So, we continue a fascinating series of articles dedicated to Bitcoin and its properties. Let's go todaylet's find out why, although the Bitcoin code lies inopen access and cannot be copied. And this is confirmed by at least the failure of several dozen forks and «best copies» the first and largest cryptocurrency. And don't forget to check out the previous articles in the series using the links below.

</p>Table of contents

Suddenly - Part 1: Bitcoin, not blockchain

Suddenly - Part 2: Here's what Bitcoin decides

Suddenly - Part 3: Bitcoin is not so slow

Suddenly - Part 4: Bitcoin doesn't waste energy

Suddenly - Part 5: Bitcoin Is Not That Volatile

To be continued…

In childhood, we all learn that money does not grow ontrees. But, on the other hand, our society is accustomed to believing that this is not only possible, but is a normal, necessary and productive function of our economy. Before Bitcoin, this privilege was assigned to the central banks of the world. After Bitcoin, it seems as if everyone believes that he can also create money. In essence, those who are trying to create a copy of Bitcoin are striving for this. Whether it is a hard fork of consensus (Bitcoin Cash), a clone of Bitcoin (Litecoin) or a new protocol with the “best” properties (Ethereum), all these are attempts to create a new form of money. If Bitcoin can do this, then why can't we?

Now, in 2019, we are witnessing the monetization of an economic product (Bitcoin) on the free market for the first time in millennia (since the time of gold). Instead of thinking about the significance of this event or figuring out how or why it is possible, many focus on the secondary or look for ways to solve problems that they themselves do not understand. Everyone wants to get rich quickly, and as long as there is money, alchemists will exist. Those who try to copy Bitcoin are modern alchemists.

They Say Bitcoin is Too Slow and Create“Faster”copy.Or they say that Bitcoin is incapable of handling the number of transactions required by the global economy, and create a copy that allows for “larger” scale. They then say Bitcoin is too volatile and create a “more stable” version. It then turns out that Bitcoin is too inflexible and needs to be more programmable, so they create a “more flexible” copy. Often they even say that their creation is not money, but a “payment” or “utilitarian” medium, or perhaps a “gas-powered global computer.” They are also trying to convince us of a world where there are hundreds, if not thousands, of currencies. But all these cases are just attempts to make money.

Bitcoin value function

Kauri shells - the first known common variety of money

If the main (if not the only) utilityAn asset is an exchange for other goods and services, and if it does not give rights to the income stream from productive assets (like stocks or bonds), it should be a competitive form of money and will save value only if it has reliable monetary qualities.With every change in "options" those who trycopy Bitcoin signal a failure to understand the properties that make Bitcoin a valuable or valid form of money. When the Bitcoin code was published, it was not money. And today, Bitcoin code is not money. You can copy the code tomorrow or create your own version with new options, and no one who has accepted Bitcoin as money will treat your version as such. Bitcoin only became money over time as its network developed properties that did not exist in the beginning or that are virtually impossible to replicate now that Bitcoin already exists.

Those trying to copy Bitcoin signal an inability to understand the properties that make Bitcoin a valuable or effective form of money.

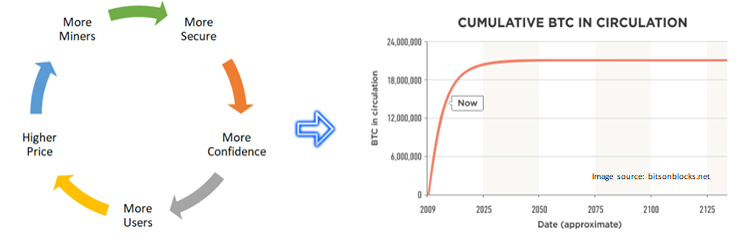

These properties arose organically and spontaneously, according toas individual economic entities around the world began to value BTC and hold part of their wealth in it. As Bitcoin's value has risen, it has become decentralized and, as a result, it has become more difficult to change the network's consensus rules or reverse or prevent valid transactions.(which is often called censorship). There are still unfounded debates about whether Bitcoin is decentralized enough or censored, but there are facts that are more difficult to challenge:

one. Bitcoin today is the most decentralized and most censorship-tolerant monetary system in the world, in comparison with both traditional currencies and other digital currencies or commodity money such as gold.

2. Bitcoin is valuable because it is decentralized and censorship-resistant. It is these properties that guarantee and support the fixed supply of BTC – 21 million(thanks to which it acts as an effective means of saving).

3. With the increase in cost and the scaling of all levels of the network, Bitcoin is becoming more decentralized and censorship-resistant.

4. Reread everything again.

Bitcoin value cycle. Images: Unchained Capital

Money systems converge to one

All other fiat currencies, commodity money andcryptocurrencies compete for the same application as Bitcoin, regardless of whether they understand it, and money systems tend to converge on a single tool, since their usefulness is in liquidity, and not in consumption or production. If we evaluate money networks, it would be irrational to store the cost in a smaller, less liquid and less secure network, if a larger, more liquid and more secure network is available.

Apply a common sense test. Suppose you have worked for two weeks, and your employer offers you payment in the currency accepted by a billion or a million people in the world. What do you choose? Will you ask for 99.9% in one currency and 0.1% in another, or join a billion associates? If you live in the USA and travel to Europe every week for a week, do you ask your employer to pay 1/52 of your salary every week in euros, or do you prefer to receive everything in dollars? In practice, almost everyone stores value in a single monetary asset, not because others do not exist, but because it is the most liquid asset in their market economy.

Users of Venezuelan bolivars orArgentine pesos would prefer the dollar system if possible. And similarly, anyone who chooses to speculate on a copy of Bitcoin is willingly making an irrational choice in favor of a less liquid and less secure monetary network. Although there are money networks that are currently larger and more liquid than Bitcoin (e.g. dollar, euro, yen), those who choose to store part of their wealth in Bitcoin believe that it is more secure(decentralization → censorship → fixed offer → means of savings). They also expect others to join them(future billion associates), which will increase the liquidity and the number of trading partners.

Why Bitcoin cannot be copied

Many creators of digital currencies do not recognizethat for success, their creation must become money. Those who speculate with these assets do not understand that monetary systems converge to one means, or naively believe that their currency will be able to bypass Bitcoin. None of them can explain how their digital currency will become more decentralized, censorship-resistant and liquid than BTC. Moreover, it is unlikely that any other digital currency will be able to achieve the minimum level of decentralization or censorship resistance necessary for a sound monetary policy.

Bitcoin is not valued because of any specificcharacteristics, but due to the achievement of the ultimate digital rarity, giving it the property of a store of value. The reliability of Bitcoin's scarcity (and monetary policy) exists only because of its decentralization and censorship resistance, which in itself have little to do with software. Collectively, this promotes increased adoption and liquidity, which strengthens the value of the Bitcoin network. As part of this process, people at the same time abandon the worst monetary networks. This is the fundamental reason why Bitcoin's emergent properties are virtually impossible to replicate and why Bitcoin cannot be copied or surpassed:Bitcoin is already available, and its monetary properties over time (and with increasing scale) only increase directly due to the worst money networks.

It is impossible to come to such a conclusion without understandingfirst, the following: i) Bitcoin is of finite rarity (how / why); ii) Bitcoin is valuable because of its rarity; and iii) money networks converge to one medium. You can come to other conclusions, but it is in this context that one should reason when considering the possibility of copying (or getting ahead) of Bitcoin, and not in the context of any specific set of properties. It’s also important to recognize that anyone’s conclusions, including yours or mine, have little effect. Market consensus matters and what it converges on as the most reliable long-term means of saving.

Empirical evidence (pricing mechanism andvalue) demonstrate that the market continues to determine the difference between Bitcoin despite a significant amount of noise. Before speculating, try to understand why Bitcoin works and how it is unique. When someone tells you about the best Bitcoin or some distinctive features, remember that the market, which during the last decade has already been at this crossroads, took into account all the concessions and preferred Bitcoin for a number of rational reasons.

Minority dictatorship

Nassim Taleb writes about how very littlean uncompromising minority can impose its preferences on the majority, calling it a dictatorship of the minority and explaining why the least tolerant wins. Bitcoin (and monetary systems) is a perfect example of this phenomenon. If a very small minority agrees that Bitcoin has superior monetary properties and will not accept your digital (or traditional) currency as money, while less convinced market participants accept both Bitcoin and other currencies, then the intolerant minority will win. This is exactly what is observed in the global competition of digital currencies. A small minority of market participants have determined that only Bitcoin is valid, dismissing the monetary properties of all other digital currencies, while the majority perceives the largest cryptocurrency along with other currencies. Thanks to its uncompromising nature, the minority gradually imposes its preferences on the majority. In the world of digital currencies, diversifying into alternatives is tantamount to allowing others (the intolerant minority) to choose what your future money will be, settling for only a small fraction of what you could save. Evaluate the concessions and consider the dictatorship of the minority before exchanging your hard-earned money for candy wrappers.Money does not grow on trees.

“Bitcoin is an outstanding cryptographic achievement, and the ability to create something that cannot be reproduced in the digital world is of tremendous value,” Eric Schmidt (former Google CEO)

Follow the news not to miss the sequel from the cycle!

</p>