Margin trading is gaining momentum, and investment funds are recording an influx of investments in Bitcoin. Howeverfaith in the strength of the current support can be misleading, as a number of indicators predict a decline to the $25-20 thousand zone.

Image Source: Cryptocurrency ExchangeStormGain

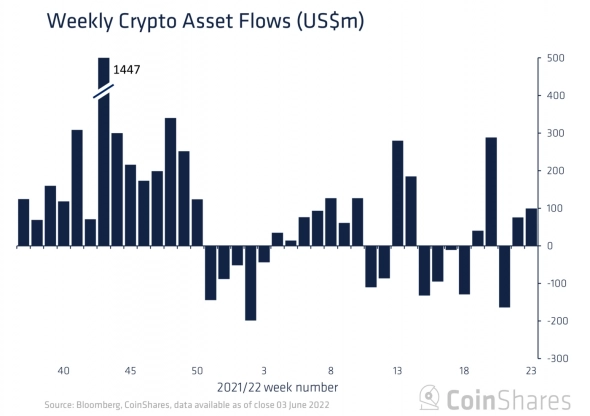

The fall of Bitcoin by 55% from the historical maximumand the subsequent consolidation around the $29K level gave hope to some participants for a speedy recovery. This was reflected in the growth of weekly investments in Bitcoin funds to $126 million ($100 million across all cryptocurrencies), and a net inflow in 2022 was $506 million.

Image Source: coinshares.com

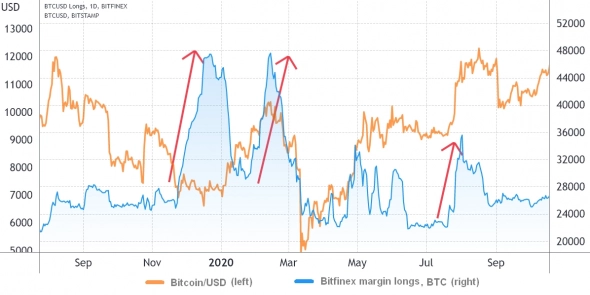

Activity is shown not onlyinstitutional, but also margin traders trading with leverage. Thus, since mid-May, the largest aggregate position has been registered on Bitfinex - over 90 thousand contracts for the purchase of Bitcoin. The previous peak was 55 thousand contracts in mid-2021.

Image source: cointelegraph.com

Such volumes could not do without whales, howeverthis does not mean that this group cannot be wrong. In 2021, traders deftly bought the bottom for the subsequent realization of profits, but in 2020 they failed and recorded losses.

Image source: cointelegraph.com

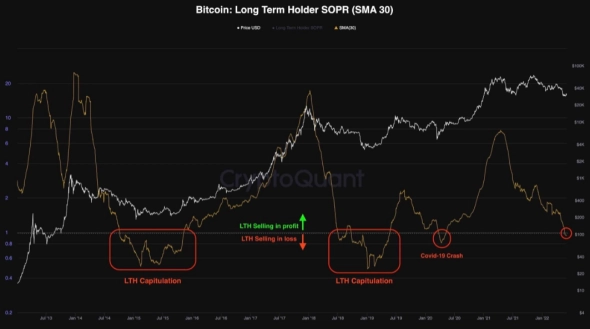

Unlike margin traders, long-termholders (LTH) are not so optimistic - many of them are already getting rid of coins at a loss. As CryptoQuant notes, the capitulation of LTH heralds a bottom, and the next few months will open up an investment opportunity for waiting investors.

Image Source:cryptoquant.com

But before the window of opportunity opens, the pricetest the next level. According to LookIntoBitcoin, the current "realized price" of Bitcoin is $23.6K. The realized price is obtained by dividing the average value of all Bitcoins (at the purchase price) by the total amount in circulation.

The fall of Bitcoin into the $25-20 thousand zone, will probably coincide with the decision of the US Federal Reserve to raise the key rate again. It is expected to increase by another 0.5%, the regulator's meeting will be held in the middle of next week. An increase in the rate leads to an increase in the cost of borrowing and a decrease in the rate of circulation of the money supply, which is likely to lead to the strengthening of the US currency against most risky assets.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)