The financial crisis of 2008 shook the world and exposed the shortcomings in the banking world. In recent monthsfinancial analysts around the world have noteda similar trend. The COVID-19 pandemic has exacerbated widespread disruptions in the global economy, as a result of which central banks have been forced to introduce quantitative easing.

It is reported that the balance of the Federal ReserveUS system as of April 24, 2020 approached $ 6 trillion. These funds were intended for small enterprises, sharply losing liquidity. In addition, the inefficiency of the traditional market coincided with an unprecedented level of unemployment.

As banks sought to reduce directcontacts with customers, the issuance of paper banknotes, with no choice, people turned to electronic payments. In addition, given the near-term depreciation of fiat due to huge cash injections, many began to consider cryptocurrencies as an alternative.

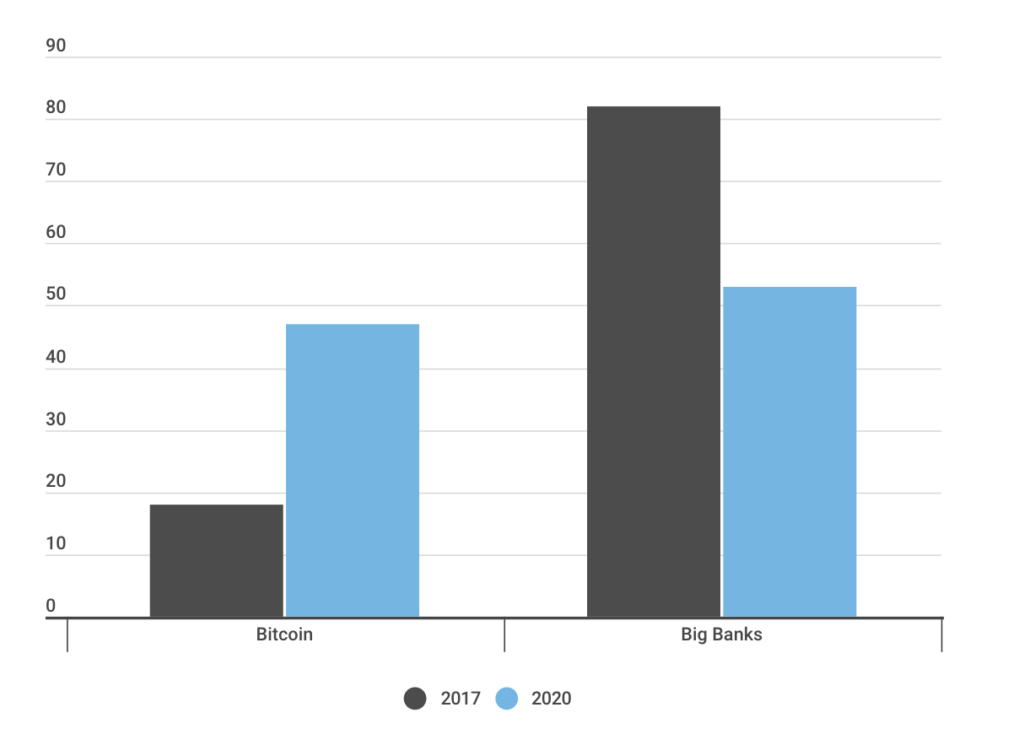

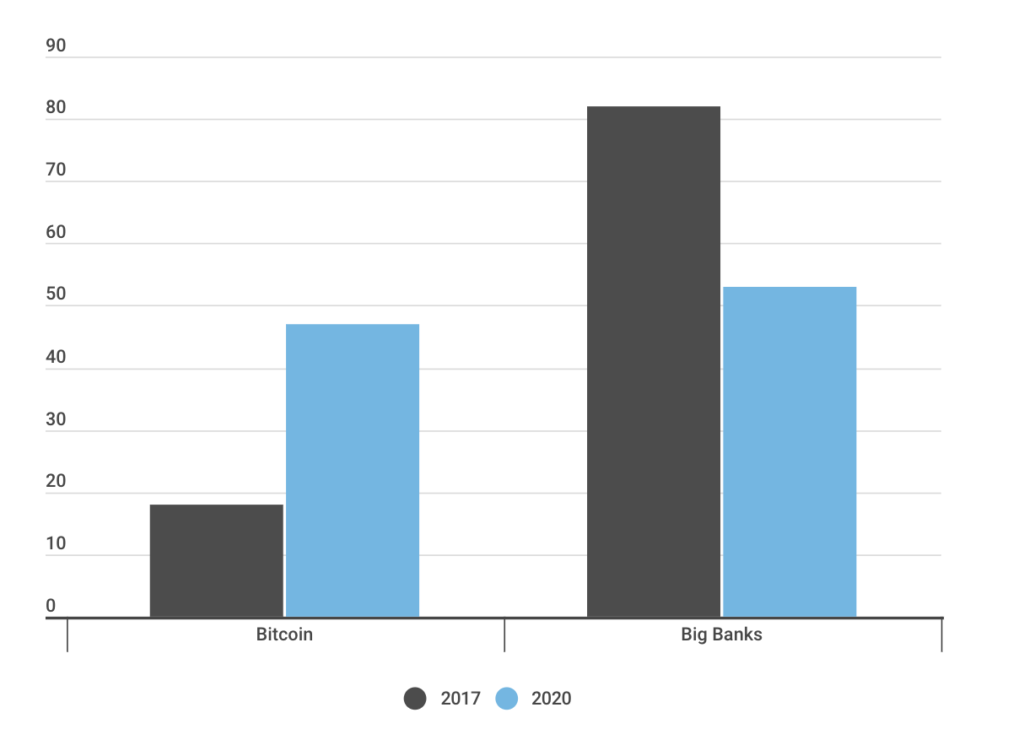

According to The Tokenist, trust inBitcoin has been growing since 2017. An upward trend was observed among 5,000 respondents in 17 countries surveyed in 2017 and 2020. 51% of millennials preferred Bitcoin (BTC) to banks like Wells Fargo, JPMorgan, and Goldman Sachs.

Perhaps this is due to asset volatility.large banks and the increased professionalization of the cryptocurrency sector. Institutionalists are beginning to perceive bitcoin as a more attractive investment asset.

The chart below shows the dynamics of growth in confidence in bitcoin compared to large banks:

Despite the fact that confidence in Bitcoin has increased,and confidence in banks and financial institutions has fallen; the latter continue to enjoy significant support. The study compares this trend with cracks that appear on the facade of traditional market institutions.

Some analysts are inclined to believe that as the pension grows older and closer, millennials begin to accumulate bitcoins, which will sharply increase the cryptocurrency market capitalization.

</p> 5

/

5

(

1

voice

)