It is worth noting that we have already come quite far in moving through our comprehensive series of articles,dedicated to Bitcoin. Reading this material is pointless if you skipped the previous articles in the series. Please read them at the links below, and then come back with us to reflect on the subject of Bitcoin price volatility, what caused it or is it so scary as they say?

</p>Table of contents

Suddenly - Part 1: Bitcoin, not blockchain

Suddenly - Part 2: Here's what Bitcoin decides

Suddenly - Part 3: Bitcoin is not so slow

Suddenly - Part 4: Bitcoin doesn't waste energy

To be continued…

You have heard from people you respectIs Bitcoin completely pointless? You may have seen how the price of BTC rose exponentially and then collapsed. You write it off, believe that your friend is right, for a while you don’t hear anything about Bitcoin and think that he is dead. But after a few years, it suddenly turns out that Bitcoin has not died and its value has become much higher. And you begin to wonder if your skeptic friend was wrong.

The list of skeptics regarding Bitcoin is long andcontains many famous names, but all this noise directly contributes to the anti-fragile nature of Bitcoin. People who store wealth in Bitcoins are forced to think about basic principles in order to understand the characteristics of Bitcoin, which, at first glance, contradict the generally accepted view of money, which ultimately strengthens their beliefs. One of these often-criticized characteristics is Bitcoin volatility. Skeptics, including central bankers, often reiterate that Bitcoin is too volatile to be a store of value, a medium of exchange and an accounting unit. Given volatility, why keep savings in bitcoins? And how can bitcoin be an effective transactional currency for payments if its value can fall tomorrow?

Currently, the main use of bitcoin is notas a means of payment, but as a means of saving, and for those who hold wealth in bitcoins, the time horizon is not a day, a week, a quarter, or even a year. Bitcoin is a long-term savings mechanism, and the stability of the value of Bitcoin will be achieved only with time, when mass adoption occurs. In the meantime, volatility is a natural function of pricing when Bitcoin is moving towards monetization and full acceptance. Bitcoin also does not exist in a vacuum. Most people and businesses are not only holding bitcoins, and having multiple assets in a portfolio dampens the volatility of one of them.

Non-volatile ≠ means of saving

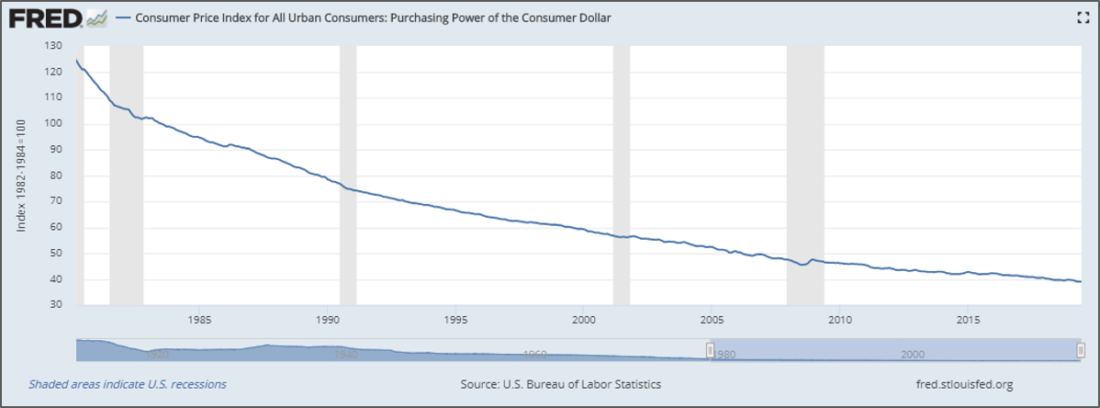

It is fair to say that volatility anda means of saving is often mistakenly considered to be mutually exclusive. But actually this is definitely not the case. If an asset is volatile, this does not mean that it will be an ineffective means of saving. Conversely, if an asset is not volatile, then it will not necessarily be an effective means of saving. The dollar is a good example: it is not volatile (at least for now), but it is a poor means of saving.

“Volatile does not necessarily mean risky, and vice versa” - Nassim Taleb, “Risking Your Own Skin”

The Federal Reserve (Fed) has been very effective at slowly devaluing the dollar, but always remember:gradually then suddenly. ANDnon-volatile ≠ means of saving. This is a critical hurdle that manypeople collide, talking about Bitcoin as a currency, and basically the matter is in the time horizon. When central bankers in the world call Bitcoin a bad store of value and a dysfunctional currency, they reason in days, weeks, months, and quarters, while we plan for years, decades, and generations.

Despite logical explanations, volatility often baffles experts. Bank of England Governor Mark Carney recently commented that Bitcoin“Has not yet paid off in terms of the traditional aspects of money. It is not a means of saving, because its price jumps a lot. Nobody uses it as a medium of exchange ”(see here).The European Central Bank (ECB) also argued on Twitter that Bitcoin is “not a currency,” noting that it is “highly volatile” while assuring everyone that it can “create” money to buy assets – because this function, its currency loses value and is a poor store of value.

There is a lack of introspection here, but MarkCarney and the ECB are not alone. From former Fed chairmen Bernanke and Yellen to current US Treasury Secretary Mnuchin and President Trump himself, they all expressed the view that Bitcoin is insolvent as a currency (or a store of value) due to volatility. Nobody seems to fully understand, or at least not recognize, that bitcoin is a direct reaction to the systemic problem of making money by governments through central banks, or that bitcoin volatility is a necessary and healthy pricing function.

But, fortunately for all of us, bitcoin is not toois volatile to be a currency, and often “experts” are not experts at all. Putting logic aside, empirical evidence suggests that bitcoin, despite volatility, has established itself as an excellent store of value in the long run. How, then, can an asset such as Bitcoin be very volatile at the same time and act as an effective means of saving?

Bitcoin value function

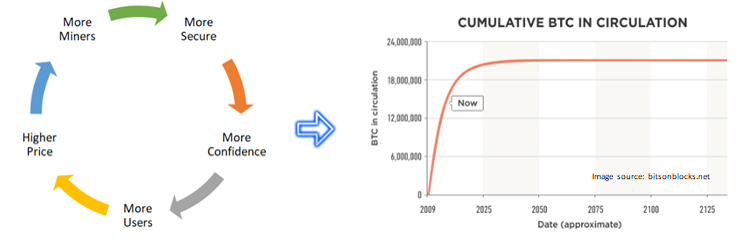

Consider why there is fundamentaldemand for bitcoin and why its volatility is natural. Bitcoin is valuable because its offer is fixed, and for the same reason, it is volatile. The fundamental driver of demand for bitcoin is its rarity. Decentralization and censorship resistance reinforce the reliability of the rarity of bitcoin (and a fixed offer schedule), which is the basis of the property of bitcoin as a means of saving.

Bitcoin value cycle. Images: Unchained Capital

Bitcoin supply does not respond to rising demand,because his schedule is fixed. The mismatch between the growth rate of demand (variable) and supply (fixed), coupled with imperfect knowledge of market participants, causes volatility as a function of pricing. As Nassim Taleb writes in the article “Black Swan from Cairo”:“Variation is information. When there is no variation, there is no information. ”. Despite volatility, an increase in the value of Bitcoin provides information:variation is information. Due to the increase in value (associated with variation), Bitcoin becomes relevant for new capital pools and new players, which causes a new wave of acceptance.

Acceptance Waves and Volatility

Knowledge dissemination and infrastructurepromote waves of acceptance, and vice versa. This is a virtuous feedback loop that is a function of time and cost. When the value rises, Bitcoin attracts the attention of a much larger audience of potential users who become interested in it. Likewise, an asset that grows in value attracts capital that is not only invested in it, but also used to expand infrastructure(exchange platforms, custodial solutions, payment levels, equipment, mining, etc.). Developing Bitcoin Understanding Is Slowthe process, as well as the creation of infrastructure, but both, contributes to adoption, which further disseminates knowledge and justifies additional infrastructure.

Knowledge → Infrastructure → Adoption → Cost → Knowledge → Infrastructure

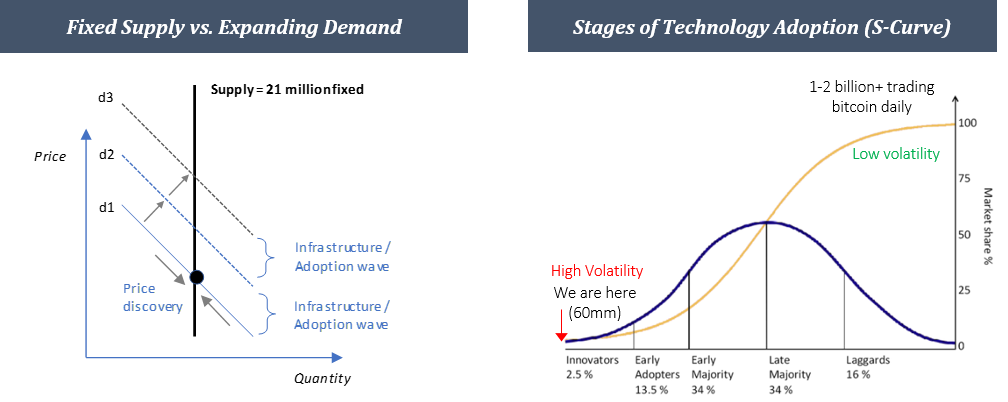

Right now Bitcoin is still in its early stages.and current adoption is probably <1% of what it will eventually be. In the foreseeable future, its adoption will increase exponentially until it has a billion users, which will continue to cause significant volatility. However, with each wave of adoption, the value of Bitcoin will also be higher due to higher underlying demand. Bitcoin volatility will begin to fall as the holder base reaches maturity and adoption rates stabilize. In other words, for Bitcoin to reach a billion users, adoption would have to grow by about 20 times, but the next 100 million users would only represent a 10% growth in the base. In this case, the supply of Bitcoin will adhere to a fixed schedule. While adoption continues to grow at a rapid pace, volatility is inevitable, but it will naturally decline gradually.

As Vijay Boyapati explained on Stefan Livera's podcast,“Establishment economists ridicule the volatility of Bitcoin, as if something that has just appeared can become a stable form of money in one night; it's ridiculous ". What happens from one wave of acceptance tothe other is a natural function of pricing as the market converges to a new equilibrium that cannot be static. In Bitcoin's boom cycles, rise, fall, stabilization and growth occur almost rhythmically. This is also naturally explained by speculative fear, followed by the accumulation of fundamental knowledge and the addition of new infrastructure. Rome was not built in a day.Volatility and pricing are integral parts of the process of becoming Bitcoin.

Historical wave of adoption

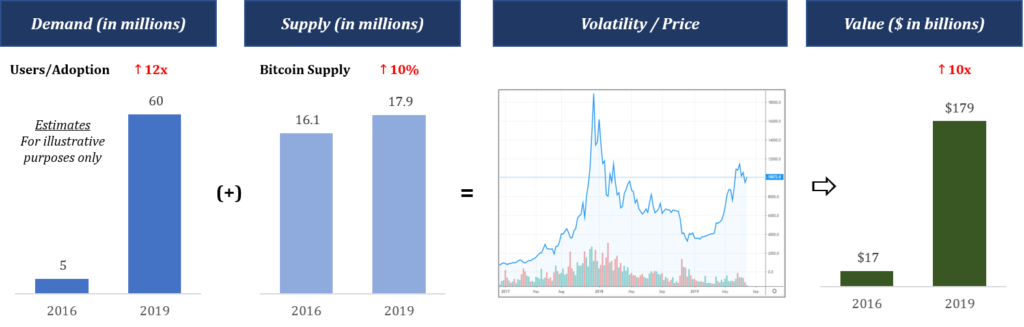

To more clearly explain the relationship between volatility and value, it will be useful to consider the latest wave of adoption -from the end of 2016 to the present (2019).

While adoption cannot be accurately quantified, a rough but fair estimate would be the increase in Bitcoin adoption from 2016 to present from ~5 million to ~60 million users(12-fold increase in demand), while the supply for the same periodincreased by only about 10%. And naturally, the information and capital of market participants vary significantly. The large wave of adoption was accompanied by a fixed offer schedule.What can be expected when demand grows many times, and supply only 10%? And what will happen if the knowledge and capital of new entrants naturally vary greatly?

The logical result would be growth.volatility and the final cost, if at least a small percentage of new participants turn into long-term holders (which happened). New users, who originally bought Bitcoin during its astronomical growth, gradually accumulate knowledge and turn into long-term holders, stabilizing base demand and contributing to a much higher final cost compared to the previous adoption cycle.

Given the early stage of formation, the aggregatethe wealth stored in bitcoins is still relatively small (~ $ 200 billion), which allows the exchange rate between marginal buyers and sellers (pricing) to represent a significant percentage of basic demand (volatility). With the growth of basic demand, the exchange rate will begin to represent an ever lower percentage of the base, so that after several cycles of adoption, volatility will decrease.

Volatility management

Photos: Unsplash

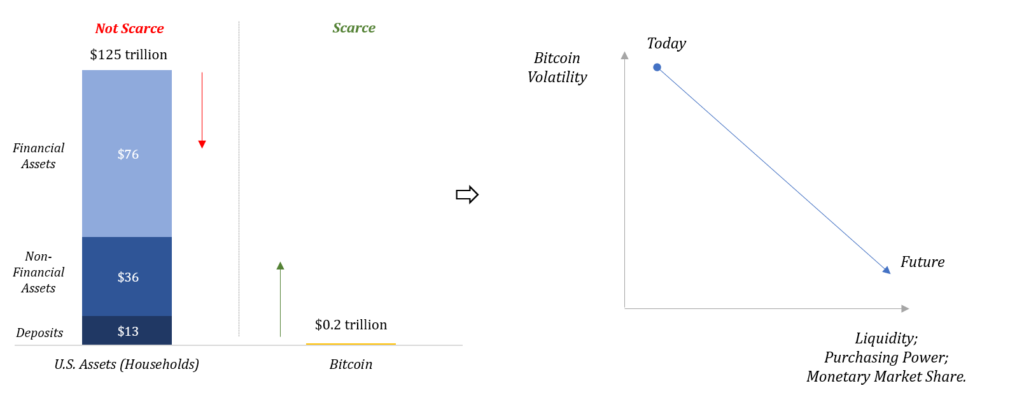

If we can accept that volatilityBitcoin is natural and healthy, then why isn't the current volatility preventing the adoption needed to make Bitcoin a sustainable form of money? It's all about diversification, portfolio allocation theory, and time horizon. There is a global network (Bitcoin) through which you can transfer funds over a communication channel to anyone anywhere in the world, and now its total value is less than $200 billion. On the other hand, Facebook alone is worth more than $500 billion. The assets of American households are estimated at $125 trillion(see here, p. 138).

Bitcoin volatility could theoreticallypresent a problem if it existed in a vacuum. But in the real world this is not the case. Diversification takes the form of real productive assets as well as other monetary and financial assets, which mitigates the impact of Bitcoin's current volatility. There is also an asymmetry of information, and those who understand Bitcoin also understand that help will arrive in due time. These concepts are obvious to those who hold Bitcoin and actively factor its volatility into short- and long-term planning, but seem to be less obvious to skeptics who have difficulty understanding that Bitcoin adoption does not mean"all or nothing".

Although Bitcoin will increase its stake inglobal competition of means of savings because of its better monetary properties, the function of the economy is to accumulate capital that improves our lives, not money. Money is just an economic commodity, making it possible to coordinate the accumulation of this capital. Since Bitcoin is fundamentally the best form of money, its purchasing power relative to the worst monetary assets (and monetary surrogates) will grow and it will gain an increasing market share in the economic coordination function, although today it is less functional as a transaction currency.

Bitcoin is also likely to contributedefinancing the global economy, but it will not eliminate financial or real assets. In the process of its monetization, these assets will continue to represent diversification that mitigates Bitcoin's daily volatility.

While failure is possible and significant downturns are inevitable, every day Bitcoin does not crash, its survival becomes more likely (the Lindy effect).At the same time, it is worth noting that investments in Bitcoin over the course of 90% of its history have brought profit, even taking into account the recent drop from 11,000 to 8,000 dollars.And over time, when value and liquidityBitcoin will increase due to its fundamental advantages, and its purchasing power relative to real goods will also increase, but as its purchasing power represents a larger and larger share of the economy, its volatility relative to other assets will decrease proportionately.

What will we come to

illustrations: BitNews

Биткойн со временем станет транзакционной валютой, но пока будет намного логичнее тратить обесценивающийся актив (dollars, euros, yen, gold)It's really hard for establishment economists and central bankers to figure this out, but I'm deviating fromOn Bitcoin's path to full monetization, a store of value should logically be the first phase, and Bitcoin, despite its volatility, has proven itself admirably as a store of value.When adoption reaches maturity, volatility will naturally decrease and Bitcoin will become more and morebecome a medium of direct exchange.

Imagine a person or business,requesting bitcoins in exchange for goods or services. Such people and businesses represent those who determine who Bitcoin will keep its value in a certain time horizon. If they did not believe in the fundamental argument of demand for bitcoin as a means of saving, why would they exchange real goods and services for it? Bitcoin will turn into a transactional currency only when its liquidity gradually transfers from other monetary assets to goods and services, which will happen on the way to mass adoption. It will not be a lightning or binary process. On a more standard path, adoption fosters infrastructure, while infrastructure fosters adoption. A transactional structure is already being created, but more substantial investments will be a priority only when enough people are an example of bitcoin as a means of saving.

Ultimately, Bitcoin's lack ofmandatory price stability and its fixed supply will continue to cause short-term volatility while promoting long-term price stability. This model is literally the opposite of that followed by Mark Carney of the Bank of England, the ECB, the Fed and the Bank of Japan.And that is why Bitcoin is anti-fragile: there are no subsidies to problem banks, and this market is free from moral hazard, which contributes to maximum accountability and long-term effectiveness.Central banks manage currencies todampen short-term volatility, which creates instability leading to long-term volatility. Bitcoin volatility is a natural function of monetary adoption, and this volatility ultimately strengthens the resilience of the Bitcoin network, promoting long-term stability. Variation is information.

Nassim Taleb and Mark Blythe ("The Black Swan from Cairo"):

“Complex systems that artificially suppress volatility usually become extremely fragile without revealing any visible risks.”

“This is one of the attributes of life: there is no freedom without noise - and no stability without volatility.”

Ben Bernanke, Fed Chairman during a major financial crisis:

"The Fed is not currently predicting a recession." - January 10, 2008

“The risk that the economy has entered a significant recession has apparently decreased over the past month.” - June 9, 2008

Remember, this series of articles is far from over. Read BitNews, do not skip the following parts. There is still a lot of interesting things.

</p>