Listing is an important milestone in the roadmap of any cryptocurrency project.Adding a coin to the list of the best exchanges significantly increases the chances of its success - an increase in value and better accessibility for investors.

Which exchange to choose for token listing: overview of listing requirements and prices for different crypto exchanges

Just the rumor that Ripple is preparing forlisting on Coinbase, was enough to raise the price of XRP by 5% about a year and a half ago, and when the coin was actually listed, the price increased by another 10%. The Bitcoin Cash listing on GDAX and Coinbase almost doubled the rate of this cryptocurrency within 24 hours. Gaining access to liquidity is vital to the success of any cryptocurrency. What price should the project pay to add its coin or token to the exchange? Can additional costs be avoided? What are the requirements for listing on leading exchanges? Read these and a number of other answers to burning questions about listing in our research on this topic.

The effect of stock listing on the price of a coin, or the Coinbase effect

In 2017, hundreds of new digital tokens surgedto the market thanks to the ICO phenomenon. This influx is not weakening today, despite the fact that ICO is already largely yesterday the crowdfunding. Today's tokens are initially tied to the recognition from the exchanges: ICOs give way to IEO - the primary exchange of tokens. However, many of the new digital tokens and currencies will never be in the public eye, as large exchanges will not float them.

Without the support of large exchanges, buying and sellinga digital asset is becoming an impossible task. Moreover, it is doubtful that anyone will need such an asset at all. Therefore, there is a clear correlation between the success of the cryptocurrency and the quantity, as well as the quality of the exchange listings in which it appears. On average, after listing, the value of cryptocurrency increases by 25-30%. This is the so-called “exchange effect”, which is achieved through popularization. It should be noted that the effect is often of a short-term nature and after a stir, the value of the coin begins to gradually decrease.

The positive effect of inclusion in the listingsof popular exchanges is very significant for altcoins and tokens of crowdfunding projects, since it not only provides a digital asset with a certain level of industry approval, but also significantly expands its list of investors. Naturally, listing on a large international exchange of digital currency usually leads to an increase in the price of the token, and listing on popular regional exchanges can also have a profound impact on the development of the project, as it allows local crypto enthusiasts to invest in it using the fiat currency of their country.

For example, after the news that Litecoin (LTC) was registered on Bithumb, the largest digital currency exchange in South Korea, the price of altcoin jumped immediately by 15% within 24 hours.

In fairness, I must say that listing ona new exchange does not always lead to higher prices. It happened the other way around: the price of an asset after listing instead of growth showed a decline - for example, when ICO tokens were purchased in large quantities during the presale and sold by early investors immediately after the coin entered the market.

Exclusion from listing also directly affectsasset value. This is especially true for altcoins with little capitalization. For example, when at the beginning of 2018, the Bittrex exchange announced the exclusion of BTC / MYST and ETH / MYST trading pairs from the listing, the Mysterium token (MYST) lost almost half its value in 24 hours and fell from 3.11 to 1.60 dollars. This drop was caused by the fact that at that time more than 90% of transactions with MYST tokens took place on Bittrex. Other altcoins, which were also then excluded from Bittrex listing, suffered the same fate: Startcoin (START), GCRcoin (GCR) and Rise (RISE) lost about half their value within 24 hours after the announcement of listing exclusion.

Perhaps the most illustrative example of influencelisting on the value of the asset can serve as the so-called “Coinbase effect”: it can be observed whenever the American giant announces support for a new coin. For example, in May 2017, Coinbase added support for Litecoin's “little brother”. Immediately after the official announcement of the addition of altcoin to the listing, its value instantly jumped 25%.

Even the rumor that the coin will be listedCoinbase was enough for a substantial price spike, as was the case with Ripple (XRP). The rumor was launched at the end of 2017 and by 2018 spread widely on all social networking platforms, so the price of XRP rose above the $ 1 mark. When Coinbase denied the rumors of adding XRP to its listing, the price of the asset fell by more than 50% in a couple of weeks.

That is why for crypto investors whoactively trading in altcoins, it is important to monitor listings of major exchanges and, in particular, announcements of exclusion from them, since these events directly affect the direction of movement of the price of assets.

Can I get listed for free?

There are some exchanges - small, medium andlarge - which really do not charge for listing tokens. However, these are often also exchanges on which listing is the most difficult to obtain, since they make the appropriate decision solely on the basis of the dignity of the token and the project behind it.

Indeed, listing a decent exchange canto get there for free, but for this, you most likely need to be a world-famous developer, Vitalik Buterin or Pavel Durov - in this case, exchanges will really include your coin in the listing simply because they want to partake of your popularity. Ordinary mortals will have to pay, and a lot. However, several exchanges with free listing will be listed below.

How much does it cost to be listed

The impact of exchanges on community perceptionsThe subjective value of coins cannot be overestimated. However, when it comes to listing fees, this maxim does not always work. Often the requested amount can simply be overwhelming - the Decred employee responsible for listing, Jonathan Zeppettini, once said that a certain exchange demanded $ 3 million for this service. The most interesting thing is that the exchange at that time had not even been launched!

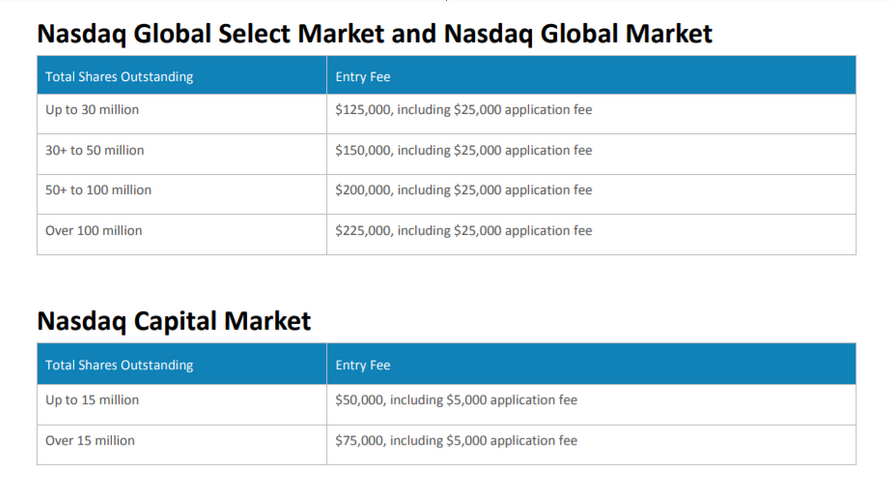

No listing fees in exchange practicenothing new: they are similar to those seen in traditional stock markets such as the NASDAQ and NYSE, which require an entry fee when applying, followed by regular service fees. Nevertheless, the size of these payments on the stock market is noticeably lower than those mythical millions of dollars that, according to many, require cryptocurrency exchanges for getting into their listings.

Most large crypto exchanges do not advertisethe real cost of this service. When obtaining a listing, you will often be required to sign a non-disclosure agreement. Such secrecy gives rise to intricate speculation regarding listing prices. Rumor has it they could range from hundreds of thousands to millions of dollars.

Listing fees too higha serious obstacle for many projects - it is difficult for them to find such funds. At the same time, in the absence of the opportunity to join the desired exchange, they see a serious obstacle to the growth of their own project. However, as the Blockchain Transparency Institute showed in its report, in 2018 the average blockchain project spent about $ 50,000 on listing fees. This means that most listing fees are not exorbitant, and most cryptocurrency exchanges do not charge millions of dollars for listing.

Yevgeny Yegorov, CEO of the Russian division of Coineal crypto-exchange, says that rumors about “millions for listing” are greatly exaggerated:

“Yes, each exchange has its own policy.listing prices. Large exchanges take a lot, medium - medium, small ones charge 1-2 bitcoins. The ranking at the moment is: from 100 to 300 thousand for the first, the second - less than 100, but more than 50 thousand, the third - from 10 to 20 thousand dollars for listing. Accordingly, if the project wants to get on the exchange, which is included in the top 10 (top 20, top 30) exchanges, it must pay a certain amount, guided by its financial capabilities, as well as considerations about which audience and what community it will work with - it is about focusing on the European, American, Asian or global market. ”

The high cost of getting into exchange listingsIt is a constant subject of discussion by the press and individual commentators. According to some, these funds are of paramount importance for ensuring the smooth and efficient functioning of exchanges that can use these tools to hire more employees, increase server capacity or search for new innovative solutions aimed at the prosperity of the crypto community. Proponents of listing fees also indicate that the process of getting listed on large exchanges helps maintain a healthy cryptocurrency market: to pass all the checks, meet all the requirements of the exchange and pay the required fee, you need to be an outstanding company, and not everyone can do it, rather, it is a positive factor, a kind of natural selection on a qualitative basis.

Critically minded citizens saythat the main profit of the exchange is to obtain a percentage of trade turnover, the increase of which should be directed at its efforts. Bloomberg reports that the largest crypto exchanges can earn up to $ 3 million per day on transaction fees. One of the famous people who are not satisfied with the current state of affairs with listing is Vitalik Buterin: in an interview with TechCrunch, the creator of Ethereum wished all centralized exchanges to “burn in hell” with all their “crazy listing fees”. Buterin believes that high listing fees are harmful for the crypto industry, because, firstly, exchanges can start scamming fraudulent unreliable projects simply because they want to make money, and secondly, high-quality projects, in turn, will not be present in listings, since they, alas, have more talent and experience than money.

Listing requirements for listing applicants

Listing on one exchange compared toanother may mean the difference between one hundred thousand and ten million customers. A project may have great potential, but will not be able to realize it due to the lack of its coin in exchange listings. That is why for cryptocurrency projects it is extremely important to try to take places in the listings of the largest world crypto exchanges. However, not every major exchange is able to take a specific crypto project under its wing - there are a number of features that this project must meet and, for lack of thereof, it will not be able to claim a place in the listing.

What steps are being taken by the exchange toto be sure of the quality of the project she takes under her wing? Initially, as a rule, an initial check is carried out to determine whether there is a need to conduct a more thorough study regarding the token that claims to be in the listing.

A full audit before listing isquite deep and expensive research. Exchanges request specific documentation from the project, enter into a Non-Disclosure Agreement (NDA) and a Listing Agreement. A committee consisting of exchange employees determines whether the token meets the listing criteria on a particular exchange and makes an appropriate decision. In the course of an in-depth audit, exchanges, as a rule, also involve external consultants.

When considering applications for listing, exchanges shouldanswer your question whether the project is innovative, whether it offers any improvement for the existing blockchain, whether it is a unique application. For the exchange, technological experience and the reputation of the project team, market interest in the product and how it is able to solve the current problems of the industry are important.

Compliance verification usually requires the applicantproviding a legal memorandum or the conclusion of a qualified lawyer. The nature of the conclusion may vary depending on jurisdiction - for example, in the United States it must confirm the fact that the candidate token does not fall under the securities law.

As a rule, the requirements of all exchanges for projects include items such as:

- completeness and legal clarity of the submitted documentation;

- the absence of any political risks;

- strong team and community;

- relevance of the practical application of the product;

- truthful and timely information about the project in open sources (Github, Bitcointalk): regular reports on the development and progress of the project, answers to user questions;

- the presence of white paper.

The following factors may become the basis for delisting:

- lack of updates of weekly reports for one to two months in a row;

- intentional concealment of information about some major events that could affect the price of a coin (hard forks, for example);

- suspicion of criminal activity, such as money laundering, fraud or pyramid schemes;

- very small volume of transactions over time (more than 30 days);

- suspicions of market manipulation.

How to be guided by the project when choosing an exchange for listing your asset

The main activity of all cryptocurrency exchangesis to list coins. Their main business task is to collect so many pairs that it is interesting for traders to trade on the exchange, which, accordingly, will increase its turnover and status in the market.

Different exchanges target different currencies, differentnumber of pairs and generally build their strategy differently. For example, Binance tries to list a lot of coins, but high-quality projects, provides an open IP, allows arbitrage, thereby creating the most favorable conditions for trading and accumulating large volumes of liquidity.

Some other exchanges choose a strategylisting of any altcoins that are just appearing on the market, thereby attracting users. At the same time, it does not matter to them what quality the coins are in their listing, the main thing is that they should go for them. Most often, scam projects are scrolled this way.

In contrast to this approach, there is anotherapproach: the Kraken exchange, for example, has only 60 coins in the listing, but these are high-quality coins with the highest turnover. And the projects are partners of Kraken. The number of traders on the exchange is not that big, but the daily trading volumes are very impressive.

There are exchanges that specialize incertain regions and, accordingly, on certain coins and projects from these regions. Each exchange has its own limitations: for example, Bitstamp, as a European exchange, works more in this region, because it is licensed and has the right to work only with certain traders, audiences, companies - all this is officially and legally confirmed. It is clear that with so many restrictions, the audience of the exchange is reliable and established, but not very wide, since not everyone can come to such an exchange.

As for the American exchanges, the servicethey are intended exclusively for US citizens, and it is difficult for Asian or someone else to go there, and accordingly, it is difficult to get fiat money there and withdraw fiat to non-US citizens, you need strict compliance with the Securities Law and US legal accountability.

There are fewer restrictions on Asian exchanges,therefore they are the most “global”. However, this coin has two sides - in connection with such an “omnivorous”, a huge influx of dubious projects is going to Asian exchanges, since they serve everyone deactively and the risk of running into scam is, alas, extremely high.

Some exchanges hack, someimperfect from the point of view of management, some of them are simply “scam”, and therefore, when the project has a choice where to go, you need to compare, analyze, choose an option that is both reliable, global, effective, without restrictions and preferably not too much expensive.

Overview of specific exchanges and listing conditions for them

Let's talk about some of the individual features of listing large exchanges on the domestic and foreign fronts.

Bithumb

The leading exchange in the South Korean crypto industry in August2019 announced its intention to form a “Listing Rights Review Committee” within its platform, the main function of which will be to regularly inspect listed coins for relevance and compliance with the strict requirements of the exchange. Variables such as daily trading volume, changes in capitalization and project support, as well as a number of other factors, will be taken into account. Cryptocurrencies found to be non-compliant will have two months to make the necessary improvements before being delisted. The Bithumb committee will consist of lawyers and professors - high experts in legal, technical and financial issues.

Bithumb is one of the world's largest exchanges fortrading volume. The exchange listing contains 15 of the world's largest cryptocurrencies, traded on which are paired with the South Korean won (KRW). Judging by the small set of cryptocurrencies taken on board, getting into the Bithumb listing is architrual - it’s not enough to be a token of a wonderful and useful project. The exchange listing contains only time-tested coins that do not need a separate presentation.

Binance

Binance's listing fees policy in2018 has undergone major changes: now all listing fees on the platform are transparent, and 100% of the money received for the listing is transferred to Binance's own charitable foundation, Blockchain Charity Foundation. The announcement on the Binance website, in particular, talks about what considerations the exchange follows when setting the listing fee: the teams behind each project themselves offer the amount that they are willing to donate to the fund. Interestingly, the minimum donation threshold is officially absent, and its size does not affect the outcome of the project verification process.

Transparency was probably necessarya step for the exchange, tired of fighting off reproaches that it requires too high a listing fee. In one of these skirmishes, exchange manager Changpen Zhao emphasized that the main criterion for entering the exchange for a project is quality, not how much money the project is willing to pay.

In addition to the main exchange, in April 2019 there wasthe decentralized project Binance DEX has been launched - a platform built on top of its own Binance Chain blockchain. Within the blockchain, users can issue their own tokens, which then, after passing a certain procedure, can be added to the listing of a peer-to-peer trading platform. Especially successful tokens, which have proven themselves well on a decentralized exchange, have a chance to get to the main one. In general, as they say in an official statement by Changpen Zhao, published by him on LinkedIn, participation in Binance projects greatly increases the chances of a token listing - meaning, issuing a token on the Binance Chain, supporting its own BNB exchange token, successful trading on DEX and generally friendly attitude to the exchange. However, like other self-respecting exchanges, the basis for listing is the value of the project, and the simplest way to determine this value is the size and activity of its community.

«In general, we like coins with proventeam, a useful product and a large user base. We do not have strict requirements, since any requirement we publish can be revised».

The delisting procedure on Binance occurs withoutany warnings regarding the project team. This is done in order to maintain the normal course of trading and to prevent price manipulation of the asset removed from the listing. The activity of the project is constantly monitored - are there updates on social networks, is the development of the roadmap consistent. If a lot of time has passed since the ICO, and the project still does not have a product, the exchange regards this as a very alarming sign.

“One of the tricks is that we try to maintain active communication with all project teams, and it’s usually a very bad sign when they don’t respond to us,” says Zhao.

Huobi

China-based Huobi Exchange, safelymoved to South Korea after the ICO ban in China in 2017, it soon opened branches in Singapore, Japan and the United States. Now the exchange has become truly global, and therefore the community that it attracts, and its listing requirements are quite wide. Listing here is real; furthermore, this process at Huobi is kind of automated. The exchange accepts applications for listing listing through a special platform after the project has successfully passed the qualification audit. The self-service platform is designed to eliminate the human factor and related abuse from the decision-making process. It offers token listing services at Huobi Main and Huobi Next. The first, according to the team, is more suitable for mature projects, and the second - for projects that are at the initial stage and do not have sufficient funding. The cost of listing on the platform is not announced publicly.

Poloniex

Poloniex American platform in the section aboutemphasizes the rules for adding to the listing: the exchange does not charge any fees for this operation. All payment requests on behalf of Poloniex are fraudulent and must be kept in mind. Subject to US jurisdiction, the exchange is primarily governed by the US Securities Act. The platform applies the Howie test criteria to each token present in its listing, regularly rechecking its assets and excluding those that no longer meet the requirements of the law. In addition to this main criterion, the determining factor in the listing decision for Poloniex is the assessment of the potential of each asset.

“We ask questions in five broad categories -fundamentals, technologies, people, business model and market dynamics. We evaluate projects in each category on the basis of publicly available data and information provided by the project through the application form for listing an asset, ”the exchange website says.

OKEx

Malta-based OKEx crypto exchange witha daily adjusted volume in excess of $ 500 million, also does not charge a cent for listing. Moreover, the procedure of adding to the listing cannot be called free in the strict sense of the word: money is needed, and considerable.

“We do not charge any listing fees, but we have inmind your budget, ”said Andy Chung, OKEx COO. Instead of listing fees, OKEx requires a guarantee deposit from the project, which is returned to it upon successful completion of the listing process.

Listing on OKEx includes three options: voting, collaboration and community building. All applications for voting on the listing of tokens are considered by a special committee, after which holders of OKB (native OKEx token) get the right to vote for crypto projects. One vote costs 0.1 OKB, and all tokens are returned to the owners after the end of the vote. The cooperation mode implies adding projects that have received investments from OK Blockchain Capital to the listing. And finally, the community building mode requires the project to attract 50 thousand new users to the exchange, of which at least 20 thousand must be active (i.e. have at least 1 ETH in their accounts and regularly trade).

ZB.COM

Another exchange trying to deposit an itemDemocracy in the field of crypto listing, is the Chinese ZB.COM. To provide traders with a wider choice of trading opportunities and give blockchain startups the opportunity to bring their product to professional investors, the Chinese platform launched an autonomous digital asset exchange called ZB Global (zbg.com), where the decision to list coins is made by the exchange community based on a vote.

The mechanism for adding to the listing is as follows: preliminary, the project must receive approval from the so-called ZB Professional nodes - companies that ensure the efficiency of ZB.COM and support the project. After receiving at least 3 votes in favor of the applicant project, his team needs to attract at least 5,000 new users to the exchange. After that, the public voting procedure begins, where one vote is equal to one ZB token, and users can vote with as many tokens as they consider appropriate - you can use any number of your choice. The funds paid by voters for the coin, which was successfully added to the ZBG.com listing, go to the “User Security Fund” of the project - a kind of buffer that protects investors from the risk of an unexpected “collapse” of the project.

Bitfinex

Hong Kong Bitfinex platform after severalThe devastating hacks that she went through, also decided to abolish listing fees. This, of course, does not mean that anyone can flip on the exchange.

“When deciding to add a new tokenAt Bitfinex, we consider several factors. Some of these factors include user requests, shareholder interest, cryptocurrency market capitalization, token design options, and a thorough assessment of the token development process. Among other things, we evaluate the team behind the coin and its strategies for solving problems of both a technical and non-technical nature. We continue to monitor these factors and make informed decisions solely in the interests of our customers, ”the exchange said in an official statement.

Coineal

Young Pan-Asian Coineal Crypto Exchange,Born in 2018, it grew very quickly to the scale of the site, which is in the top 10 world cryptocurrency exchanges according to Coinmarketcap. Initially focused on the Asian market, the exchange has been actively developing its regional offices over the past year, including in the Russian-speaking space. All listing requirements are announced in detail on the exchange website and openly. Assessment of the factors influencing the approval of the listing of the token on the platform is a comprehensive and expert work, as well as the result of negotiations between the applicant and the exchange specialists, where measured and qualitative indicators, as well as the idea, long-term plans of the project and technology, and a number of other values are evaluated.

The price range of listing on Coineal refers toto the middle segment, the final cost of listing depends on the number of pairs, the complexity of technical work, the volume of marketing and other conditions. At the same time, an important factor is that the exchange provides all new tokens with a market-making service, without which trading in a new asset may not even start - thanks to this service, the price of the asset will not drop below its reasonable minimum and will not be charged, thereby avoiding reputation risks. In addition, the exchange takes on PR and marketing work to announce the listing of the token on the exchange, opening a new project to the huge Asian market.

“It is very important that the exchange provide the projectfurther marketing support for the withdrawal of coins for trading, worked with the community, provided technical support and much more, including market-making. Some exchanges simply do listing, but without market-making it works inefficiently: there is no bidding, investors and traders may be disappointed, and after some time the picture will turn out to be sad, ”says CEO Coineal,“ If the platform is strong, able to provide an effective market-making, then the behavior of the coin price turns out to be much more stable and traders get the necessary level of token liquidity. Our exchange is in the top 10, well-positioned, well-known, provides effective market-making, and Coineal is a very good option for listing for its price / quality ratio. ”

EXMO

Since the project team consists of formernatives of classical finance, for whom the word compliance is not an empty phrase, the Ukrainian-Russian crypto exchange EXMO is very attentive and strict about the applications for listing, which is why it has gained a positive reputation in the market. It takes from 3 days to several weeks to consider an application from a profile team.

“It’s very important for us to be completely confident inproject, ”says EXMO listing director Vadim Prikhodko. “If the project is interesting and promising, we sign a contract, set the deadlines for listing and begin the procedure itself.”

Vadim identifies 5 main criteria that the team pays attention to when deciding on a listing:

- Evaluation of the project in terms of work done- Is the idea interesting and promising, is there a working MVP (minimum working prototype), what does the roadmap look like, how is the work moving, are the deadlines and deadlines being respected.

- Evaluation of the project from the point of view of the community: what is the general information field around the project, how are the branches in specialized forums.

- Team assessment: who is driving the project, were there successful projects in the team’s professional history. Most often, we prefer to talk personally with the CEO of the project in order to understand the motivation and plans of the team.

- Evaluation of the project in terms of market value: is your business really useful and necessary for the market?

- Assessment of the project in terms of willingness to workon joint marketing and PR: for us it is important that we together can create an interesting information guide and bring your customers to us on the stock exchange, and interest our customers in a new interesting coin.

It is clear that this article cannot cover allaspects and all business models of the operation of exchanges and listing conditions, but the issues raised, the examples given and an overview of some leading exchanges can already help to get a general idea and focus on what points should be paid attention to, what questions to ask exchanges, what listing strategy to choose .

Cryptoworld is changing very quickly. Now the picture looks like this, but in a couple of months new solutions and new offers from market participants may appear. In any case, the success of the coin lies in the demand for it. If there is stable demand, there is always an optimal path to traders!

Shortex

The Shortex project positions itself not only ascrypto-exchange, but also as an absolutely independent ecosystem, in which people can pay with cryptocurrency for products and services, transfer digital assets to each other, trade and invest in promising crypto projects, doing all this in one place, which is extremely convenient. The exchange is registered in the EU and more than 70 thousand active traders trade on its platform.

For projects that bring their tokens to the market,Shortex offers a complete solution. First of all, it is about providing liquidity to a young asset, and for this purpose the exchange offers market-making services, as well as drawing up a market-making strategy for 6 or 12 months in advance. An important factor is that the projects included in the listing are presented to the exchange's institutional partners - cryptocurrency whales. This is a great chance to make yourself known and a real opportunity to attract significant investment in the project. In addition to market-making support, Shortex conducts in favor of the PR campaign included in the listing of the token - through its own media channels and channels of its representatives in 20 countries of the world.

In relation to the purchase of a token, the exchange providesthe choice for its users: you can buy both for fiat and for cryptocurrency. In addition, the function of buying cryptocurrency with a credit card is available. Listing on Shortex is also a great opportunity to become part of S-paiment's progressive payment solution, an instant payment acceptance service. The service button is integrated on the website of any company, after which it can accept payments worldwide with a minimum commission of 0.5%. This is an excellent alternative to the expensive Visa and Mastercard systems - in addition, when using the Shortex solution, there are no chargebacks and no capital freeze is required.

The cost of listing on Shortex depends on a number of variables and ranges from 15 to 45 thousand dollars.

Posted by: futuretime