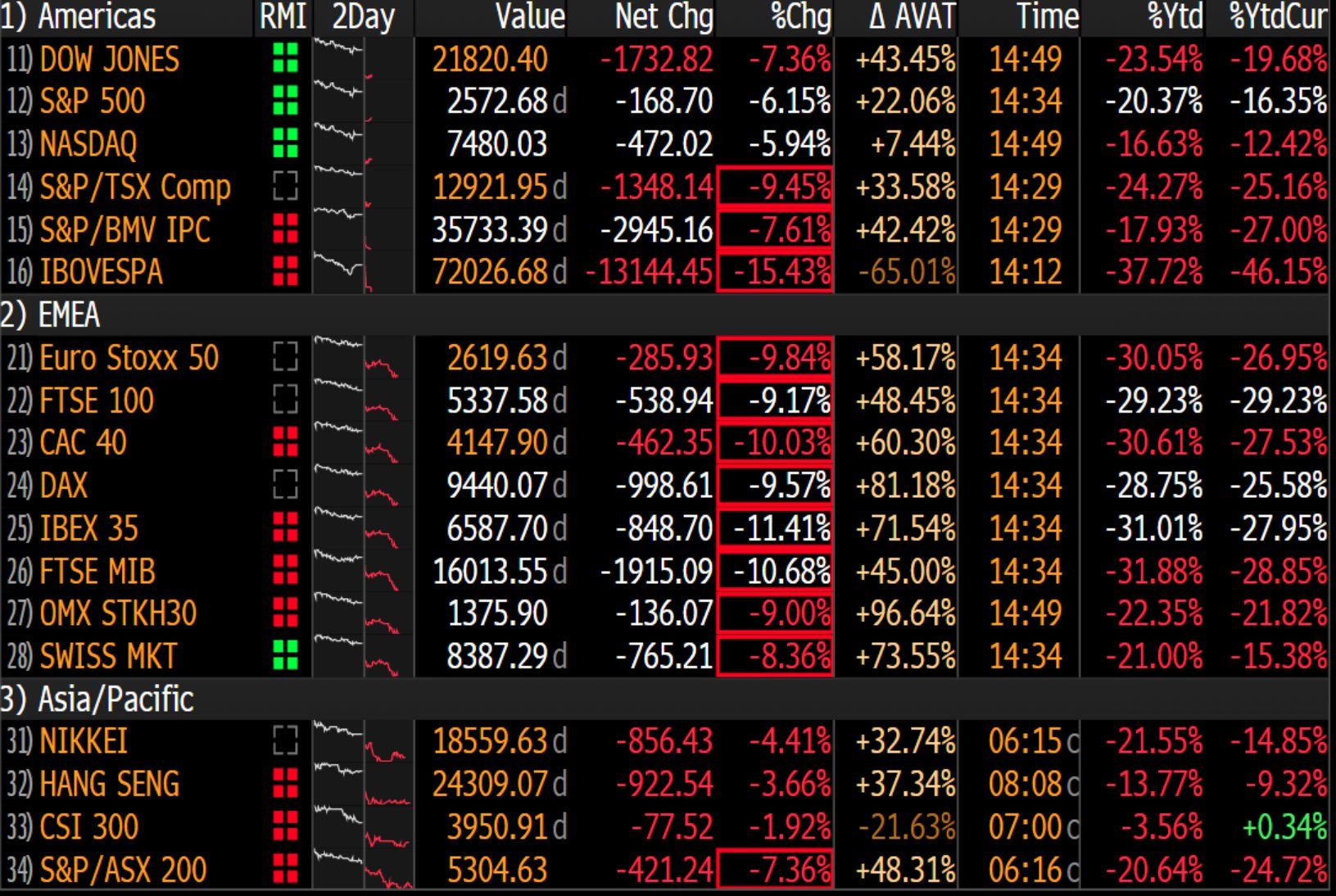

And this is what happened. The bubble of everything in the world, the bubble of bubbles, burst.

(source: BitMEX Research)

Do not dig another hole - you yourself will fall into it.

We are witnessing a historical event about whichwill be remembered for a very long time. An incredible experience, the reality of which is difficult to immediately realize. Sports competitions around the world are canceled, the seasons end ahead of schedule. College students are massively returning home. The network was flooded with photos of Trump with a coronavirus infected by the press secretary of the President of Brazil, taken just a few days ago. Chaos reigned. Getting your thoughts to write this post is not easy.

A combination of slow transition to industrial globalism, decades of artificially maintained low volatility, and erosion fromThe accumulation of capital by a privileged minority has put us in a very dangerous position.The Titanic crashed into an iceberg called COVID19, and the damage fromThe clashes are taking on catastrophic proportions.

The familiar world is destroyed by an invisible pathogen -both physically and economically. Of course, I practically do not understand in pandemics, and in this sense I can only, after all, recommend washing my hands more often and leading a healthy lifestyle. But as far as the economic consequences of the virus are concerned, I feel more confident and would like to share a few thoughts with you.

It is very telling that the US government's response to the pandemic has been to "save the economy" at all costs.

This is what you get in an economy that's on the bike.

Growth at all costs!

It's time to get off the bike, freaks. https://t.co/KTtOC334u8

— Marty Bent (@MartyBent) March 11, 2020

@MartyBent:Here's what you get from decades of pedaling to contain volatility and artificially prop up performance bycheap loans.

Growth at all costs!

It's time to get off this bike, freaks! https://t.co/KTtOC334u8

Unfortunately, due to the factors listed inthe third paragraph of this post, we have no way to protect the economy from this virus. We were taken by surprise. Due to the combination of the consequences of the terrible decisions made over the past 50 years, the economy, and the United States in particular, is now more vulnerable than ever.

Slowly move our supply chains to other countries over the course of decades.

At the same time, destroy the middle class with easy money and financialization of the economy.

Tear apart the Nuclear family in the process.

Red or Blue team, they have all been complicit.

— Marty Bent (@MartyBent) March 11, 2020

@MartyBent:For decades, they have gradually moved supply chains to other countries, while at the same time destroying the middle class with "easy money" and the financialization of the economy.Democrats or Republicans, it didn't matter, they were all complicit.

Right now most of the drugs that wethey will be needed to fight this virus if it gets out of control (unless, of course, this has happened yet), it is produced in China, with which the States, for example, have not been getting along very well lately.

"Accommodative" monetary policy with cheap credit and financialization of the economy after the (temporary) abandonment ofThe gold standard in 1971 dealt a big blow to ordinary people.This system gradually eroded their purchasing power, reduced their ability to accumulate capital gradually, and weakened their families as wage earners were forced to take on more shifts and then their wives had to go to work to make ends meet.Such constraints in money and time have led to a constant increase in stress levels and an increase in the number of divorces.

To today, when stress levels insociety breaks all records when the metaphorical barrel was already sufficiently filled with gunpowder in the form of decades of artificially suppressed volatility, and financial inequality is greater than ever, an invisible virus rushes over the planet and strives to finally knock the ground out from under the feet of ordinary citizens.

The institutions on which they depended for many years -their governments and central banks - showed absolute helplessness and could not do anything better to save the situation than once again turn on the printing presses.

I can directly hear them warming up as I writethis article. Get ready to expand the monetary base, next to which the expansion of 2008 will seem like a naive child’s game. And there is no doubt that this attempt to collect Humpty Dumpty will be as ineffective as the previous one. This will again somewhat restrain volatility, but will lead to an even greater fall in the future. And, probably, the period of calm before the next storm will be significantly shorter. I am afraid that the reactions to these crises from now on will be less and less effective.

That’s why, despite yesterday’s 45 percentthe fall (truly, it was very spectacular), I will continue to save my satoshi. Bitcoin provides deep protection, comparable to which the traditional system at the moment is simply not able to provide. As they push their printing presses to the maximum, I think more and more people will look for security and balance in Bitcoin. More and more people will understand that the artificial political agenda and the mental cell into which they were driven only distract their attention from the true problems, one of which is that we broke hard money.

Repair money, and you repair the world.

* * *

In the meantime, take care of yourself, wherever you are. Say hello to your neighbors and ask what is happening in your local community.

The salty air is refreshing.

</p>