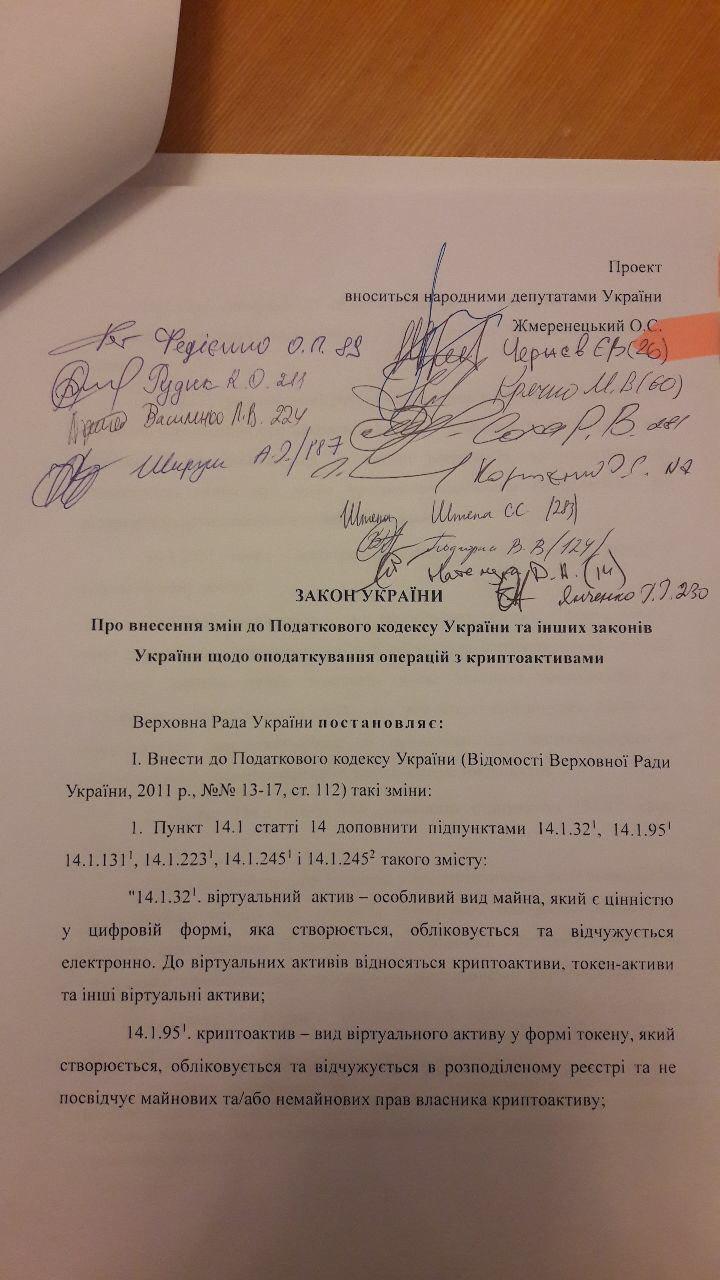

A draft law that will regulate the taxation of transactions with cryptocurrency assets onterritory of Ukraine, submitted to the Verkhovna Rada. This editorial ForkLog said one of the co-authors of the document, the head of the inter-factional association Blockchain4Ukraine Alexey Zhmerenetsky.

The document is enshrined in the legislative fieldterms «virtual asset», «crypto asset», «operation with crypto assets», «distributed ledger», «token» and «token-asset». In particular, a virtual asset is defined as property and is divided into crypto-assets (without the right of claim) and token assets (with the right of claim).

«The object of taxation is profitfrom transactions with crypto assets, which is defined as the positive difference between the income received from the sale of crypto assets and the costs associated with their acquisition and/or mining», — states the text of the bill.

The financial result for operations with crypto assets is determined separately from the financial result for other activities of the taxpayer.

For individuals, income from operations with crypto assets is taxed at a rate of 5%. So far, the personal income tax rate for individuals in Ukraine is 18%.

In this case, the sale of crypto assets will not be subject to value added tax.

The rate on cryptocurrency transactions for legal entities remains at the level of 18%.

Recall that in early November, deputies of the Verkhovna Radaadopted in the first reading a draft law on the implementation of FATF standards to combat money laundering and the financing of terrorism, which will be further applied, including in the regulation of the cryptocurrency market.