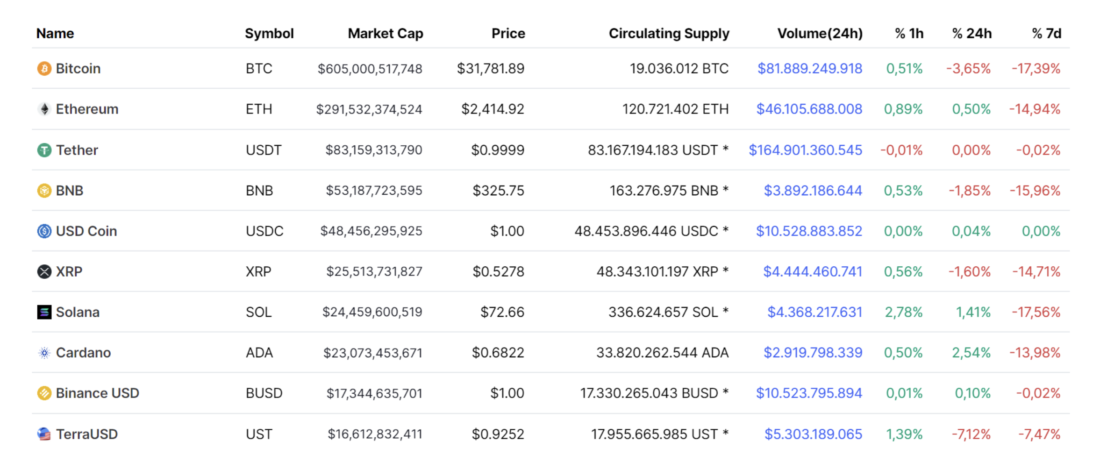

This week, in a review from Cred and DonAlt, the authors of Technical Roundup: BTC/USD has reached a range low on the weekly chart,the relative strength of Ethereum despite the general weakness of the market and the comment about the decoupling of the rate of UST, a stablecoin from Terra.

https://coinmarketcap.com/coins/views/all/

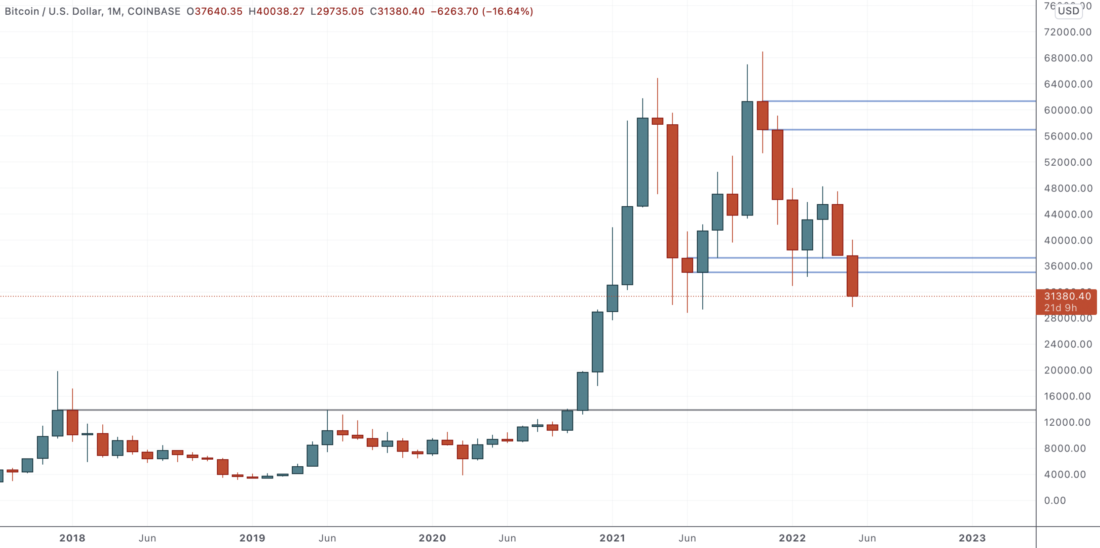

Bitcoin Hits Range Low

Bitcoin/USD is right at the lower end of its macro range ($30-60k). The market at the moment fell below the “round” psychological level of $30 thousand, but quickly recovered.

On high timeframes, charts still need saving. In particular, on the monthly timeframe, BTC/USD is trading well below the support of $35-37 thousand.

As before, if you stick to the conservativeapproach, then you can simply wait for the month to close above $35-37 thousand. The current price movement in this case would turn out to be just a long wick of the monthly candle.

For participants who are more open to risk, it is possibleoption and pre-empt such a rebound by buying from weekly support ($32-34 thousand). Even for a bearish retest, the price can rebound by 15-20% and we rarely criticize those who open trades at the edges of the range.

Here you either catch the formation of the bottom (and make money on it, even if the maximum rebound potential is only a bearish retest), or you get a refutation of the thesis quite quickly.

As we will talk about below, on Monday,In addition to the significant sell-off, a lot of other things broke, and yet the market did not collapse. This is usually a good formula for some bounce. And a weekly close above $32-34 thousand would be a good confirmation of this.

Ethereum Shows Relative Strength

Ethereum is behaving amid a weak marketcomparatively strong. The pair against BTC has not faltered and is climbing back to the upper limit of its range at ₿0.077. The pair against the dollar is still traded between levels. Much to Cred's dismay, the weekly low at ~$2500 is back.

If the $2500 breakout is redeemed and the price closes above that level on a weekly basis, then a recovery to the all-important cluster around $3000 is likely on the agenda.

A common theme for both major cryptocurrencies is that there has been a lot of emotional and urgent selling at key levels and/or across important boundaries.

A sell-off that does not continue usually results in a reversal, at least temporarily.

$32k+ for BTC/USD and ~$2500 for ETH/USD are two inflection points that need to be re-established to make the bounce scenario clearer.

Terrible day for Terra

LUNA collapsed, UST deviated significantlyfrom its $1 peg, capital outflows from Anchor Protocol continue, and there is a sort of disruption in communications from Do Kwon, LFG, Terra, and Jump Capital.

We have all watched the UST/USDT move on Binance.The Terra dollar momentarily fell to 0.6065 USDT before recovering to 0.93 USDT at the time of writing. The Terra token itself collapsed by almost 50% that day.

The basic premise is thatTypically you can exchange $1 in LUNA for $1 in UST. For example, if LUNA is trading at $100, then you can exchange 1 LUNA for $100 UST. If the UST price rises above $1, the protocol incentivizes users to burn LUNA and mint* UST. The reverse is also true: if the UST price drops below $1, the protocol incentivizes users to burn UST and mint LUNA.

The incentive to hold UST (“pegged” to $1), andnot LUNA, there was a 20% yield provided by Anchor Protocol. Thus, when the peg is under pressure, participants sell their UST (and mint LUNA in the process) and then sell LUNA for dollars.

This created a reflective feedback loop(along with the usual batch of margin calls), resulting in an outflow from UST out of fear that its peg to $1 would no longer be restored, leading to large sells and exits at the expense of the LUNA price.

Now there are rumors about the next bigfundraising (yes, almost like a bank bailout) to presumably replenish LFG reserves and stabilize the $1 peg. More information is likely to come out during this week: Terra's post-mortem, reserve status, further fundraising, and so on.

If the peg comes under pressure again,it is likely that we will get a similar impact on other crypto-assets as participants are already speculating about what assets will be sold to protect the peg.

A calmer environment and fewer urgent sales would have contributed to a rebound.

* From mint - literally "to mint"

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>