Cryptocurrency Behavior Dependsmany factors, and the emotions of cryptocurrency owners are one of them.PeopleIt's not uncommon for greed to rule, especially when the market is rising.Or, conversely, investors see the market fall– and they are in a hurry to get rid of their savings, often doing it unreasonably, and leavein FUD (Fear, Uncertainty, and Doubt).

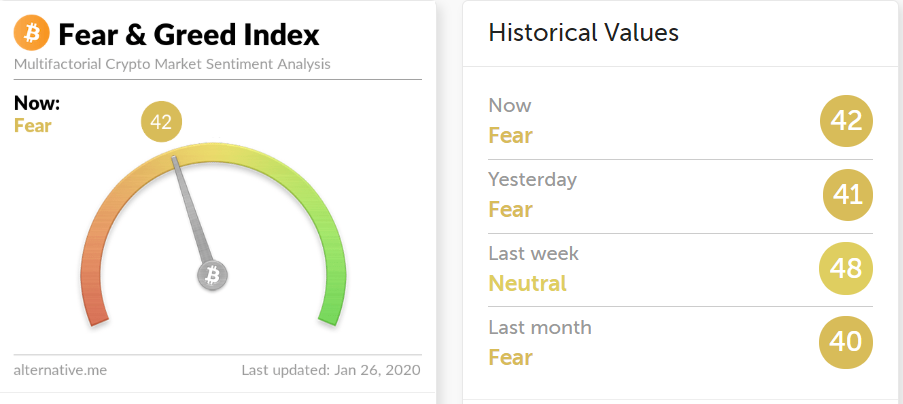

At the time of writing, this indicator is 42, which saysabout the lull in the cryptocurrency market.

What is the index of fear and greed?

The Fear & Greed Index is a method of measuring the sentiment of asset owners in the cryptocurrency market.By analyzing people's emotions and feelings from different sources throughout the day, various online resources, such as Alternative.me, determinea single assessment.

For example, on November 23, 2019, the index valuefell to 17, indicating that the market is driven by an extreme fear of heavy losses. As already understood, extreme fear is characterized by a low score and is a sign of concern. But it can open up great opportunities for traders.

When investors become too greedy (as evidenced by a high score), the market needs a correction to be followed by a high scoreA value of 0 indicates that the market is being drivenextreme fear, and 100 is extreme greed.

The importance of the index of fear and greed

This indicator is important, because to some extent it is emotions that drive cryptocurrency markets. About this, a RektCapital analyst wrote in a blog post:

Emotions drive the market. Greed leads to higher prices. Fear reduces her. Human psychology tends to be predictably irrational, because many people tend to react the same in certain contexts.

It is important to be aware of investor sentiment as it determines the best trade entry.When investors are ruled by greed, you should be careful, and when others are afraid, you need to act!Times that accompany extreme levels of fear tend to be ideal for those who don't loveFear lowers the price, while greed, on the contrary, increases the priceTherefore, when investors are afraid, greed begins to grow.

At the same time, other market participants mayuse the index of fear and greed for personal gain. By controlling its level, investors can determine the best moments for buying a coin. Times of extreme fear signal rapid growth in the near future, in turn, traders need to act or succumb to fear.

Understanding how people's emotions affect the market is vital to successful trading.Therefore, the Fear and Greed Index is a fantastic tool for both beginners and experienced traders.