Bitcoiners don't think it's right to accept inflation. We believe that it represents an unspokenslow regressive taxwealth from ordinary people in favor of those closer to power. Bitcoin's critics have responded that even though inflation can be frustrating, the alternative to it looks even worse — a stagnating deflationary economy. In this article, we: (1) create a conceptual framework for what deflation is, (2) answer critics' concerns about price cuts, and (3) show how the emission model used in Bitcoin actually protects against the formation of deflation spirals.

Part One: Bitcoin is not deflationary, its money supply is relatively constant

First of all, we need to define what exactly we will call deflation. Although deflation is colloquially referred to as a decrease in prices, formally it isreduction in the volume of money supply or their substitutes. This is an important distinction. Deflation is not a decline in prices, but a monetary phenomenon thatsometimes leadsto lower prices.

In this sense, Bitcoin is actually notcall deflationary. The money supply of Bitcoin will not decrease, but will continue to grow until the block subsidy is expected to be completely canceled, expected in 2140. At this point, Bitcoin's issue volume will reach the limit of 21 million coins specified in its program code.

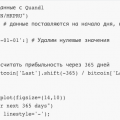

The chart below shows the Bitcoin emission rate, with a relatively high inflation rate at the beginning and gradually slowing down over time, until the limit of 21 million coins is reached.

X axis - block height, Y axis - Bitcoin money supply volume; the blue line is bitcoins, the orange line is% of inflation.

In the long term, the Bitcoin protocol is not inflationary or deflationary. It's programmeddisinflationary, and at the climax, the volume of its money supply should reach a constant value and no longer change.

Here someone might object that, «even withAssuming a constant volume of money supply, the lost coins will create deflation because they are effectively removed from the supply of coins in circulation.

This is not a concern. The number of coins lost will decrease over time, as Bitcoin storage services become more professional and convenient to use. Most coins were lost in the earliest period of Bitcoin's existence, and over time the number of lost Bitcoins will continue to decline. Thus, as the growth in Bitcoin's supply volume tends to zero, the impact on the volume of its money supply of lost coins will decrease.

Another argument from critics is thatthat while Bitcoin's monetary base may be constant, the population is growing. Consequently, a fixed amount of money supply will lead to deflationary pressures as more and more people seek a fixed-size piece of the pie.

This is also a rather dubious statement. In different cultures, as their societies go through the process of urbanization and people receive a higher level of education, population growth decreases. This trend will continue in the future as the regions with the highest population growth rates continue to go through industrialization.

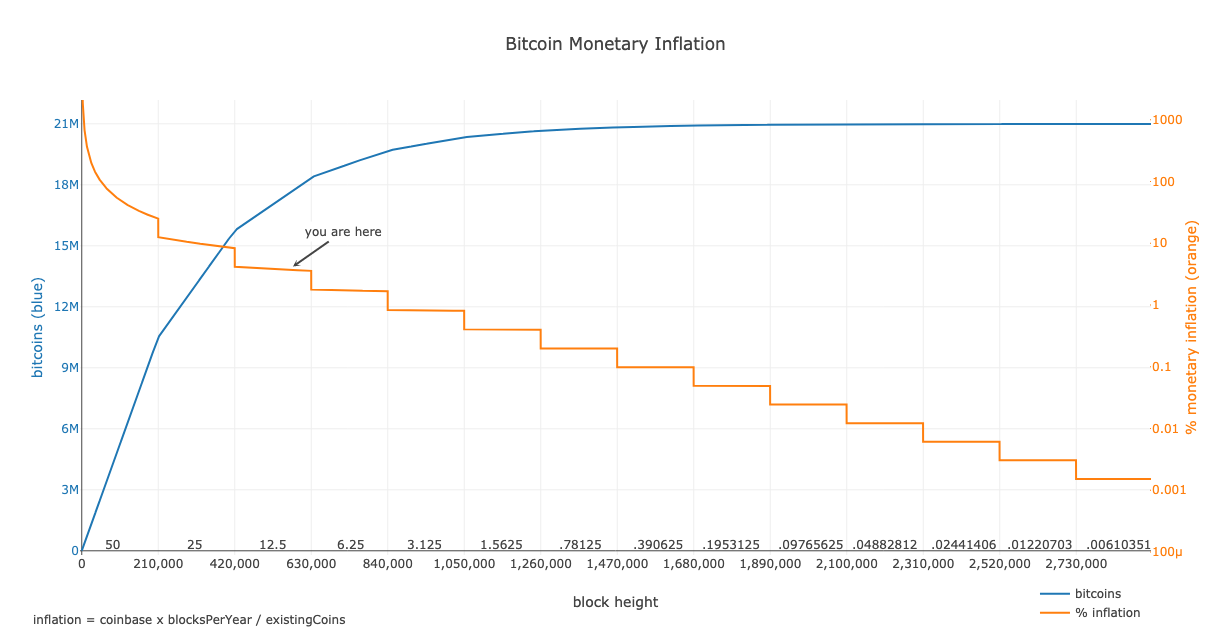

The left axis and the orange graph represent the average annual population growth (%); the axis on the right and the black graph are the total population (billion), the green region is 95% of the prediction interval.

The chart above shows the latest forecasts.regarding population growth submitted by the UN. According to these forecasts, the total population of the Earth will reach equilibrium and cease to grow by 2100. And this almost ideally coincides with the time when Bitcoin emission stopped. Could you wish a better match?

Bitcoin is not deflationary in formalsense of the word. Its continuation will continue to increase along the curve, offsetting the influence of lost coins and population growth over the next century. Having reached a constant money supply, Bitcoin will not exert any pressure on prices in any direction - it will function as a clean and neutral environment in which prices will fluctuate solely on the basis of signals from market participants.

Despite the fact that this is a completely accurate way to showwhy Bitcoin is not deflationary, it still does not take into account the very essence of the critics' arguments: concerns about a likely price drop. So, with an understanding of the constancy of the volume of the money supply of Bitcoin, let's now completely dispel these fears!

Part two: debunking concerns about price cuts

When critics talk about«deflationary» Bitcoin, what they're really worried about is that «Bitcoin will put downward pressure on prices». Typically, critics' concerns about these «deflationary» prices at the achieved Bitcoin standard come down to three main points:

- Resentment of wage workers as a fall in nominal wages denominated in bitcoins.

- Constantly growing real debt burden on Bitcoin-denominated loans.

- The lack of an influx of funds from investors who now prefer to accumulate valuable bitcoins instead of investing them.

But before moving on to these specific concerns, let's first establish a basic understanding of how prices work.

Fundamentals of the functioning of prices: price reduction is normal

Imagine some simple product oncompetitive market - say, a toothbrush. Suppose that every year it becomes easier to produce such a toothbrush. Maybe machines in production are getting a little better, or supply chains are getting a little more efficient, etc. If our consumer demand for this product does not change, then what will happen to the price? She will decline.

There is nothing surprising. Free markets lead to lower prices for products as their production becomes more efficient, and competing manufacturers fight for the consumer, setting prices as low as possible. These processes have been going on for thousands of years, during which people use their ingenuity to meet the needs and requirements of others.

Are prices always dropping? Of course not! There can be many reasons that make production difficult. A sharp increase in demand can also trigger a price increase. I just want to say that in the long run, as people make efforts to increase productivity, objects that were once complex and expensive become cheaper and easier to manufacture. That is, price reduction is a natural and understandable process.

But despite this understanding, for decades the prices of basic consumer goods have risen while their quality has declined. This is explained quite simply:in order for productivity to be reflected in prices, the money supply base must remain constant. Money is a unit of measure for this process. In a monetary measurement system with a fixed base (for example, in Bitcoin), productivity growth leads to lower prices. However, in a distorted system (for example, due to the release of new money), prices will increase year by year, despite a significant increase in productivity.

Now, with this general theoretical understanding, let's turn to specific fears worrying Bitcoin critics.

Concern 1: lower nominal wages

Critics express concern thatlower consumer prices with the Bitcoin standard may also extend to salaries of employees, which will disappoint and demoralize them. At the same time, critics forget that wages are compensation for the time spent on a person’s life. In the case of a toothbrush, it is quite obvious that technological advances every day simplify its production, but this does not apply to the lifetime. Time is a truly scarce and irreplaceable resource. Some types of work can be automated, but at the same time, the growth of technological advances creates the need for new specializations. The number of jobs is not finite. Consequently, although the cost of a toothbrush with a constant amount of money should gradually decrease, there is no reason to think that this should also concern the value of human time.

Let's look at the historical data. Below is a graph of average prices in America in the 1800s.

As you can see, this was a century of rapidly declining prices. But what happened to salaries? They grew up. From the report of the Bureau of Labor Statistics:

«The overall trend in wages has been upward and the cost of living has been decreasing. This divergence in the dynamics of wages and retail prices has led to a significant increase in real incomes.”

And this happened against the background of an almost 10-fold increase in available labor since the beginning of that century and a brutal civil war that devastated the economy and claimed hundreds of thousands of lives.

You may notice that prices have been falling so sharply,because America was young and developed from scratch, but, for example, in the technology sector today there is about the same picture. Electronics prices have been dropping for decades, but companies still manage to pay employees competitive salaries. That is, even with lower prices due to increased production efficiency, the cost of labor may well remain the same or even rise.

But if the fears of critics become reality andSince nominal wages are really going to decline, purchasing power is still the main indicator. To say that hired workers will be disappointed, despite the possibility of buying more goods of higher quality on their salaries, means treating them like children who are unable to perform even the simplest arithmetic operations.

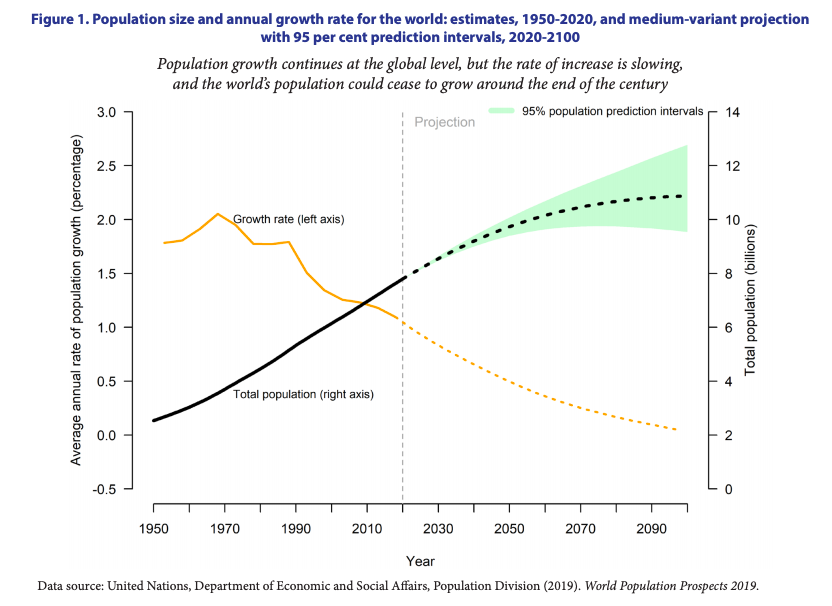

In comparison, inflationary money losesvalue every year, depriving ordinary people of a means of safely storing their savings while the rich profit from their financial assets. This is especially painful when you consider the phenomenon of sticky wages. Below is a chart showing the complete divergence of labor productivity and compensation received for it, the beginning of which clearly coincides with the complete abandonment of the gold standard and the last sound money that existed.

Yellow chart - performance; red graph - the amount of compensation for labor. More interesting graphs on this topic can be found on this wonderful site.

The trends described above lead to predictablyterrible results: to a huge (and growing) level of income inequality, populism and social unrest. If critics were really interested in the situation of wage workers, they would support Bitcoin as a savings technology for ordinary citizens, able to protect their funds from forced, silent recession.

Concern 2: increasing real debt burden

Critics also claim that as they growthe value of bitcoin will increase and the real debt burden on loans denominated in bitcoin. They fear that this will create debtors who are unable to continue paying on loans, and further lending will become impossible. This statement is naive at best, because it assumes that Bitcoin will continue to rise in value forever.

It will be useful here to pay attention to evolutionBitcoin as money. New, more perfect money cannot just come and instantly create a perfectly balanced world - it takes time. In the initial stages, Bitcoin gradually absorbs value from traditional means of preserving it. This initial phase of pricing can last for decades, during which Bitcoin will accumulate liquidity and market capitalization relative to other traditional reserve assets due to its excellent monetary properties.

As Bitcoin Becomes Graduallyto win in this competition of money, he will also pass into the status of a reliable standard for accounting and exchange of value. At these later stages, Bitcoin, having stabilized in relation to other assets, will transfer to the status of a reliable unit of account.

Those concerned about the value of denominated inBitcoin loans are confused in terms. Of course, now, at such an early stage, you should not evaluate debts in bitcoin. But the good news is that no one offers this. However, later, when the cost of bitcoin is gradually stabilizing, this can be easily done, and the real value of these loans will remain stable, since the asset itself will mature to a reliable unit of payments by this time.

Concern 3: Stagnant Growth Due to Reduced Investment or Cost

Finally, critics worry that Bitcoin maycause stagnation of the economy, as people will accumulate bitcoins instead of investing in business. This is another example of confusion regarding the evolutionary trajectory of Bitcoin. As I already said, as Bitcoin approaches the end of the phase of determining its price, it will gradually stabilize in relation to other assets. At this point, Bitcoin will play the role of a global value constant in informing about prices and making investment decisions. At these later stages, investors will certainly be motivated to invest and make profits in bitcoins, while simple walking will be more akin to a low risk-free rate.

This change will actually becontribute to the growth of investment quality! Due to inflation, high net worth individuals and financial institutions are forced to invest in speculative ventures simply to protect them from the effects of inflation. If Bitcoin becomes a store of value that protects it from dilution, then the manic hunt for «risk-free» protection against inflation will become a thing of the past, resulting in investment decisions on average becoming more accurate and balanced.

But what about spending amid falling prices? Will people spend less, thereby slowing economic growth? Let's look at the research results. Even the Fed concluded:

«Strikingly, in almost 90% of casesdeflationary prices did not lead to economic depression. In a broader historical context, not limited to the Great Depression, references to the idea that deflationary prices and economic depression might be somehow related virtually disappear.

This is understandable and intuitive. Lower prices do not mean that people suddenly stop spending money! People will still have needs, and they will spend money on their satisfaction. And this applies not only to essential goods. The high-tech industry has been in a deeply deflationary trend for decades, but consumers are still lining up for new releases.

In fact, it can be expected that with lower pricespeople will spend more - due to the effect of wealth and increased purchasing power. Consumers love when prices go down. Promotions and discounts are not just popular.

Part Three: How Bitcoin Prevents System Deflation

«Deflationary spirals» that do not giveMainstream economists can sleep well at night; under the Bitcoin standard, problems will be much less widespread and serious. Again, money is a measurement system that market participants use to express prices. Manipulating the monetary system - through central banks printing new money at their own discretion, changing reserve requirements and key interest rates - leads to its distortion.

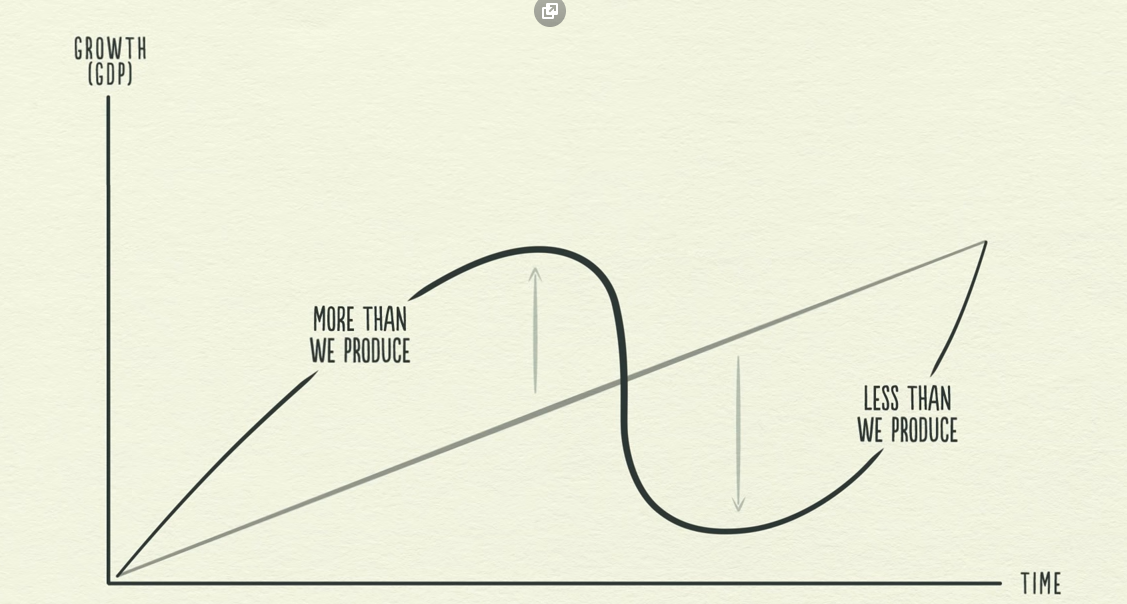

Through the creation of artificial market signals andmanipulation of the cost of lending, inflationary monetary systems lead to excessive use of borrowed capital and improper investment management. Risks are systematically underestimated. People consume more than they produce, and this can go on longer than would happen if there were no government intervention.

X axis – time; Y axis – GDP growth.The black line represents debt, the gray line represents productivity. Taken from Ray Dalio's educational video «How the Economic Machine Works» («How the economic machine works»).

Unfortunately, what is growing should then fall. Artificial stimulation of the economy leads to a decrease in the quality of investments and the formation of a bubble, which ultimately will have to burst with even more pronounced and painful consequences.

Here are some noteworthy examples:

- The roaring (or stormy) 20s were provokedhuge central banks responsible for artificially low interest rates and huge foreign bonds. This intervention led to the deprivation of the credit system of stability and, ultimately, to the Great Depression.

- Japan went through a similar crisis in the beginning1990s, when the years of monetary expansion by the government led to a powerful increase in asset prices, followed by a collapse of the market. In a few short years, stocks fell 63%, and many real estate markets sank by half. Prolonged interventions have led to decades of slow growth and zombification of many companies.

- 2008 global financial crisis It was also deflationary when a large-scale liquidity crisis led to a complete halt in credit markets and pricing mechanisms. The situation was aggravated by the policy of cheap loans and artificially low interest rates, as well as the collapse of the value of euro-dollar deposits with a high share of borrowed funds.

Horrific deflation and market bubbles onlyaggravated in conditions when large financial institutions have the ability to manipulate currency. The short-term interests of elected officials encourage central banks and politicians to conduct monetary expansion on a regular basis for temporary benefits, despite the disastrous long-term consequences.

As Ray Dalio noted in his book on the study of major debt crises,

«In many cases, monetarythe policy is helping the bubble grow even bigger instead of containing it. This is especially true in an environment of strong economic growth and good investment returns… In such cases, central banks, looking at inflation and growth, are often reluctant to reduce the amount of money adequately. This is what happened in Japan in the late 1980s and in many countries around the world in the late 1920s and mid-2000s.”

Do not believe?

Donald Trump: «The economy is doing great.The Fed can easily make it break records! The question is why do we pay a much higher interest rate than in Germany and several other countries? Make changes earlier rather than later. Let America not just win, but win big!»

Even worse, inflationary money makes it difficult andrecovery after a fall. By initiating a collapse, the authorities then immediately intervene to save large companies. Again, they provide short-term care at the cost of devastating long-term consequences. As a result, chronically mismanaged zombie companies linger in the economy for decades.

Will Bitcoin put an end to these credit cycles? Not fully. But a stable monetary base will no longer allow governments to artificially provoke the formation of large credit bubbles with terrifying deflationary consequences. Instead of sharp fluctuations, Bitcoin will smooth credit cycles to their natural ranges and create an economic basis for consumption in accordance with productivity.

Conclusion

Bitcoin's money supply is not deflationary. Bitcoin is programmed in such a way as to ensure its constancy. As the world unites around the Bitcoin standard, our new money supply base will contribute to deeper economic signals, providing sustainable growth like never before. A side effect will be a natural decline in prices as productivity increases and the absence of truly terrifying deflationary spirals caused by artificial monetary injections of governments.

</p>