It’s time for major players in the financial world to think about how to enter the cryptocurrency market, experts saidbank Morgan Stanley.

The institutionalization of cryptocurrencies opens up“big opportunity” for asset managers. This opinion was expressed by Morgan Stanley analysts in a report prepared in collaboration with the consulting company Oliver Wyman. The bank emphasizes that the market’s readiness for big players is evidenced by market capitalization, which grew from less than $50 billion in 2017 to $2 trillion in April 2021.

According to Morgan Stanley, asset managers,who want to enter the crypto market, it is worth considering investing in cryptocurrencies either through a mixed asset fund or through separate passive / active crypto products.

The Bank recognizes that the segment of private investorswill continue to strive for cryptocurrencies. They are primarily of interest to "technology-savvy asset owners." However, managers need to develop their own products to meet demand, the bank said.

Difficulty for large players may beregulatory uncertainty as well as volatility. However, despite the pitfalls, cryptocurrencies could form a new market with $300 billion in client funds and $1 billion in revenue if the regulator approves cryptocurrency ETFs.

Morgan Stanley's interest in the cryptocurrency markethas been known for a long time. For example, in January of this year, Counterpoint Global, a division of Morgan Stanley that manages about $150 billion in investments, was considering purchasing Bitcoin as an investment asset. Whether the division has invested in cryptocurrency remains unknown.

However, it is known that Morgan Stanley is in the samemonth bought 10% of MicroStrategy. The company is especially known in the crypto market as the largest public holder of Bitcoin. For example, at the time of writing, MicroStrategy holds 105,085 BTC (~$3.6 billion) in reserves.

Morgan Stanley buys 29,000 shares of Grayscale Bitcoin Trust

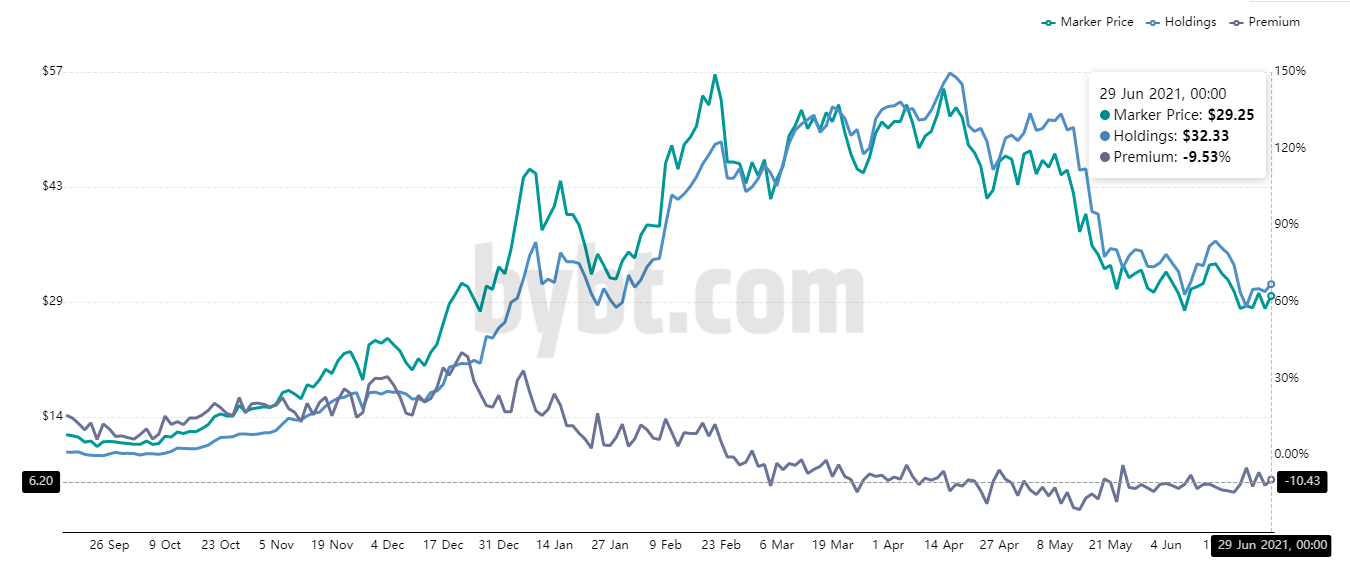

Through its European subsidiary Europe Opportunity Fund, Morgan Stanley Bank owns 28,289 shares of the Grayscale Bitcoin Trust. This was reported in a report to the stock exchange regulator.

At the time of this writing, the declared amountthe investment is estimated at $ 827,000. Still, Grayscale is not doing very well. The trust margin is still in the negative zone. At the time of this writing, GBTC margins remain at 9.5%.

Let us remind you that in early May Digital Currency Group(DCG), the parent company of Grayscale, announced a deal to purchase shares of GBTC worth up to $750 million. Prior to this, the company acquired shares of GBTC worth $193 million. Moreover, DCG announced its intention to continue repurchasing shares on the stock market at its own discretion. However, it remains unknown whether the company bought $750 million worth of GBTC shares.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication