Article Reading Time:

1 min.

California Silvergate Bank,specializing in cryptocurrency transactions, reported a net loss of $1 billion attributable to common stockholders in the fourth quarter of 2022.

The bank disclosed the data in a report to the Commission onUS Securities and Exchange Commission (SEC). Bankers emphasized that they observed a significant outflow of deposits in the last quarter and decided to support cash liquidity through wholesale financing and the sale of debt securities. Silvergate complains about a crisis of confidence in the entire ecosystem of digital assets, due to which clients began to refuse risky actions on trading platforms.

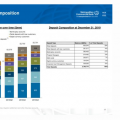

Average deposit of clients with crypto assets inIn the fourth quarter, the Silvergate team states, it amounted to $7.3 billion. This is almost two times lower than in the previous quarter - $12 billion. Now the company is preparing for a long period of decreasing deposits - it is trying to optimize costs and review its products, weeding out unprofitable ones.

According to Silvergate CEO Alan Lane, the team continues to believe in the digital asset industry and intends to maintain a highly liquid balance sheet with strong capital.

Late last year against SilvergateCapital Corporation, Silvergate Bank and Alan Lane personally were sued in the Southern District of California court accusing them of direct participation in the machinations of representatives of the collapsed crypto exchange FTX.