Ideas have visited humanity throughout its history. A new and useful idea is an innovation thatin the future everyone can win.Therefore, it is important to build socio-economic structures that will be conducive to the emergence of new ideas: civilization can only progress with a continuous flow of fresh knowledge. Free trade maximizes the generation of ideas and the resulting accumulation of wealth. Anything that impedes trade, such as central banks, is(a-priory)terrible idea. Conversely, anything that accelerates free trade, such as money, is the most brilliant idea in history.

</p>Ideas drive the economy

"A pile of stones ceases to be such when someone contemplates it, imagining a cathedral." - Antoine de Saint-Exupery

Ideas are at the root of everything we say or do. The goal of any economy is to create and spread useful ideas through free trade(to achieve what economists call division of labor or specialization of knowledge)... Civilization does not arise from aimlesscoincidence of circumstances, but is formed in the image of our ideas, which we express through our actions to transform the world around us. Better ideas or more accurate knowledge allow humanity to use the gifts of the Earth more intelligently in order to more and more quickly meet their needs. Competition in the field of ideas is free and fierce: only the most useful ideas stand the test of time. The resulting knowledge encodes patterns of actions, with the help of which we transfer our imagination to the world around us. The winning ideas are chosen by the market, and then they are distributed in the form of material wealth, sophisticated manners and mores and more soulful art. Our life is the embodiment of our ideas. As H.G. Wells said:

"Human history is, in essence, the history of ideas."

Or, as William Durant explained this thought in more detail:

“History is a laboratory where hundreds ofthousands of experiments in economics, religion, literature, science and management; history is our roots and our enlightenment, the path we have traveled and the only light that can clarify the present and lead to the future. "

We have inherited from our ancestors ideas on whichcivilization holds and which were honed through free trade and expressed in the tools, technology and culture we create. As we trade, our ideas are refined, allowing everything we say or do to better meet our needs. Think about how our language has evolved from obscure mumbling to eloquence, or how our behavior has changed under the influence of culture, or how our transportation technology has progressed from carts to airplanes. The basic ingredients of all modern miracles around us were always available, but before we simply lacked the ideas necessary for these inventions. As the current generation responsible for generating ideas, our goal should be to hone ideas for our descendants - and this goal is achieved through innovation.

: Unsplash

Innovation is just reconfigurationnatural "raw materials" in accordance with our most useful ideological structures. In other words, creativity is when you take known components and combine them according to new knowledge. Honing knowledge to better serve one's needs requires the heated ideological clashes and frictions inherent in trade. Thus, trade is the “meta-idea” of humanity, giving rise to all our best ideas. "Meta"(from Greek μετά - "after" or "for")is a prefix meaning something broaderor higher: trading is the idea of improving ideas. It assumes that anyone can know something that others don't, motivates others to teach, and allows others to benefit from similar opportunities. Trading shows us when we are ill-informed in pursuing our goal, what saves us from harm or helps us achieve the goal more easily. The creation of wealth is inseparable from the creation of ideas: the more we know, the easier it is to satisfy our(current and potential future)needs through innovation and the more wealth we gain. Writer Matt Ridley captured the spirit of this relationship between free trade and innovation in these words:

"Innovation is a child of freedom and a parent of prosperity."

Free market capitalism is an idea, nothas no equal when it comes to generating innovation. In the 20th century, it established itself as the most successful economic model for expanding trade, generating ideas, and accumulating wealth during the ideological rivalry between American capitalism and Soviet communism. Confused by utopian promises, the Soviet Union tried to replace the profit motives inherent in American capitalism with calls for patriotism and selflessness, thereby poisoning the source of knowledge generated by trade. Under the moralistic camouflage of communism(the Marxist slogan read: "From each according to his ability, to each according to his needs")some of the most horrific atrocities were committed instories. Even at the very beginning of the Soviet experiment, productivity collapsed and millions of people died from starvation or at the hands of the state. When the authorities think of themselves as God, civilizations burn in hell. The Soviet Union rediscovered what Aristotle had warned about centuries earlier:

"When everything belongs to everyone, nobody cares about anything."

American capitalism has surpassed Sovietcommunism. Capitalism is a socioeconomic system built on three pillars: private property, the rule of law, and honest money. Private property represents the exclusive relationship between individuals and any part of nature in which they invest their time in transforming and which they can then exchange with other similarly independent individuals. The rule of law is a mechanism for the non-violent resolution of disputes involving private property. Honest money is private property, which is naturally chosen by unhindered market processes as the most liquid. Because capitalism facilitates trade, it maintains this productive source of new ideas by encouraging economic cooperation and (peaceful) competition. The stability of the rules is the cornerstone of the world: with fixed and simple laws, market participants are forced to play by the rules in order to earn an honest living. As Frederic Bastiat said:

"When goods don't cross borders, soldiers do."

In the simplest sense, trading is nutritious.the moisture that supports innovation and its steady flow is the source of peace. Capitalism is a socioeconomic "well" built to protect this inexhaustible ideological source of civilization - trade.

Supercomputer of ideas

: Forbes

“Great minds discuss ideas. Average minds discuss events. Small minds discuss people. " - Eleanor Roosevelt

Being the main intermediary in trade, money isan essential tool for generating ideas. In trading, everything is valued as a fraction of everything else. For example, a car can cost 132 chairs, and a house can cost 11 cars. Money is a tool that makes it easier to calculate these exchange rates: a tool that simplifies trade by standardizing its intermediation. Like other tools, money allows us to achieve better results with less effort; and the time saved thanks to tools is wealth. In particular, money allows us to evaluate, negotiate and close deals faster. Without money, constant recalculations of countless exchange rates between various economic goods would be required. With money, all exchange rates are compressed into a single number - the market price expressed in money. Thus, money accelerates trade and its invisible twin - the emergence of ideas. Standardization of money leads to large-scale economies in trade. It is this economy that encourages the market to converge on some single money - as was the case with gold and(formerly his currency abstraction, and now his ghost)American dollar.

"Paper is poverty ... it's just the specter of money, not money itself." - Thomas Jefferson

Money is the vehicle through which participantsmarkets express their ideas, preferences and values. Pricing systems are economic communication networks that endlessly reflect and coordinate market behavior, informing everyone about the transactions of everyone else. For example, when you buy a car and sell a house, the economy reacts by producing more cars and fewer houses. Even when you buy a stock, you are expressing the idea that their expected future cash flows are worth more than the current price, and the market engulfs this thesis when you enter into a trade. Price signals continually adjust incentives to ensure that resources are allocated according to the current aggregate set of market participants' preferences. Trade entrepreneurs promote truthful pricing by striving to buy cheap, sell high, and serve one another profitably. An authentic free market is a platform for free and voluntary exchange, where ideas compete, combine and transform. From this point of view, the free market can be compared to an ideal distributed computing system - a network of minds driven by human actions and connected by prices.

Interesting on the topic: Our series of articles on the History of the origin of money

Money empowers our minds.Thinking is a manifestation of rationality: activity in comparison of all relevant factors with one or another course of events. By generating in the mind various aspects and manifestations related to a particular situation, people create a mental step-by-step picture of future behavior. Thinking involves weighing one thing against the other. When our thinking extends to money, we gain access to the collective intelligence of other market participants through price signals, which are themselves also manifestations of rationality: relative valuations expressed in money. When the rationality of all market participants is collected in the market price, this gives rise to the active emergence of ideas. Thus, free markets are supercomputers that generate ideas. This is why American innovation is unmatched. Humanity is mastering the world, directing energy along the ideological lines of force that exist in its collective mind - in the free market.

Free markets are free thinking

"The human mind, once expanded by a new idea, will no longer return to its former framework." - Oliver Wendell Holmes

Contrary to popular belief, money is notare created by the government. Money arises on its own - it is simply the most liquid commodity on a particular market. When people seek to satisfy their needs through trade, they constantly try to exchange their goods for some more liquid ones in order to get closer to obtaining the desired objects. In this process, a particular asset - be it salt, cattle or gold - becomes the most liquid, and this(a-priory)and there is money. Thus, money is an inevitable consequence of free trade.

: Unsplash

With the development of global markets, generally acceptedprecious metals have become money because of their best monetary qualities, such as durability, divisibility, portability, recognizability and rarity. Gold, surpassing all other metals in terms of rarity, has become the main money of the world precisely because its supply is the least volatile. But over time, central banks got their hands on gold and built a pyramid around it known as fiat currency. When central banks monopolized the money market, it became not free. Going against free-market capitalism is a very bad idea, as I learned from the bitter experience of the USSR: it goes against the natural human propensity to trade, generate ideas, and create wealth. As Marcus Aurelius poetically described our ability to cooperate:

“We are born to work together, like legs, arms and eyes, like two rows of teeth - an upper and a lower one. When one hinders the other, it is unnatural. "

It is obvious that inhibiting the ability of participantsmarket to express its ideas through trade is a violation of the “rules” of capitalism. Any restrictions on free trade are detrimental to both innovation and wealth creation. A true capitalist society requires ironclad rules of trade, such as an equal rule of law, inviolable private property rights, and unlimited honest money. In such a pure capitalist system, individuals can create wealth for themselves only by providing society with something it needs.(even if his needs have not yet been formulated)... However, our modern world, where everything and everyone is regulated, is far from this ideal.

Interesting read: A Century of Fiscal and Monetary Policy: Inflation and Deflation

Any regulation is a limitationfree market forces that prevent the emergence of ideas and its material consequence - the creation of wealth. The extreme manifestation of legal regulation is monopolization, when all peaceful competition is suppressed by coercion or violence. In the modern world, the money market is not free, as it is dominated by central bank cartels - institutionalized monopolies that distort prices, restrict trade and prevent the emergence of ideas. Notably, the central bank was also a key component of Soviet communism: the state banking monopoly was the fifth measure inCommunist ManifestoMarx.True capitalism has never existed precisely because the rules of money have always been twisted by interventionists who pursued their own vested interests in every market known to history. The legal barriers that governments have erected to insulate the central bank monopoly on money from free market capitalism are varied. Such refinements destroy accountability, ingenuity and virtue.

"The more laws, the less justice." - Mark Tullius Cicero

Under immutable capitalist rules, the "game"macroeconomics would provide humanity with an organizing principle, encouraging us to look for better ways to say or do something by placing mutual bets in the market, instead of lying, stealing, or levying taxes. When the rules cannot be broken, the game is fair and needs are better met. When “players” prove each other wrong in the market — by discovering and selling better means of satisfying needs — the resulting productivity gains are disseminated in society through trade. Capitalism creates an environment conducive to continuous mass learning. In other words, when ideas compete freely, more wealth is created - most often in the form of better tools, services, or knowledge. Mises describes this inextricable link between the emergence of ideas and market competition in his masterpiece Human Action:

“Competition does not mean that anyone cansucceed simply by imitating others. It means being able to serve consumers better or cheaper without the constraints created by privilege for those whose interests are harmed by innovation. A newcomer looking to challenge old, established firms only needs brains and ideas. If his project successfully meets the most pressing unmet needs of customers or serves them cheaper than older suppliers, then he will succeed, despite the size and influence of the old firms. "

To use Ray Dalio's term, freemarkets are meritocracies of ideas: unfettered trading networks that encourage the best ideas to emerge and permeate civilization. This idea implicitly assumes that innovation can only be encouraged, not regulated. And here the ignorance of the supporters of modern monetary theory, who advocate"Activation of dormant capital through inflation": funds stolen through inflation,can mobilize people and capital, but only in an unreasonable way, since bureaucrats have neither the accountability nor the distributed computing power inherent in a free market, and only as long as this parasitism on the productive economy does not kill it. In simple economic terms, free markets make humanity more productive, and monopolies, or non-free markets, less productive. In addition, the state of our collective mind reflects the state of our money. We think today in dollars only because they were once converted into gold. By monopolizing and substituting money, central banks have distorted our ability to perceive the world clearly.

A free mind needs the opportunity to freelychoose money. By adopting a free market paradigm in all our actions, we think freer and become smarter and richer. The free market can also be thought of as a system for identifying and correcting errors: through prices, it incentivizes the discovery and resolution of unsatisfied needs(socioeconomic mistakes). Inflation created by central banks distorts this error correction system, causing dissatisfaction to grow. Such market manipulation is justified by the intentions of central bankers"Manage the economy"as if any of the people evermanaged to successfully manage a complex system without causing a cascade of undesirable consequences. The belief in the usefulness of their inevitably limited knowledge, as opposed to free-market processes that constantly update knowledge, is the rotten essence of central bank sabotage. As the author of Paradise Lost, John Milton brilliantly observed:

"Evil is a force that believes in the fullness of its knowledge."

Central banks could repent by admittingthis terrible ideological error and by allowing the free market to correct the blunders of more than a century. It will hurt at first, but it will definitely serve the long-term interests of civilization - as happens when a drug addict finally begins rehabilitation. However, pride and greed will almost certainly prevent such a perfect outcome. To summarize the argument, free market pricing is a system for correcting errors, and central banks limit this ability to detect and correct errors. Central banks acting as if they have complete knowledge of the markets is a real evil, an institution of economic tyranny, as stupid as the Soviet Union. In the realm of ideas, freedom is creative, and tyranny is destructive.

Greatest idea in history

: Unsplash

"Idea is salvation through imagination." - Frank Lloyd Wright

An integral part of the idea of any money isthat current and future market participants will freely accept them in trade. The likelihood that the money will be accepted by as many trading partners as possible depends largely on how well it maintains its rarity. To maximize this function of a store of value, money must be resistant to misappropriation - whether through inflation, counterfeiting, or confiscation (since these are all theft). The most resistant to involuntary exchange (that is, theft) money usually becomes the most popular voluntary medium of exchange. In other words, in free-market competition, the money that is most resistant to theft wins. Those who mistakenly choose less robust money are out of favor with the marketplace when thieves rob them of their wealth through inflation, counterfeiting, or confiscation. We can put it another way: market participants choose the money that minimizes the need to trust each other. Central banks keep hoarding gold because it is money that minimizes the need for trust. Bitcoin further minimizes the need for trust and therefore competes with gold.

Money is the best idea we've ever hadcame to mind, because without them all the other wonderful ideas generated by the market would not exist. As the most liquid commodity, money is the supreme embodiment of our meta-idea, offering us unlimited choice in market exchange. As technology, the money chosen by the free market maximizes human freedom and cooperation. Historically, gold has reduced the motivation for violence, as it was a more reliable form of wealth than food, land, and most other assets. Thus, gold has significantly narrowed the range of assets worth fighting for, and thereby sparked unprecedented social cooperation, trade, and wealth creation. It also has deep moral implications: when money is difficult to steal, society becomes industrious; when they are easy to steal, society gravitates towards kleptocracy. Let me summarize the argument in one sentence: gold has been the greatest tool in history to drive us to become more civilized.

If humanity's goal is to build civilizations, then our brightest idea was to use gold as money.

The global gold standard has improved trade(our meta-idea), minimizing the need for trust, and gavethe world a single monetary protocol - thereby maximizing the time savings in trade and, accordingly, the creation of wealth (two sides of the same coin). Again, wealth creation is absolutely dependent on the emergence of ideas: the use of gold as money led the world to an incomparable splendor of new ideas and innovations, marking the era known as the Gilded Age and Belle Époque.

This is a truly brilliant idea, but far from it.ideal: due to its physical nature, gold is still vulnerable to theft; and because it is heavy, its use as money on a large scale led to the centralization of its storage in bank vaults(since it is cheaper to conduct transactions in paper abstractions of gold than in physical metal)... On these centralized reserves of gold, as ifpurulent abscess, anti-capitalist institutions were formed - central banks. These deceptive and perverse institutions blatantly disregard the fundamental principles of capitalism: central banks are above the law; they practice constant confiscation of private property through inflation and impose the most dishonest money in history. All business models of central banks are critically dependent on the shortcomings of gold in terms of divisibility, portability and recognizability:

- If gold were perfectly divisible, there would be no reason to replace it with fiat currency.

- If gold were perfectly portable, then it could be encoded in the form of information, and then there would be no need to trust the banks, since the calculations would take place at lightning speed.

- If gold were ideally recognizable, there would be no economic sense in the "state seal" on national currencies, since anyone could instantly verify the authenticity of money on their own.

These technological shortcomings of gold createdan attack surface that has been repeatedly abused by central banks. Fortunately for 21st-century citizens, free trade—improved exponentially by the internet and digital technology—has given birth to an even more brilliant idea that promises to put a permanent end to the criminal schemes of central banks.

The greatest idea of our time

"There is nothing more powerful in the world than an idea whose time has come." - Victor Hugo

The United States of America was based on threepillars of free-market capitalism: private property, the rule of law, and honest money. The American Constitution gave states the right to issue gold or silver currencies, prohibited income taxes, and ruled out the existence of a national central bank. Unfortunately, after the successful creation of the American central bank (after two unsuccessful attempts), the fundamental right of free-market capitalism to private property became vulnerable to endless disruption through inflation. An example of such insolvency was the "great golden robbery of 1933" (also known as Presidential Decree No. 6102): This was unconstitutional and openly violated the right to private property. Any decrees of the authorities (including the decree to use fiat currency) are a lie, because the truth is impossible under duress. Free market forces always lead to truth.

Bitcoin is an ideological synthesis of gold and the Internet.It perfectly embodies the three pillars of free-market capitalism, the founding idea of the United States, and in a way that government decrees cannot pervert. Since its money supply cannot be changed, its holders are protected from confiscation through inflation, which improves their private property rights (pillar # 1). Disputes on the Bitcoin network are resolved by consensus, and it is impractical to use violence in an attempt to influence this process, which improves the non-violent dispute resolution process embodied in the rule of law (pillar # 2). By perfecting the first two pillars of free market capitalism, Bitcoin will inevitably improve the last pillar as well, becoming the final stage in the evolution of fair money, chosen by the free market (pillar # 3). The only untouchable money in existence, Bitcoin is capitalism in its purest form: the unshakable embodiment of the most enduring socioeconomic well in history.

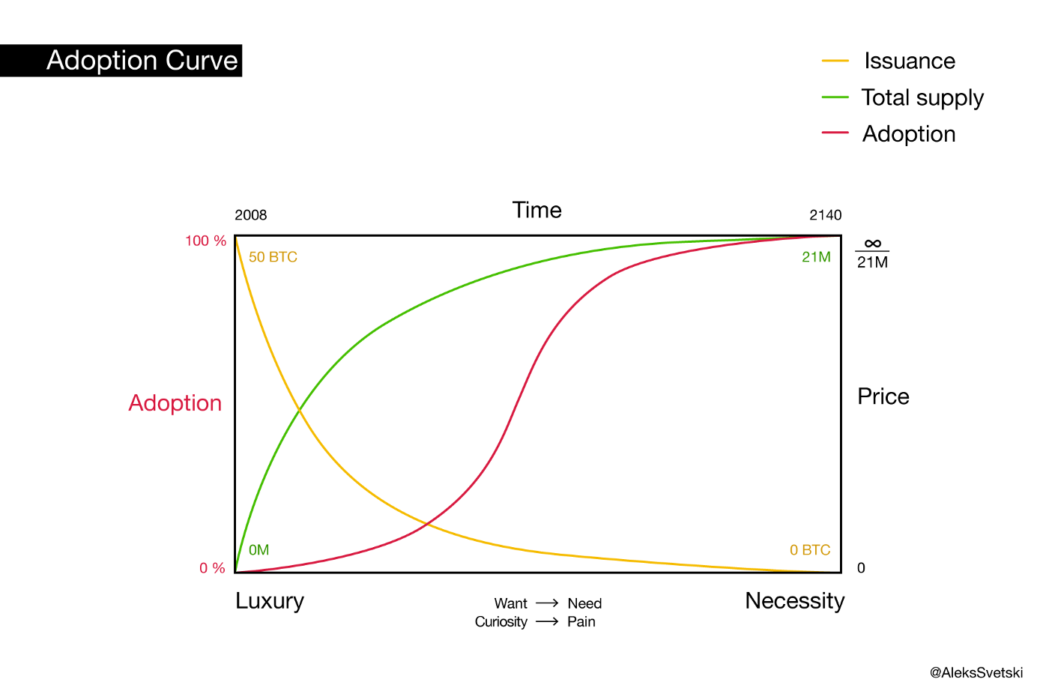

Bitcoin adoption curve. Bitcoin — this is capitalism purified: an elegant mathematical solution to past money problems. :medium

Competition and cooperation are vital.Energy conservation is an undeniable fact: organizations, methods and tools that achieve the best results with the least effort usually achieve superiority, as they are willingly chosen by market participants,"Risking their own skin". All natural systems develop strictly following thermodynamic principles(no other way)... Money, moral principles and strategies,those who increase productivity best, win in competition in the free market - recognizing this truth means freedom. Bitcoin is a system that minimizes competitive asymmetries while maximizing accountability, and thereby encourages fair play and the correction of errors in the market. Built not by the immutable laws of the universe - thermodynamics - Bitcoin is known for its rapid growth.

We are what we build and we build what we arewe are. The generation of ideas and the creation of wealth are just manifestations of the main impulse of life: the desire to grow. Without adequate metabolism, the growth of organisms and economies deteriorates. In this regard, nature is ruthless: if you stop changing, you are finished. As we age, our circulation slows down, which portends a decline in body and mind. Exercise can provide some protection by improving oxygen, water and nutrient metabolism, making us smarter, healthier, and more energetic as we age. As William Durant eloquently describes aging:

“This is a physiological and psychological wilting. Arteries and categories harden, thoughts and blood slow down. A man is as old as his arteries and as young as his ideas. "

What is true about the microcosm of the individual participantmarket, then it is true about the macrocosm of the global market: obstruction of free trade clogs the circulation of ideas and makes the "socioeconomic superorganism" (humanity) more vulnerable to disease and death. The more limited individuals there are, the worse the whole collective is adapted to reality. Barring trade through regulation and confiscation — the unspoken goal of central banks — is detrimental to the free-market paradigm that reinforces economic vitality, public morality, and the progress of civilization.

All individuals strive to find freedom, goods andpower. Governments are us and our desires on a larger scale, only not accountable to anyone and possessing weapons of mass destruction. No tears will wash away the blood shed in the war; only practicality, applied correctly, can achieve success. Without struggle, be it moral or physical, people become weaker. The presence of a common enemy brings people together. Perhaps Bitcoin can act as a moral alternative to war - a peaceful but disciplining force. American pragmatist William James believed that a "moral equivalent" to war was needed to end its horrors:

"Until now, war has been the only force capable of disciplining an entire society, and until an equivalent discipline is organized, I believe war should have its own."

If so, then Bitcoin could be newan organizing force for civilization - a kind of religion born of economics and computer science, a spiritual teaching that will ruin and destroy the war machines and ideologies of central banks. War is Darwinism on a geopolitical scale, and there will be no end to its atrocities until all countries agree or are forced to submit to a higher power - the "superstate", whose main axiom is personal freedom. Bitcoin, an infrastructure that facilitates private property trade flows, is a bridge between communist utopianism and capitalist pragmatism, and it can become the kind of superstate to which all countries will kneel. Perhaps the creation of this superstate began with a genesis bloc, or maybe it is still ahead. For now, we can only say: Bitcoin is money.

illustrations: BitNews

Money is the main intermediary in trade, andtrade is a meta-idea of humanity. Whatever money wins in the free market, it is a brilliantly formulated, civilizing idea. Capitalism is a socioeconomic system that promotes the expansion of trade, respecting the principles of the free market, the main of which is personal freedom. Bitcoin - fair money, offering its holders inviolable private property rights and perfect rule of law - is the culminating innovation of capitalism. It seems as though trading throughout history has led us to this idea: unlimited, honest and affordable money. Like ideas, Bitcoin is immaterial, fast, and antifragile: it can travel at the speed of light and be stored in the mind. Because it is robust against theft and based on thermodynamic principles, Bitcoin opens the door for us to a world of unprecedented freedom, lofty morals, and improved productivity. Bitcoin gives us the freedom to trade without central bank intervention, store our wealth in a place where it cannot be confiscated, and embrace the truth in a world steeped in deception.

Together, these ideas make Bitcoin itselfa brilliant idea in the entire history of mankind - a saving foundation upon which we can build a future civilization that will be distinguished by greater ingenuity, better morals and prosperity.

“To see everything as it really is, to knowits nature and purpose, to do only what is right, to speak only the truth, without hiding anything - is this not salvation? What else can it be if you do not live fully - to repay with good for good, creating a chain of good deeds without the slightest flaw. " - Marcus Aurelius

You can always thank the translator for the work done:BTC:3ECjCH5tPoyDCqHGCXfiiiLZQ3tVGzCSxBETH:0xf45a9988c71363b717E48645A412D1eDa0342e7E