Investor confidence in Bitcoin appears to be at an all-time high along with numerousindicators: price, hash rate, shares of mature coins in the total supply.

</p>Bitcoin has had a surprisingly strong week. The on-chain market continues to show strong supply dynamics, while on-chain activity remains well below the highs of the bull market.

Long-term holders have distributed verya small fraction of their assets, as has usually been observed in all previous cycles. However, despite fluctuating just below record highs, on-chain activity remains only marginally above bear market levels. In addition, exchange balances continue to deplete, and hash rates and miners' dollar revenues are approaching new highs.

This combination of strong supply dynamics, mining network recovery and relatively low network activity indicates a fairly constructive prediction for Bitcoin over the coming weeks.

Assessing supply side dynamics

On-chain analysis gives us insight into movementcoins between the wallets of investors, exchanges and other network entities. Generally speaking, we use a combination of coin lifespan (time since it was last moved) and heuristics to differentiate between seasoned «smart money» and new investors without experience.

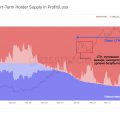

Typical Behavior When Bitcoin Pricesapproaching all-time highs is that long-term holders (savvy investors) are starting to distribute coins. When Bitcoin hit its recent $ 66K level, the supply held by LTH also peaked. At the time when they collectively owned the local maximum of the entire supply of coins, the share was 81.5%.

Since then, LTH has spent 0.73% of the coin supply back into circulation, providing an upper bound estimate for the degree of selling pressure from this cohort.

Share of LTH and STH offers in profit or loss (updated source)

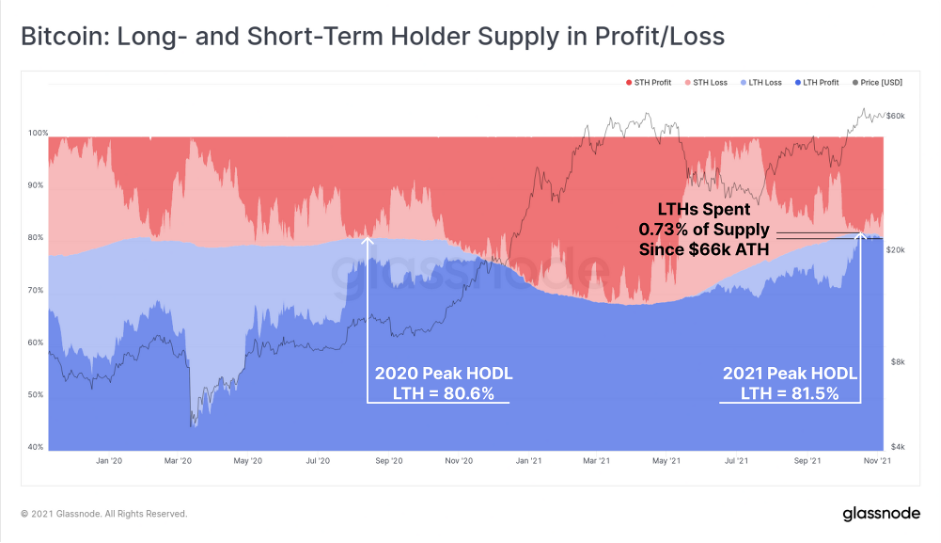

Such spending dynamics even slowed downthe metric of changes in the net position of the long-term holder, which has been in the accumulation phase since April of this year. The accumulation rate of coins by long-term holders reached over 400K BTC per month for about 5 months until the end of September and is now back to neutral. This indicates that the supply of LTH has not changed over the past 30 days, and the equivalent volume of coins is both transferred to the LTH status and is spent from it.

Change in net long-term holder position (updated source)

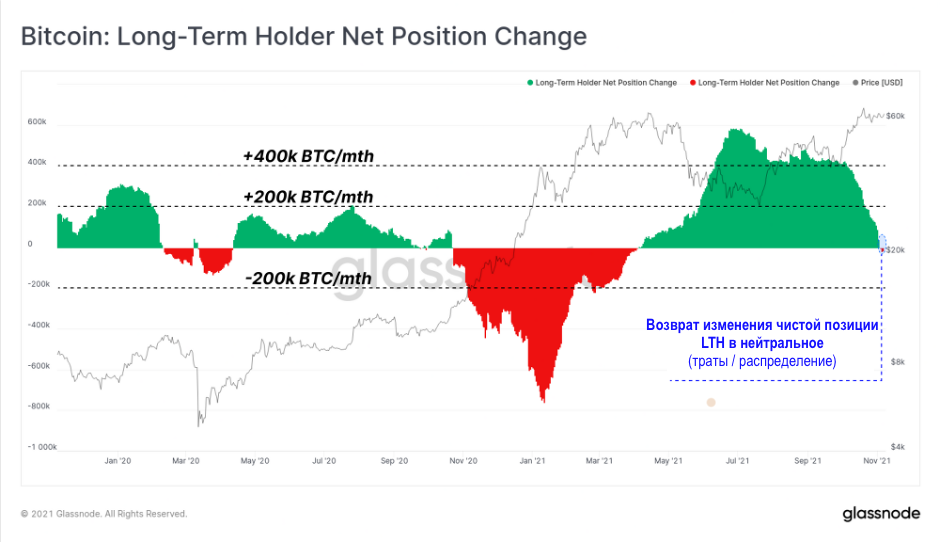

We can observe similar behaviorof spending coins in the coefficient of the age of the spent volume (Spent Volume Age Bands, or SVAB), where the prevalence of coins older than 1 month increased to 6% of the total on-chain volume. Note, however, that 6% levels were common throughout most of 2021, and especially in Q1, when they hit over 10% as the bull market rallied.

This metric emphasizes that whileolder coins are increasingly on the move, the market seems to be absorbed on the sell side without issue. Note also that bull markets can often withstand this increased selling pressure for some time before surpassing it.

Age Spent CoefficientYoma (SVAB)(updated source)

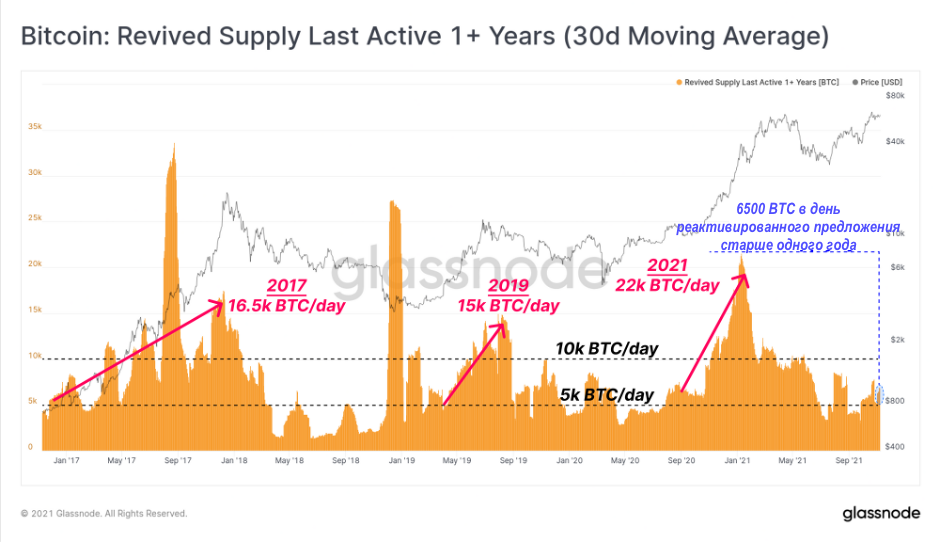

To quantify the selling side,we can refer to the reactivated offer metric by tracking how many coins older than one year are returned to liquid circulation. Investors who have withstood the volatility of Bitcoin for 12 months are likely to have a reasonable estimate of the market risk and which coins are considered expensive and which are considered cheap.

What we can see is what's in the presenttime about 6.5 thousand BTC are reactivated daily. It is also clear that this is a relatively low level compared to the bull rallies of 2017, 2019 and 2021, when more than 20K BTC were reactivated per day. In fact, the current reactivated supply levels are similar to the late 2019-2020 spending patterns, which are generally considered to be the late stage of a bear market.

Reactivated Supply Ratio for coins older than one year (30-day moving average) (updated source)

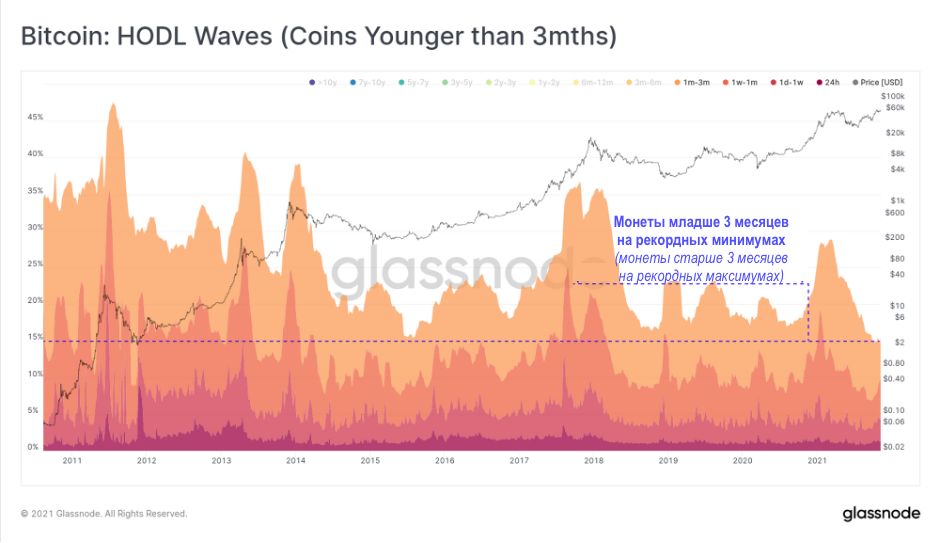

To show even more how relativelow running costs, we can view the HODL waves filtered for coins less than 3 months old. This figure will tend to rise as older coins belonging to experienced investors are distributed and sold.

By definition, given that the supply of coinsunder 3 months is at an all-time low of 15%, which means coins older than 3 months are at an all-time high of 85% of the supply. More than 85% of the coin supply has remained dormant since August 2021. Investors just don't spend their coins.

The above supply dynamics drawsa compelling picture of long-term holders holding on to the vast majority of savings. Ongoing costs appear to be closer to strategic profit making rather than going to market in general due to the belief that these prices are expensive.

HODL waves (coins under 3 months) (updated source)

Assessment of demand dynamics

Demand dynamics in a bull market usually takes place in two stages:

- Accumulating smart money (to record highs)when on-chain activity is low, supply dynamics remain constructive and most costs appear to be strategic profit making.

- Hype and euphoria (after all-time highs)as media coverage of the asset increases,the interest of retail traders is increasing and on-chain activity is starting to grow. Older, more experienced investors usually increase the allocation from now on.

Both the sell-side supply dynamics described above and the subsequent demand dynamics strongly suggest that current market characteristics are still in the first stage:accumulation of smart money, although they are located closer to the exit from this phase.

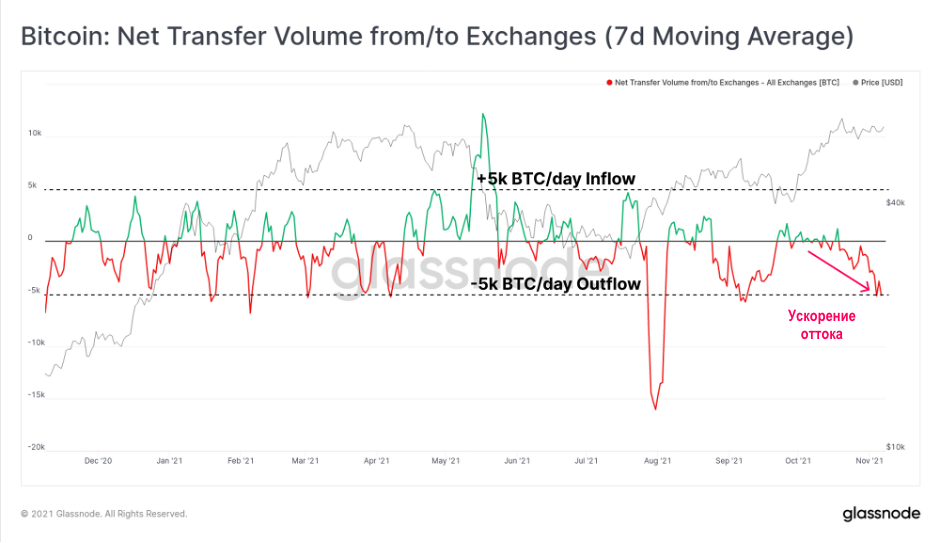

The first evidence of this is the indicatornet exchange flows, which continues to demonstrate a noticeable predominance of outflow of funds. The outflow of funds accelerated this week, reaching over 5,000 BTC daily.

Net volume of transfers from / to exchanges (7-day moving average) (updated source)

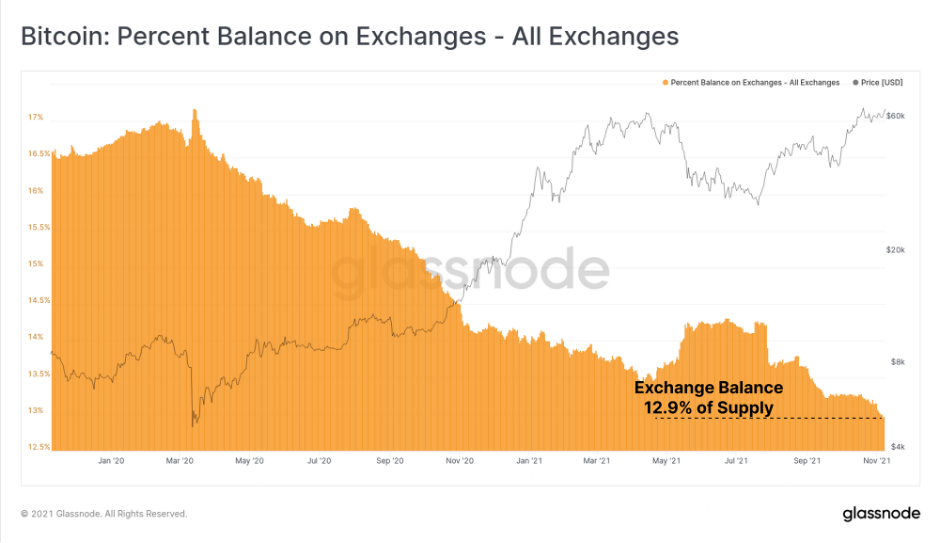

As a result of the ongoing outflow of currencythe aggregate balance of bitcoin exchanges fell to multi-year lows of 12.9% of total supply. Even as bitcoin consolidates below all-time highs, exchange reserves continue to decline.

Balance percentage on exchanges - all exchanges (updated source)

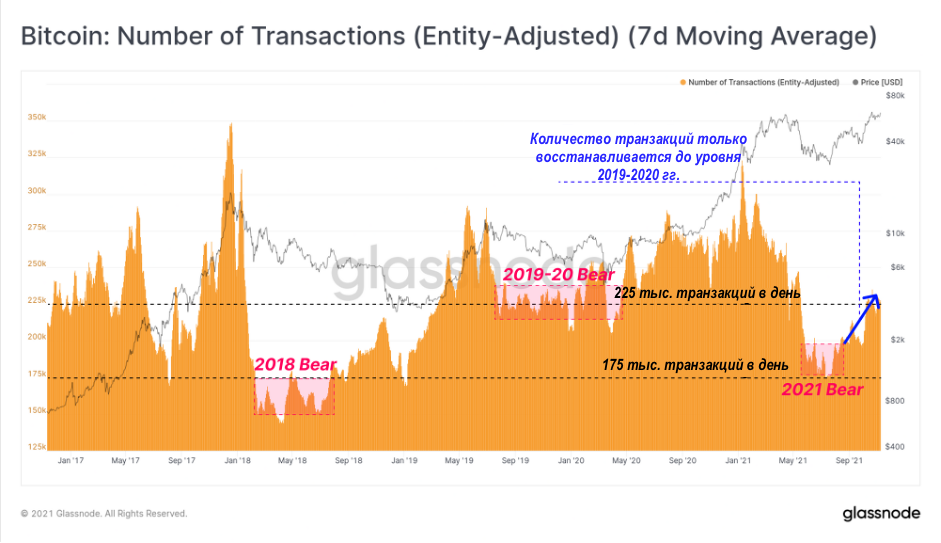

Meanwhile, on-chain activity is recovering, albeit very slowly, and certainly still well below historical examples.hype and euphoriaas in 2017 and Q1 2021.The number of transactions remains well below the peaks observed in the first half of 2021, currently about 225 thousand transactions per day. This is in line with the levels seen throughout the 2019-2020 bear market.

Number of Transactions (Adjusted by User) (Seven-Day Moving Average) (updated source)

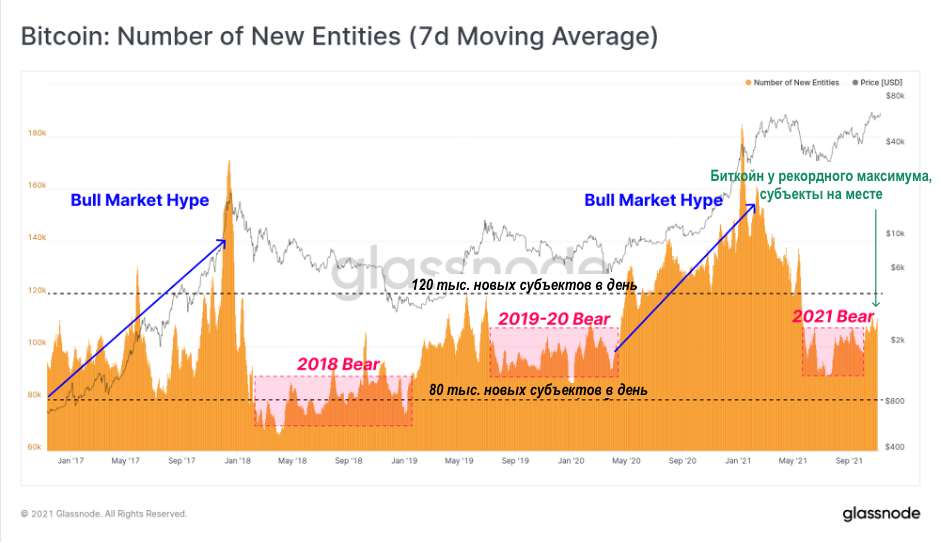

A very similar pattern can be seen in the number ofnew on-chain actors observed in the space of on-chain transactions. There is a very modest upward trend, with new subjects reaching 110k per day. Again, this is barely above the levels that have persisted throughout the 2019-2020 bear market, when activity ranged from 90k to 110k new subjects per day.

This is the observation of prices near recordhighs, while on-chain activity is near the lows of the bear market, is a fairly noticeable divergence. Which suggests that the market is probably still in a phase of quiet accumulation, marked by low activity, large outflow of currency and very modest strategic spending by experienced holders.

Number of new entities (seven-day moving average) (updated source)

Mining recovery

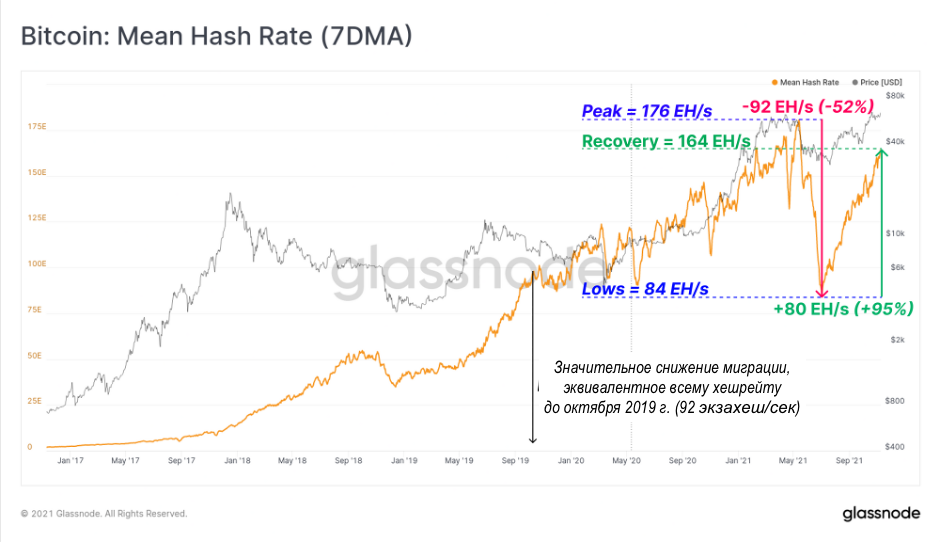

The mining industry continues to recoverafter an extraordinary event where 52% of the hashing power network went offline almost overnight. On a seven-day MA basis, the hash rate dropped from 176 exaches / sec to 84 exaches / sec in the second half of May.

This 92 exaches / sec reduction was equivalent tothe entire hash power of the network until October 2019. From the low in early June, the hash rate has recovered by 95% and reached 164 exaches / sec. Given the current recovery trend, the mining market hashrate may well reach new levels by the end of 2021.

Hash Rate Average (7DMA) (updated source)

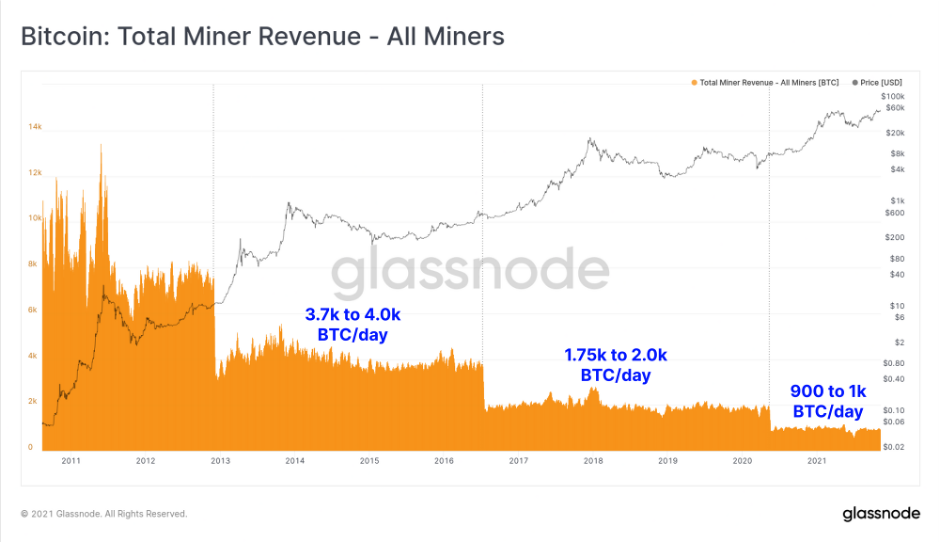

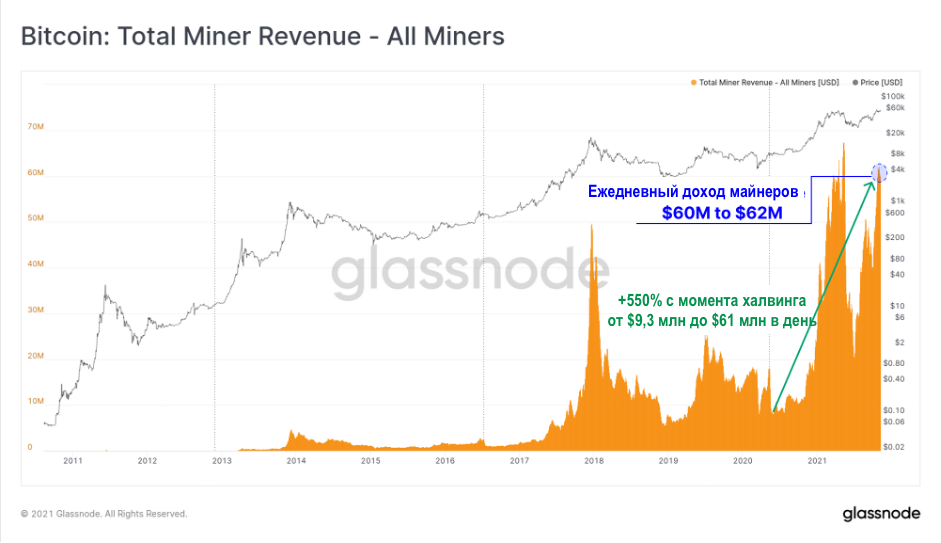

It is well known that mining revenues,denominated in BTC declines sharply every four years as the block subsidy component is programmed to be halved (during halving). Taking into account transaction fees, the current gross income of miners ranges from 900 to 1,000 BTC per day.

There is still a discussion about whetherwhether halvings negatively affect the safety of the protocol in the long term. We will not analyze this fully here, but the following diagrams provide some comments on the current situation.

The total income of miners - all miners (updated source)

While miners' earnings are denominated in BTC,their equipment, logistics, electricity and financing costs are denominated in fiat currency. While the block subsidy is indeed at the lowest level in history, the fiat currency earnings of miners are not at all the same.

Total revenue from May 2020 halvingin US dollars rose more than 550%, increasing from $ 9.3 million per day to more than $ 60 million per day. In fact, daily revenue is near all-time highs, down just 5% from a $ 67 million daily peak set in May. This means that the mining industry is paid at almost the highest level in history.

The total income of miners - all miners (updated source)

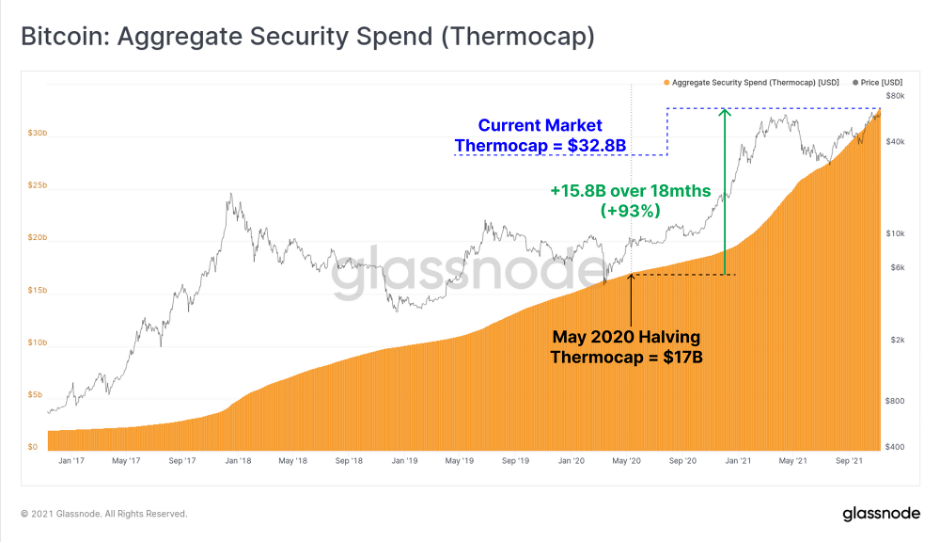

One approach to assessing total aggregateinvestment in the bitcoin mining industry is the use of thermal capitalization, a metric that calculates the cumulative sum of all block rewards in USD from the outset. Miners are supposed to be rational, profit-motivated entities and will thus invest up to $ 99.99 to win a $ 100 reward.

Thermocapitalization of bitcoin is technically alwaysis at record highs, but has recently accelerated along with the price increase, reaching $ 32.8 billion.In about 18 months since the halving in May 2020, thermocapitalization has grown by 93%, amounting to a total of $ 15.8 billion. In other words, 93% of the total security budget denominated in US dollars was issued in the last 18 months, even after the last halving.

Considering that bitcoin hashrate is almosthas fully recovered from a 52% decline, miner revenues in USD are close to their maximum level and 93% of the security budget has been allocated in the last 1.5 years, the bitcoin security and incentive system seems to be functioning exceptionally well.

Such a simple protocol design and extraordinary results.

Cumulative security costs (thermocapitalization)

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>