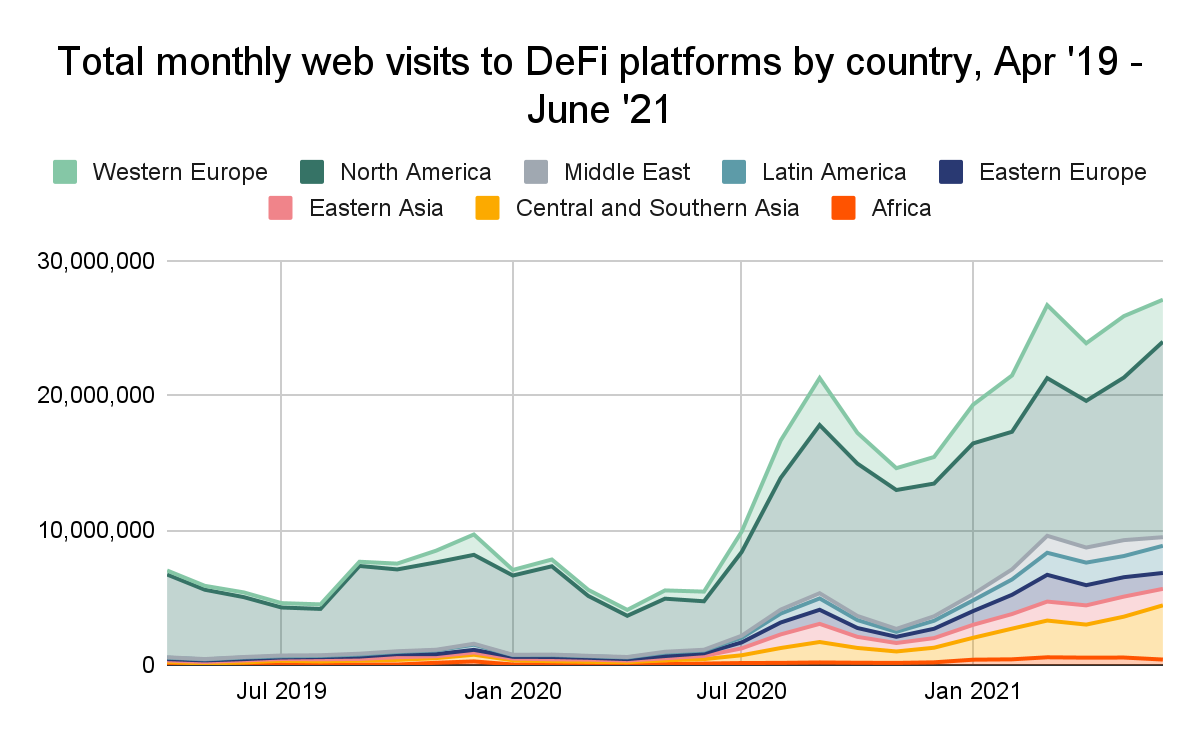

Analysis of web traffic on DeFi platforms alsoshowed that residents of North America showed the greatest interest in the DeFi sector. At the same time, from September 2019, traffic from Western Europe began to increase sharply, and from June 2020, from other regions, especially from Central and South Asia.

Interestingly, although China has become one of theof the largest countries in terms of DeFi transactions, the country's share of web traffic on DeFi platforms in East Asia remains low compared to its share of traffic on centralized crypto services.

The total number of visits to DeFi platforms by country from April 19 to June 21 according to Chainalysis

Thus, it becomes obvious that acceptanceThe DeFi sector is moving fastest in high-income countries, with mature cryptocurrency markets, and the largest institutional and professional markets. They are the driving force behind the popularization of decentralized finance.

This is another difference in development trendsDeFi sectors from trends in the crypto market. According to the same Chainalysis, digital currencies are generally more popular among residents of developing countries - they are used for international transfers, protection against inflation and access to the financial system. Chainalysis experts consider them to be the main driver of the spread of cryptocurrencies.

“Currently the DeFi market is focused oncrypto insiders - people who have been working in the industry for some time and have enough funds to experiment with new assets. In the long term, when gas prices on the Ethereum network fall, the DeFi sector will become accessible to more people,” David Gogel, developer of the dYdX DeFi protocol, commented on the Chainalysis report.

The expert also highlighted the United States, China, Russia and several Western European countries with a high level of cryptocurrency adoption as key growth markets for DeFi.

Chainalysis analysts are asking:Will the DeFi sector repeat the general path of the crypto market, will it be in demand among a wider audience, and will it gain popularity in developing countries? Let's try to answer these questions.

DeFi Growth Prospects

In the future, DeFi is quite capable of growing by 10 andmore than times the volume of funds raised. For example, famous crypto investor and billionaire Matthew Roszak believes that this could happen as early as 2022. There will be several reasons for such a rally: the mass adoption of cryptocurrencies, the global pursuit of high yields by investors and the global rise in inflation.

Graph of growth in the volume of funds blocked in DeFi-protocols

Another driver of future growth in the sector is institutional investment. Now institutions cannot directly own cryptocurrencies and are forced to use the services of custodial services.

For example, the largest crypto fund Grayscaleplans to create investment funds for DeFi projects such as Aave and Uniswap. And crypto asset manager Bitwise launched its own DeFi index at the beginning of the year, tracking tokens of the 10 most popular DeFi protocols. Lending protocol Aave has been working on launching liquidity pools for institutional investors since May. The interest of institutions in the DeFi market is also noted by the largest American exchange Coinbase.

But it is also important to understand that gradually the paceDeFi sector growth will decline. For example, the high returns that DeFi protocols currently offer should decline significantly as the industry matures. But this will also reduce speculators' interest in DeFi.

What's Stopping Mass Adoption of DeFi?

While DeFi could potentiallycreate an alternative financial system, now this sector is mainly used for speculation and is not popular with the mass audience and residents of developing countries. There are several reasons for this.

Lack of responsibility.Decentralization is the main advantage andmain drawback at the same time. The absence of an intermediary means that no one is responsible for anything or takes responsibility for the safety of user funds. This is an understandable risk when investing, but a deterrent to other financial transactions, especially since most DeFi project teams remain anonymous.

Safety problems. Hackers regularly withdraw funds fromDeFi protocols, finding vulnerabilities in project code. Developer mistakes are a result of the haste with which new projects are launched. Investor money constantly flows from one project to another - each new one takes off faster than the previous ones. Therefore, working on security for a long time is simply unprofitable.

Difficulty to use.Understand the operation of DeFi protocols or poolsliquidity is much more complex than simply buying cryptocurrencies on an exchange and keeping them in your wallet. The complex interface of many DeFi platforms also does not help with this. It is rarely localized into national languages, it is confusing and does not contain hints - you have to figure it out yourself or look for information on the Internet. All this is designed for experienced users who already know what they are doing. Therefore, only technically savvy users enter the sector - hence the predominance of traders and large players.

Limited liquidity.There are currently no DeFi protocolssufficient liquidity for a much larger audience. To reach a mass user, liquidity will need to increase hundreds of times. And the existing liquidity models are not ideal: for example, MakerDAO has a complex collateral mechanism, a gradual decrease in liquidity when the asset price changes in Uniswap, and fragmentation of liquidity between different networks.

Amount of collateral.DeFi protocols do not have credit ratings or scoring services, so projects require a deposit of at least 150% of the loan amount. This option is not suitable for those who really do not have the funds.

No direct exchange for fiat.Stablecoins do not replace the simple exchange of digital assets for fiat money, which is necessary for the mass user.

Scalability.Although there are now over 40 blockchain networks in DeFi, most protocols run on the slow and inefficient Ethereum blockchain - it really is simply impossible for a mass market to use it.

Regulatory barriers.Although regulators are still more occupied with ICO projectsand large centralized exchanges, they are already beginning to pay attention to the rapidly growing sector. For example, US Securities and Exchange Commission (SEC) Chairman Gary Gensler believes that DeFi protocols pose “a number of challenges” for investors and regulators, and hinted that the sector could be high on his list of priorities. The SEC itself is investigating the activities of Uniswap Labs, the developer of the decentralized exchange Uniswap. At the same time, we should not forget that the tokens of DeFi projects have shown impressive growth over the past two years - the regulator may well classify them as securities.

DeFi problems can be solved

All the problems listed above can be solved and shouldgradually fade away as the sector develops and matures. Thus, security problems will be significantly reduced if developers conduct more stringent audits.

Quality of interfaces, support functionality andEase of use is also gradually improving. Ethereum has begun the transition to version 2.0, which should solve scaling problems and make it possible for tens or hundreds of millions of people to participate in the sector. And Ethereum is gradually losing its share in the sector, giving way to other, faster and more efficient networks.

Huge impetus to popularize the DeFi sectorwill set a desire for at least minimal regulation. DeFi protocols will need to reduce the risks of fraud and money laundering, otherwise regulators may seriously look into them.

Is DeFi going to be massively adopted?

DeFi will definitely not replace traditionalfinancial system: we will not see mortgages or benefit payments in this sector. But DeFi will not share the fate of ICOs, the sector of which collapsed a year after the boom - decentralized finance is with us for a long time, if not forever.

Probably, DeFi technologies and principles in one way or anotherwill move to a different extent into traditional fintech companies: we will see p2p products based on smart contracts, but with regulation and a central governing body. This will make the financial system fairer, more transparent and more accessible.

In the coming years, DeFi will remain a niche forprofessionals, but if the industry gets regulated and attracts more institutions, we may see a gradual popularization of decentralized finance among mass users.

For DeFi to go mainstream, the sector needssolve security problems, implement minimal regulation, for sites - improve the interface and user experience, as well as increase scalability and attract liquidity. Then the benefits of decentralization will become more apparent to the widest possible audience.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication