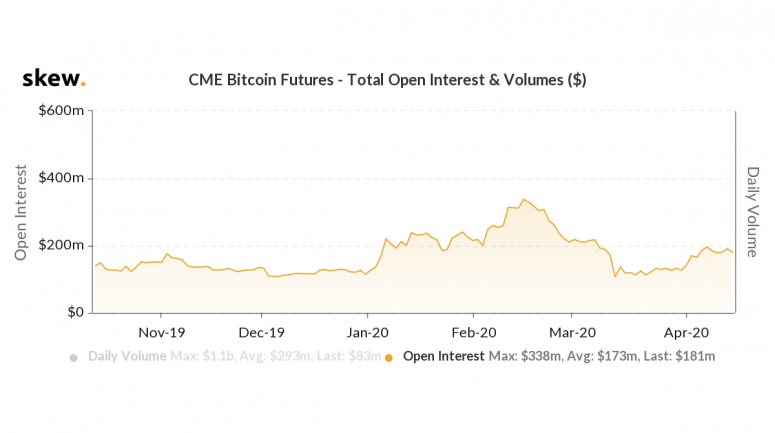

Open interest in bitcoin futures,listed on the Chicago Mercantile Exchange (CME), has recovered significantly after March lows, indicating a resurgence of institutions that want to buy cryptocurrency.

As of Wednesday, open interest, or the number of outstanding futures contracts, amounted to $ 181 million, which is 70 percent more than the $ 106 million recorded on March 22.

That number was $ 196 million nine days ago. It was the highest since March 7, according to data provided by research firm Skew.

“An increase in CME’s open interest maypoint out that traditional finance companies are more open to increasing Bitcoin's exposure to their portfolios, while retail investors are apparently more reluctant to engage in the futures market, ”said the Luno cryptocurrency platform on its latest weekly report.

They say that an increase in open interest along with an increase in price confirms the trend towards growth. EASIER TO SAY, THE RECENT BITCOIN RALLY HAS FEET.

Bitcoin Futures Listed on CME,widely regarded as synonymous with institutional activity and macro traders. CME is the largest futures exchange in the world, providing institutions with access to derivative instruments for stocks, goods, currency pairs and bonds, and was one of the first exchanges to launch bitcoin futures in December 2017.

Open interest plummeted from $ 316 million. U.S. up to $ 107 million The United States for three weeks until March 12, as institutions viewed Bitcoin as a source of liquidity during the coronavirus-smashed Black Thursday crash in global stock markets. Investors usually prefer to store cash, mainly US dollars, during times of crisis.

Over the past couple of weeks, financial marketshave stabilized somewhat, largely due to the unprecedented monetary and fiscal lifeline put in place by the Federal Reserve and the US government. S& The P 500 is now reporting a gain of more than 25 percent from its multi-year low of 2,192 recorded on March 24.

Growing interest, rising price

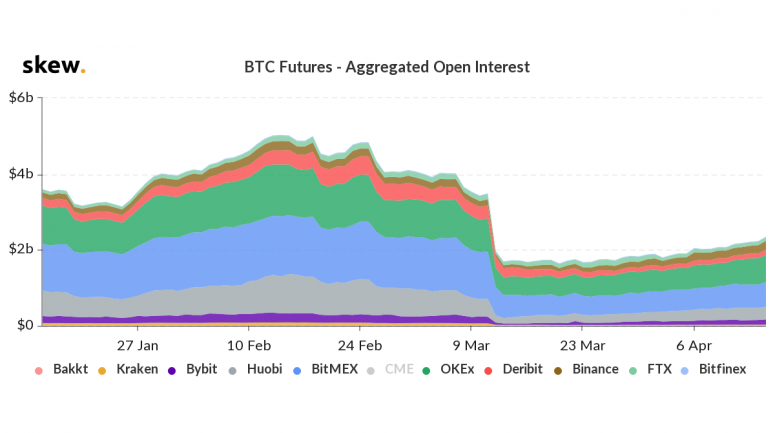

Bitcoin has survived over the past four weeksstrong price increases. Rising prices are accompanied by increased interest in CME futures, as noted earlier. The overall open interest in other major exchanges, including Bakkt, Kraken, ByBit, Huobi, BitMEX, OKEx, Deribit, Binance, FTX and Bitfinex, also increased from $ 1.7 billion on March 13 to $ 2.3 billion on March 15.

Rally is said to be caused by short coverage or profit taking, when a price increase is accompanied by a drop in open interest and is often short-term.

Futures Trading Volume Falls

Some observers, especially chart analysts, are looking at trading volumes to confirm price trends. Trading volume means the number of contracts sold over a given period of time.

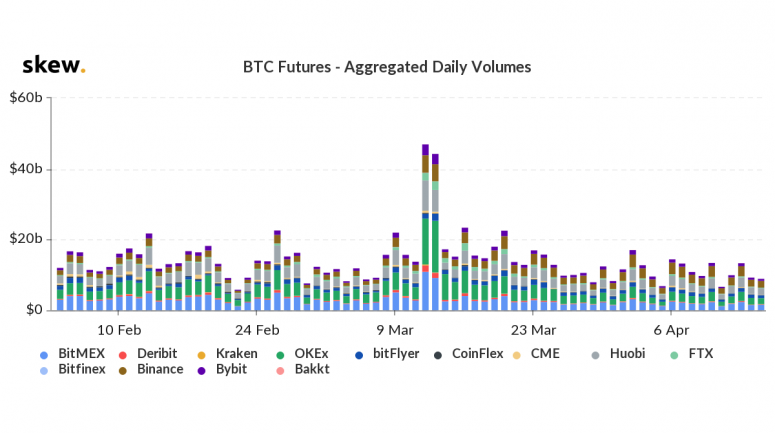

They say that the increase in volume along with the increase in prices confirms an uptrend. However, in the case of bitcoins, trading volumes are in a downtrend, as shown below.

Total daily futures trading volume,Listed worldwide, it exceeded $ 45 billion in mid-March and fell below $ 10 billion on Wednesday. Meanwhile, according to Skew, the daily volume of CME futures fell to a 4.5-month low of $ 83 million.

Consequently, chart analysts may question the sustainability of the recent price rally.

However, futures trading volume fell byAmid growing open interest. “This is often the result of investors holding their positions,” said Emmanuel Guo, CEO of Skew, in a Telegram chat in February, when the futures market faced a similar situation.

In such cases, the market usually extends the previous movement, which in this case is bullish.

Join us:

Vkontakte:

https://vk.com/schizopub

YouTube:

https://www.youtube.com/channel/UCw7xm4K2HEHxi8riFG5LXoQ

Telegram:

https://t.me/Bitmaister

Instagram:

https://instagram.com/bitmaister

Twitter:

https://twitter.com/bitmaister

Smart-lab:

https://smart-lab.ru/profile/Bitmaister

Tradingview:

https://ru.tradingview.com/u/Crazy_Put_in