Soros Fund Management Investment Director Dawn Fitzpatrick reported that the fund invests in the cryptocurrency industry,as it sets the variable torque for bitcoin and other crypto assets.

When she was asked if she owned bitcoins, Fitzpatrick magically replied that there was no way to answer this question.

He did not cover his personal crypto-assets, the top-manager told about his views on the crypto-currency industry:

«We think that all infrastructure inThe crypto space is really interesting. We have invested in this infrastructure and we think that now has come a turning point. I would say that everything from asset managers of the exchange to such mundane things as tax reporting of crypto-currency income and everything in between is very interesting.

Then she said how the printing of money by the Federal Reserve System is a factor of bitcoin success.

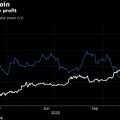

«We are at a truly important momenta time when something like Bitcoin could remain a secondary asset. But over the last twelve months we have increased the money supply in the US by 25%. So there is a real fear of depreciation of fiat currencies.

In her words, bitcoin is not a currency, but a product that is easy to store and transfer. The IRS also classifies it as a physical asset with a limited supply.

What you can buy from the central bankCBDC, Fitzpatrick noted that they will appear faster than people expect. At present, China is leading the CBDC race, since the country has already passed several tests of the digital yuan.

«There are several strategic reasons whywhich they are going to become pioneers. I evaluate this from a geopolitical point of view: they want to use the currency around the world. And this is a potential threat to Bitcoin and other cryptocurrencies.

Despite the fact that Fitzpatrick thinks that CBDCs pose a threat to cryptocurrency, it will be temporarily, since it is impossible to be constantly bitten.

</p></p>