Over the past few days, the situation has been dictated by the attitude towards risk, that is, interest in risk remains high atamid the fact that the negotiation process does not brexitresolved to the end. By and large, there is a definite breakthrough, apparently, there will be another delay for the release until January 31 of next year. These events are regarded by the market as positive, although British Minister Boris Johnson is not too happy about this circumstance, however, the parliament won this battle.

GBP / USD

The GBP/USD pair remains consistently below itsrecent highs of 1.30 and even Johnson’s calls to hold early parliamentary elections in December this year do not negatively affect the pound exchange rate. As we have already noted in previous comments, 1.30 acts as a kind of watershed, that is, a confident increase above will be marked by the final formation of the bottom on large charts (week/month) and further movement towards 1.35-1.40 in the long term.

Now the pound looks clearly undervalued andin fact, such a low price is dictated by events in geopolitics, at this stage we are below 1.30, and there are several important events ahead regarding the results of Brexit. While we do not know where this will lead, and under what conditions a delay will be granted, but at this stage we see consolidation somewhere between 1.28-1.29.

Note that persistent negative headersthey do not have a serious impact, that is, below 1.28 there was only one short rebound, and on this it was bought out. This means that interest in fixing short positions that still remain in the market remains high. In addition, there are many players who are already set for promotion. In any case, no one expects a serious fall and this is one of the surprises of the market: if there is a really significant negative that will not fit into the expectation of the market, the pound has the potential for a serious enough decline, short positions from the market are supplanted, nothing falls does not interfere, and the accumulated longs only contribute to the acceleration of the fall as a snowball. It’s too early to talk about this yet, it seems that the next few days the couple will try to stay at current values. Of course, you need to pay attention to news headlines, since no other factors now affect the pound and will not affect it.

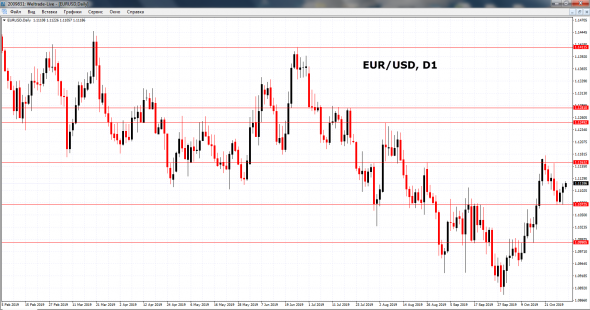

EUR / USD

Let's look at the EUR / USD pair, everything is calmer here,a decrease of 1.11 occurred, as a result of the attack below 1.070 we do not note. That is, high liquidity in this pair plays a role, no serious fluctuations are expected, with a maximum of 20-30 points per day. Nothing global is happening here and is unlikely to happen, although I would not rule out attempts to break out of such narrow ranges at some of the events of this week.

There are quite a lot of interesting news items this week, first of all thisFed meetingwhich is expected on October 30, the rate will be reduced by 0.25 percentage points, this has been in the market for a long time, the probability of this movement is noted to be more than 90%, that is, the matter is decided.

If Powell’s rhetoric at the end of the meeting does not differ too much from the forecast, then the event may go unnoticed, fluctuations of 30-40 points can be ignored.

There will be a surprise if the rate remains the samelevel, or Powell will develop new notes in his speech, which could lead to a change in the current status quo. While this is unlikely, I would say that we need to prepare for such a calm outcome of the Fed meeting, without unnecessary hesitation and switching market expectations to the further Fed policy until the end of this year.

As for further events – willlabor market report friday, the most important statistics of the month. As we know, in the past few months, even these statistics may not have a serious impact, that is, 30-40 movement points, this may be limited. Whatever it was, there are informational events this week, respectively, there are chances of some attempt to stir up that standing swamp, in which the financial market now resides.

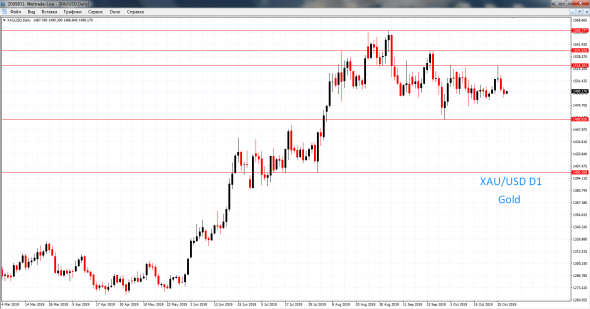

XAU / USD

Let's turn to gold, here we have a classican example is the opposition of interest in risk and, on the contrary, risk aversion; at the moment, interest in risk wins, which accordingly affects gold, it is decreasing.

Just recently we saw a surge above $1500 andrapid growth towards $1520, but again there was no breakthrough and the disappointed bulls quickly closed their purchases. We are now seeing movements below $1,490, which is certainly associated with a general increase in risk appetite. In such conditions, gold is not in demand, and speculators have complete freedom of action. They pushed below $1,490 today, with some sell stops being triggered, fueling further declines.

Now we are looking at the $1480 mark –quite a powerful level, strong support, there were passages even lower. In the zone of 1475-1480 dollars, within these 5 dollars, there is regularly demand, which helps gold to push higher, so we will see how the situation develops this time. A confident decline below $1475-1480 could send gold towards $1460, however, given the large number of news events expected this week and the potential for risks, I would not expect a strong fall in anticipation of such events; we can expect a rebound higher. Speculators are very active here, and accordingly, there are much more opportunities for interesting movements.

Once again, we note the levels of $ 1480 - below and$ 1,500 - above, metal trading remains approximately within this framework, but with a breakthrough in one direction or another, you can expect a movement of about $ 15-20.

Brent

Now we will consider the situation in the oil market,Brent oil was above $ 61 this week, but it does not stay there. As I have already noted many times in the comments, any jumps above are actively used for sales, this is happening now, even the $ 62 mark was not affected, sales immediately entered $ 61.5. Oil is again about $ 60, in the current situation it is possible that the downward movement will continue again towards $ 58-59. The level of $ 58 is a powerful critical support level, it has kept falling for many times. There is no reason to believe that in the near future this level will be passed, we focus on the medium-term trading range of 58-61 dollars.

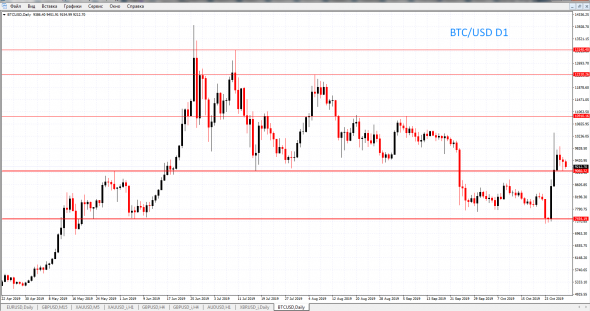

Bitcoin

Here we have an interesting event, wasquite a large-scale growth, probably one of the most impressive in the history of this cryptocurrency. From the mark of $ 7,400, we saw growth above $ 10,000, then there was a logical rollback and now there is a consolidation between $ 9000-9500. As I have already noted many times, Bitcoin is becoming, or has become, almost a traditional financial trading instrument, technical analysis works very well here. If we, for example, look at the Fibonacci levels, then just in the area of 9300 is the last level of the rebound and it was critical support for bitcoin. Accordingly, growth above the $ 9000 mark and, importantly, consolidation above, makes the picture more positive from a technical point of view and suggests further growth.

From a technical point of view, this isit looks like this: there is a consolidation, a regrouping of forces, so to speak, in the range of 9000-9900 dollars, after which an attempt will be made for new growth in the direction of $ 10,000 and maybe $ 10,500 - where will be the next resistance. Now the price is above the level of 8900-9000 dollars. Such a scenario is the highest priority.

Drops below $ 8900-9000 (these one hundred points constitute a support band), can lead to disappointment of the bulls and to the elimination of long positions, which of course will affect bitcoin. Most likely we will see a new wave of decline to 8000-8500 dollars, where we again expect a slowdown decline and the period of consolidation. A return to the $ 7300 mark and so on - while this looks unlikely.

News background that served as a starting pointfor growth remains positive. The main catalyst for the upward movement was the statement of the head of China, in which he indicated that he warmly welcomes blockchain technology and all developments based on this technology; accordingly, the invigorated market received an impetus. In addition, many expect the expiration of Bitcoin futures on American stock exchanges, which also traditionally contributes to the growth of demand for Bitcoin. But still, the speech of the Chinese leader was more significant and Bitcoin managed to recover from a rather sad dive. This gives reason to believe that the worst may be over for him and we will see confident growth towards the $10,000 mark - on large charts this will greatly improve the technique and improve the current situation in the market.

Vasily Barsukov (Chief Dealer WELTRADE)</strong>