Solana shows excellent dynamics in 2023, showing an increase of 227% to $22.9. However, investors shouldexercise caution as the rise is largely driven by technical factors.

Image Source: Cryptocurrency ExchangeStormGain

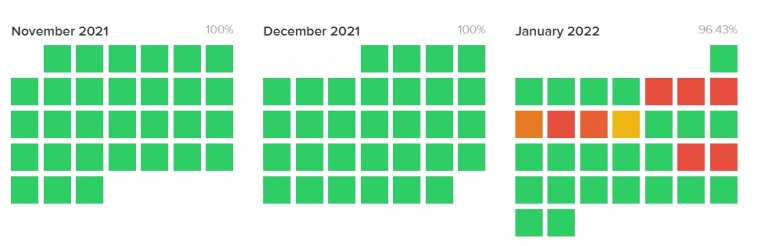

Solana started 2022 with a drop in capitalization,since already in January it faced a traditional series of failures, some of which ended in a complete stop for the network. But users and developers have come to terms with this feature, highlighting the low transaction costs and the speed of operations.

Calendar of errors in the network. Image source: status.solana.com

The real blow came from FTX, collapsewhich revealed close business ties between the crypto exchange and Solana. A number of experts believe that SOL was one of several coins that were artificially pumped (inflated in price) by an affiliated company, Alameda Research.

Just a few days after the crypto exchange fiascoSOL "lost" three times, and there were so many people willing to sell that the funding rate on perpetual futures contracts fell below -5% on individual crypto exchanges.

Image Source: coinglass.com

At the end of December, Vitalik Buterin spoke withthe support of the developers, and the subsequent rise of the cryptocurrency market played a cruel joke on the bears: a slight increase in the price led to the collapse of protective orders, which further pushed the coin to growth. As a result, sellers lost $58 million in the first two weeks of the year.

At the same time, FTX and Alameda store a total of 11% ofthe total supply of SOL or 58 million coins worth $1.3 billion. At the end of the litigation, the liquidation commission will start selling them to cover the losses of investors. Even if implemented smoothly over the next five years, there remains a significant risk of pressure on the price.

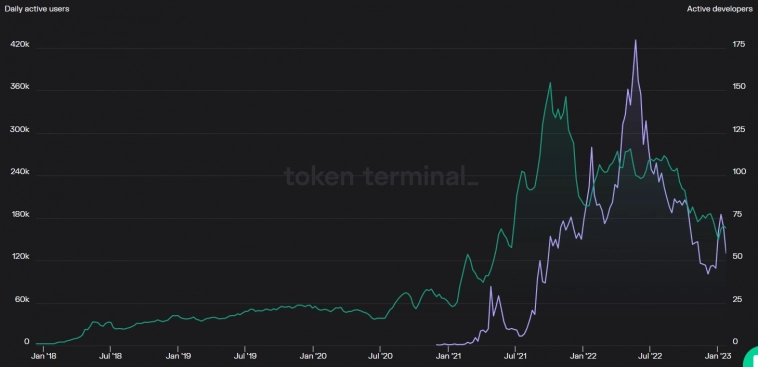

Another long-term factor is the falltrust in the network. The FTX controversy led to the departure of two of Solana's biggest NFT projects: DeGods and y00ts. If other developers follow, the network will face oblivion. Over the past six months, the number of active developers and daily users has already halved.

Image source: tokenterminal.com

SOL growth in 2023 driven by strongoversold, in the stock market a similar situation with an oversupply is called a short squeeze. At the same time, Solana's long-term prospects remain dim for objective reasons.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)