Blockchain Opportunity Fund Manager and Blockware Solutions CEO Matt D'Souza predicted a fall in Bitcoin in the absence of a newwaves of growth in its price. The reason is the massive sales of cryptocurrency by miners, which provide 30% of the network hash.

</p>Matt d’Souza, who as supplier CEOMining equipment is notorious for the cost structure of cryptocurrency mining companies, presented its calculations of the profitability of popular devices, and its conclusions were disappointing.

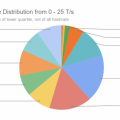

According to his estimates, with quotes in the region of $ 8500 after the third halving, about 30% of the current hashrate is ensured by the operation of unprofitable ASIC devices.

“At a price of $ 8550, the Antminer S9 model (13.5 TH / s and1.4 kW) does not make a profit when the cost of electricity is 3 cents / kW. Newer Innosilicon / Canaan miners (30 TH / s and 2.4 kW) have zero recoil at an electricity price of $ 0.0393. For the new Antminer S17, this threshold falls at 7 cents (50 TH / s and 2.2 kW) "- brought his calculations d’Souza.

Blockchain Opportunity Fund Manager Comes toto the conclusion that in the conditions of the unprofitability of bitcoin mining, miners can start selling BTC from reserves in order to stay afloat. According to observations d'Souza, the process of disconnecting equipment has already begun.

Recall that the halving of the bitcoin miners' rewards for the mined block halved their revenues by 44% and the computing power of the network by 16%.

Forklog previously published special material on the prospects for bitcoin after the May 11 halving.