"First Gradually, then Suddenly" – this is how Hemingway described the bankruptcy process, and this is how it can be describedthe hyperinflation of government currencies is how many come to understand Bitcoin.Today we continue our series of articles dedicated to Bitcoin and its properties.Today's text will be fromnamed after Professor of Economics at the Lebanese American University and author of the book "StandardBitcoin" by Saifiddine Ammous.

</p>Table of contents

Suddenly - Part 1: Bitcoin, not blockchain

Suddenly - Part 2: Here's what Bitcoin decides

Suddenly - Part 3: Bitcoin is not so slow

Suddenly - Part 4: Bitcoin doesn't waste energy

Suddenly - Part 5: Bitcoin Is Not That Volatile

Suddenly - Part 6: Bitcoin cannot be copied

To be continued...

Bitcoin is money

It was a slow process involving overcoming a number of psychological blocks, but it all started with a question:What is money?This is where the real rabbit hole begins.“Blockchain will change the world”, but trying to answer the question:“Why am I wearing a fiat in my wallet?”Why do hundreds of millions of people exchange real, hard-earned value for these pieces of paper (or a digital representation of them) every day?It's a difficult question to ask, but it's even harder to answer.I realized that everyone should approach this issue in their own way, at their own pace and guided by their own life experience.To even begin to understand Bitcoin, you need to be interested in this question.

For me, the journey began with understandingwhy gold was money. For this, it was necessary to understand the unique qualities that make this or that better or worse form of money, as well as what distinguishes money as a unique economic product from most other types of economic products. The book “A Brief History of Money” contributed to my education in these matters, not as a gospel, but rather as a foundation for setting a task. When I applied this foundation to my own life experience and my own understanding of the existing financial system and its shortcomings, only then everything began to become intuitive. For those who have spent years thinking about monetary principles, it may be obvious that bitcoin is money, but for others it may not be so. But when Bitcoin became intuitive, over time its monetary nature will not be in doubt.

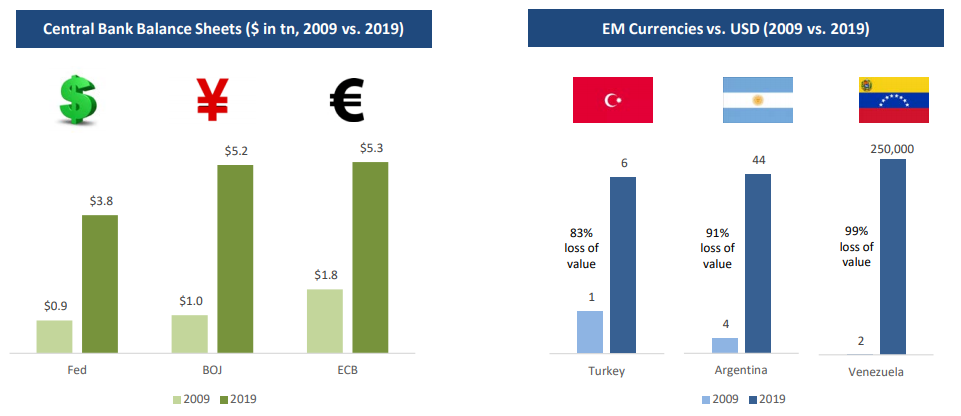

I found it useful to compare bitcoin with twotangible landmarks: gold and the dollar financial system. Does A (Bitcoin) have common properties with B (gold or dollar)? Is A Better Than B? After all, what makes something money is not something absolute. It is all a matter of choosing between storing value in one medium or in another, which always includes concessions. Without understanding the flaws of the existing financial system (be it the dollar, euro, yen, bolivar, peso, etc.), I would not have come to understand why Bitcoin is money.

: unchained-capital.com

When I was working at Deutsche Bank during the crisis,I had no basis to understand what was really going on. It was only ten years later, after working in restructuring and at a macro hedge fund, that I began to develop a clearer understanding of the events of 2008-2009. Through my own research into the great financial crisis, the US Federal Reserve (Fed), and the impact of quantitative easing in particular, I came to the basic conclusion that the root problem was that the financial system was leveraged at about 150:1 (too much debt and too few dollars) and that such crazy leverage was only possible as a consequence of the Federal Reserve's anti-leveraging policy in the three decades leading up to the crisis.It further became apparent that the decision (quantitative easing) only led to metastases of an unstable credit system over the next 10 years, making future quantitative easing inevitable.I have come to believe that, regardless of whether Bitcoin survives, the current financial system is near its end and a change to the current status quo is inevitable.

Then I realized that Bitcoin has a fixedoffer. Understanding how and why this is possible is the basis for understanding Bitcoin as money. This requires significant personal investment in understanding how economic incentives are intertwined with Bitcoin's technical architecture and why Bitcoin cannot be "counterfeited" or copied(or rather, why are the incentives strong enough for collaboration and why the costs of lost profits are too high for betrayal). It is a long journey, but ultimately it leads tothe understanding that the global network of rational economic actors operating in the voluntary monetary system will not reach an overwhelming collective consensus that depreciates the currency that they independently and voluntarily choose as a means of saving. This reality (or belief system) thus supports and reinforces economic incentives, the technical architecture, and the network effect of Bitcoin.

So it’s not just that the program codedictates that there will be only 21 million bitcoins, and in understanding why such a monetary policy is reliable and stable, and how bitcoin reaches verified rarity. It is impossible to understand this in one evening. It is impossible to explain at the party. This reality is reinforced only gradually, by observing how this motivational structure works every 10 minutes (on average). If we then compare this with how the dollar system works, or even with the foundation of gold, then bitcoin as money becomes more intuitive.

Overall, when trying to understand Bitcoin as money, it's worth starting with gold, the dollar, the Fed, quantitative easing, and why the supply of Bitcoin is fixed.Money is not just a collective hallucination or belief system; they have a certain meaning. Bitcoin exists as a solution to the money problem -global quantitative easing, and do not assume that the depreciation of local currencies in Turkey, Argentina or Venezuela cannot be repeated in the United States or any other developed economy. Bitcoin represents a fundamentally different structure and a more viable path, but in order to know where we are going, you need to understand how we got to the current state.

Hayek writes about the price mechanism as the greatestthe system of dissemination of knowledge in the world ("Use of knowledge in society") Money manipulation distorts global pricing mechanisms, which is why “bad” information is disseminated in the economic system. When this manipulation lasts 30-40 years, a huge imbalance is created in the basic economic activity, and it is in this situation that we are today. Ultimately, the dollar became the gold problem, and the dollar problem was the economic distortion, which led to a quantitative easing and was aggravated by it.

Bitcoin promises to solve both problems. Since the offer of bitcoin is fixed and impossible to manipulate, it will sooner or later become the most reliable pricing mechanism in the world and, as a result, the greatest system of disseminating knowledge. Today's volatility is nothing but a logical way to detect prices in the process of multiple growth in adoption and advancement to a future state of full adoption.

“Establishment economists ridicule Bitcoin's volatility, as if something that just came out could become a stable form of money overnight; This is ridiculous." – Vijay Boyapati in SLP

We are almost at the end of the series. Follow the news. Do not miss the ending!

</p>