Article Reading Time:

5 minutes.

Opinion

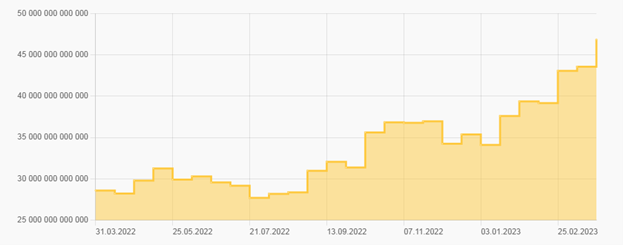

As a result of another recalculation of the mining difficulty, a new record was set in the Bitcoin network: 46.84 tons.This is the third difficulty increase in a row.for miners.

Bitcoin mining

For the first time in its history, the mining difficulty has exceeded 45 T (trillion), and it is projected to increase to 48.8 T as a result of the next difficulty change.Thus, the recalculation in favor of the increase may occur for the fourth time in a row.For the most part, this figure has been increasing since the beginning of 2023, and the last serious pullbacks were observed in December 2022, when the difficulty did not even reach 40 tons.

With the current level of difficulty and the number of blocks until its recalculation in real time, you can follow the Bits.media tools at the link.

Recall that the average time to search for a newblock on the network is 10 minutes, and the difficulty is recalculated every 2016 blocks or approximately once every two weeks. If the total computing power in the network grows and the speed of searching for a block increases, as a result of recalculation, the complexity changes upward. The downward adjustment accordingly occurs against the backdrop of a decrease in total computing power and an increase in the time interval for searching for one block.

In total, the difficulty of BTC mining is nowat a historical high. At the same time, the block time remains almost constant - 10 minutes, which is not least achieved due to the efficiency of modern equipment. The last big deviation was on March 23, when the figure dropped to 7.87 minutes.

When analyzing the state of the network, it is worth taking into account such an indicator as the current Bitcoin mining hashrate. Currently it is more than 360 exahash/sec.

The current level of the current Bitcoin hashrate and the dynamics of changes in real time can be found at the link.

As we see, the dynamics of the current hashratecorrelates with changes in network complexity. This suggests that miners prefer to use more and more computing power specifically in the Bitcoin network, despite the protracted crypto winter, the drop in exchange rate in 2022 and severe financial consequences, including bankruptcies for individual players.

Challenges for miners

In the current situation, individual experts

including Cryptonomist, see certain difficulties and challenges for miners.

The main problem is that whatThe more difficult it is to mine cryptocurrency, the more energy it requires. The difficulty of mining lies in the large number of hash function calculations before the very value with which the block is confirmed is found. For each confirmation there is a reward, which is currently equal to 6.25 BTC. Obviously, this work uses a huge amount of electricity.

On the other hand, the release of new ones, includingmore energy-efficient ASIC solutions and the development of new technological processes for such devices lead to a reduction in the level of energy consumption of an individual piece of equipment. This allows you to spend less energy processing the same number of hash functions. Consequently, there is some rebalancing of costs due to the difficulty of mining. But in any case, competition in mining and the chances of a successful block search (and therefore potential income at an equal BTC rate) for an individual miner are reduced.

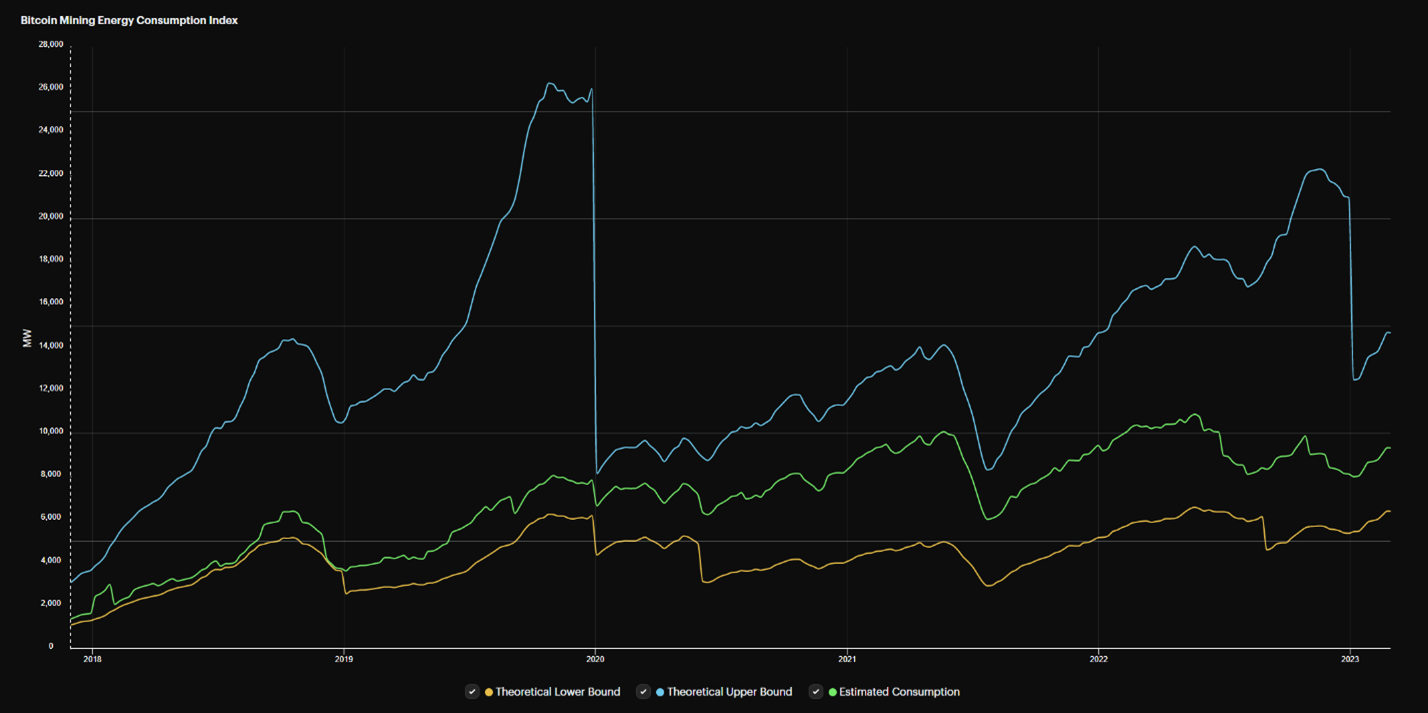

These statistics

Cryptonomist experts confirm, notingthat over the past seven years, the hashrate has grown approximately seven times, while the network’s energy consumption has only doubled. This is supported by the relatively stable level of the energy consumption index when mining BTC.

Source: hashrateindex.com

Hashrate level

As we already mentioned, there is a dependency:difficulty increases due to low block search time, which in turn decreases due to an increase in hashrate. In turn, miners compete to get as much hashrate as possible and maximize the likelihood of mining that single value. That is why they unite in pools, dividing their income in proportion to the results and capacity invested in the network.

Moreover, there is alwaysthe problem of the actual profit from mining, which depends on the market value of Bitcoin. Because converting to the fiat equivalent of 6.25 BTC when Bitcoin is worth $69,000 is one thing, but “cash out” when BTC is only worth $23,000 is quite another.

Currently the difficulty is atat a record high, and the BTC market value is more than 60% below its all-time high. Based on this, miners’ incomes are close to the minimums of the end of last year (at the same time local exchange rate minimums were reached). From this data, it's clear why 2022 was the worst year for Bitcoin mining.

High hashrate and record difficultymay indicate an increase in the interest of miners in Bitcoin as a long-term asset, since immediate profit taking into account all costs is controversial. Potentially, such interest leads to an increase in the cost of mining new coins, and the bet of individual players on long-term prospects and the holding strategy can be considered as one of the possible signals for further growth of the rate.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.