Malta-based cryptocurrency exchange OKEx has rolled out options contracts on Ethereum (ETH), putting an end to the virtualmonopolies of the cryptocurrency exchange Deribit, based in Panama.

“OKEx ETH option contracts will be concluded in ETH. The face value of each ETH / USD option contract is 1 ETH, ”said Jay Hao, OKEx CEO.

Options are derivative contracts that giveBuyer has the right, but not the obligation to buy or sell the underlying asset at a predetermined price at a specific date or time. While the call option is the right to buy, the put option gives the holder the right to sell.

Brand prices of exchangeoptions are determined by the Black-Scholes model in real time, and the final settlement price will be generated by a time-weighted average of the underlying price over the period of time leading up to expiration.

To avoid what OKEx calls“Social compensation of losses”, the exchange has already created an option insurance fund ETH / USD in the amount of 1000 ETH in the amount of about 240,000 dollars. Refunds occur when the insurance fund of the exchange does not have sufficient reserves to cover the total losses of investors on margin. Exchanges face such a deficit and socialize losses, taking part of the profit of profitable traders when the market suddenly sees a big bull or bear move, which leads to the forced unwinding of long / short positions.

“Options will give traders greater flexibility anda great way to insure your risk, ”said Hao. The success of the broadcast is closely related to the use of Ethereum in decentralized applications (dApps). Consequently, it can be argued that on-air options are hedging instruments for dApps.

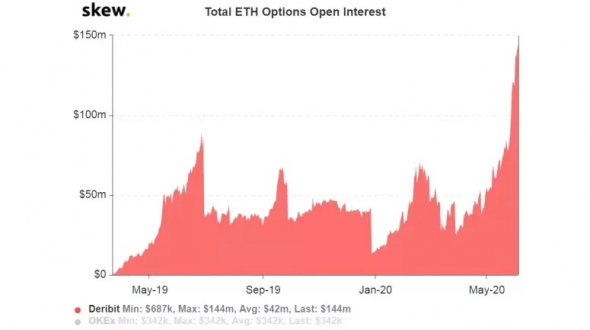

This year, investor interest in the marketCrypto derivatives have skyrocketed and open interest in Ether futures listed on major exchanges has increased by 100%. Meanwhile, open interest in ether options listed on Deribit rose more than 900%, according to data provided by crypto derivatives research firm Skew.

OKEx is the largest Ethereum futures exchange withopen interest rate, it accounted for 26% ($179 million) of the total $672 million. Additionally, the exchange recently surpassed BitMEX to become the largest Bitcoin (BTC) futures exchange by open interest.

“Adding options with ETH is as followsa logical step for us, as well as market demand, especially because we are proud of the wide range of products and functions that we offer traders, which allows them to maintain the flexibility of their pricing strategies, ”said Hao.

While OKEx dominates the futuresproduct, the options segment is managed by Deribit. Deribit accounts for more than 75% of the total open interest of $ 1.3 billion in bitcoin options and $ 144.35 million in ether options. Meanwhile, OKEx contributed only 4% of the total open interest in options on BTC.

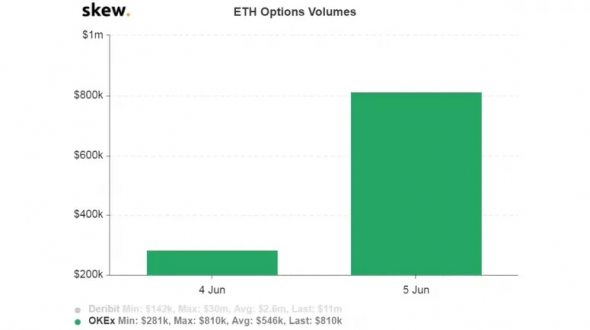

So OKEx has a lot of features,to jeopardize Deribit's first position in the options market. Since its opening, the stock exchange has been trading on ethereal option contracts for $ 1 million and has open positions for $ 342 thousand at the time of publication.

OKEx also plans to launch options on EOS, the ninth-largest cryptocurrency by trading volume, on June 18.

Telegram | Vkontakte | Instagram | Twitter | Smart-lab | Tradingview

</p>