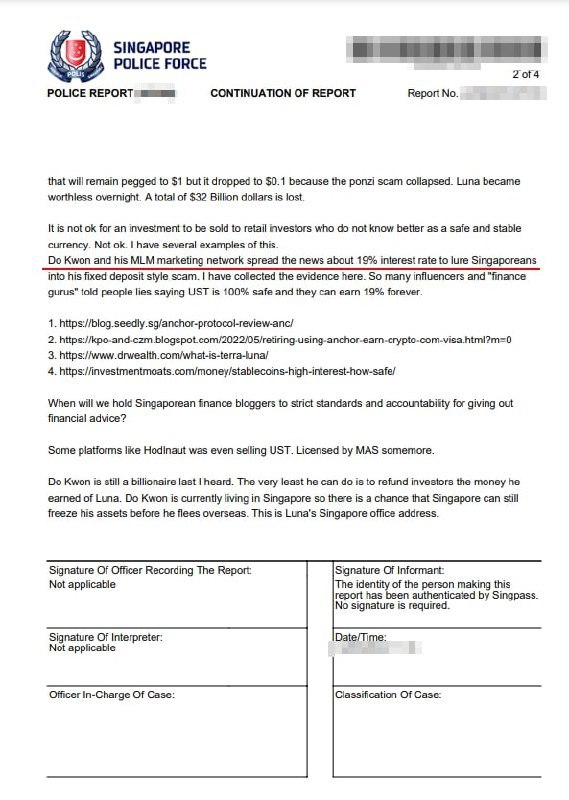

A statement by one of the victims, submitted to the police, appeared on the Internet.It states that UST and LUNA areA pyramid scheme, and investors' losses are estimated at $32 billion.

The statement states:

Do Kwon and his network marketing policy have disseminated information about the possibility of earning 19% per annum fromMany influencers and "financial gurus" told their audience about the 100% reliability of buying UST and the opportunity to earn 19% per annum.

Besides:

When will we start penalizing Singaporean financial bloggers for providing financial advice?

SEC investigation

There is every reason to investigateregarding the UST, lawyers say. The actual regulatory regime for stablecoins is still a work in progress. But that may not matter in the case of TerraUSD (UST), says a former SEC advisor.

The current SEC investigation into Terraform Labs and the interaction of the Terra protocol with synthetic securities changes the basis for the SEC's involvement in such cases.

The SEC is likely already investigating what happened to the UST over the past week, two former SEC lawyers said.

"The SEC is already in action as they investigate the Mirror Protocol," said Philip Moustakis, who in 2019 moved from the SEC's law enforcement division to the law firm Seward & Kissel.

An SEC spokesman put it this way: "The SEC does not comment on the presence or absence of a possible investigation." The regulator also declined to comment on TerraUSD.

The Mirror protocol allowed synthesized or "mirror" versions of US stocks such as Tesla and Apple to be traded in exchange for UST based on the Terra blockchain.

Subscribe to ForkNews on Telegram to keep abreast of news from the world of cryptocurrencies