Summing up the past week, we recall the new price maximum of Bitcoin this year, the launch of tradingBitcoin options on the Chicago Mercantile Exchange, the continuation of the confrontation between the SEC and Telegram, as well as the further expansion of the Kraken exchange, which is now targeting the Russian market.

Bitcoin price

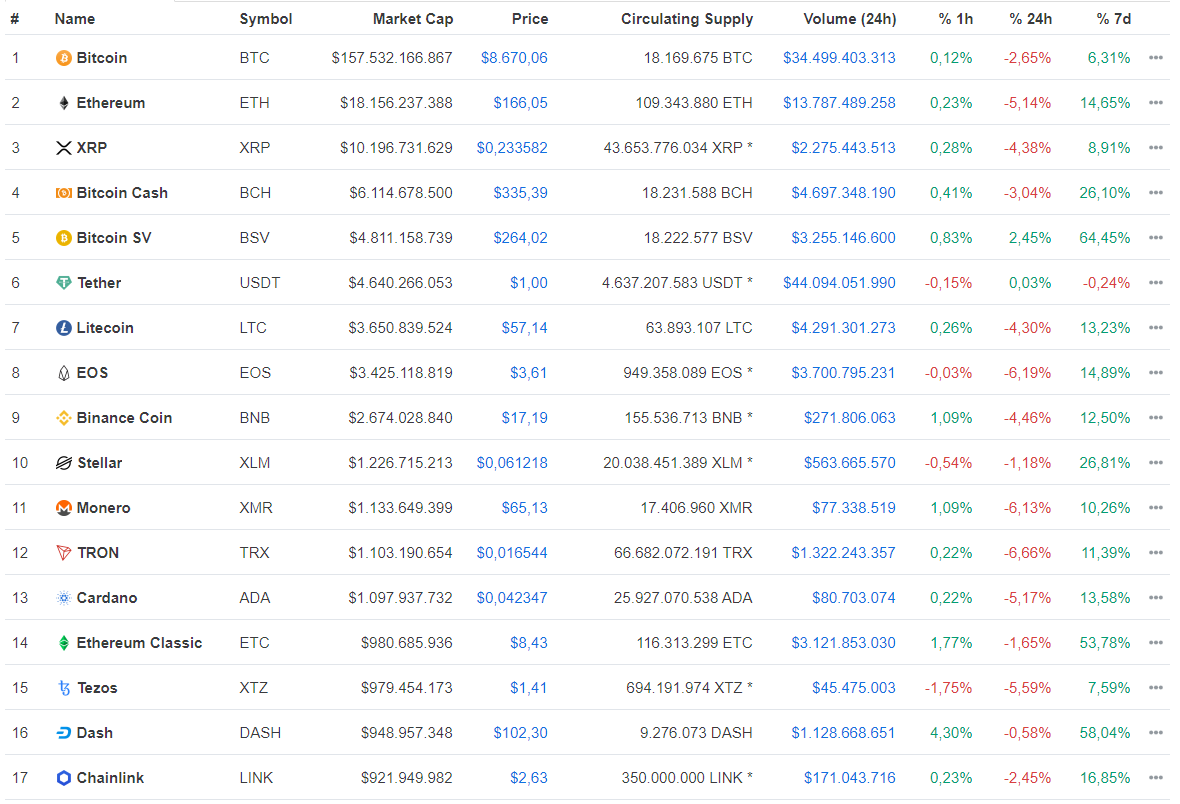

Despite a sharp drop in prices on Sunday, the first cryptocurrency completes the next week with a new price maximum of 2020 and an increase of more than 6%, trading by 17:00 UTC in the region of $ 8650.

This seven-day stretch of bitcoin began onmarks around $ 8,000, but already on the night of Tuesday, shortly after the launch of bitcoin options trading on the Chicago Mercantile Exchange, went up, confidently breaking the level of $ 8500. The progressive movement with short periods of correction continued in the following days, when BTC several times came close to $ 9000, and only on Sunday night did the first cryptocurrency overcome this psychological barrier, only slightly reaching $ 9200.

Bitcoin lasted at these levels, however, not for long — Already at 11:00 UTC Sunday, the price fell sharply, falling at a certain point below $8,500.

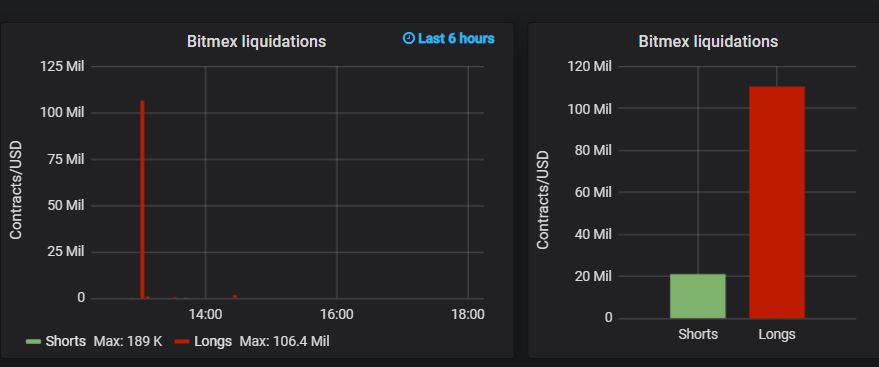

According to datamish, in recent hours, the cryptocurrency derivatives exchange has liquidated short positions worth almost $ 110 million.

The wider cryptocurrency market as a whole followedBitcoin movements, although several abnormal trends were noted during this week. Among these, it is worth highlighting Bitcoin SV, which continued the growth begun last week and for a certain time even climbed to 4th place in the CoinMarketCap rating. Analysts at Arcane Research, however, are convinced that the reason for this growth was the hype caused by claims by "self-proclaimed Satoshi" Craig Wright about gaining access to 1.1 million bitcoins.

“This rumor raised the prices of all forks of Bitcoin, especially BSV, where Wright is the central figure.”— experts shared their thoughts.

The company emphasized that Bitcoin SV is illiquid due to its absence on most popular exchanges. Consequently, the asset is easy to manipulate.

Be that as it may, Bitcoin SV ends its weekan increase of more than 64%. Among other assets that have shot up this week, we highlight Dash (+58%), Bitcoin Gold (+56%), Ethereum Classic (+53%), Zcash (+45%), Bitcoin Cash and Stellar — both of these cryptocurrencies added 26%.

Ethereum, the second most capitalized cryptocurrency, rose to $ 175 on Sunday morning, correcting for writing material to $ 166 (+ 14%).

Bitcoin options on CME

Monday, January 13, Chicago Board of TradeExchange (CME Group) has opened previously announced trading of bitcoin options. The new tools are calculated and based on the CME CF Bitcoin Reference Rate (BRR) - the reference bitcoin rate against the US dollar, compiled according to the spot exchanges Bitstamp, Coinbase, itBit, Kraken and Gemini.

As well as for futures, 1 option contract of the European type corresponds to 5 BTC. The minimum price step is 5 index points, corresponding to $ 25.

So today CME has become directcompetitor of the regulated exchange Bakkt, the option trading on which started in December 2019. It is noteworthy that on the first day the trading volume of CME bitcoin options exceeded $ 2 million. Bakkt failed to achieve such successes in more than a month.

Kraken Acquires Australia's Oldest Exchange and Targets Russia

Kraken Exchange Announces Acquisition Based in2013 Australian Bit Trade crypto trading platform. Thanks to the takeover, Kraken expects to strengthen its presence in the Asia-Pacific region and become the largest cryptocurrency service in Australia.

Kraken also believes that the acquisition will strengthen its position in the field of over-the-counter cryptocurrency trading.

Somewhat earlier, the head of the business development departmentKraken Futures Kevin Beardsley confirmed that the exchange plans to enter the Russian market. It is expected that this year Kraken Futures will open a Russian representative office, as well as concentrate on providing support to the Russian-speaking community in social networks and entering into partnerships with local organizations.

Digital US dollar begins to take shape

On Thursday, January 16th, the launch was announced.The Digital Dollar Project - initiatives to digitize the US dollar using blockchain technology. It was led by Christopher Giancarlo, former chairman of the Commodity Exchange Commodity Trading Commission (CFTC).

Digital dollar, according to the authorsThe project, which will be the third currency format, will be provided with reserves of the Federal Reserve and, having a digital form, should be as easy to carry out transactions as, for example, sending text messages.

“We are launching the Digital Dollar Project forpromoting the digital tokenized US currency, which will exist in parallel with other obligations of the Federal Reserve and will serve as a means of payment, responding to the need to create a new digital world and a cheaper, faster and more comprehensive global financial system, ”- Giancarlo said in a statement.

Among the main goals of the initiative are calledstimulating research and public debate on the potential benefits of the digital dollar; and developing a framework for practical steps that can be taken to implement such an idea.

For more effective implementation of the setThe objectives of the project include the non-profit organization Digital Dollar Foundation. Accenture was named as its main technology partner, which in December became a partner of the Central Bank of Sweden on a pilot project for a digital crown platform.

The court ordered Telegram to disclose financial information about ICO TON

New York Southern District Court ordered this weekTelegram to disclose banking documentation for the Telegram Open Network (TON) project before February 26 at the request of the US Securities and Exchange Commission (SEC). The decision emphasizes that the date set is final. Previously, the SEC called the requested documents “very important” for the proceedings.

At the same time, the court allowed Telegram to hide partinformation in documents in accordance with foreign privacy laws, however, the company must explain the reason for each individual case.

Remarkably, just a few days later the SECpresented new evidence in the case against Telegram. The regulator claims that company employees themselves considered the Gram tokens of the TON platform as securities. These facts can be considered one of the key facts in the SEC case against Telegram, since it was the question of whether the tokens of the TON blockchain platform are securities that became the main reason for the litigation.

Telegram representatives previously insisted thatGram tokens are not a security, and SEC claims are based on a “fundamentally distorted theory” that Gram is subject to relevant US laws.