Post from a leading specialistJarvis Labsand his vision of the market outlook in response to possible approvalthe first Bitcoin ETF in the United States.

</p>It took eight years on the first try. And the ETF is still not there.

Yet for some reason, manyAsset managers believe we are now on the cusp of the first ETF traded in the US. The reason for this is a speech by Gary Gensler, chairman of the US Securities and Exchange Commission, at the Aspen Security Forum last month.

For those who do not know, the forum is held inThe Aspen Institute: A place that regularly hosts world leaders, business executives and leading thinkers. It is the epicenter of discussions about shaping the world of tomorrow.

During Gensler's speech before thiswith a highly respected audience, he discussed the cryptocurrency industry in detail. One of the items of particular importance was the Bitcoin ETF. Gensler's words that we will discuss are as follows:

“Given these important safeguards, I look forward to staff reviewing such applications, especially if they are limited to bitcoin futures traded on the CME.”

He signaled to Wall Street about the Bitcoin ETF.ETFs based on futures rather than direct purchases of an asset in the spot markets. Whether this is the right path or not is beyond the scope of today's discussion. However, fund managers, investors, and traders alike await ETF approval. I have never seen such a high level of confidence.

In fact, unofficially, we even heard fromfrom several of their sources that SEC employees are now buying bitcoins in anticipation of the emergence of ETFs. So it becomes difficult to ignore it. This means that people have been buying ETF rumors lately.

The question arises:Since rumors of an ETF exit are buying bitcoin, does that mean there will be a sell-off on the news? Or will Bitcoin's chart just become parabolic in the coming weeks and months? Today we will investigate this very issue.

To determine what might happen, take a look at a Bitcoin-like asset. One that is both a commodity and had a well-established futures market before the advent of ETFs. This asset is gold.

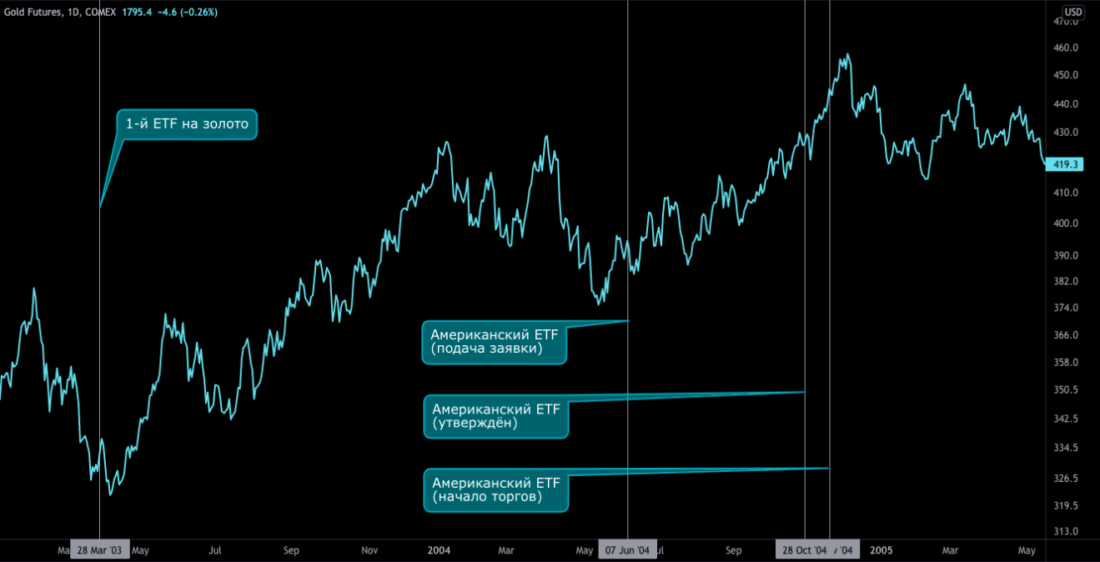

The chart below shows the history of the ETFfor gold. In 2003, Australia issued the world's first ETF. Then the first ETF for the US was GLD. It began trading in November 2004 after being approved by the SEC in late October 2004.

This is what the story looks like on the gold price chart.

Chart executed in TradingView

The reason I bring this up is to try to predict if Bitcoin can be bought on rumors and then sold off on the news.

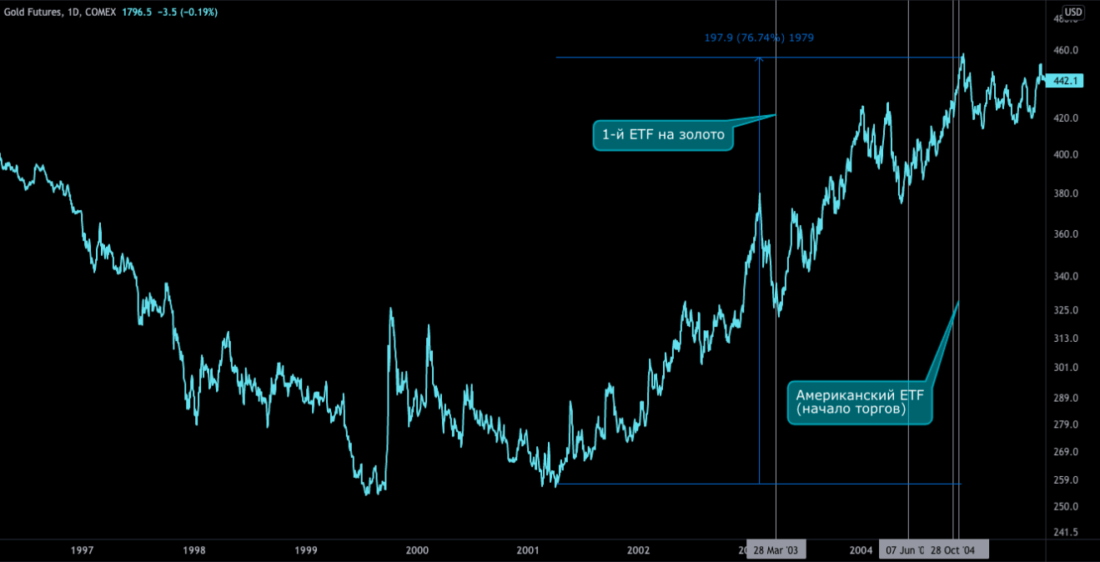

To determine what happened to thengold, let's zoom out. This is how price behaved prior to both ETFs. From the lows of 2001 and shortly after the GLD began trading in late 2004, the price of gold rose about 76%.

This is in line with a likely “buy on rumor”, at least before the start of ETF trading in the US.

Chart executed in TradingView

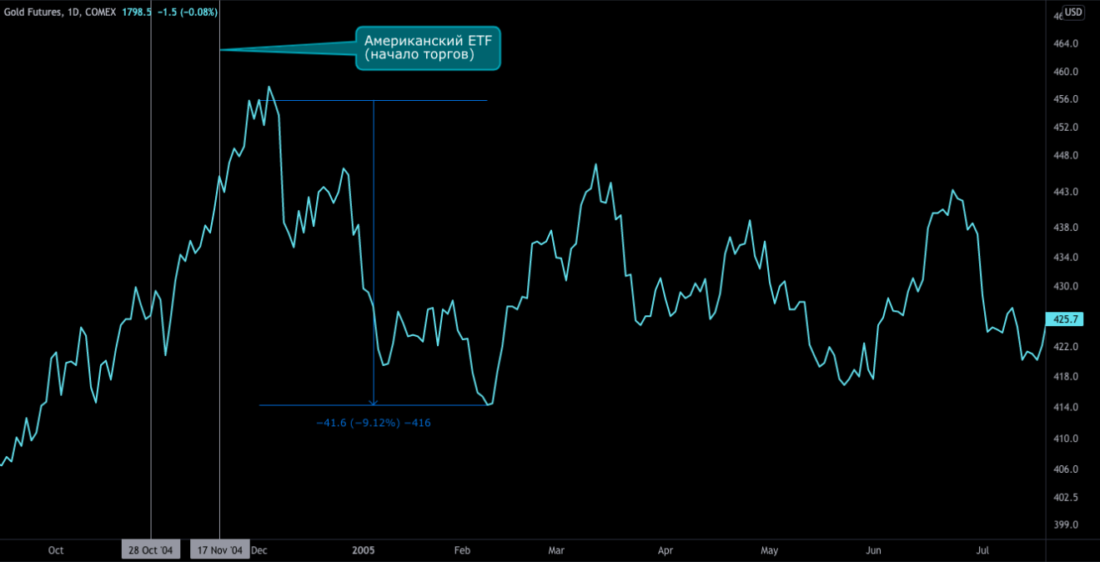

But what happened next? Was there a “sale on the news”?

Chart executed in TradingView

Gold fell more than 9% over the next month. Then, after a year-long sideways trend, the ETF's impact was fully revealed.

Now more traders got easieraccess to precious metal. It also meant that new organizations could access the gold market through ETFs without having to store the metal, hire auditors, keep it in a bank, etc. - sounds familiar, right?

And when new traders were imbued witha readily available asset on the open market, that's what happened. Gold jumped from the $ 420-440 range to $ 1,900 over the next few years. Plus 330% from the start of ETF trading.

Chart executed in TradingView

Perhaps this was the best time to buy gold. After this epic bull rally, the “golden beetles” could only dream of repeating such dynamics once again.

But now many years have passed, and gold has shown almost nothing. I believe that once the ETF made gold readily available, fresh money came into the asset. And nothing can compare with this.

This is an asset crushing.The only way gold can replicate this dynamic is through its tokenization, which will make it available to anyone with a mobile phone. This will be the adoption of the tokenized form of gold. Which won't happen until the time comes for cryptocurrencies.

But instead of dreaming of such opportunities with gold, let's take a look at where we are in relation to the future Bitcoin ETF.

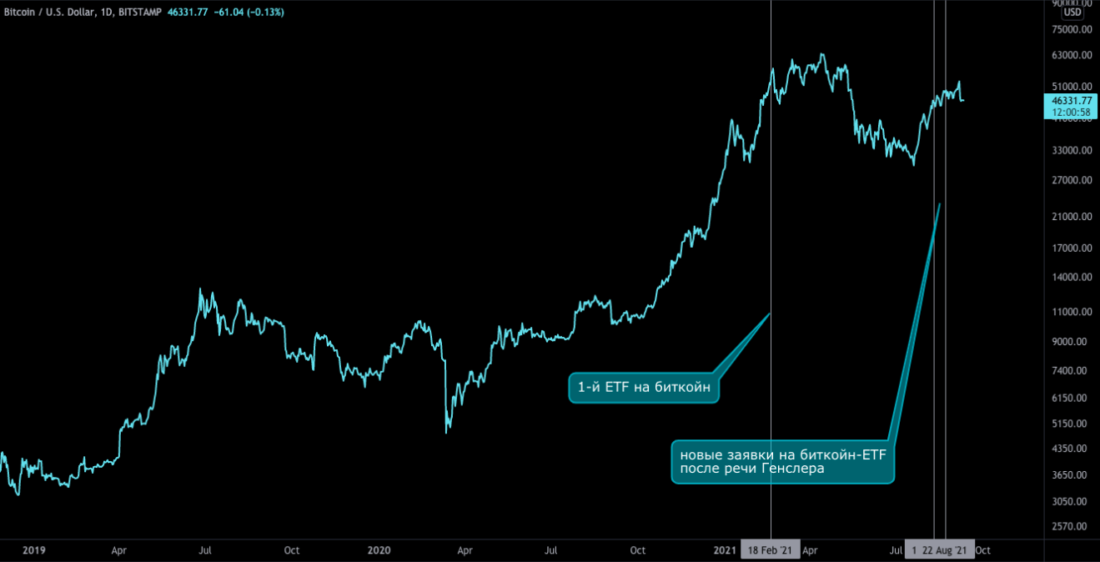

Here is the current situation of bitcoin history.In February 2021, the Purpose Bitcoin ETF began trading. Then in August, we heard conditionally positive statements regarding Bitcoin ETFs from the SEC (primarily Gensler).

Now we are on standby ...

Chart executed in TradingView

How long will it last?

ETF approval takes 221 days on average.The maximum time required to make a decision on an application is 240 days. Based on these two numbers, this means March or April 2022. Many are calling for ETF approval before the 2021 holidays, but historical data suggest that this may not happen.

But what about buying rumors and selling onnews? I think it's safe to say that the market will respond positively to the Bitcoin ETF opening. Simply put, increasing the availability of an asset with low inflation and severely limited supply is an attractive setup.

What does the combination of growing demand andconstant offer? Of course, the price increases. However, one problem is that we are talking about ETFs based on futures. This limits the amount of demand that the asset will experience, unlike an ETF based on spot markets.

Futures contracts, such as those on the CME, cancreate excessive downward pressure. Since the CME market is backed not by an asset, but by paper derivatives, traders can short more than 21 million bitcoins. I will not go into all the details now, but, most likely, this can serve as a basis for additional concerns among many market participants.

However, I see this as positive.

My biggest fear with Bitcoin isis that it will become obsolete. Wall Street and various institutions will create Grayscale-style financial products in which the physical asset never moves. That is, transactions with such derivatives do not enter the Bitcoin network at all. And if this progression continues, and transactions take place offline, this could affect miners.

If most of the BTC doesn't move in on-chain transactions for an even longer time, will miners start leaving the network?

To be honest, I have no idea right now. And for the next 4-5 years, you don't need to worry about that.

More and more organizations, individuals, foundations,corporations and other players will have easier access to bitcoin. It will grow for many years before this catalyst takes effect. We saw this with its analogue - gold.

When to open an American Bitcoin ETFwill work as a catalyst, raising its price to new heights, then it will be possible to start having philosophical conversations about what effect this has on the network and whether it does harm to the underlying asset. Until then, the only thing that matters is ETF approval.

BitNewsdisclaim liability for anyinvestment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

</p>