In an updated version of the class action lawsuit against the fintech startup Ripple for violating securities laws, itsThe head of Brad Garlinghouse is suspected of imposing tokens on investors, which he got rid of after receiving them.

Ripple by ForkLog on Scribd

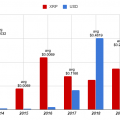

The plaintiffs indicated the sale of 67 million XRP by Garlinghouse during 2017 almost immediately after their receipt. Before that, he actively positioned himself as a “hodler”.

The new version also states that “all of the 100 billion emitted XRPs were created by Ripple from the air before they began to be distributed and without any purpose, except for speculation.”

“The value of XRP owned by the defendants is significantly higher than the value of Ripple’s income or cash flow from all other sources, - indicated in the statement of claim.

The plaintiffs also disputed the argument that XRP is a “bridge currency” that does not fall within the definition of a security.

“The claims of the defendants that XRP has a utilitarian purpose are false ... This is nothing more than an attempt to avoid the application of securities laws and stimulate demand for this token”, - opponents of Ripple are convinced.

The updated version of the statement of claim was registered within the period allotted earlier by the court within 28 days.

Recall that earlier the court did not recognize the fact that the company provided false information during the promotion of cryptocurrency, and also recommended that a more detailed statement of claim be filed.