I've written extensively about how to get into the crypto markets, the basics of investing in Bitcoin and blockchain, and analysisprices. Today I want to talk about my personal journey into the world of cryptocurrencies and some noteworthy events that I met along the way, since I myself like to read such stories.

</p>Early days - 2011 or 2013?

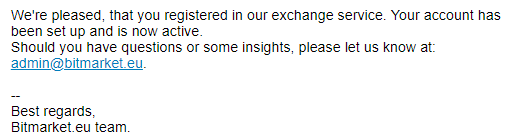

They say that the Internet forgets nothing.But my email accounts, which I've used over the years, still seem to forget things. I'm pretty sure I bought my first Bitcoin in 2011, but since I was very curious about exactly how much I paid back then, I tried to find evidence of my earliest adventures with this relatively young phenomenon. Unfortunately, in my old email accounts I was only able to find a letter confirming registration forbitmarket.euin May 2011. Perhaps you should ask Facebook. I'm sure they know the exact date, and they will have the missing letters on their servers.

: Medium

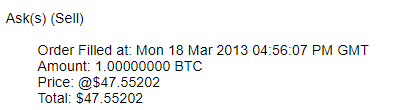

Letter from bitmarket.eu is interesting in that it is a Bitcoin news service, and if I registered on it then, we can assume that I already invested at that time. It also makes sense, because for some reason I remember the price of $ 18 per BTC. But the earliest letters from Mt.Gox that I managed to find date back to February 2013, and the price of $ 18 was also popular at the beginning of 2013. Be that as it may, in the earliest transaction certificate I managed to dig up - confirmation from Mt.Gox - $ 47 is mentioned. Given that there were applications for sale, you can stop at the thought that I bought bitcoins somewhere in early 2013 for $ 18 and sold part a few months later, when the price more than doubled.

The earliest evidence of transactions I managed to dig up is confirmation from Mt.Gox. : Medium

How did I come to Bitcoin? One IT specialist who played with me on an amateur hockey team once mentioned that his friend is mining digital coins. He said that his friend is convinced that this is the future payment method, but also added that he tries almost everything in a row and usually does not show much perseverance. I wonder if he showed perseverance in this case - if so, then now his fortune could be estimated at tens of millions of dollars. However, neither me nor my friend knows anything about this.

I'm not very tech savvy. I would describe myself as something between a geek and grandfather regarding technology, since I once experimented with programming in HTML and Pascal and even developed websites in high school, but this did not go beyond this. Bitcoin attracted my attention for another reason: earnings. This topic has always fascinated me. So much so that I started trading stocks in high school, in 2000, at the peak of the dot-com bubble, then I studied business and in 2012 founded an investment fund, where I work today.

Thus, it is worth recognizing that the mainThe motivation for me has always been bitcoin trading, not the technology behind it. I also read a lot about the technological aspect, and I can say that I am a little versed in the blockchain and really respect Andreas Antonopoulos, whose book, however, I managed to understand only partially. But in the first place for me there will always be trade, as this is what I am fond of and what I am well versed in.

I clearly remember discussing this with my parents when the price of Bitcoin topped $150 and my initial investment grew 10x(although I didn’t have as much as you might think, since I had just opened a new business and had little cash, so we’re only talking about three figures). My father thought that playing with Internet money was childishly naive, and a few days later I sold most of my reserves for about $ 150.

Mt.Gox - 2014-2015

However, being a trader, I did not close myaccount on Mt.Gox and did not sell all of my bitcoins. I kept some of it in a wallet on my old computer. Of course, I watched with envy as my “children’s” Internet money grew in value from $150 over the course of a year(when I sold most)up to $800. And although throughout that rally I was mostly able to sit quietly and watch(one of my best qualities), I still traded bitcoin a bit at a price of $ 650-700 closer to the beginning of 2014, transferring coins from my wallet to the exchange. I remember that my balance on Mt.Gox in dollars was approximately $ 4,500.

And that's when it happened. Despite all the precautions(yes, yes, never keep bitcoins on the exchange ...)with two-factor authentication usingYubikey, etc., when I wanted to log into my account, there was nothing there. Not only could I not log in, but the site seemed to disappear altogether. The rest, of course, is known to everyone. Thus, due to Mt.Gox's bankruptcy, I lost almost all of my remaining bitcoins.

Then in 2015, when Bitcoin was around $400, I used coins to buy options for the first time. As far as I remember, that was my last 2.5 bitcoins, after which I was“Knowcoiner”as they would say today.

Ethereum and The Dao - 2016

Almost two years I was not too interestedcryptocurrency. Then I tweeted about Ethereum. Unfortunately, I don’t know when exactly it was or what message first caught my attention. Then I first became interested in the technology behind the cryptocurrency.

Images: BitNews

Call me unimaginative, but a simple application for sending and storing money(as I understood Bitcoin then; now I know that it can do much more)didn’t have much fascination for me at the timein technological terms. After all, I'm not one of the unbanked, and while it may not be possible to send money through a bank in 10 minutes, the last time I tried it, I had no problem sending payments via SWIFT within an hour and at no extra cost . Of course Bitcoin is moving on, but that wasn't enough to hold my interest for long. Ethereum, on the other hand(for a technically semi-literate person like me)seemed a quantum leap in this regard.

Decisive for me was met meinfographics, where it was explained that the blockchain can be used for decentralized applications (dApp). I realized that such applications cannot be hacked and that they are likely to allow users to control all their data and not give them free to corporations. I was excited.

After reading a little about this topic, I immediately bought onsome exchange of bitcoins and exchanged them for broadcast. Not many of my deals paid off as well as this one. But at first, of course, a fair amount of drama unfolded. I bought my first broadcast for about $ 11 per coin and happily watched how in the summer of 2016 the price exceeded $ 18.

Then The DAO hack happened. The DAO was, of course, the first real ICO(yes, I know that Ethereum had ICOs and even had some even earlier, but I mean ICOs with mass participation, which laid the foundation for further movement). And although I did not participate in this ICO and did not knowwhy my ether is so beautifully growing in price, I well learned what The DAO is when the price of ether has fallen. As it turned out, some hacker managed to deduce the broadcast contained in him from the smart contract The DAO. I studied the situation a bit and, since I was repeatedly convinced that it was unreasonable to sell a good asset during maximum stress, I did not get rid of my ether. Ultimately, I managed to gain from this disaster, when the Ethereum community began to lean towards the fork to repair the damage. This meant an arbitrage opportunity to buy an asset that no one wants. Therefore, I added a few DAO coins to my reserves, given the likelihood of reconversion at the issue price, which was much higher than the one at which they traded during the discussion about fork. I did not wait for the conversion, but switched back to the air when the market realized that there was a described arbitrage opportunity. After the troubles with The DAO, I, perhaps, turned out to be a little “richer” than before, after which I did not touch my coins until the end of the year. I also did not go deeper into cryptocurrencies.

However, I often checked the price of the broadcast, waiting for my "lottery ticket" to shoot.

Bubble - 2017

And he really fired.By the end of the first quarter of 2017, despite problems with The DAO, Ethereum had become an established network on which tokens were traded. While the computing power this network provided was intended for dApps, its first real use was in the ICO frenzy that defied the best days of the dot-com bubble.(when IPOs were similarly popular).

Since the dotcom bubble(when I lost a lot of money)I had one secret desire:at least once again in my life to take part in some kind of bubble. I promised myself that this time I would do it right and apply everything that my first experience in the 2000s taught me when I got into the game too late.

The first thing I remember from those days is how what I call formed on the NASDAQ chart"Bubble roof". That is, there was an exit from the previous channel of the trend up, then a very quick jump to a maximum, followed by a fall.

: Medium

In the 1st quarter of 2017I didn't see a similar pattern in Bitcoin, but I didn't want to just invest. I was waiting for the right moment. The Securities and Exchange Commission's (SEC) March 2017 deadline for a Bitcoin ETF decision seemed ideal to me. First of all, I know that the most sensational events end up not being as great as they seemed(“Buy on rumors, sell on the news”). Secondly, I was also almost sure that,given the many trust storage issues, the SEC at that time would not give permission for ETFs. Thus, when Bitcoin was trading at around $ 1,200, I set a purchase threshold of just below $ 1,000 in anticipation of a sharp drop in the event of a negative decision by the SEC. I was lucky and my threshold just worked, so I returned to the game of Bitcoin.

But I definitely did not expect what happenedfurther. As we all know, after the “minimum” of March 2017, Bitcoin began to grow steadily. I was tempted several times to sell everything, but I was restrained by the fact that the “bubble roof” described above did not appear. For almost the entire 2017, Bitcoin remained below the channel’s top line. I decided not to repeat the previous mistakes, therefore, for almost the whole of 2017, I also continued to keep a small reserve of ether purchased a year earlier. True, it is necessary to clarify that when I trade an asset, of which I am sure, I always sell a little with every big move up and buy a little with every move down.

Of course, the dot-com bubble taught me something else.For example, the fact that the earliest IPOs were then extremely profitable for those who invested in them before listing on the stock exchange. So, of course, I wanted to get in on the ICO hype. I thought I was in the game early, but I think I actually invested in the first ICO around the peak of coin speculation's profitability.(when invested in ICOs and sold coins immediately after receipt), so in reality I was part of the "early majority". My first ICO was Monaco(which turned out to be a very profitable investment)after which I also played a little with Status,InsureX, 0x and, of course, Tezos (these are the best ...). Most of the ICOs in which I participated turned out to be losers compared to just keeping bitcoins or ether, so I soon got involved with them.

I also happened to encounter a scam. I invested in Monkey Capital(can't believe Daniel Harrison is still not in jail), and although I'm too experienced to buy onsomething like Bitconnect, I still had a few other misses. And although some of them may still have some hope, I wrote them off. And here we come to Tezos.

Tezos is an interesting example, because before launchMainnet, I was forced to "walk." I am not a fan of doing this when a bubble roof appears. So I watched the whole journey, starting from my purchase of coins during the ICO for about $ 1.20 until rising to $ 12.00 before launch and then falling to $ 4.50, which is slightly higher than the increase that I could get if just kept bitcoins, but quite sobering, given that I sold most of the other cryptocurrencies when Tezos cost about $ 10.00.

I have fonder memories of buying Raiblocks on the advice of a friend and after briefly reading the promotional materials.(i.e., by pure chance)and saw the price rise from $4.40 to over $22.00, and also, of course, that I did not sell my Ether reserves below $350.

Of course, I could make more money on the air,but when Bitcoin got a bubble roof, I was sure that it would end badly. I did not know how high the prices would go up yet, but once I thought that they could go up by more than 100%, after which they would collapse. Therefore, from December 2017 to February 2018, I sold almost all of my cryptocurrency reserves.

My best cryptocurrency bets turned out to beEthereum, Raiblocks, Lisk and Monaco, and the worst are Coeval (Monkey Capital), Enigma (due to my own stupidity, I accidentally sent my tokens to the address of the main contract) and Zcoin. And no, I never went all-in. The sums of my investments have always been very small, since this is just a hobby for me.

2018-2019

Then it seemed that a new world was before us.Cryptocurrencies are no longer in their infancy, at least from an investment point of view. I was confident that Bitcoin would someday reach new all-time highs if it survived (and it will), but those investing today are no longer early investors. Those who say this are repeating the same lies that were told at the peak of the Internet bubble, and my opinion about the current generation of ICOs(IEO, STO, substitute any name…)it's not a secret to anybody. So for now I'm still waiting for the outcome of some of my less successful investments, and in my free time(mainly on weekends)I am engaged in short-term trading of BTC. I now view investments in tokens as similar to investments in securities and therefore no longer invest in them.

</p>